Key Takeaways:

- Keto is a high-fat, low-carb diet that induces ketosis so the body burns fat instead of carbs for energy.

- Keto-friendly products aren’t always marketed as such, which can make them harder to find.

- Keto products continue to drive growth in new categories even as it slows in existing ones.

The Ketogenic (keto) diet has been a major diet trend for years now and in the past, we’re reexamining the growth that its seen and its continued impact on the CPG space across categories. While many diets can be seen as fads that have come and gone, keto has maintained relevance for years.

What is the Ketogenic Diet?

The ketogenic diet is a pattern of eating that signals your body to burn energy differently. By consuming a diet rich in high-quality fats, adequate protein, and low in net carbohydrates, the body’s metabolism begins to shift and utilize ketone bodies from fat as the main source of fuel rather than carbohydrates. Ketone bodies are a type of fuel the liver produces from fat when carbohydrate levels are inadequate. This shift in metabolism (ketosis) has shown to have a variety of promising health benefits including weight reduction and blood sugar management.

Ketosis can be achieved by a variety of diets, such as the Classic Ketogenic Diet, Modified Atkins, or the Low Glycemic Index Diet. One thing these diets have in common is that they all restrict carb-rich foods.

Ketogenic diets were originally developed to treat epilepsy but may also reduce blood sugar and insulin levels. This, along with the increased ketones, can have some health benefits.

Why It Matters

Overtly keto-friendly products continue to represent innovation and differentiation across aisles, however, there’s a surprising amount of flexibility in what keto adherents can eat. Products with a wide range of nutritional profiles—even if they’re not explicitly marketed as keto—can still make their way into a dieter’s basket. The common thread is that they all have low-to-no carbohydrate or “net-carb” amounts.

As such, it’s important to note that following a keto diet does not mean that every product purchased or consumed needs to be high in fat and moderate protein. Rather, the sum of foods consumed throughout the day should fit the macro ratios.

In light of this, while marking an item as keto makes a difference—especially in categories like yogurts, frozen appetizers and snacks, sodas and sports drinks, and cold cereals where starches and sugars are highly prevalent, there is a massive opportunity on the table to increase visibility into this attribute. Data that can dive deep into keto eligibility and surface hidden sugars and carbs goes a long way to this effect. For retailers, this may mean creating keto endcaps and shelf tags, and for brands, this could involve badging and filtering on websites and product display pages. This greatly streamlines a keto shopper’s experience and saves them from scrutinizing the nutrition fact panel of each product they consider purchasing.

Product Intelligence helps identify product that eligible as Keto even if it's not labeled on the package.

Keto Growth Opportunities

When we look at where keto products are growing, shelf-stable cold cereals saw the strongest growth across keto products, particularly within the granola and muesli subcategory, which grew 72.6% over the past 52 weeks. This growth is driven by high protein products with low net carbs, particularly as new brands have continued to emerge in this area.

