Key Takeaways:

- Growth in the supplements category has shifted from digital to brick-and-mortar stores.

- Joint supplements are starting to grow at a high rate.

- Immune health supplements are experiencing growth, particularly in the children’s supplement subcategory.

- Women’s supplements are seeing growth in reproductive health and libido boosters.

- Performance nutrition supplements are up almost 37%.

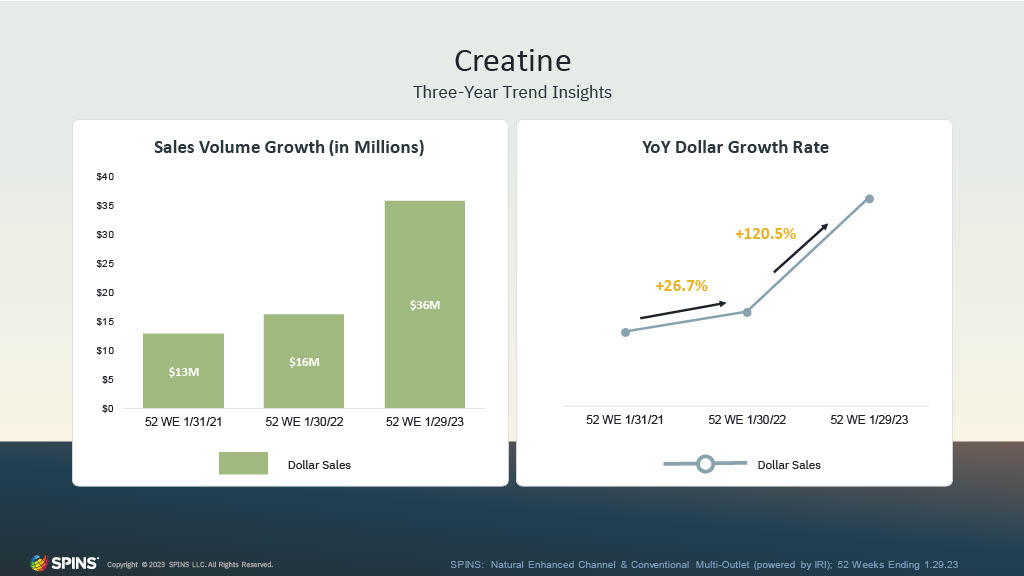

- Creatine is the big trending ingredient pick for the year.

State of Supplements: Understanding Recent Trends

The Vitamins, Minerals, and Supplements (VMS) industry, like many others, has experienced some shifts in recent times. With the impact of the pandemic, changing consumer preferences, and evolving market dynamics, it’s important to take a closer look at the current trends shaping the landscape of the supplement industry.

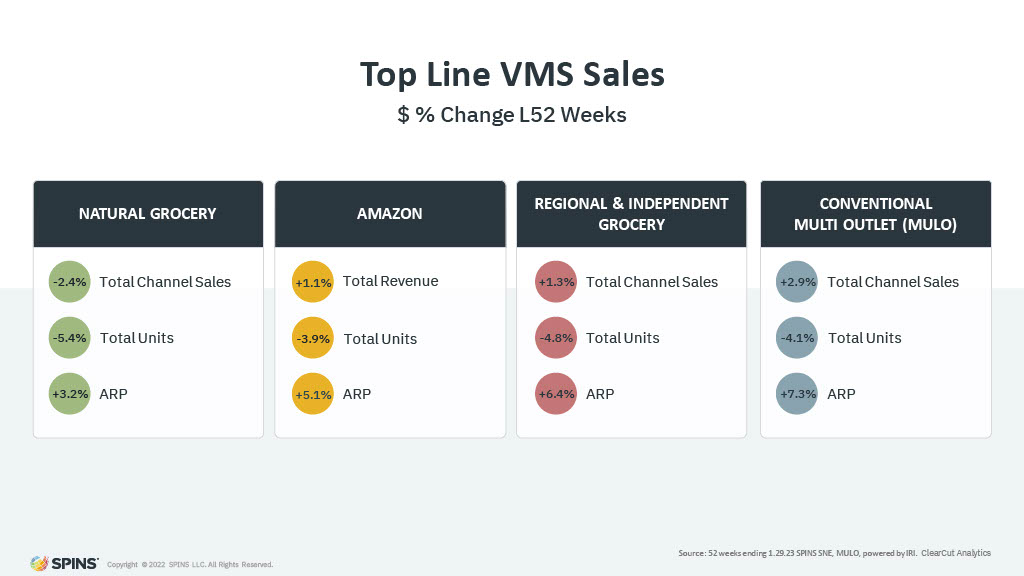

Sales and Units: A Mixed Bag

In the past year, the supplement industry has seen mixed results in terms of sales and units. While the Natural channel has experienced flat sales and all channels have seen decreased units, overall, across channels there has been an increase in sales. However, it’s worth noting that this increase is primarily driven by price increases, rather than a surge in demand. This leveling off comes after a period of high growth during the pandemic, and rising costs have led some consumers to potentially trade down to private labels or larger-size purchases.

Price Increase: Relatively Low

Compared to other food and beverage categories, the supplement industry has experienced relatively low-price increases. While rising costs have impacted the overall sales and units, the price hike for supplements has been moderate in comparison. This indicates that the industry is adapting to market dynamics and consumer expectations, while still maintaining affordability for consumers.

