The greatest price increases and decreases in top VMS categories

Inflation is on everyone’s minds. The BLS announced that the Consumer Price Index rose 8.5% in March, setting a 40-year record. Brands feel it when they look at the cost of manufacturing. Retailers see it when they’re forced to increase the sticker price of items. Shoppers feel it in the checkout line when they’re at the store or grab a burger.

More than a few experts have weighed in on the variety of factors (such as supply chain woes) leading to today’s inflation and how to solve it. While the policymakers get a handle on the situation, we looked to digital shelves to get a snapshot of today’s prices—specifically within the Vitamins and Supplements channel. VMS offers a unique look into the Health and Wellness landscape because it has become more shoppers have turned to this category over the last two years. These items can be integrated into any lifestyle and diet, helping shoppers pursue wellness in a way that’s most convenient and effective for them. Analyzing our SPINS Amazon channel data powered by ClearCut, we focused on the top 20 VMS categories (by revenue) to understand the effects and nuances of inflation in this pivotal channel.

The Highs and Lows of Inflation for VMS Categories

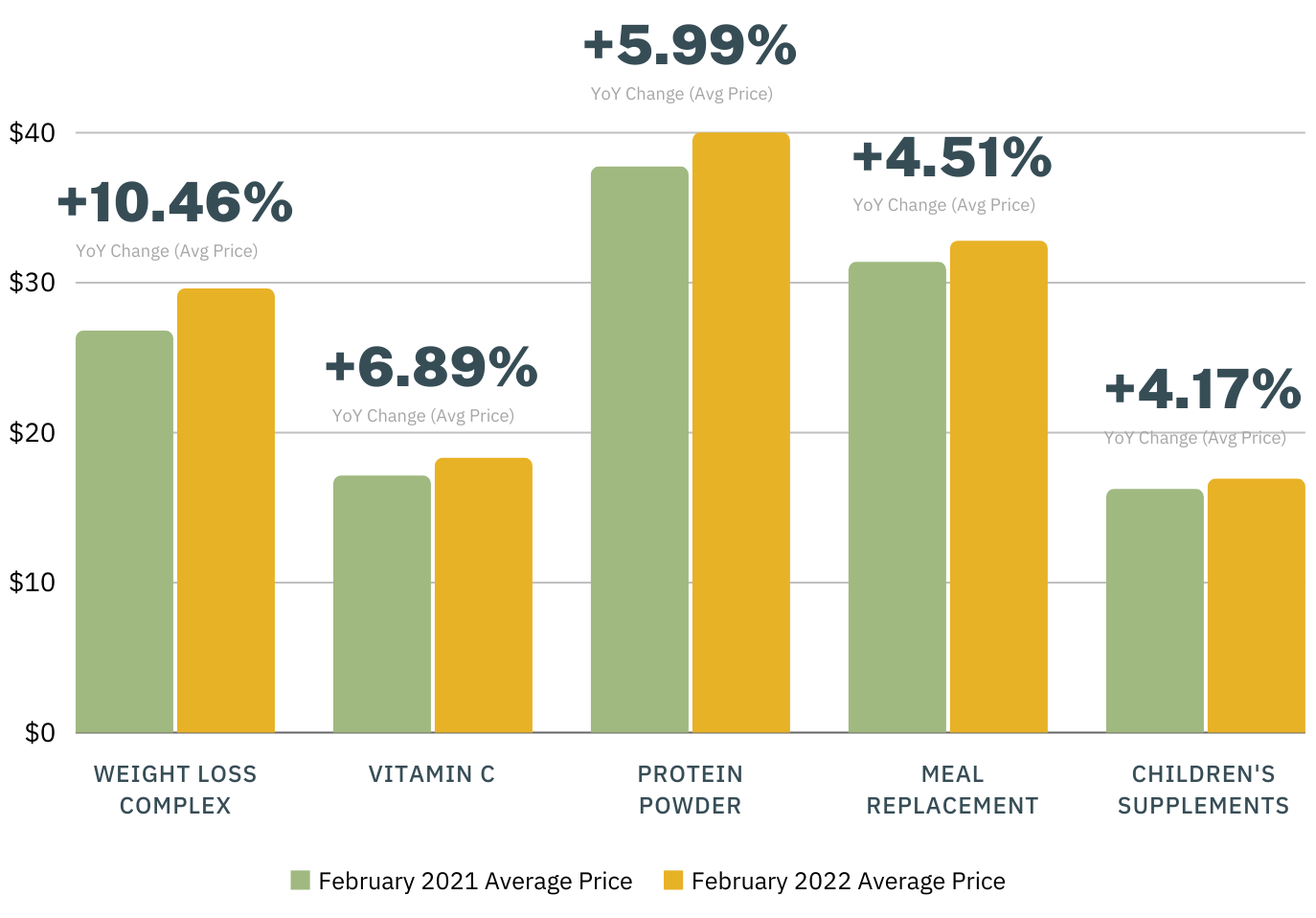

Inflation becomes more noticeable when we take a closer look at a sample of 5 of the top 20 VMS categories. A month-over-month (MoM) comparison for February 2021 vs February 2022 reveals a drastic price change for many of those same items.

First, the highest price changes:

- Weight Loss Complex items experienced a 10.46% average price increase, which no other category came close to.

- Average price increases for Vitamin C (up 6.89%) and protein powder (up 5.99%) came in next.

- Meal replacement (4.51%) and children’s supplements (4.17%) price increases took the 4th and 5th spots.

Although inflation rove up average prices for many of the top selling VMS categories, some items saw smaller increases and decreases. When we look at categories with the lowest MoM average price change:

- Electrolytes decreased by 7.94%

- Women’s Health average prices dropped by 3.14%

- Multivitamins decreased 1.50% and Hair, Skin & Nail Complex had a similar decrease at 1.49%.

