SPINS acquires Datasembly to create a more expansive and transparent view of the marketplace.

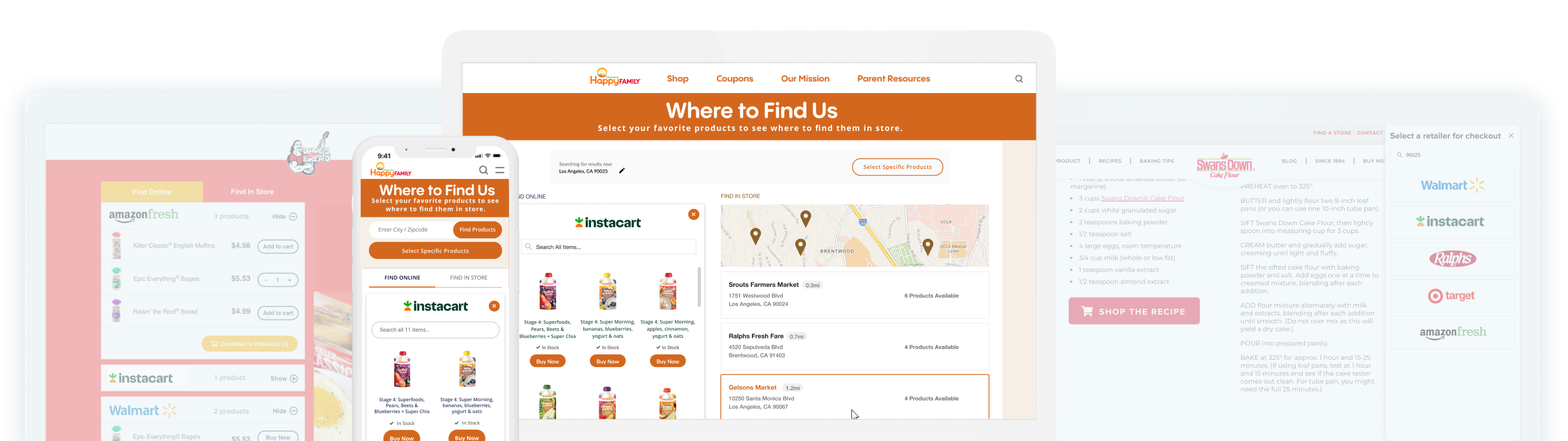

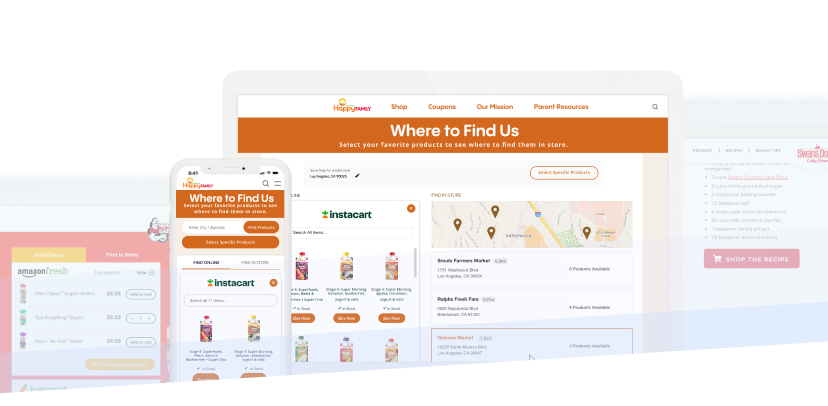

Destini applications are fueled by the leading data providers in the CPG industry.

No other company can combine real-time online inventory data with store-level sales data to provide consumers with the most accurate availability from the largest network of retailers in North America.

Depending on your stage of growth, we tailor our commerce enablement solutions to fit the needs and budget of any brand from startup to enterprise.

Destini is the only Where-to-Buy solution that can integrate with SPINS data to display search results for exclusive retailers in the Natural Channel.

Present your customers with online and in-store purchase options in a single click to meet them wherever and however they choose to shop.

Better serve all of your customers and avoid legal risk with the first and only Where-to-Buy solution in the industry to accomplish third-party certification for ADA, GDPR, and CCPA compliance.

Equip your internal consumer affairs teams with a single, easy-to-navigate platform that facilitates quicker resolution of product inquiry tickets with trackable links to measure results.

Maximize accuracy and coverage with the industry’s only omnichannel store locator that integrates proprietary store-level sales data with web-scraped inventory data.

Learn More

Generate custom landing pages with eCommerce checkout functionality for social media and digital marketing campaigns.

Learn More

Grow sales and protect your hard-earned distribution with store-level data insights that allow you to manage your brand's performance down to the UPC level.

Learn More