Introduction

When it comes to on-the-go snacking, Wellness Bars are a popular choice among consumers. From high-protein bars to low carb/keto bars to plant-based, consumers can pick the bars that fit their needs and diets. Though wellness bars can be bought in grocery and convenience stores, it is no secret that consumers turn to eCommerce platforms like Amazon to stock up on them as well. To better understand consumer preferences within the Wellness Bar category, we took a look at the category’s performance over the past 12 months on Amazon. Read on to discover our findings for the category.

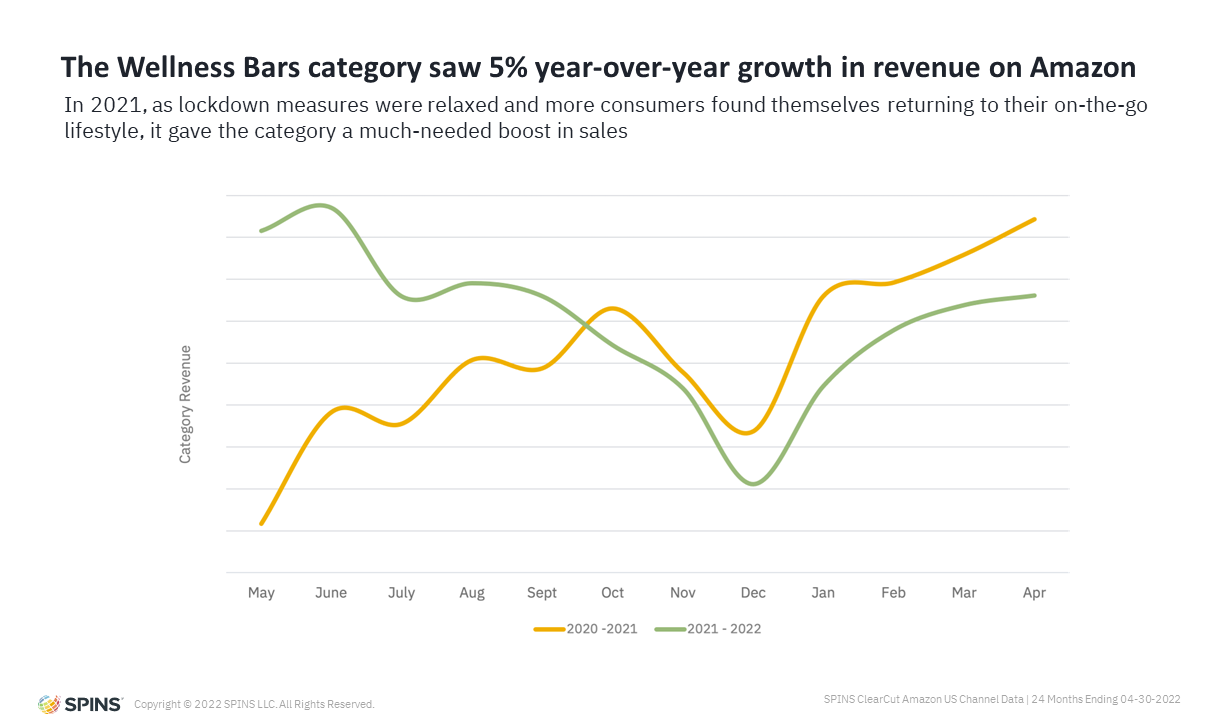

Sales in the Wellness Bars Category Grew by 5% YoY Online

As of April 2022, the Wellness Bars category saw 5% year-over-year growth in sales on Amazon. As we waded through the first few months of the pandemic, sales of wellness bars were slow. It gradually began to pick up in 2021 as lockdown measures were relaxed and more consumers found themselves returning to their on-the-go lifestyle, giving the category a much-needed boost in sales.

