Introduction

From Vitamin C serums to clay masks to pimple patches and beyond, there is no shortage of products that claim to be able to help your face stay youthful or help keep acne at bay. To better understand consumer preferences within the facial serums, masks and treatments category, we took a look at the category’s performance over the past 12 months on Amazon. Read on to discover our findings for the category

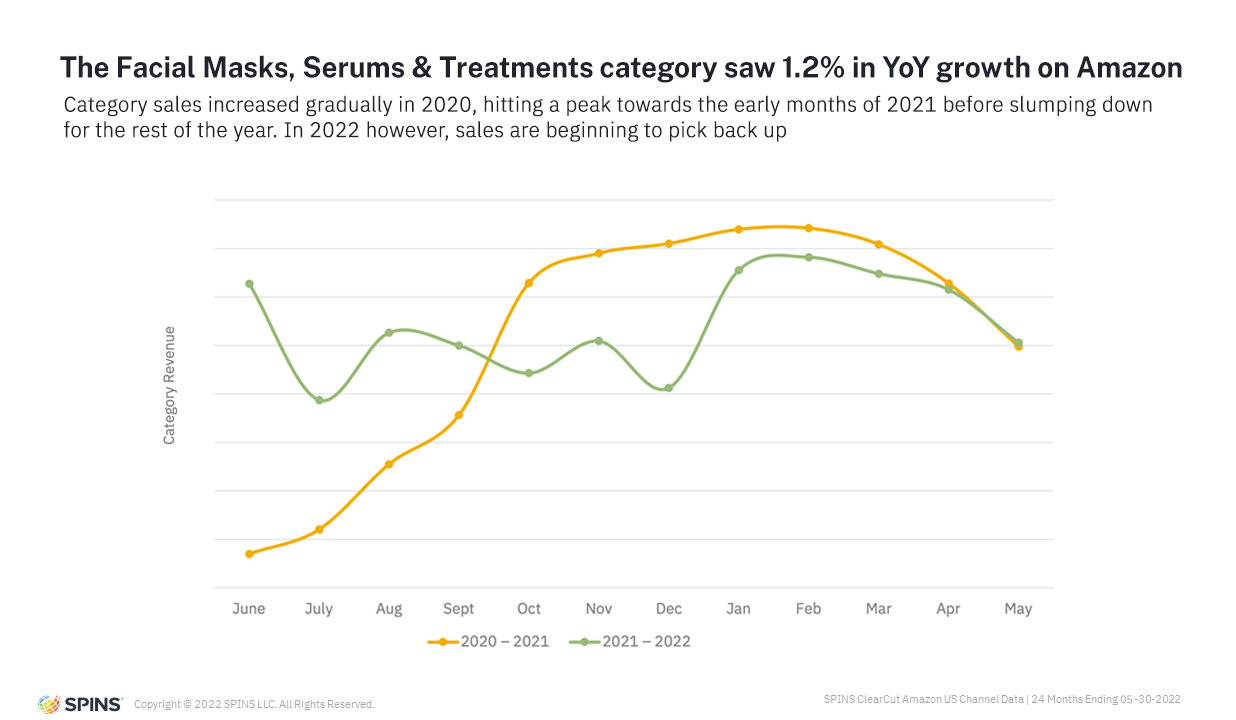

Sales in the Facial Serums, Masks and Treatments Category Grew by 1.2% YoY Online

As of May 2022, the facial serums, masks and treatments category saw a 1.2% year-over-year increase in revenue on Amazon. The category saw a gradual increase in sales during the early months of the pandemic in 2020 and ramped up even further towards the end of the year.

In 2020, the Skin Care category on TikTok (otherwise known as SkinTok) started gaining mass popularity with viral videos that gave many of the products in the Facial Serums, Masks and Treatments category a large sales boost. The strong sales continued into the early months of 2021 before tapering off, with the last quarter of the year underperforming compared to 2020.

