The Mission-Driven Consumer

Consumers have long been spending their dollars with a purpose—whether it’s a personal matter or a larger social cause. Many businesses have followed their lead and built their brands on the premise of better the world in their own way. Now, thanks to this diversifying product selection and a growing sense of responsibility, today’s mission-driven consumer and the natural shopper can remain equally committed to their health and to their ideals.

SPINS, in conjunction with New Hope’s virtual expo Spark Change, looked at data in the natural market over the past year to understand what mission-driven consumer trends are emerging. Every brand and retailer needs to realize that consumers are making a shopping list that’s more complicated than simply getting items they need or want. They’re thinking about where it comes from, what effect it has on the planet, and how it fits into their own health goals.

Plant-Based: Improve Health for the Planet, Animals, and People

Earlier this year a Gallup poll found that shoppers who choose plant-based foods do so primarily for health reasons (70%), though the environment (49%) and animal welfare (41%) were significant factors. This could be a reason that items that are positioned as plant-based are growing at an even faster rate than items that fit a plant-based diet but aren’t necessarily positioned as such.

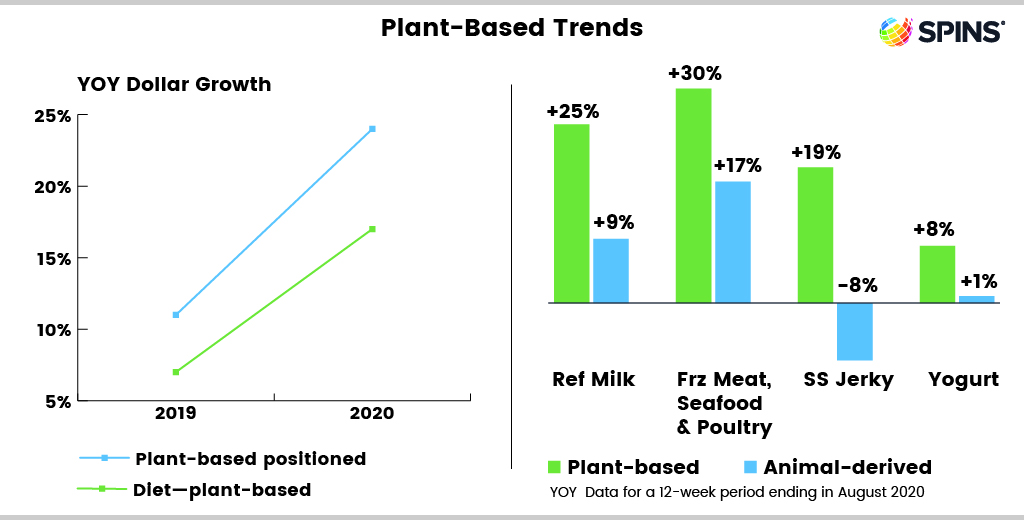

Plant-based positioned products have grown 24% year over year in the Natural Enhanced channel, compared to 11% growth in 2019. In comparison, products that fit the plant-based diet have grown 17% this year and grew 7% in 2019. Clearly, plant-based is on an upward path, but brands that emphasize that attribute are seeing the most benefits.

Also worth noting is how the expanding selection of plant-based products is aiding this strong growth. Shoppers opting for meatless meals aren’t confined to the produce aisle or hamburger alternatives. From desserts to beverages, the options are growing quickly. Plant-based options are actually outpacing animal-derived products in a variety of categories when looking at year over year data for a 12-week period ending in early August.

Find more plant-based content here:

Allergens: Give Mission-Driven Consumers Trustworthy Options

Each year, 85 million Americans spend $19 billion on foods that allow them to avoid the 9 most common allergens. For these shoppers, food sensitivity or allergy is a health risk they can’t ignore. According to the Food Allergy Research and Education Center, allergen-free customers spend more on the average basket than other shoppers, spend 3-5 minutes reading labels on each item they buy, and 68% of them trust allergy-friendly brands. In other words, their shopping experience is a serious process for them.

Allergen-free shoppers are gravitating toward the options that suit their lifestyle and giving certain categories a boost. In the same 12-week period ending in early August, products free of the top 8 allergens are up 18%, FODMAP diet-friendly products are up 17%, and products labeled allergen free are up 9%. In the last 12 weeks, baking ingredients and flour labeled allergen free are up 52% compared to 2019 and frozen entrees labeled allergen free are up 5%. For allergen-free shoppers, reading labels is necessary for every purchase, from snacks to entrees to baking ingredients—and they are looking for the items they can feel safe putting in their cart.