A Shift in Purchasing Behavior: Return to In-Store Purchases

Traditionally, the supplement industry has been dominated by digital sales, with Amazon being a key driver of growth. However, there has been a recent shift in purchasing behavior, with a return to in-store purchases. In fact, brick & mortar contributed to 92% of the growth in the VMS department, that’s up from last October when that figure was 85%. As people are gradually returning to physical stores, mainstream, and specialty retailers are expanding their offerings, providing more options for consumers to purchase supplements offline. This does not mean that people will stop buying from Amazon altogether, but rather, a resettling of purchasing behaviors is expected. Amazon is still expected to show steady growth in the future, as it continues to be a prominent player in the supplement industry.

Adapting to Changing Consumer Preferences

The supplement industry is also witnessing changes in consumer preferences. With the ongoing pandemic and increasing focus on health and wellness, there has been a growing demand for immune health supplements. Consumers are also showing interest in innovative ingredients such as MSM, maca, beetroot, and creatine, which are gaining popularity in the market. In fact, products containing Horehound saw a 29.7% increase in year-over-year sales.

Furthermore, there is a growing push towards using supplements for kids, as parents seek alternatives to pharmaceuticals, particularly in the areas of immune health and mood support.

Women's Supplements: A Focus on Reproductive Health and Libido Boosters

One interesting trend in the world of supplements is the growing focus on women’s health. While hair, skin, and nails have traditionally been a growth driver for female-focused supplements, there is now a shift towards reproductive health and libido boosters. This is a category that has historically been male-focused, but now we are seeing more products positioned towards women and significant growth in that segment – a +39.4% increase in year-over-year sales to be exact. This indicates a changing consumer landscape and a growing demand for supplements that cater to women’s specific health needs.

Sports Nutrition: Beyond Just Sports

Sports nutrition has been the fastest-growing category in the supplement market over the past couple of years, driving innovation in the food and beverage industry as well. It’s not just about sports anymore, as the category has evolved to cater to a wider audience that embraces an active lifestyle. While some consumers may be actively engaged in sports or physical activities when using these products, the category now includes a broader range of consumers who seek functional ingredients and protein-packed items for various purposes.

Performance Nutrition Supplements: Driving Growth in the Market

When we look at the sports nutrition category, performance nutrition supplements have been a key driver of growth. Energy and sports drinks have seen a crossover from sports nutrition brands, with the ready-to-drink versions of pre-workout products being positioned as energy drinks and gaining significant popularity. High protein meal replacements have also seen a 10% increase in sales, although with some price increases. Performance nutrition supplements have shown impressive growth of almost 37%, contributing significantly to the overall growth of the VMS department.

Millennials and Hydration: Beyond Athletes

Hydration and electrolyte products are popular among younger millennials, with older millennials also showing interest. These products are not limited to athletes, but also used for hangover remedies or by college students, as seen in TikTok trends.

The sports nutrition and supplement industry has seen significant growth in the popularity of hydration and electrolyte products, indicating a broader demand beyond traditional sports nutrition. For reference, the Hydration & Electrolyte category has seen a +79% increase in year-over-year sales.

Trending Ingredients: Creatine on the Rise

One trending ingredient in the sports nutrition space is creatine, which has seen remarkable growth with a year-over-year increase of 120%. This growth can be attributed to the expanding consumer base, which now includes not only young, male gym-goers but also Gen X, boomers, and females. The softer marketing and increased education around the benefits of sports nutrition supplements have made these products more approachable and appealing to a broader audience, especially towards women.

Promising Potential of Creatine: Breaking Gender Stereotypes

Creatine, with over 20-25 years of research supporting its benefits, has a strong consumer base. Traditionally targeted towards young men, creatine is now being researched for use in females, including throughout the menstrual cycle.

Research on creatine use in females challenges gender stereotypes and expands the potential consumer base of this mainstream ingredient. Influencers and fitness enthusiasts are promoting creatine as a beneficial supplement for women, dispelling the common thought that it is only for men. As a result, more women are incorporating creatine into their fitness routines to enhance muscle strength, performance, and recovery.

What’s Next for the Supplement Industry?

The supplement industry is constantly evolving, with shifting sales, changing consumer preferences, and emerging trends. From in-store purchases making a comeback to a focus on women’s health and the mainstream appeal of sports nutrition supplements, the market continues to adapt to evolving consumer demands. As the industry continues to evolve, staying abreast of these trends can help businesses and consumers make informed decisions about their supplement choices.

How can Brands use this data?

CPG brands can use information like this and other data from SPINS to stay ahead of the curve and meet evolving consumer demands for supplements such as:

- Incorporating these findings in their products. By doing so, they can tap into the growing demand.

- Differentiating their products to appeal to consumers who are looking for innovative ways to add to or change their diets.

- Explore new categories. By incorporating these insights they can offer new and innovative products to add to a retailers mix.

- Leveraging SPINS data. Insights like these help brands identify growth opportunities, track category performance, and optimize product offerings.

How can Retailers use this data?

Retailers can use the information to make informed decisions about their product offerings, marketing strategies, and category management. Here are a few ways they can use this information:

- Identify growth opportunities. Retailers can use SPINS data to identify growth opportunities in the supplement category and adjust their product offerings accordingly. By stocking popular supplement products and exploring new product categories, retailers can tap into the growing demand.

- Cater to consumer preferences. Retailers can use the information to cater to consumer preferences by offering a variety of supplement products that meet different needs.

- Highlight popular values. By doing so, they can differentiate themselves from competitors and appeal to consumers who prioritize sustainability.

- Optimize category management. By tracking category performance, identifying trends, and adjusting their product offerings they can stay ahead of the curve and meet evolving consumer demands.