Introduction

When natural products evolved from a specialty sector in food and beverage to a mainstream staple, it transformed the industry. Now, shoppers can find natural options in every aisle. That same transformation is happening in the beauty industry as natural products gain popularity with mainstream audiences.

The beauty industry ($51 billion) grew 5.4% in the last year, with the natural beauty industry growing 15.2% and reaching $4.3 billion in sales. Although natural products only hold an 8% share of the beauty industry, they are outperforming their conventional counterparts and driving 21% of the beauty industry’s growth. The SPINS and DAAP eBook, The State of Natural Beauty: Unpacking the Natural Industry’s Next Growth Frontier, delves into the changing world of natural beauty. To give you a preview of all the insights you’ll find in the eBook, here are a few highlights.

Why Natural Beauty Is Growing Now

A perfect storm has created the ideal environment for natural beauty’s rise in popularity. Natural products’ saturation of the food and beverage space has prepared shoppers to think of what other products and ingredients they’re putting in or on their bodies. Simultaneously, an ongoing cultural shift has made beauty a topic that shoppers of all gender identities care about, which has also inspired manufacturers to expand their product offerings and rethink their marketing approach. Both of those factors have been amplified by the rise of beauty content on social media. Natural beauty is part of a conversation happening in store aisles and on TikTok and Instagram.

Here are 3 critical principles to follow and capture growth in natural beauty:

