Emerging Trends Indie Retailers Should Know

SPINS recently attended The NGA Show, a gathering of independent retailers, wholesalers, food retail industry executives, CPG manufacturers, and service providers. In addition to meeting with some of the best and most exciting minds in the industry, we had the privilege of hosting a breakfast where we discussed the trends and themes shaping the independent retail landscape.

During this presentation, we dove into data and SPINS’ product attributes to get a granular look at the growth and decline of ingredients, shopper focuses and product forms.

Here are some of the highlights on the latest wellness trends:

The Pandemic Continues to Affect Wellness Shopping Habits

Although current day-to-day life is quite different for most shoppers compared to this time two years ago, their shopping habits haven’t reverted entirely. Shoppers continue to consolidate trips. Club and the internet outlets pulled share of wallet from Drug, Food, MassX and SupercenterX, Health & Vitamin, and All Other outlets. Shoppers still relying on stock-up shopping trips continue to rely on Club and Walmart in particular.

Wellness Products Drive Sustained Growth and Innovation

Although conventional still has a larger share of the market, wellness-positioned products have been driving innovation and market growth over the last year. Natural and Specialty-positioned products are significantly outpacing conventional offerings based on SPINS Product Intelligence:

- Natural Positioned Products grew 4% ($80 billion)

- Specialty & Wellness Positioned Products grew 3.6% ($117 billion)

- Conventional Products grew 0.6% ($596 billion)

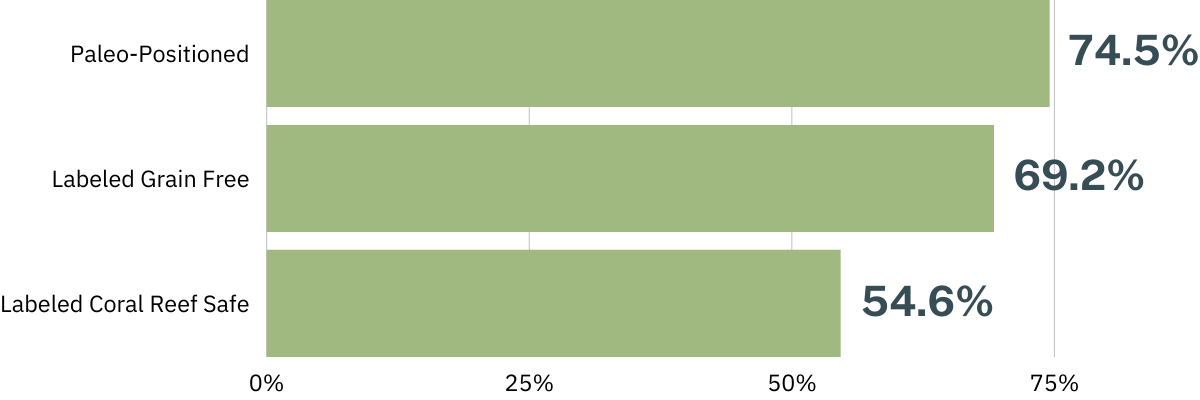

Wellness Attributes Deliver Outsized Results

Within Natural and Specialty-positioned products, certain attributes are showing tremendous year-over-year growth as well:

Shoppers Take an Omnichannel Approach to Wellness

Daily life has been hectic for the past two years, and that’s not going away as shoppers adjust to the demands of life during a pandemic. Constant stress, balancing a work-from-home lifestyle, and the ongoing pandemic (just to name a few reasons) are likely causes for increased interest in products boosting day-to-day wellness. SPINS data shows that shoppers are relying both on brick-and-mortar and Amazon to fulfill these needs.

- Cognitive Health shows significant growth at 66%

- Sleep health-focused items are up 33%

- Adaptogens grew 51% on Amazon and 14% in brick-and-mortar storefronts

- Sales growth was nearly identical on Amazon and brick-and-mortar for other wellness/functional ingredients, such as ashwagandha nootropics, and Vitamin D.

Related: SPINS Omni-Intelligence – Your Complete Market View with Amazon

To dive deeper into these trends and learn how you can stay ahead of trends, download the complete deck here.

And for even more insight from the NGA Show, watch our end of day recap where SPINS experts, Jeff Crumpton and Meagan Nelson, share their key takeaways from the show.