Introduction

Recently, SPINS joined forces with Goldman Sachs to take a close look at today’s pet industry to uncover the current state of the market, and better inform its outlook going into 2021 and beyond. With nearly 7 in 10 households being home to a pet, there is a massive opportunity—$43 billion to be exact—for brands and retailers alike to engage both seasoned and new pet parents to connect and create loyal customers for life. Below we will navigate from a broad market view to trends just gaining steam.

OVERALL PET DEPARTMENT

The total pet marketplace is up 6.2% vs. last year in SPINS’ Natural Enhanced, Neighborhood Pet, and Conventional Multi–Outlet (powered by IRI) channels. Like all consumer products, the pandemic certainly has affected the normal seasonal sales cycles of pet products, with a large spike in March and downfall that followed. However the strong growth that followed and continues proves the industry’s resilience.

UNDERSTANDING THE NATURAL, SPECIALTY, AND WELLNESS SHOPPER

SPINS’ sweet spot is the natural, specialty, and wellness pet market, which drives many trends that turn mainstream. To better understand this shopper and further our research on today’s pet industry, we turned to panel data powered by IRI. The trend toward these better-for-you products was certainly growing before the pandemic, but one can assume that pet parents’ focus on their own health and immunity offers a halo effect to their fur babies: In the 52 weeks ending October 4, 30% of households purchased natural, specialty, and wellness items on a routine basis, and a whopping 75% purchased these products at least twice.

So who is this shopper? The same panel data shows that two person households purchasing natural, specialty, and wellness products index higher than other households, and those without children, with higher income and educational levels are also driving this behavior.

WHERE ARE THEY SHOPPING?

Taking a closer look at the different channels that SPINS tracks reveals a shift in shopping behaviors from channel to channel. Looking at four of the most recent four-week periods (quads) that SPINS tracks, we see that the Natural and Regional Grocery channels posted the highest gains but are softening over time. One of the biggest changes we can see, however, is a shift towards the Neighborhood Pet channel as pet parents return to their trusted local pet stores. These retailers are a source of trusted information for their shoppers thanks to their vast knowledge of pets and how both consumable and non-consumable products can affect them.

SPINS PET TRENDS 2020 - NON-CONSUMABLE PRODUCTS

Let’s take a closer look at the Neighborhood Pet Channel to better understand why shoppers are drawn to these stores, what products they offer, and how they spotlight innovation and incubator brands.

