A look at shopping behavior, innovation, and trends affecting Body Care

Thanks to inflation concerns, ongoing supply chain issues, and pandemic-affected shopping habits, 2022 is proving to be an eventful year. That’s especially true of the body care category, which is experiencing noteworthy price changes, sales growth, and innovation.

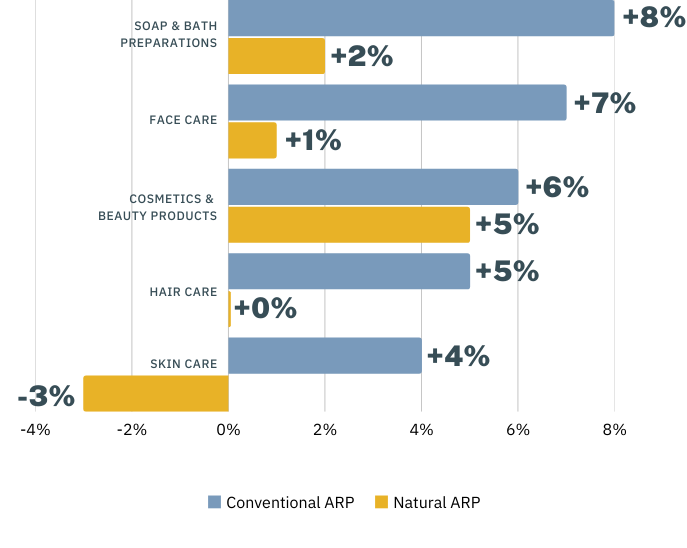

During periods of inflation, natural products have historically seen less price fluctuation than conventional products, and that seems to be happening once again. We looked at the base average retail price (ARP) for top body care items during the 52-week period ending March 20, 2022. Conventional ARP increases outpaced natural ARP for several personal care staples:

- Soap & bath preparations (up 8% vs 2% in natural)

- Face care (up 7% vs 1% in natural)

- Cosmetics and beauty products (up 6% vs 5% in natural)

- Hair care (up 5% vs no increase in natural)

- Skin Care (up 4% vs a 3% decline in natural).

There were a few exceptions, such as deodorants/antiperspirants and body fragrances/perfumes, where natural’s ARP increase outpaced conventional.

Spotlight On Shampoo

Shampoo, a body care staple of every home, has had an unusual 12-month period. Sales began to increase in April 2021, peaking in the summer months, before beginning a gradual decline in August. December, however, showed a steep drop that bottomed out even lower than its April sales—and then December brought a bounce to higher sales than even November had. While sales haven’t remained at that level, they have stayed strong enough to make shampoo’s year-over-year (YoY) growth 14%.

Several factors contribute to a product’s growth, so we delved into the top 5 shampoo brands in the SPINS ClearCut Amazon channel and looked at how pack counts are performing. The pack count attribute, which is the number of items in each pack sold, shows us that shoppers are mostly buying ad hoc but buying bulk is gaining traction. Shampoos sold in single packs account for 89.8% of the market share and have seen 13% growth over the last 2 years. Next, 3-packs account for 1.9% of market share but has grown 10% during that same period. Just behind is the 10-pack, which has 1.7% of market share but has grown an astonishing 4,677% over those same 24 months. That period of time obviously includes the pandemic’s initial stockpiling phase, but it also suggests that a small segment of customers have adopted a preference for buying bulk and reducing trips to the store (and maybe even reducing their expenses).

What Shoppers Are Avoiding in Body Care

SPINS Product Intelligence allows you to look at attributes that customers are seeking out and avoiding. Attributes—which includes label claims, nutrition panel information, and ingredients—give you a look at what shoppers are considering when they place an item in their shopping cart (in stores or online). According to the SPINS Natural Enhanced Channel and SPINS MultiOutlet (powered by IRI) Channel for a 52-week period, shoppers are choosing cleaner label products. We’re seeing decreases in products that contain sodium lauryl sulfate, parabens, and triclosan.

Some customers are avoiding these ingredients because they worry about potential harmful or toxic effects. As a result, more brands are beginning to create clean label products or, if they already offer them, amplify this label claim to grab shoppers’ attention.

3 Body Care Trends to Look For

Now that we know what the current landscape of body care looks like, let’s look at where it’s heading. Early adopters (both shoppers and brands) are already influencing emerging trends that we expect to show up in more stores over the coming year:

- Waterless products will appeal to sustainability-minded customers who are concerned with an impending water shortage. As industry experts point out, waterless products also mean there’s less dilution and less opportunity for bacteria growth.

- Ingestibles expand body care from the usual lotions and other staples into items you can eat or drink. Collagen is already common in topical products and as a supplement, but now we’re seeing some retailers place beverages with beauty-focused ingredients in the body care department. This layout not only creates a new sales opportunity but also helps shoppers rethink what body care looks like in the long term.

- Skinimalism, as the beauty industry’s begun to call it, is a focus on using the bare necessities for your daily routine. Rather than layer several products every morning and night, shoppers are selecting items that address their top priorities—such as moisturizing or reducing blemishes—and foregoing the rest.

Use Omnichannel Insights to Stay on Top of Body Care Trends

Body care is an exciting category that is constantly evolving as shoppers rethink how they approach wellness and as brands are innovating in response. To stay on top of and—most importantly—ahead of trends, gain an omnichannel view of body care with SPINS Omni-Intelligence. You gain access to data from natural, conventional, and Amazon channels so you can compete and grow today and in the future.