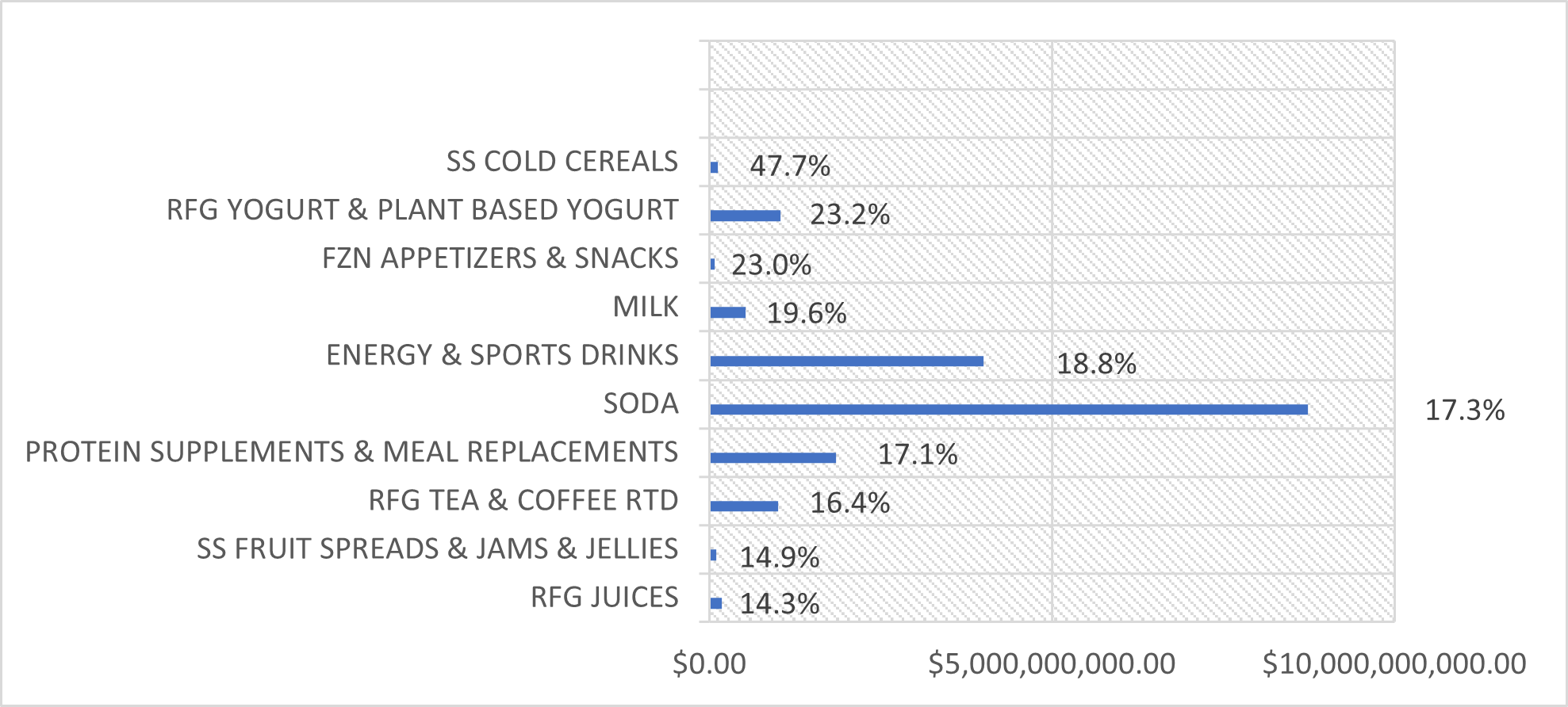

Percentage (%) Increase Year-Over-Year in Keto Sales by Category

Soda has some of the highest total dollar sales across all keto products and continues to have strong growth year over year. This growth is largely fueled by Diet and Alternatively Sweetened Sodas. Zero-calorie sodas, e.g., those sweetened with Stevia or other alternative sugars, have shown some of the strongest growth across its products. Similarly, Energy and Sports drinks with few calories and alternative sweeteners continue to show strong growth, specifically sports and rehydration drinks. Within shelf-stable candy, candies with health and wellness positioning such as keto gummies and functional chocolates drive growth. Keto protein supplements, specifically protein and meal replacement powders, is another category showing strong growth, with plant-based keto protein products having some of the strongest sales growth.

Categories that have not had a large presence in keto historically are also on the rise, making them prime categories for continued strong growth. Refrigerated yogurts and plant-based yogurts grew over 20% in the past year, with low-sugar, high-protein options such as Greek yogurt driving growth in keto yogurts. Similarly, there is a demand for low-sugar, high-protein keto milk, which has led to impressive growth from brands that make ultra-filtered, higher-protein milk.

It’s worth noting that one doesn’t need to be a keto dieter to buy these products. Because of its long-term popularity, keto has had a remarkable impact on the health and wellness marketplace. Some of the keto’s most basic tenets—low/no carbs and sugar, along with fat as an energy source—have become aligned with values like healthy eating. In today’s marketplace, brands across many categories are now innovating and catering to shoppers who seek out those values across the entire store. Frequently these products position themselves as ‘keto,’ but oftentimes they simply market themselves as a healthier alternative.

Challenges and Slowdowns

While the growth in certain categories has been impressive, some categories have seen slower sales, likely a result of inflationary pressure, less new product development, and attention towards other, more dynamic categories. Many of these categories that comprise smaller areas of the keto market, e.g., shelf-stable hot cereals, shelf-stable beans, grains and dry rice, frozen juice and beverages, and refrigerated pasta, have struggled to take off and are facing declines to their relatively smaller market sizes. Other categories with a more established presence in the market are also seeing declines, such as frozen breakfast foods, which were down 7% over the past year. This decline was driven mostly by a decline in frozen keto waffles, which had a sales decline of 46%.