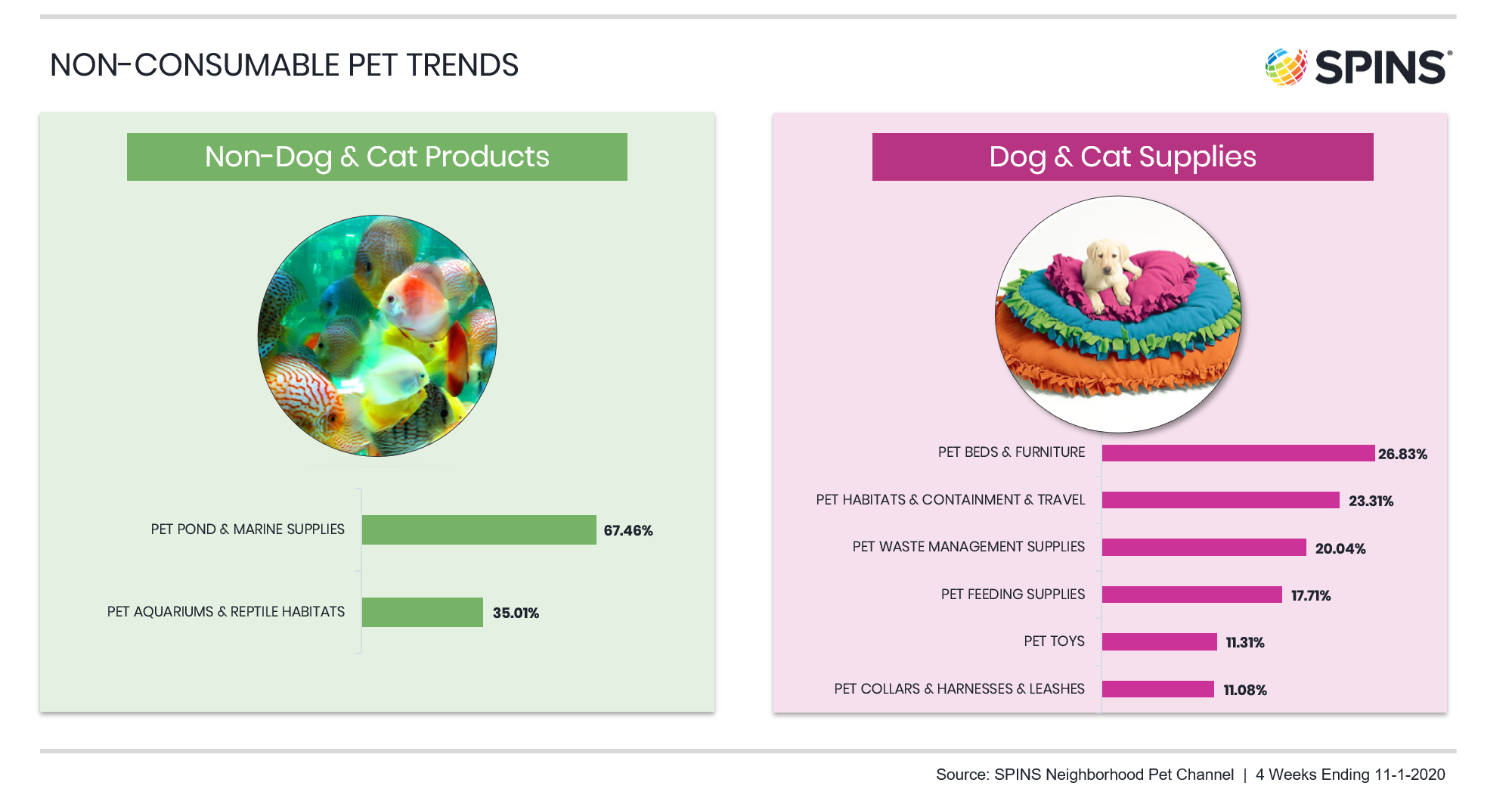

NON-CONSUMABLE PRODUCTS, HARDGOODS, AND SUPPLIES

SPINS continues to see Neighborhood Pet stores lead and drive growth for these products. Pet parents only want the best for their fur babies, so to educated themselves on how best to care for them they build relationships with their local stores. As a result, pet parents shop the entire store, corresponding in growth for non-consumable products. Beds, furniture, toys, and more designed for our furry friends are showing double digit growth for every single category. While pet parents have always had their pets’ best interest at heart, spending more time at home may have accelerated the growth of this area as people seek to make their pets as comfortable as possible.

Let’s not forget our scaly friends! While multioutlet growth for products like pet pond and marine supplies is relatively flat, pet aquariums, and reptile habitats, the Neighborhood Pet channel is showing double digit growth. We will continue to track brand leaders and products as this area gains even more attention.

PET CARE AND WELLNESS IN SPINS’ NEIGHBORHOOD PET CHANNEL

Any pet parent knows how difficult it can be to get your fur baby to take their vitamins and supplements. Brands are listening, and reacting with some incredible delivery platforms, from spreads, to chews, and even liquids to pour over food. To top it all off, these products sport label claims such as USDA Certified Organic and Non-GMO, so that pet shoppers know they are providing the most high-quality ingredients possible. These products are up 7% and we expect that to grow as brands continue to enter the space with innovative formulations, packaging, and delivery formats.

The same story continues when you look at the natural flea and tick brands driving growth. All different forms and end uses of these natural standards are showing growth potential, from sprays, to collars, shampoos, and more. Shoppers don’t want to bring sprays with artificial chemicals into their homes and on their furry friends, so the non-toxic, non-artificial formulation Tropiclean offers is the perfect solution. While Mad About Organics offers a different format with their shampoo, the brand has been similarly thoughtful about how to deliver products to the market, resulting in effective solutions that are also safe for puppies four weeks and older and pregnant dogs. Lastly, we have our eye on Earth animal, who is bringing pet parents peace of mind and protection in the form of a collar, again eliminating deet and synthetic chemicals.