Certifications: Promote Responsible Sourcing

Concern for working conditions, animal welfare, and production quality are driving shoppers to look for 3rd party certifications on packaging. Over the last year, certifications have driven significant growth in the natural market sales:

- Labeled organic products grew 11% to reach $3.8 billion

- Certified Non-GMO Project Verified products grew 12% to reach $3.6 billion

- Certified B-Corporation products grew 8% to reach $1.3 billion

- Products with Fair Trade claims grew 6% to reach $527 million

- Products labeled for animal welfare grew 15% to reach $375 million

Across a variety of products, these certifications have direct effects on sales. These are the fastest growing categories for some of these certifications over a 52-week period:

- Shelf stable jerky and meat snacks with animal welfare certifications is up 122.7%

- Non-GMO Project Verified refrigerated pasta grew 54.5%

- Certified B-Corporations shelf stable pasta is up 95.4%

- Fair Trade certified shelf stable coffee grew 32%

Sustainability: Improve Packaging and Reduce Food Waste

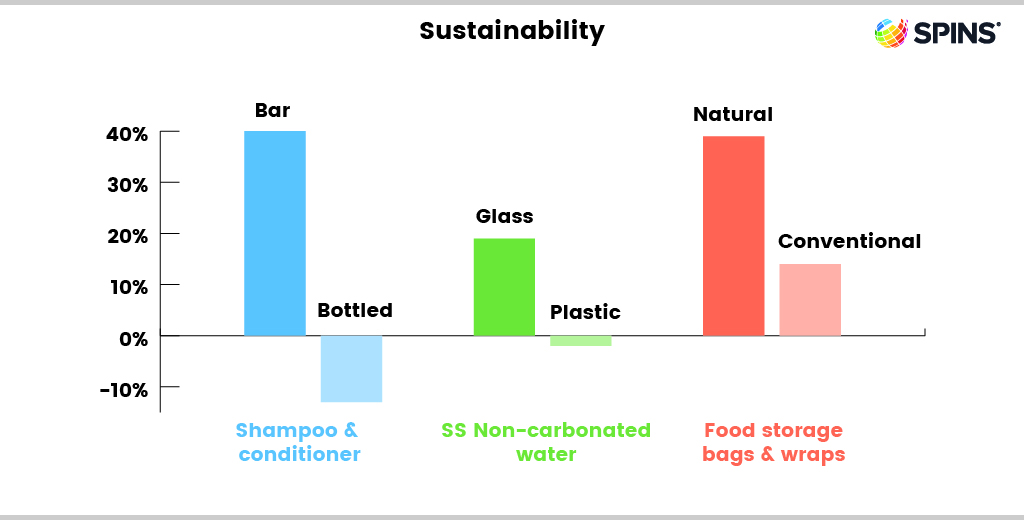

Although sustainability isn’t as much about food ingredients as other environmentally friendly products (i.e., plant-based) are, it’s as important to many shoppers. A lot of packaging and food waste ends up in landfills, but they don’t have to. Mission-driven consumers are increasingly selecting products that reduce their damage to the environment.

When given the option shoppers are clearly choosing reusable packaging and avoiding disposable items that can’t be composted or upcycled. Looking at the sales in the Natural Enhanced channel over a 52-week period, plastic is not seeing the same level of growth as less wasteful options:

Brands: What's Next?

The trends are clear: shoppers care about more than calorie counts. They’re on a mission to support brands with the right mission. Don’t miss out on conscientious shoppers, especially if you’re already offering products that align to their preferences. Put certifications, positioning, and mission statements on packaging. Run promotions and put these products in front of customers in the store. They’re already looking for these items and doing the research; save them time and earn their loyalty by showing them that you care as much as they do. Dig deeper into these growing trends to learn more.

We have even more resource if you’re wondering how to take help your brand succeed:

Retailers: What's Next?

The trends are clear: shoppers care about more than calorie counts. They’re on a mission to support brands with the right mission. Don’t miss out on conscientious shoppers, especially if you’re already offering products that align to their preferences. Put certifications, positioning, and mission statements on packaging. Run promotions and put these products in front of customers in the store. They’re already looking for these items and doing the research; save them time and earn their loyalty by showing them that you care as much as they do.

Dig deeper into these growing trends to learn more: Discover how shopper-centric attributes drive shopper behavior. Or become a SPINS partner to see which brands are driving the hottest categories in the market.