Adaptogens, Cognitive Support, and CBD Lead VMS Growth

For a trend to emerge, several factors must come together. What’s happening right now in vitamins and supplements (VMS) is the result of years of evolving shopper attitudes meeting pandemic-era needs. For many shoppers, day-to-day life doesn’t look like it did a year ago, much less two or three. More people are working from home. Stress levels are high. Health is constantly on shoppers’ minds (and in the news). Brands are offering more products with functional ingredients as well as vitamins, minerals, and supplements to address a variety of wellness needs, such as mood support and cognitive health.

Shoppers want to feel rested, calm, and focused—and vitamins and supplements are a way to make that happen in a hectic world. Here are the 3 mood support trends we’re seeing in VMS:

Stressed Shoppers Turn to Adaptogens for Relief and Mood Support

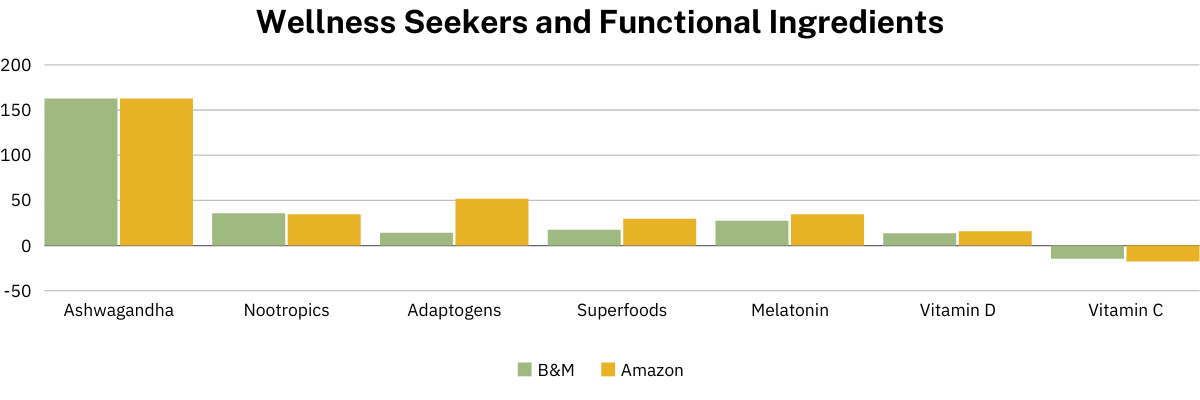

Mood support supplements are up 46% YOY (MULO +SNE, 52 weeks ending 12/26/21), not surprising considering the upheaval everyone—including stressed shoppers—have experienced. Ashwagandha, an adaptogen herb, has long been a supplement mainstay for anyone on the hunt for stress relief. Today, Ashwagandha is one of the most in-demand functional ingredients on the market, growing more than 160%. Its versatility also makes it a go-to for more than just stress and been a gateway for shoppers as they explore other adaptogens, which have grown 14% YOY. Expect that growth to continue to spread as more shoppers who grow comfortable with trying out more adaptogens on the shelf next to ashwagandha.