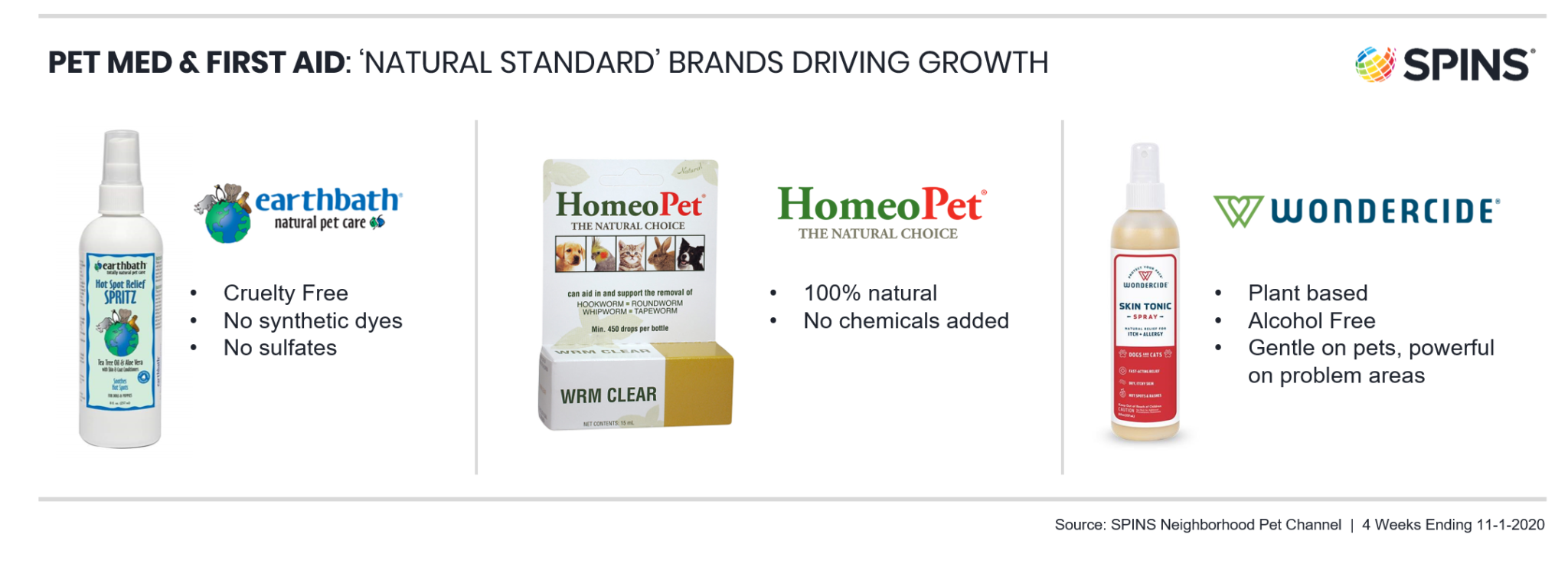

Last but certainly not least with a growth of 62%, is the Pet Med & First Aid category. Earth Bath realizes that for most pet parents, their pets truly are like their children. Their Hot Relief Spritz is cruelty-free, with no synthetic dyes or sulfates to ensure they meet pet shoppers’ expectation for the best pet care. Homeopet is innovating for dogs, cats, and even equines! Inspired by nature, they offer natural medicines to the pet community with effective products featuring natural label claims. Another brand innovativing in natural medicine is Wondercide, who focuses on promoting both their plant–based claims and the power of these gentle products.

