Key Takeaways

- Supplements are maintaining gains from thriving years but slowing accretions

- Active Nutrition continues to drive the category

- New weight loss drugs can reshape the way consumers shop weight management

- Social media plays a major but hard-to-predict role in elevating ingredients

Introduction

The Vitamins, Minerals, and Supplements (VMS) industry has witnessed explosive growth over the past few years, but with rising inflation we’re beginning to see that growth slow down.

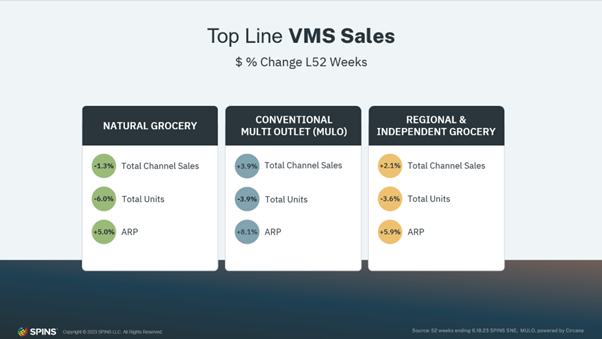

Looking at top line VMS sales by channels, we can see across all channels that the average retail price is up while units are down. For both the conventional channel and the regional and independent channel, sales are up despite units being down, meaning that the growth in dollar sales is mainly being propped up by the increase in prices. In the natural channel, however, unit sales have declined slightly more, which is likely the cause of the decrease in dollar sales as well.

Vitamins and Supplements: A Mixed Picture

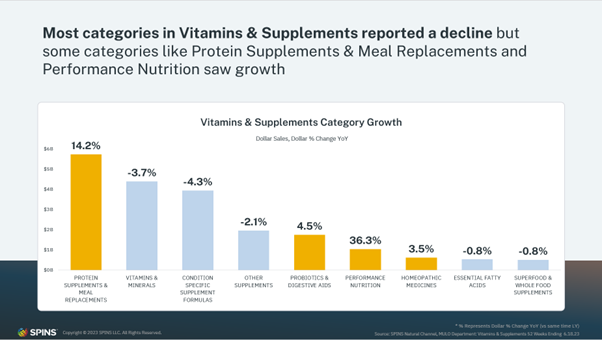

After enjoying years of consistent growth, some categories within the vitamins and supplements space reported a decline when looking at the data for the last 52 weeks. Only 4 out of the 9 categories in the VMS department showed growth, with Performance Nutrition and Protein Supplements & Meal Replacements showing the strongest growth with a 36.3% and 14.2% increase in year-over-year sales, respectively.

Probiotics and Digestive Aids as well as Homeopathic Medicines also saw growth, albeit at a smaller rate with a 4.5% and 3.5% increase in year-over-year sales respectively. The categories that are showing growth truly highlight which health focuses and general lifestyle trends matter the most to consumers and where they are spending their dollars despite rising prices

Customers Seeking Functional Ingredients

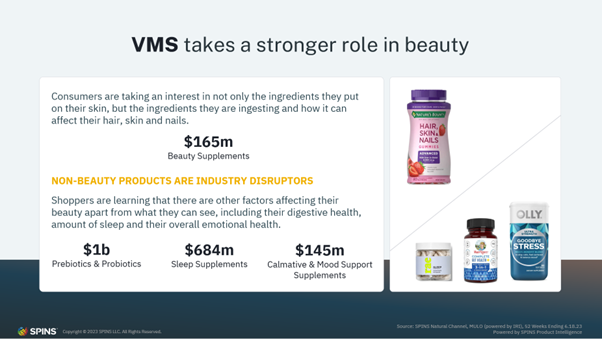

VMS has begun to take a stronger role in beauty with the total sales of the Beauty Supplements category clocking in at $165M. Gummies are particularly popular in the beauty supplements category and include a variety of options, from collagen gummies to Nature’s Bounty’s Hair, Skin & Nails gummies that contain biotin and other nutrients. Another type of delivery form that’s gaining consumer interest is chocolate, such as Sourse’s vitamin chocolate that are currently stocked in beauty retailers like Sephora.

For those unfamiliar with the space, it may come as a surprise to see vitamins and supplements being sold alongside make-up and personal care products, but beauty retailers have long been stocking supplements in their stores.

Beyond the traditional Beauty Supplements category, with the rise of social media, consumers are quickly learning that factors like gut health, sleep, and mood also affect their beauty. When influencers share their supplement regiments for perfect skin on social media, they often include supplements from categories like Prebiotics and Probiotics, Sleep Supplements, and Calmative and Mood Support Supplements – categories that don’t sit squarely in the Beauty Supplements category. Hence, we see consumers showing interest in these supplements as they eventually incorporate them into their overall routine.