Cognitive Support Improves Attention Spans

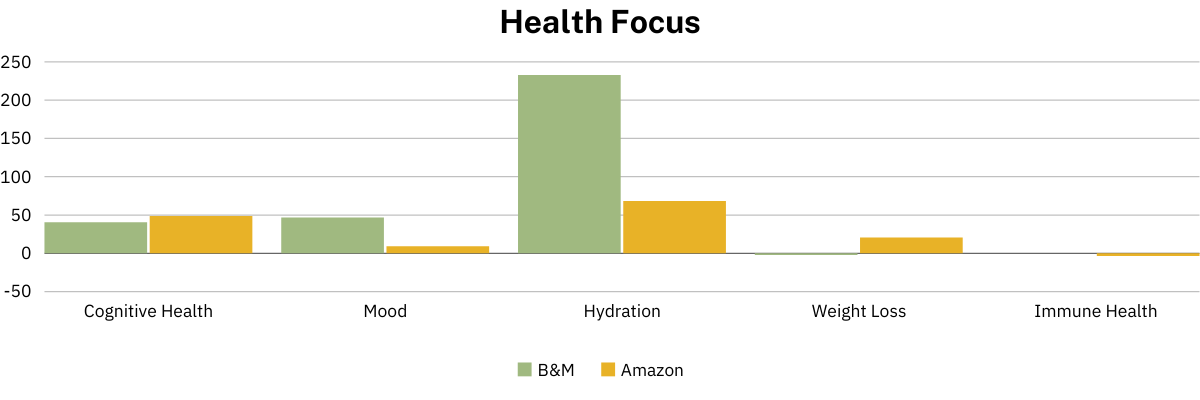

Cognitive health is about focus and concentration so you can be productive at whatever task is at hand at work or in your personal life. Daily life has never had more distractions, between regular duties (i.e., working, raising children, preparing food, performing household chores) and newer tasks (i.e., texts, emails, and social media). We’re getting distracted at every moment, so it’s no shock that cognitive health supplements saw almost 40% growth YOY. Items specifically focused on sleep health are up 33%, parallel with the increase we see in Melatonin as a functional ingredient.

That’s also why we’re seeing a YOY rise in nootropics associated with a mix of functions, including energy supplements (32%) and mood support (27%). This trend has even crossed into the food and beverage aisle, with many energy drinks now including brain health ingredients intended to differentiate themselves from a growing number of caffeinated options. As a result, energy drinks that include nootropics are growing at 134% YOY.

CBD Finds a Friend in Pets

CBD has had a storied time on the market. A few years ago, it was the buzziest ingredient, appearing in virtually every possible item you can imagine. It launched with so much aggression that it soon oversaturated shelves and was destined to fall quickly. That decline is ongoing, with a decrease of 20% YOY in SNE + MULO. Fortunately, there are positive signs when you begin to dig deeper. CBD-related products are performing impressively in the SPINS Pet Channel, with 24% YOY growth. With more companies adopting a hybrid workplace or switching entirely to remote work, shoppers will be spending more time with their four-legged friends—and more money on their food and overall needs. For example, chews and treats containing CBD have gained 7% market share from oils over the past 52 weeks. Watch for more pet brands to offer new forms of CBD as they discover the potential of the pat parent audience.

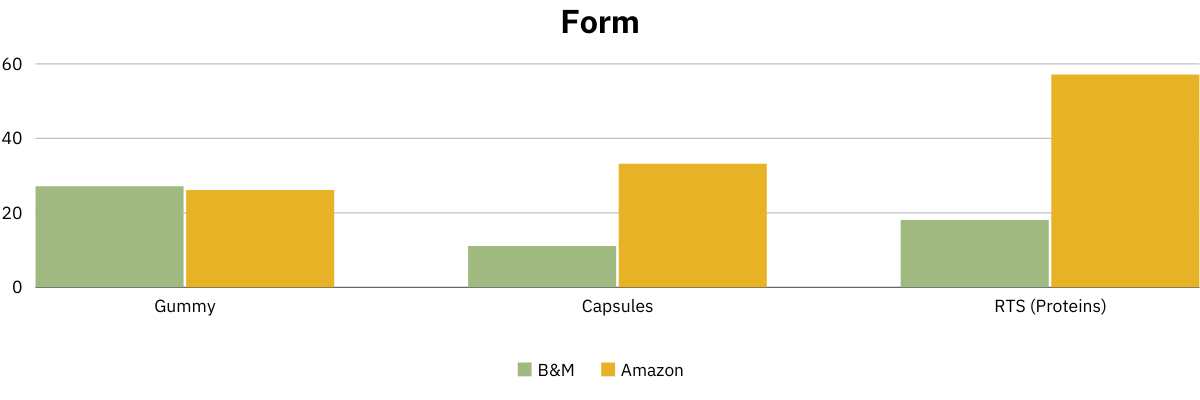

Gummies continue to be a leading product form for vitamins and supplements.

Product Intelligence Helps You Stay Ahead of Trends

SPINS granular view of product attributes provides a glimpse into the growth and decline of specifical functional ingredients, health focuses and product forms. As shoppers adjust to their new routines, they will create new habits and shed old ones. Let SPINS Omni-Intelligence provide the cross-channel view you need to stay competitive and keep growing in store and online.