SPINS PET DEPARTMENT CONSUMABLE TRENDS

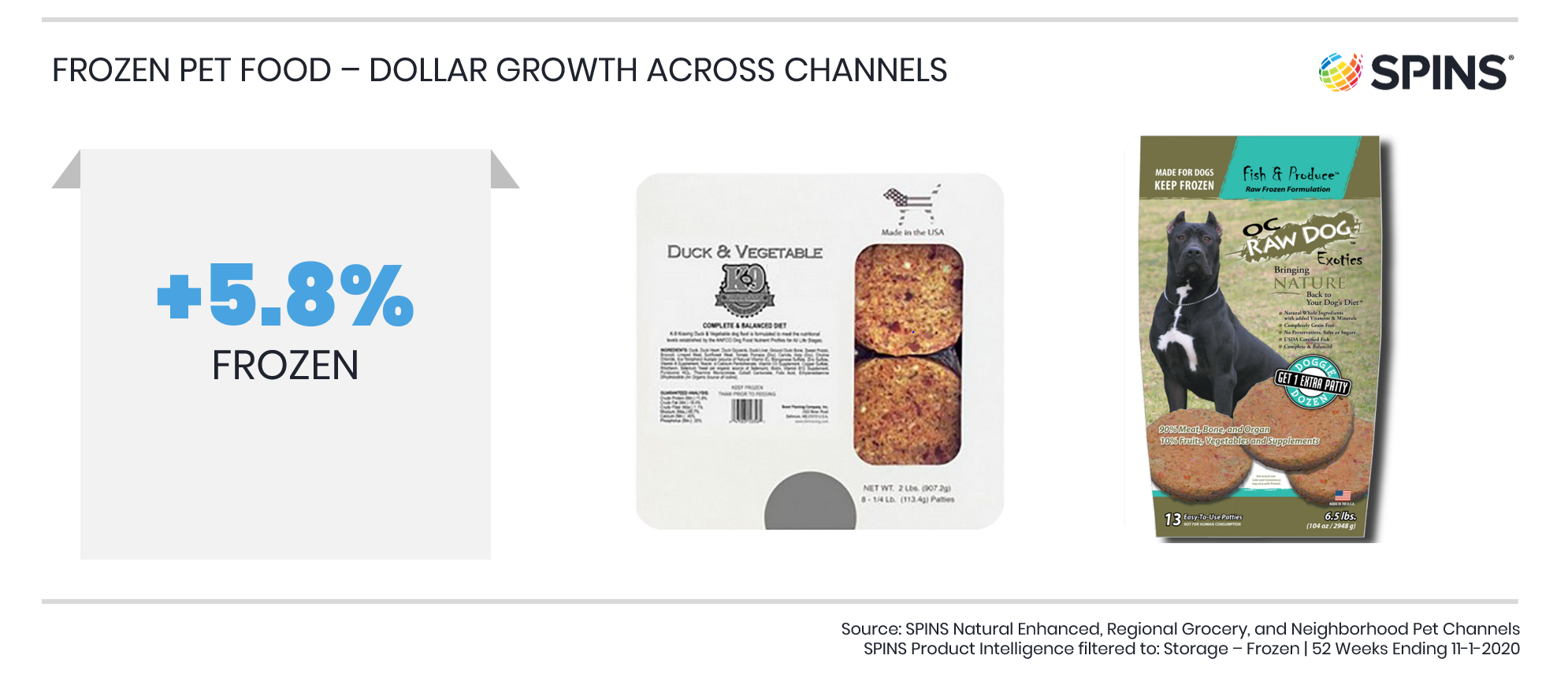

While pet food has long been found in the form of shelf-stable products, the industry has been paying close attention to new refrigerated and frozen pet food products. SPINS data shows that refrigerated items are showing significant growth across retail channels, up 32.5% in SPINS’ Natural Enhanced, Regional Grocery, and Neighborhood Pet Channels, with growth being led by Regional Grocery. Brands like Fresh Pet, found in the Regional Grocery Channel, and Tiki Cat, found in SPINS’ Neighborhood Pet Channel, are leading the charge in fridge space.

The freezer is proving to be a good option for raw pet brands like K9 Craving and OC Raw, who both offer raw patties. SPINS is also keeping our eye on frozen treats, which we expect to continue to grow as more brands take advantage of the benefits of frozen storage.

“Here at SPINS, we’re passionate about Natural and Health & Wellness products so to be able to blend our knowledge of these products with our love of pets is such a natural fit.”