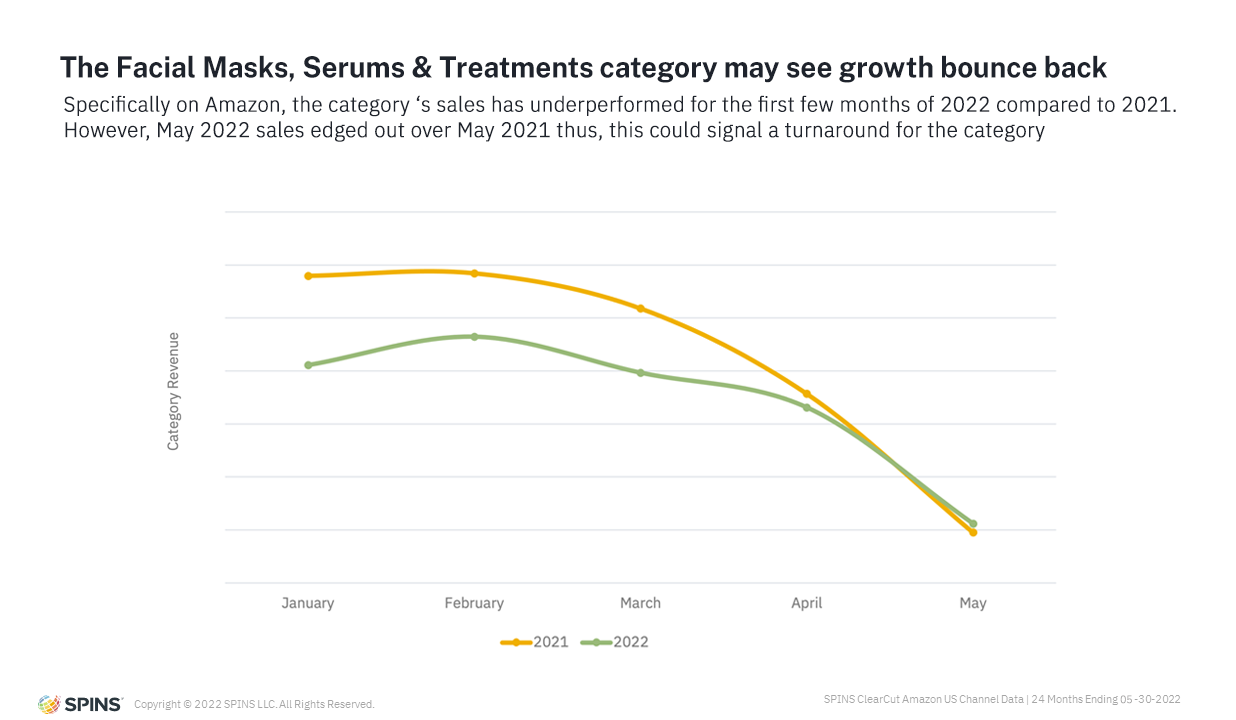

Looking at the category sales figures for the first half of 2022, we can see that the category has recovered slightly from the Q4 sales slump but not to the levels of the year prior. However, May sales figures show some hope as 2022 May sales outperformed 2021 May sales by a small margin of 0.34%. Many categories across the board from grocery to personal care and beyond have seen a slump in sales in 2022 with many issues like rising inflation and other supply chain woes affecting sales. Though the average price of products in the category has risen by 1.8%, that hasn’t seemed to deter consumers for long.