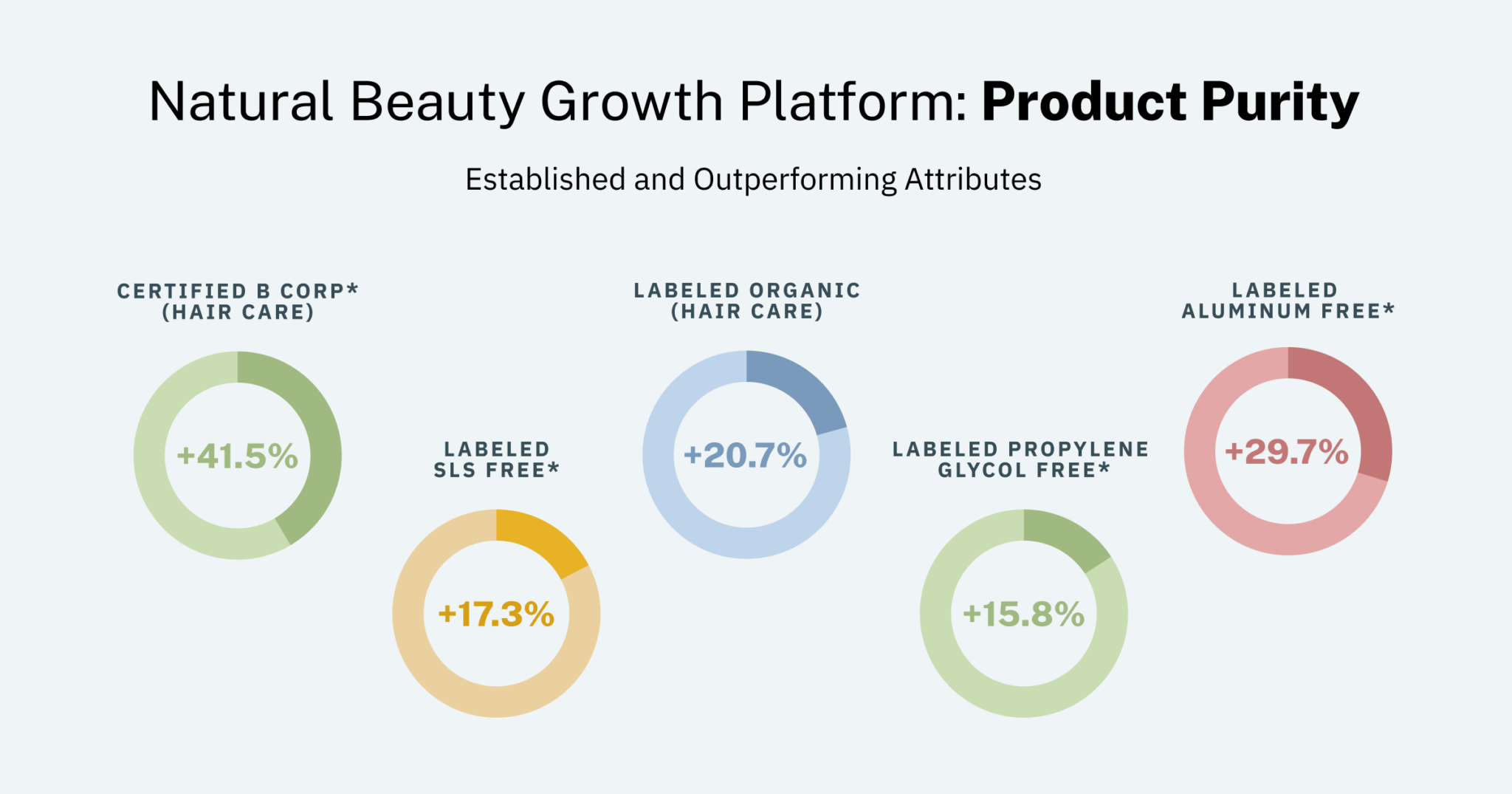

1. BUILD TRUST WITH CERTIFICATION AND FREE-FORM FORMULATIONS

Retailers helped establish natural products as a reliable food and beverage option for shoppers by adopting standards that made clear what they were (and weren’t). For example, Whole Foods created a list of prohibited ingredients for its inventory. When SPINS created its Natural Channel, the industry understood it as a signal that natural products were a new way of shopping that could not be ignored. Today, beauty retailers are going down a similar path, as industry leaders like Credo and Sephora have developed their own set of standards for natural and clean beauty—and even big box leader Target has introduced its own Target Clean symbol. As Natural products enter traditional retail outlets, certifications, and formulation callouts become increasingly crucial for consumers to find the products that align with their preferences.

Brands that fail to leverage certifications run the risk of being passed over on crowded shelves. Retailers that fail to align to a stringent list of allowable ingredients will struggle to build trust with consumers regarding their authority, interest, and intelligence in the accelerating natural beauty space.

