Introduction

The organic industry continues to have an exciting if not unusual year, thanks in large part to ongoing effects of COVID-19. Recently, Jeff Crumpton, SPINS’ manager of Retail Reporting Solutions joined other industry leaders for Weathering the Economic Storm, a webinar from the Organic Trade Association, to discuss the organic industry’s ever-changing landscape.

Organic products performed well during the initial stock-up periods in the earlier part of the year, experiencing strong growth week after week. In fact, organic outperformed analog items’ growth consistently during that period. Even in the weeks before the pandemic caused widespread pantry loading and lockdowns went into effect, and customers were purchasing items to proactively stay healthy, organic-only performance was strong. As we moved into the next phase, organic stayed competitive but the supply chain caused some shortages and growth varied week to week.

Now that the supply chain issues have been sorted and shoppers are settling into a new lifestyle, organic has once again returned to growth that’s outpacing analog items. As the summer wore on, during a phase of sporadic reopening in cities and states, growth wasn’t as robust as it had been in the earliest stage of COVID, but it was still up well above 2019 levels. In fact, organic-only items outsold analog counterparts every week since the end of June, and in the week ending August 9, organic-only products grew 12.4% year over year, compared to 10.7% for analog. Shoppers are clearly keeping organic as part of their new routine.

Based on growth looking at data from over the past year, Crumpton identified 3 trends emerging in today’s shopping environment:

1. Private Label Stays Strong

Looking at food and beverage sales for the top 5 organic brands between late March and the first week of August, private label leads by a wide margin. According to data from SPINS Natural Enhanced Channel and SPINS Conventional Channel (powered by IRI), private label organic products consistently outsell the 4 closest competitors combined.

Private label organic’s role is more complicated in when looking at year over year growth for vitamin and supplements and herbs and homeopathics. As for most products, the earlier stock-up phases were a boon for most products, with private label, label 95-99% organic, and 100% organic seeing growth from compared to 2019. However, private label organic’s growth was significantly higher than the rest for most of the year, slowly tapering in July. As the months wore on and shoppers continued to focus on immunity products, private label organic products began to lose share to products labeled as 95-99% organic. It’s worth remembering that private label continues to see strong year over year growth, but those gains may not be as robust as they were in in Q1 and Q2.

2. Shoppers Are Choosing Lifestyle Trends

When looking at the Natural Products Industry, it’s easy to look at organic as one broad classification, but that doesn’t give you the full picture of what’s happening. SPINS proprietary Product Intelligence allows you to dig deeper, beyond the label attributes, and understand more about shoppers as they set the trend that are changing the industry. Looking at data from SPINS Natural Enhanced Channel and SPINS Conventional Channel (powered by IRI), the attributes emerging in organic are easier to identify.

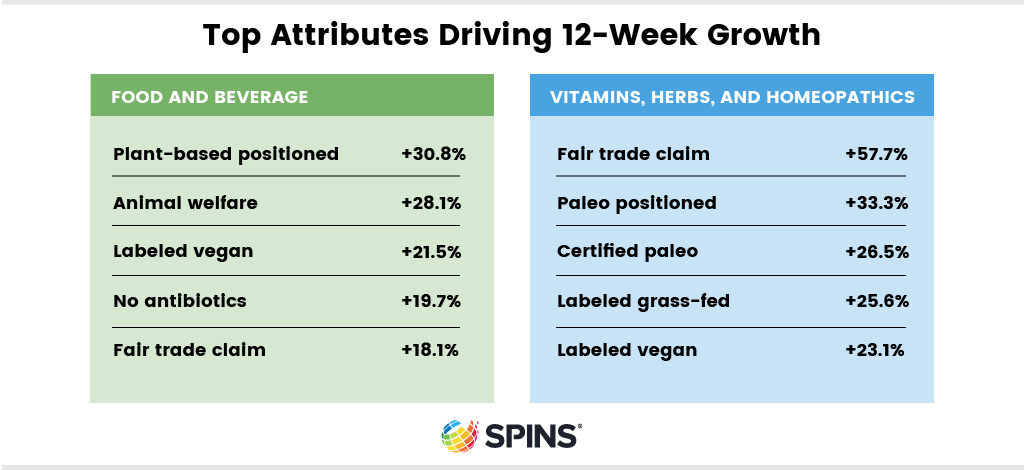

Within food and beverage, the top attributes driving 12-week growth are:

Shoppers continue to choose options that align with their lifestyles and ideals, showing an emphasize on sustainability and the ethical treatment of workers and animals.

3. Organic Categories Outperforming Competition

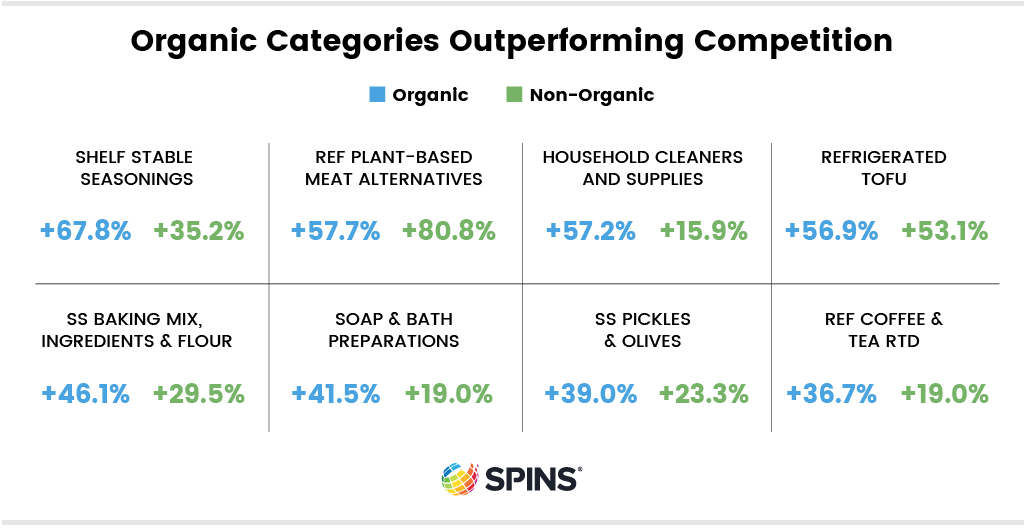

The organic products that saw strong growth during the start of the pandemic were nutritionally dense foods, but today’s growing categories hint at an evolving shopper with shifting priorities. Of the 8 top organic growth categories, 7 are outpacing their non-organic counterparts and 2 are household, non-food items.

Shelf-stable seasonings lead organic growth with 67.8% (versus 35.2% for non-organic). The next 3 categories share similar growth rates with each other, with refrigerated plant-based meat alternatives growing 57.7% (versus 80.8% non-organic), household cleaners and supplies up 57.2% (versus 15.9% non-organic), and refrigerated tofu increasing 56.9% (versus 53.1% non-organic).

If you want to dive deeper into these trends and hear from other leaders about the organic industry’s newest developments, watch the on-demand webinar here. And if you want to learn more about how SPINS data solutions and our proprietary attribute insights can help you succeed, contact us today.