Top Functional Ingredients In the Beauty Supplements Category

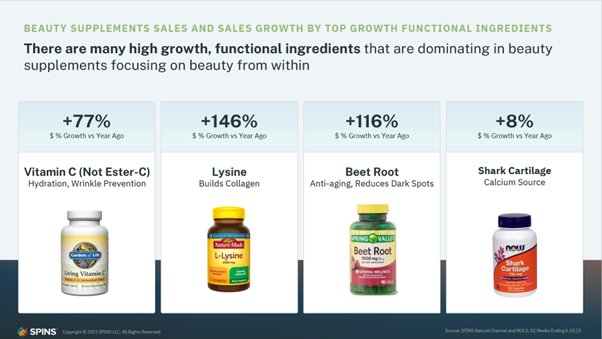

When looking at specific functional ingredients that resonate with consumers in the beauty supplements category, we see a few standouts: Vitamin C, Lysine, Beet Root, and Shark Cartilage.

While Vitamin C is typically known for its use in boosting immune health, it can also be used in promoting healthy skin. Though there are many topical versions of vitamin C in the beauty space, consumers are also choosing to consume it as a supplement, leading to a 77% increase in year-over-year sales of products containing vitamin C. Another functional ingredient that is touted as one that can help consumers achieve clear skin is Lysine and it is growing at 146% year-over-year. Beet root, mainly known for its high antioxidant content and thus purported anti-aging properties, is seeing strong growth as a functional ingredient with products containing it growing at 116% year-over-year.

The Influence of Social Media

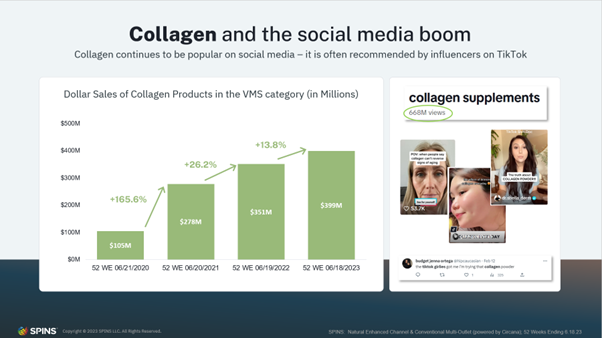

Social media platforms are becoming instrumental in shaping trends in the VMS industry. For example, collagen which has been the topic of numerous viral videos over the years continues to see exponential growth, maintaining popularity across social media. On TikTok, videos under the topic ‘collagen supplements’ have collectively garnered over 668 million views in total. This continued popularity shows up in the sales data as collagen products in the VMS category have seen a 13.8% increase in year-over-year sales, totaling $399 million in total sales in the last 52 weeks.

Collagen’s online trend demonstrates how interconnected the industry is with modern technology and digital influencers. However, not all ingredients or products touted on social media are able to sustain continued growth year-over-year.

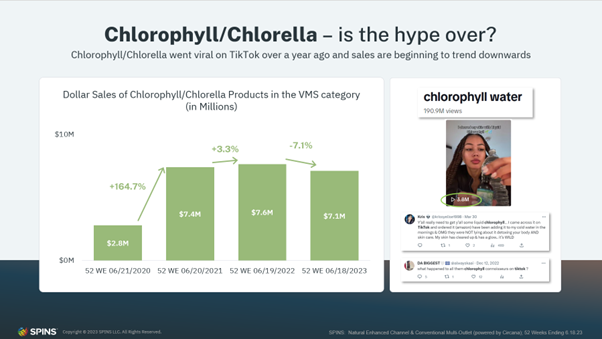

Chlorophyll/Chlorella is another ingredient that went viral on social media, promising consumers clear skin if they mixed it in their water and drank it. Video related to chlorophyll water has been able to garner over 109M views on TikTok alone, with multiple viral videos pushing the ingredient into the limelight.

Though the ingredient initially displayed strong growth, interest in it has seemed to wane as the ingredient saw a 7.1% decrease in year-over-year sales in the last 52 weeks. The signs of decline illustrate the transient nature of viral trends like this and it raises questions about the sustainability of such trends and how the industry should respond to rapid changes in consumer interest.

Functional Ingredients Showing the Highest Growth in the Natural Channel

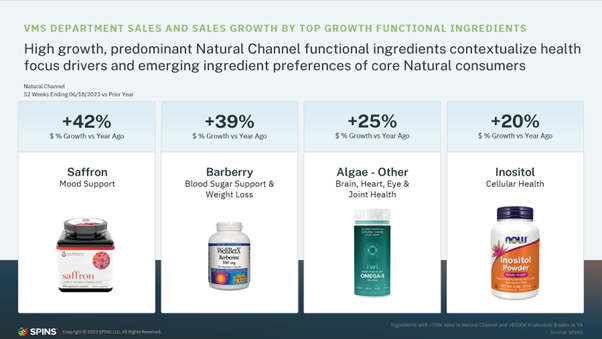

Keeping tabs on what’s trending in the natural channel can often be a good way to predict which trends will hit the mainstream. Looking at which functional ingredients are showing strong growth in the natural channel, we see a few standouts like saffron for mood support, barberry for blood sugar support and weight loss, and algae and inositol for brain, heart, and joint health experiencing significant growth. Looking at the trending functional ingredient contextualizes health-focused drivers and emerging ingredient preferences of the core Natural consumers.