Acne Treatments Are Seeing Tremendous Growth Online

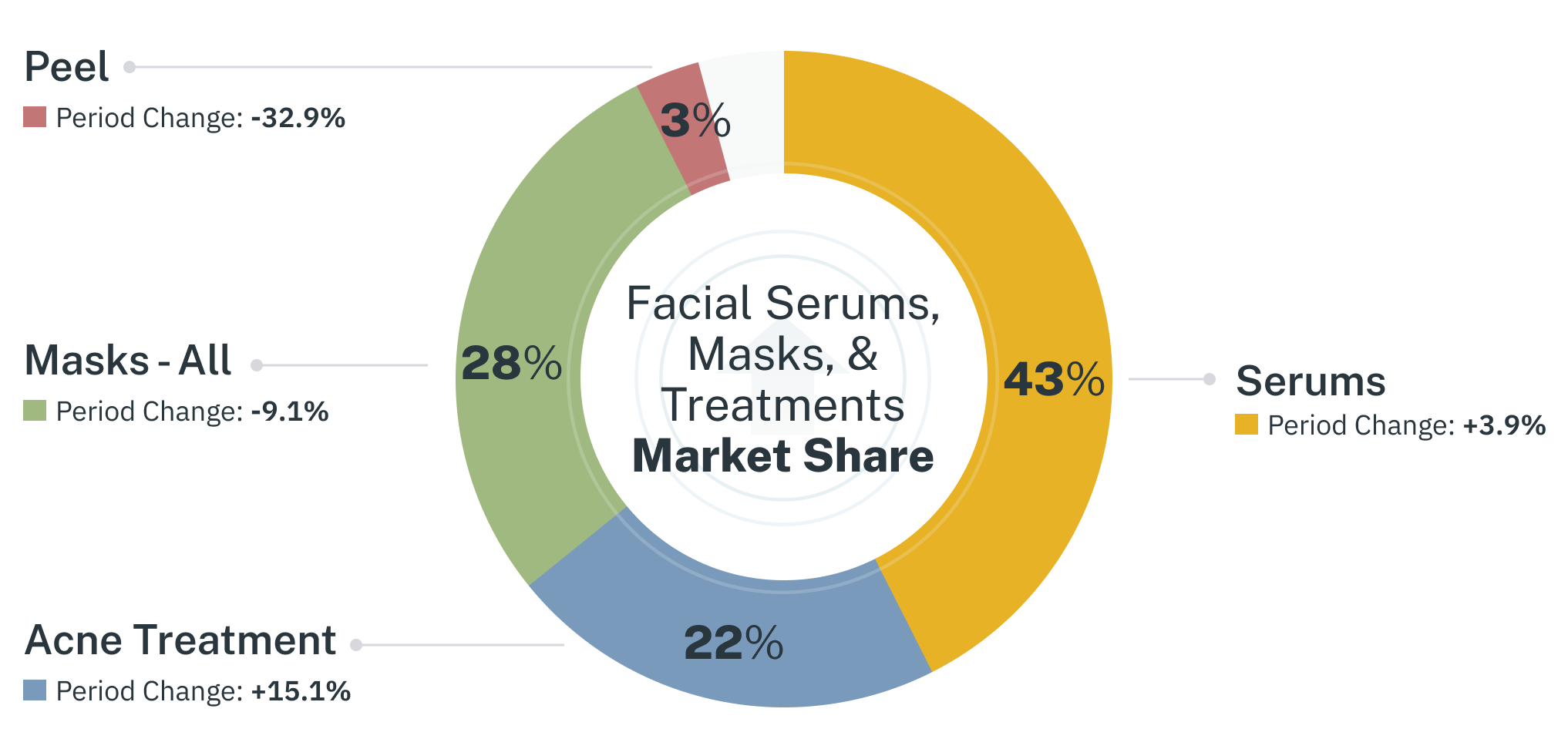

Taking a look at the subcategories within the facial serums, masks and treatments category, we can see that serums holds the majority of the market share with 42.5%, while masks come in second at 28.4%, acne treatments take third place with 21.6%, and peels close out the top 4 at 3.2%.

Though the masks subcategory—which includes products such as sheet masks, mud/clay masks and more—saw a huge spike in sales September 2020 onwards, interest began to wane around July 2021. Post-July 2021, sales for the subcategory consistently trended lower than the year prior and it remains the case as of May 2022. In fact, the masks subcategory has seen a –9.1% decrease in terms of year-over-year sales.