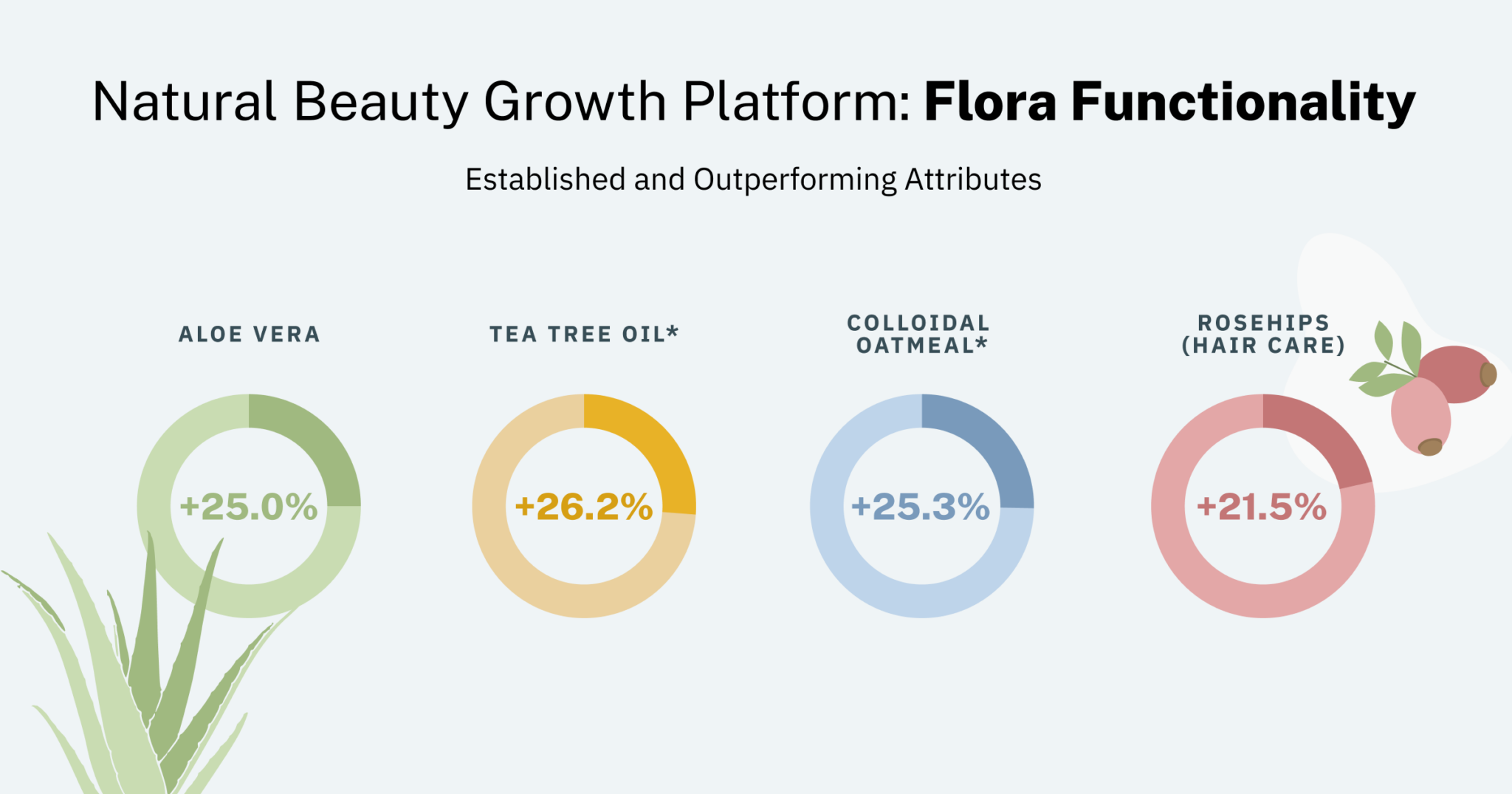

2. LEAD WITH INCREMENTAL INNOVATION

Successful innovation requires the balance between the concepts of “free from” and “functional with,” when the addition of new components frequently compensates for the removal of others. Natural beauty brands are capitalizing on the functional properties offered by botanical ingredients, taking the potency of plants to differentiate formulas from both conventional and specialty beauty products. Plant-based ingredients, for example, hold an advantage because they are easily identifiable and readily understood by consumers, aligning with shoppers’ desire for product purity and transparency. Values-oriented consumers continue to reshape the standard for shopper expectations and plant-based formulations seem likely to stay relevant for the long term.