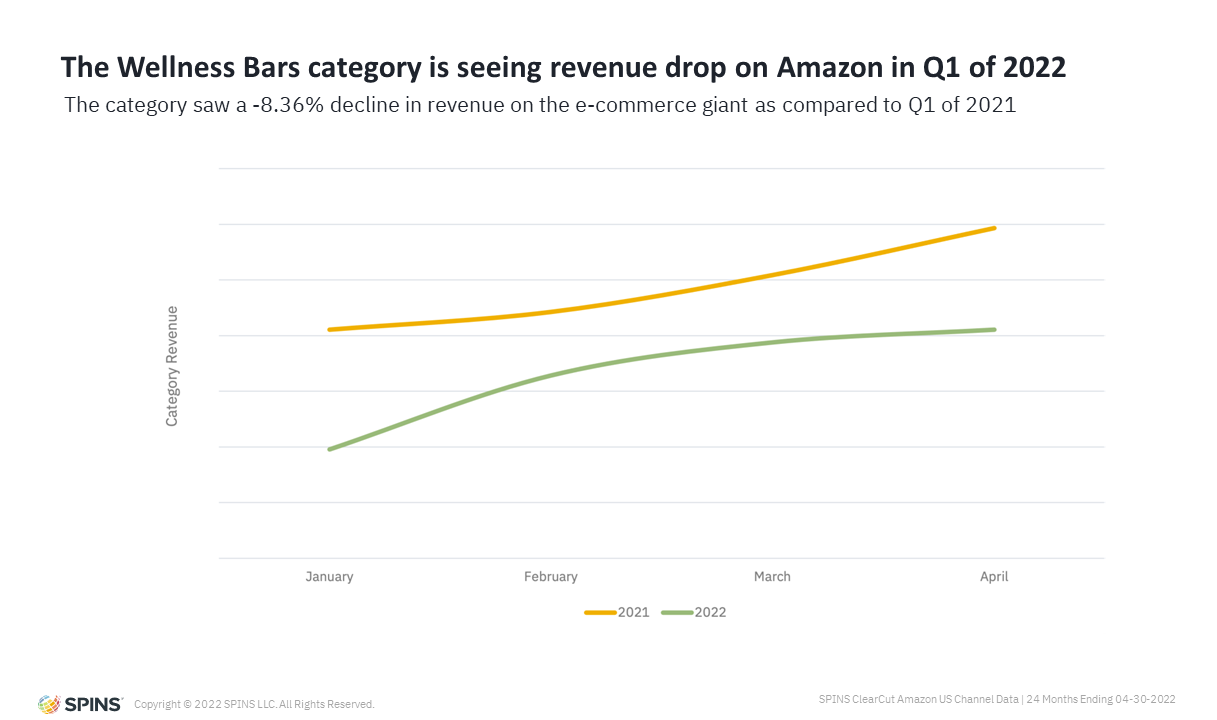

Though the category usually sees a dip in sales heading towards the holiday season, we often see sales rise in the new year. However, once we hit October, the Wellness Bar category began performing below what was seen the year prior. Sales slumped to a low in December before rising again in January, only to do not as well as before. In the graph below, it is clear that Q1 sales category is 8% lower than the year prior. Issues ranging from supply chain woes to rising inflation could have contributed to this decrease in sales. These factors could have also affected the average price for the category which has risen 9% from $19.87 to $21.71.