These highs and lows that inflation might be affecting the overall market but it’s not happening uniformly.

Digging Into Minerals

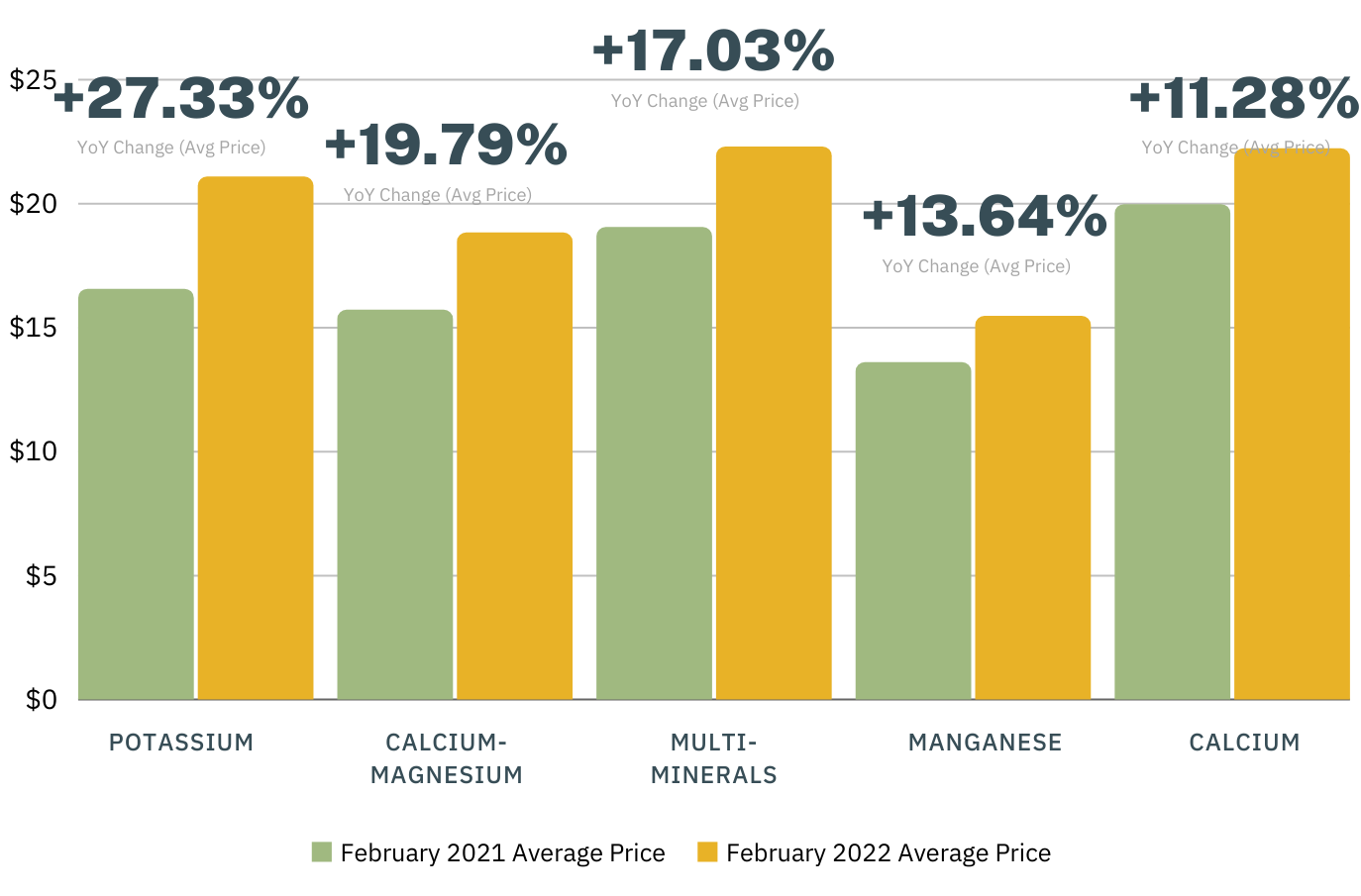

You likely hear inflation spoken about at a top-line level as the overall cost of goods goes up or down. However, as you might expect, there is far more nuance in what’s happening when you begin to delve into the data. For example, let’s look at the VMS category of Minerals.

In the same MoM time period, the average price for items in the Minerals subcategory only rose 0.17%. That’s surprisingly small compared to many of the category increases we saw in Weight Loss Complex, Vitamin C, and others. However, some subsegments showed aggressive average price changes that paint a different picture:

- Potassium’s price went up 27.33%

- Calcium-Magnesium rose 19.79% and Multi-Minerals were only a couple points behind at 17.03%

- Rounding out the top 5 are Manganese (up 13.64%) and Calcium (11.28%).

From there, the cost increase begins to diminish to single digits and lower, with Chromium only rising 0.20%. And at the other end of the spectrum is immunity mainstay Zinc, which experienced an average price drop of 15.45%.

This is a reminder that the shopping baskets might cost more overall, but shoppers can still find better-for-you items that fit their budget or even save money on some products. For some shoppers, vitamins and supplements aren’t optional costs, and they will not waiver from their wellness regimen even as costs increase. Succeeding during a period of inflation will require businesses to stay on top of what’s happening in the market so they can adapt, maintain strong relationships with retailers, and meet consumers where they are.

Get Started with SPINS Omni-Intelligence

SPINS Product Intelligence library and omnichannel data are essential to evolving alongside today’s shoppers and trends. With a macro view of the market and the tools to delve down to a micro level, brands have an exciting opportunity to understand. Learn more about SPINS Omni-Intelligence today.