Omnichannel Sales Data Combined With Product Intelligence Drives Innovation and Growth

With rapid innovation in brick-and-mortar stores and growth of online retailers, brands have never had more opportunities to get their products in front of shoppers. This expansive retail landscape is the key to finding new customers, innovating new products, and evolving as a business. It also brings a lot of competition, an endless amount of data, and an overwhelming number of choices every day. That’s why successful brands need an omnichannel view of today’s market.

SPINS Omni-Intelligence combines omnichannel point-of-sale data with SPINS product-level attribute data, revealing how consumer preferences translate into shopping behavior. Brands then have the insights they need to make informed decisions in a highly competitive market. When you have data from natural grocery, regional and independent grocery, conventional multi-outlets, and Amazon, you can learn about the entire industry—from the shoppers down to the product labels.

Here are 3 ways brands can transform their business by leveraging the powerful combination of omnichannel sales data with product intelligence to succeed:

1. Bring Amazon Into Your View

Amazon’s reach into the retail space cannot be overstated, and no brand of any size can afford to ignore it. Whether you’re in brick-and-mortar storefronts, digital outlets, or both, you need to understand how your current performance holds up in the context of Amazon market measurement data. Shoppers don’t behave the same across all outlets and, consequently, trends can differ wildly as well.

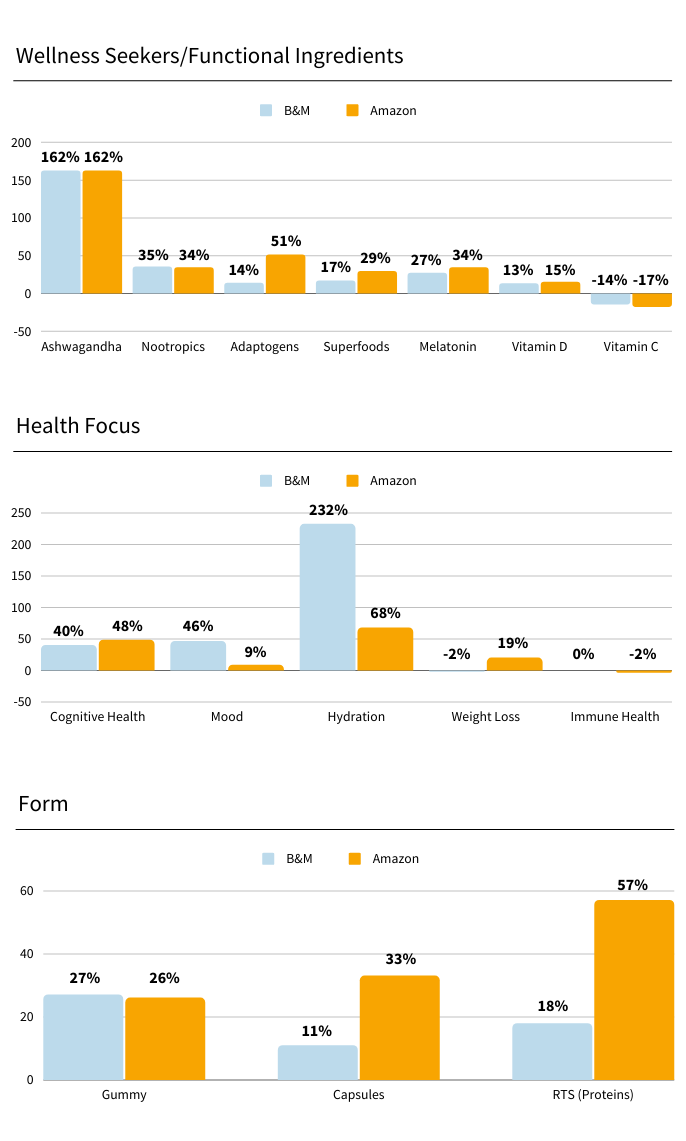

For example, vitamins and supplements (VMS) have gained popularity over the last two years as more shoppers focused on their wellness and looked for accessible ways to stay healthy during the pandemic. SPINS Omni-Intelligence finds that shoppers are increasingly turning to Amazon to purchase vitamins and supplements—and they’re not always shopping the way they do in person. Consider how vitamins and supplements focused on hydration were up 232% in brick-and-mortar stores but up 68% on Amazon, according to data from the SPINS Natural Enhanced Channel and MULO channel powered by IRI and Amazon ClearCut. Yet, we’re seeing ready-to-drink proteins up 57% on Amazon and only up 18% in brick-and-mortar. If you’re only looking at one or the other, you’re missing half the story. These kinds of insight can help you build your channel strategy and determine packaging and pricing for each channel.

2. Understand the “Why” Behind the Growth

Data can show you what is and isn’t selling, signaling emerging trends, and in today’s omnichannel world you want as much information as possible to understand what’s driving trends in each channel. Looking at growth at the attribute level allows you to understand the nuances happening across categories. Ingredients, certifications, allergens, and product forms influence how and why shoppers choose certain products. That’s why SPINS Product Intelligence maps raw product data against its attribute database.

The database– powered by SPINS Product Intelligence—begins with product attributes, which include information from the nutrition panel, ingredients list, allergen list, and label claims. These attributes give reporting depth that reveals insights beyond what is and isn’t selling; they uncover possible motivations and circumstances influencing shoppers. For example, category sales can show growth, but looking at the attribute level you might discover ready-to-go options are outpacing all other forms or plant-based items are outpacing their animal-derived counterparts. These discoveries within the data let you think about the lifestyles, preferences, and other factors behind product performance. Product Intelligence across omnichannel sales data can help you innovate and position properly to maximize growth in every channel.

3. Reveal Trends and Begin Innovating

Perhaps the greatest value of having an Omni-Intelligence view of your market is having data to inform the strategic decisions that lay the foundation for long-term growth. SPINS Product Intelligence provides the detailed look that businesses rely on to influence brand positioning and competitive differentiation.

First, spot which trends are emerging and in which channels using SPINS Product Intelligence. Then examine how those trends play out channel by channel. If the trends you see on Amazon differ from those in natural retailers, you can respond accordingly and prevent competitors from making inroads. When products with certain ingredients trend downward across all channels, these insights tell you what to avoid when innovating and adding to your product portfolio. Or if your products don’t include those avoider ingredients, promote that message on your packaging or in positioning. The combination of product intelligence and omnichannel provides opportunities to adjust, innovative, and act, based on quantifiable insights.

Get Started with SPINS Omni-Intelligence

SPINS Product Intelligence library and omnichannel data are essential to evolving alongside today’s shoppers and trends. With a macro view of the market and the tools to delve down to a micro level, brands have an exciting opportunity to understand. Learn more about SPINS Omni-Intelligence today.