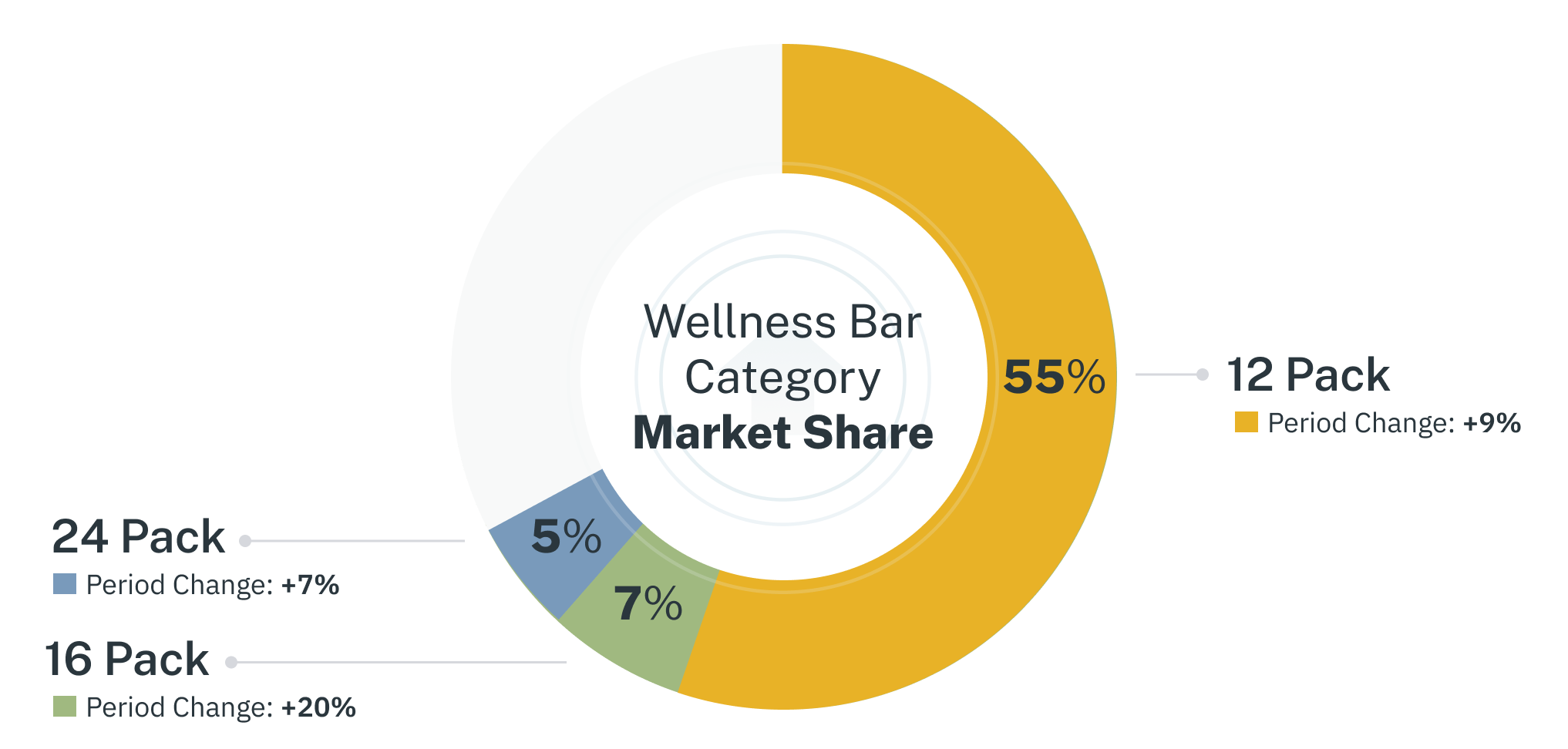

12 packs account for most of the market share

The top 3 pack counts for the Wellness Bar category is the 12 pack, 16 pack and 24 pack respectively. In particular, the 12 pack accounts for 55% of the market share and is growing at 9%. The best performing 12 pack products are those that are of a singular top flavor rather than a variety pack. Meanwhile the 16 and 24 pack sees a mix of products that are a variety pack and also those that just represent a single flavor.

What products are resonating with consumers?

Looking through the top-selling products, it is evident that consumers are looking for ways to snack without the guilt since most of these products are low in sugar but high in protein. Moreover, consumers seem to lean towards decadent flavors like Chocolate Chip Cookie Dough, Peanut Butter and etc.

Brands in the space may see some reshuffling in terms of market dominance as 4 of the top 5 brands have seen a decline in year-over-year sales. Meanwhile brands outside the top 5 have seen growth in sales, with some even seeing double digit growth of over 50%. In fact, while the top 5 best-selling products tend to come from the top brands, we see products from outside the top 10 brands breaking into the top ranks.

As consumers gravitate toward products that not only deliver taste but also lets them hit the macros that they want, it will be interesting to see how brands will innovate in this space.

Interested in learning more about SPINS Amazon Solutions and where your brand stands compared to the broader category? Contact us today.