Health and Wellness Products Are Leading Growth

One of the most exciting aspects of the health and wellness industry is that we collectively enact change every day. Retailers stock innovative products that meet the needs and goals of pioneering shoppers—all before the rest of the mainstream market catches up. The only way to stay relevant and competitive in this constant change means paying attention to what shoppers are asking for.

And what shoppers are asking for right now is an approach to the pursuit of wellness that empowers them to choose what’s best for their own goals—whether that’s focusing on mental health, improved vitals, weight management, sleep habits, or environmental concerns. As New Hope points out, shoppers are focused more on health span than lifespan these days. This means making choices that support “health with diet, lifestyle and supplements not in mid- to late age, or only when health issues arise, but throughout our lives.”

Health and Wellness are Driving CPG Growth

Conventional products are still the dominant player in terms of dollars spent. But that’s not where innovation is happening—and shoppers are catching on. Looking at the CPG market, conventional products account for 75% of the share of dollar volume, with Health and Wellness products accounting for the remaining 25%. However, the picture is quite different looking at the share of dollar growth: Health and Wellness products account for 63% to the 37% of conventional.

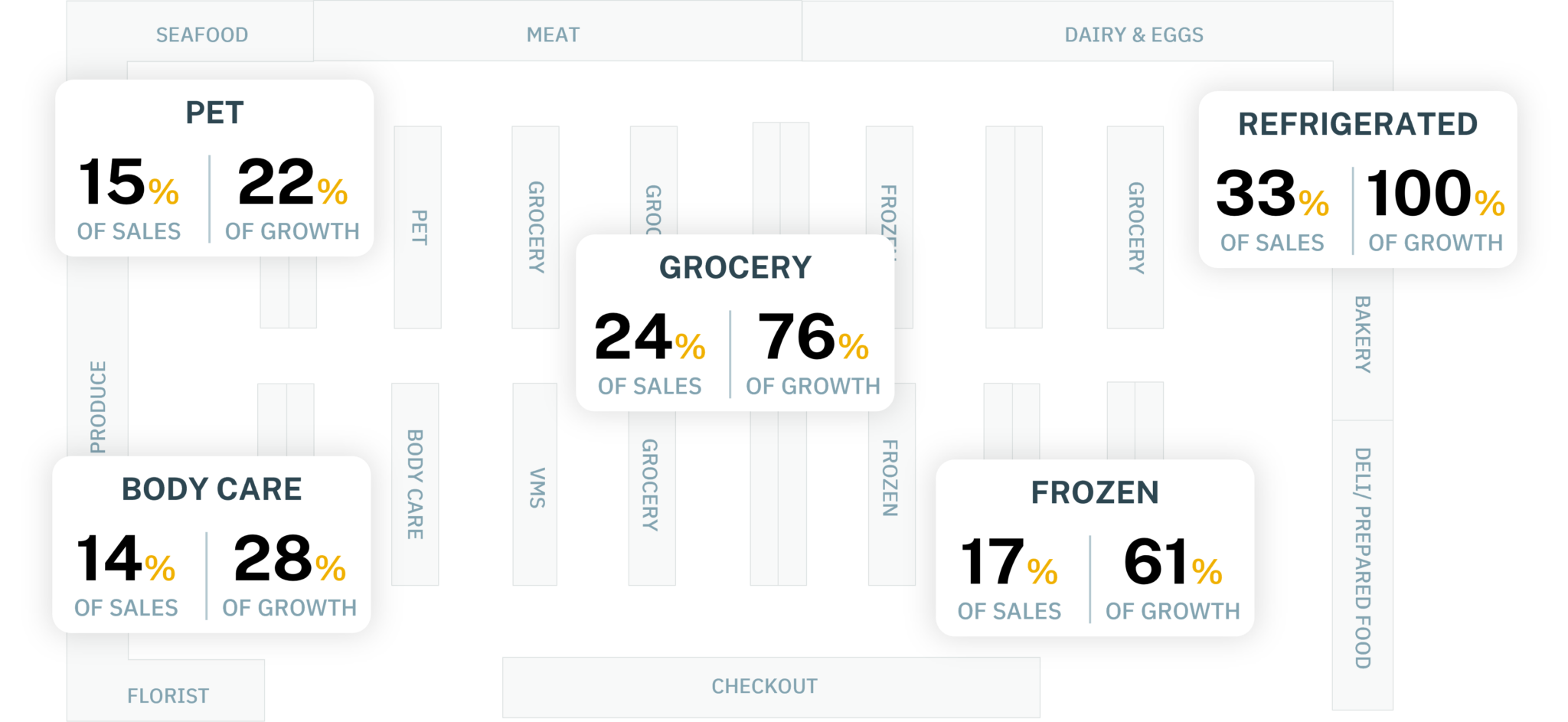

Taking a walk through the store reveals a similar pattern. These products are providing outsized growth in the overall marketplace in several categories. Health and Wellness products:

- Are 24% of grocery sales but provide 76% of the growth

- Make up 17% of frozen sales but account for 61% of growth

- Create 14% body care sales but spur twice as much growth (28%)