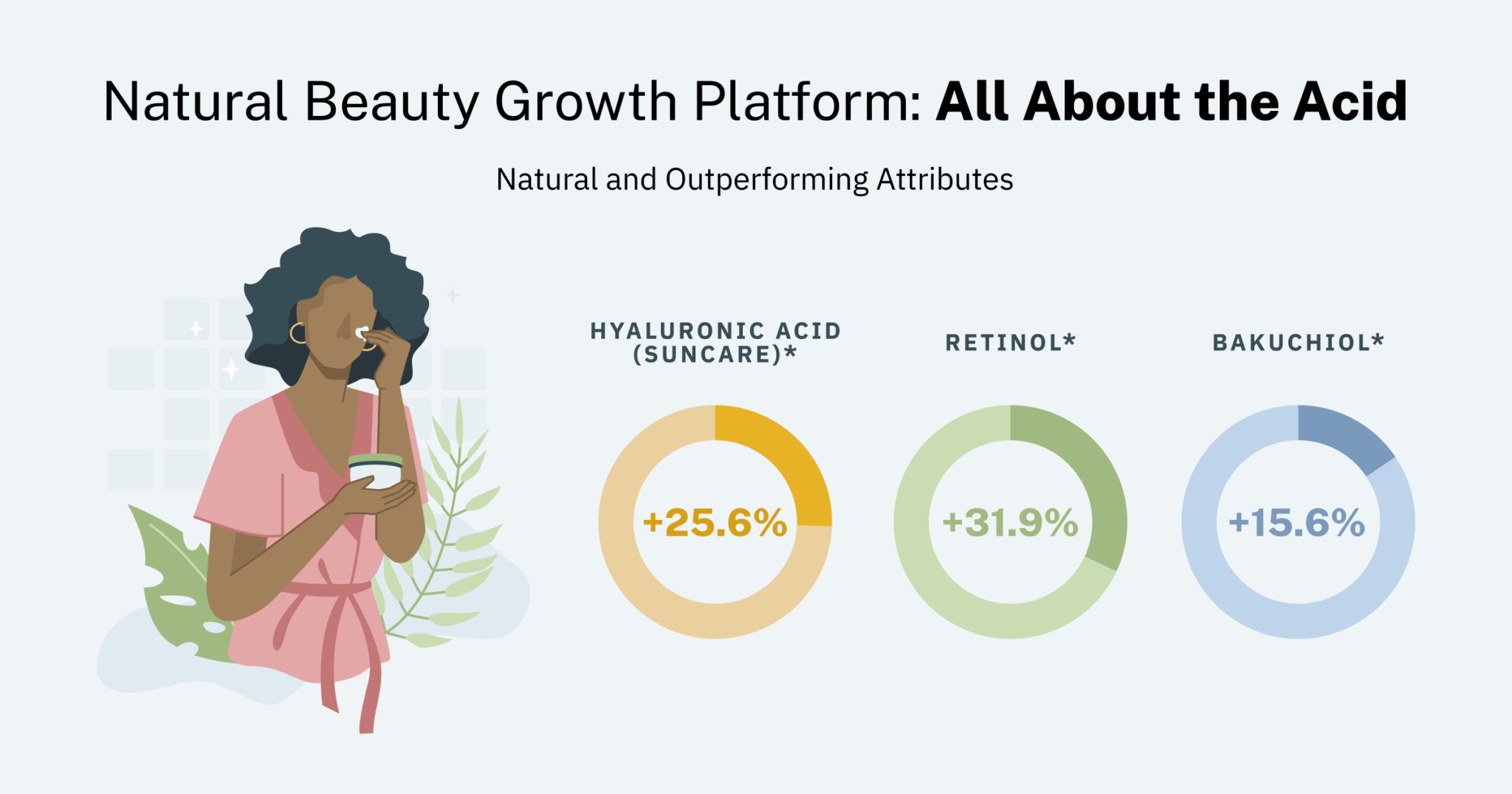

3. EFFICACY RULES THE ROUTINE

Beauty products often make bold claims about their ingredients and benefits, and shoppers are often skeptical about how factual they are. Natural products, and particularly natural beauty products, have to earn consumer trust and adoption by proving they do not fall short of advertised claims. Natural beauty can incorporate science-backed ingredients into their formulation without compromising ethos. Medical practitioners are sharing their expertise online and through social channels, educating consumers and empowering them to develop their own routines. Now, consumers are seeking out active ingredients, like acid, that promise performance.

Natural beauty is in the midst of an exciting shift, and it’s on track to continue evolving and growing. Consumers will look to social media for easily accessible education and rely on eCommerce to conveniently find and purchase products. Brands are launching online without the retailer reset cycles and buyer biases. Now is the time to understand the natural beauty industry’s current state and future potential so you can be part of its seismic transformation. SPINS and DAAP are uniquely positioned to help you achieve these goals: SPINS’s proprietary segmentation provides a holistic view of the natural industry, and DAAP helps retailers and brands measure their performance across the dynamically changing CPG industry.