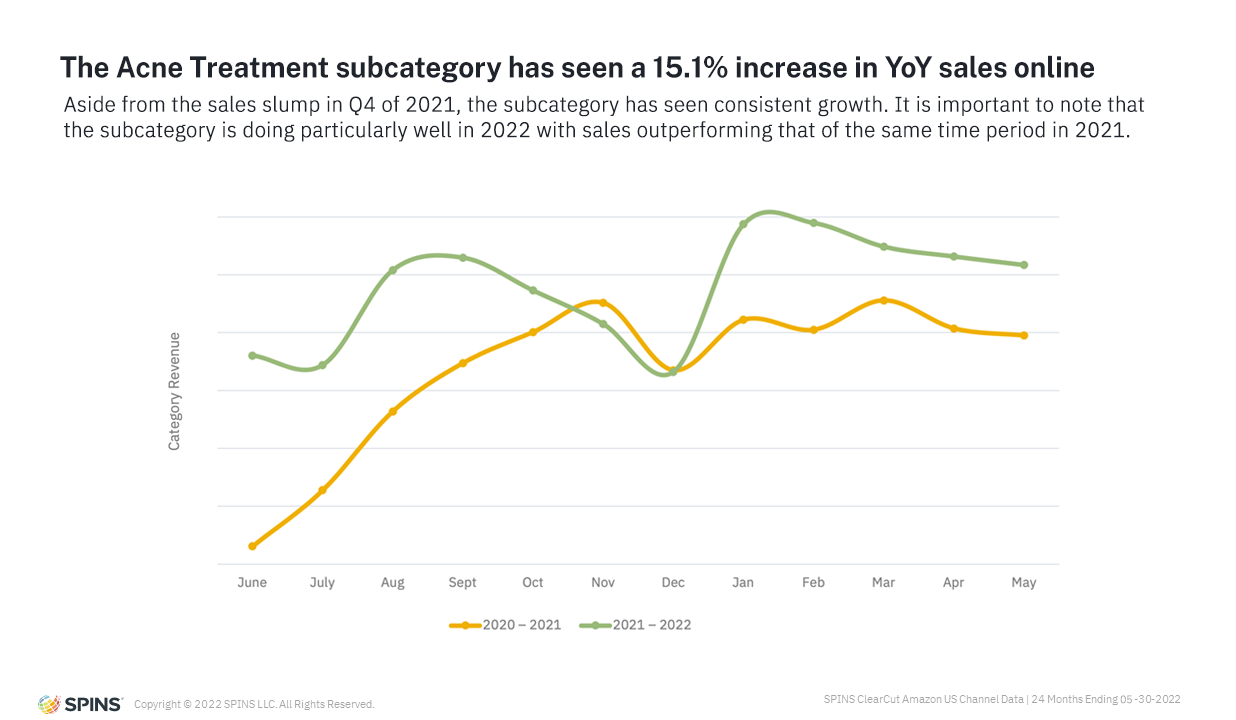

The acne treatments subcategory, however, tells a different story. The subcategory, which includes products like pimple patches and spot treatment gels and creams, has been growing since June 2020. Aside from a slight slump in Q4 of 2021, the subcategory is doing better than ever. Overall, the subcategory has seen a 15.1% increase in year-over-year sales.

Products like pimple patches gained widespread popularity due to TikTok where many videos of people showing the effectiveness of the product – i.e. users showing the ‘gunk’ left behind on the patch after using it– rack up millions and millions of views.

Brands That Are Connecting With Shoppers Are Winning

Companies at the forefront of influencer marketing such as Hero Cosmetics have seen sales go through the roof via their efforts on TikTok and Instagram. Beyond that, they also partnered with the streamer Seum on Twitch who has worn said pimple patches while streaming, homing in on the fact that there is space for beauty & skincare in the gaming sector even if that’s not what most people think.

Hero Cosmetics’ pimple patch product – ‘Mighty Patch’ is in fact one of the best sellers in the entire facial serums, masks & treatments category. More interestingly though, is the fact that in the pimple patch subcategory, consumers tend to buy in bulk – e.g. the 96-count or 72-count products. This alludes to the fact that these are probably repeat customers who have likely tried the smaller version of the product previously and are now making a bulk purchase. This means that for most pimple patch products, the larger count size products sell more than their smaller count size products.

Meanwhile for Hero Cosmetics, their smaller 36-count size ranks one spot higher than its 72-count counterpart. This means that particularly for this brand, consumers are turning to Amazon even when they’re in the trial and discovery phase, since many of the 36-count pimple patch purchasers are likely to be first-time buyers. Alternatively, the 36-count could also be a sweet spot in terms of size for customers who have occasional acne versus being very acne prone.

As the year progresses, it will be interesting to see if the acne treatment category can keep up this momentum. Sales from the first half of the year shows some signs of trouble as it has been on a slow decline after a very strong January. However, the sales figure seems to be levelling out so it will be intriguing to watch not only the acne treatment subcategory but the broader facial serums, masks & treatments category to see how it performs.

Interested in learning more about these insights and where your brand stands compared to the broader category? Contact us today.