These products let shoppers take ownership of their pursuit of wellness and easily fit in within their daily life. For proof, look no further than how they’re incorporating immunity-focused items into their shopping carts.

Immunity Is a Top Priority

Simply put, COVID turned immunity into a hot topic for the past 2 years, and as a result it’s now part of the everyday shopper’s lexicon. During this period, shoppers discovered ways to incorporate immunity boosting ingredients into their diets and now—even with pandemic restrictions lifting and cases ebbing and flowing—they can continue to enjoy these products.

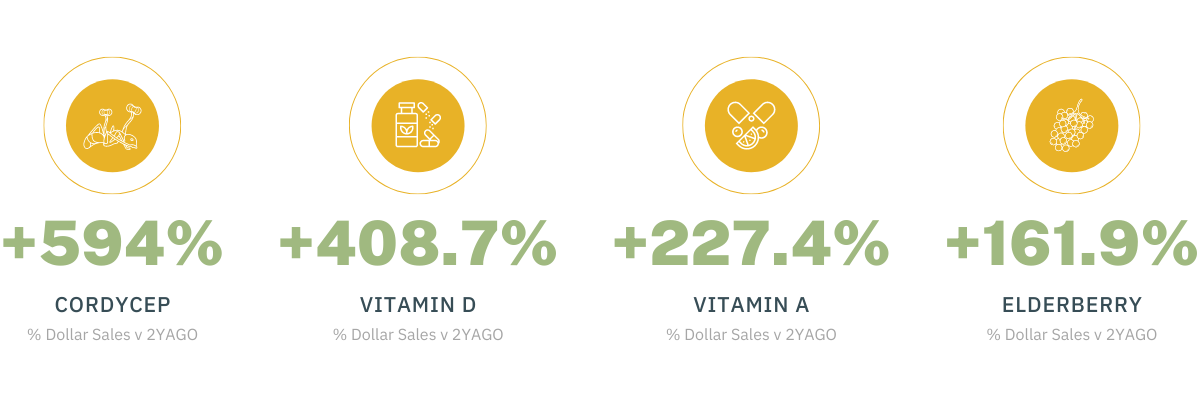

Looking at percent of dollars spent versus two years ago, immunity staples have enjoyed their sales boost in food and beverage:

As we’ve mentioned before, functional ingredients like ashwagandha and zinc are go-to options for shoppers looking to address immunity as well as mood support. Any ingredient that can do double duty is key to meeting shoppers’ needs in any aisle.

Use Omni-Intelligence to Meet Health and Wellness Trends

These trends are taking shape in brick-and-mortar retailers as well as on D2C sites and major players like Amazon. That’s why understanding what shoppers are buying (especially in the vitamins and supplements aisles) is crucial. SPINS Omni-Intelligence brings together omnichannel point-of-sale data with SPINS product-level attribute data, allowing you to see how consumer preferences translate into shopping behavior. Brands gain insights to make informed decisions in a highly competitive market with data from natural grocery, regional and independent grocery, conventional multi-outlets, and Amazon.

Unless otherwise noted, all data is from SPINS’ Natural Enhanced Channel & Conventional Multi-Outlet (powered by IRI) for the 52 weeks ending December 26, 2021.