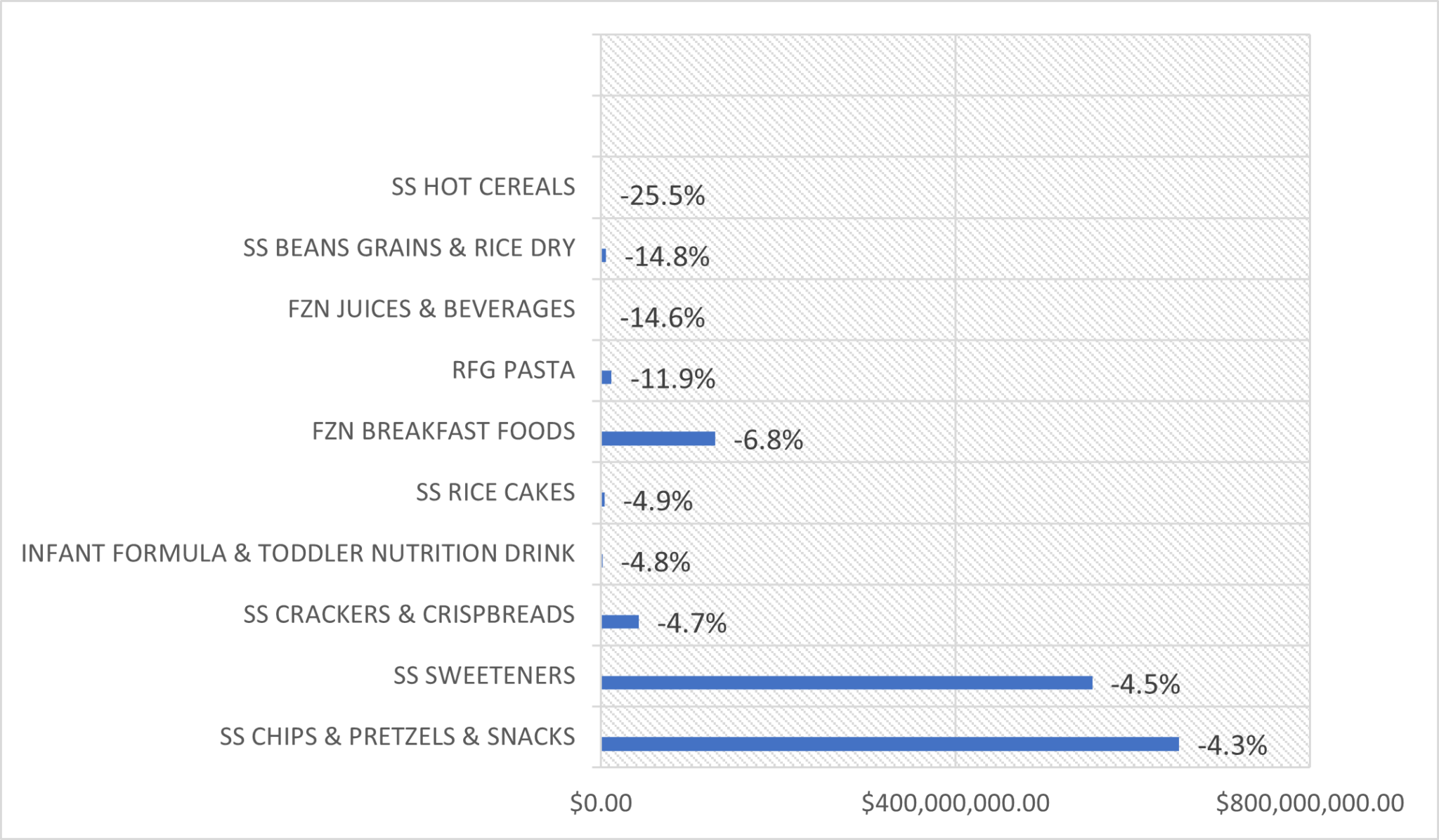

Percentage (%) Decrease Year-Over-Year in Keto Sales by Category

We are also seeing a slowdown in sales of keto-friendly snacks across some crackers and salty snacks subcategories. This subcategory is typically rife with new product development and innovation and had seen significant growth in the past. However, due to the relative maturity of this category, these snacks may be now facing a bit of a slowdown as other categories attract consumer attention, leading to declines for snacks such as puffed snacks and straws, popcorn, and veggie chips.

Despite this, some corners of the keto-friendly snack space continue to show strong growth such as within tortilla chips, potato chips, and snack mixes.

In conclusion, keto remains a popular diet and while growth is slowing in some areas, it’s still a multimillion-dollar corner of the market rife with innovation. Many adherents claim that it is an effective diet for weight loss or other health benefits and continue to aggressively seek out products across categories that further their health goals.

How can Brands use this data?

CPG brands can use information like this and other data from SPINS to stay ahead of the curve and meet evolving consumer demands for keto friendly products.

- Incorporating keto friendly products. By doing so, they can tap into the demand for the popular diet.

- Differentiating their products to appeal to consumers who are looking for innovative ways to add to or change their diets.

- Explore new categories. By incorporating keto friendly ingredients they can offer new and innovative products to add to a retailers mix.

- Leveraging SPINS data. Insights like these help brands identify growth opportunities, track category performance, and optimize product offerings.

How can Retailers use this data?

Retailers can use the information to make informed decisions about their product offerings, marketing strategies, and category management. Here are a few ways they can use this information:

- Identify growth opportunities. Retailers can use SPINS data to identify growth opportunities in the hemp seed market and adjust their product offerings accordingly. By stocking popular keto friendly products and exploring new product categories, retailers can tap into the growing demand for these types of products.

- Cater to consumer preferences. Retailers can use the information to cater to consumer preferences by offering a variety of products that meet different needs and tastes.

- Highlight Keto. By doing so, they can differentiate themselves from competitors and appeal to consumers who prioritize Keto.

- Optimize category management. By tracking category performance, identifying trends, and adjusting their product offerings they can stay ahead of the curve and meet evolving consumer demands for diet specific products.