Mood support has been a hot topic of late, pushing ingredients in that space like ashwagandha and super mushrooms like Reishi to stardom, and now those ingredients have crossed over into broader food and beverage. Saffron has not yet gained wide recognition for its role as a mood support-focused ingredient but is growing at over 42% in the natural channel.

Barberry has seen a huge spike in growth mainly due to viral videos touting its ability to help with weight loss – causing a 39% increase in growth. In just a bit, we’ll chart out the rise of this ingredient and the sheer power of social media to move products off the shelf.

Products containing the functional ingredient Algae – other (which means all algae excluding spirulina) have been growing at 25% year-over-year. Algae is a source of omega-3 DHAs and EPAs that vegetarians and vegans can reach for instead of animal-based sources.

Inositol, also known as Vitamin B8, is a naturally occurring sugar in our bodies and an important component of our cell membranes. Its purported benefits range from helping with insulin resistance to serving as a sleep aid. However, the most studied use is for its treatment of Polycystic Ovary Syndrome (PCOS). Hand-in-hand with its claimed ability to regulate insulin and by extension, certain hormones it has shown some success when used in randomized control tests in the treatment of PCOS. With inositol growing at 20% year-over-year, it shows that certain consumers are turning to these ingredients to seek relief from issues they’re facing.

TikTok Trend: Berberine for Weight Control

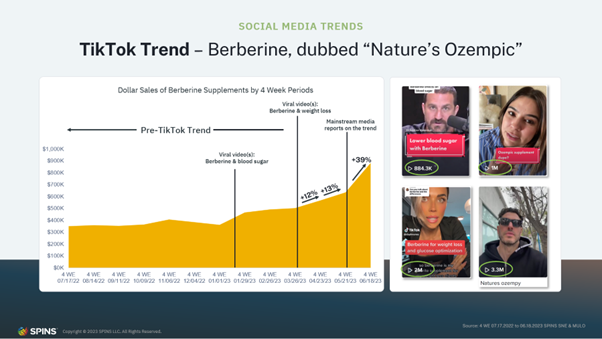

As discussed previously, Barberry/Berberine has been seeing significant growth. Berberine, dubbed “Nature’s Ozempic” for weight control, has caught attention due to a TikTok trend. Initially, discussion around the supplement was around its ability to lower blood sugar levels. However, much like the discussion around the drug Ozempic, it quickly became less about regulating blood sugar levels and more about weight loss. In viral videos on TikTok, users often raved about how Berberine helped them lose weight, with videos detailing their 30-day journey using the supplement and the subsequent claimed weight loss, racking up millions of views.

As the videos gained popularity, sales of the supplement began to climb, but the largest spike came after videos began to hit peak virality and larger traditional media outlets began to report on the trend too. The supplement saw a 39% increase in sales compared to 4 weeks prior.

It’s yet to be seen if Berberine will follow the path of sustained growth or fade slowly like the Chlorophyll/Chlorella trend.

Green Supplements: Steady Growth

Taking a three-year view, Green Supplements have grown 7.2% in the past year, slightly higher than the 4.8% increase from the previous year, signaling the market’s continued interest in this category. Green Supplements have been popular in the natural channel for years but it has gained broader popularity as of late with brands like Athletic Greens (now renamed AG1) drumming up interest in the category. The DTC giant is extremely active on social media and was an early sponsor of many popular podcasts and influencers on social media platforms, introducing a larger audience beyond the usual consumers to green supplements. In brick-and-mortar, powerhouse brands like Amazing Grass, Goli, and Vibrant Health continue to drive growth in the category.

Another point to ponder is how the growing interest in drugs like Ozempic will affect an adjacent category like Green Supplements. Those who have used Ozempic have reported losing appetite or the desire to eat, which means many turn to products like green supplements or meal replacements to ensure they’re getting enough nutrients. Tracking the performance in these adjacent categories will be interesting as drugs like Ozempic and other similar ones become more accessible to the public.

A Changing Landscape

The VMS industry remains dynamic, maintaining gains in certain areas but is showing signs of slowing acceleration overall. Active nutrition continues to drive the category as more casual athletes join the scene and brands continue to encourage a larger audience into the category through softer marketing. The emergence of new weight loss drugs could reshape consumer shopping trends as these drugs often result in the loss of appetite, therefore encouraging consumers to reach for products that can easily help them fulfill their daily nutritional needs.