Fragmented audiences create a unique challenge for brands and retailers

Product innovation is one of the most exciting aspects of the health and wellness industry—and it can also be one of the most overwhelming. Within one year, SPINS channels tracked 71,000 new brands, with 65% of them specifically within the health and wellness space. This unprecedented product innovation didn’t happen overnight: The where, how, and why of shopping has been a gradual shift that’s still ongoing. The values-oriented shopper is driving today’s trends, and changes in modern commerce are changing where and how they can shop. Brands and retailers need to identify what shoppers are looking for and deliver those products in an effective way.

Health & Wellness Are Now Mainstream Priorities

Shoppers go to the store (or log onto an eCommerce site) with a mission that’s more personal than simply buying a list of items. Before making a purchase, they consider many factors: price, allergens, diet, sustainability, fitness and health goals, and certifications. Modern commerce’s core challenge remains the same—sell products shoppers want—but these intentional shoppers create a fragmented audience. Each shopper has a set of product attributes they’re seeking.

Think about the state of the natural industry 30 years ago, with only a niche audience with the finances and interest to seek out the limited selection of better-for-you products. Even a decade ago, the average conventional retailer and big box stores were not offering a wide range of wellness-focused items beyond organic staples and some plant-based options. Today, shoppers can find everything from collagen to Certified B Corporation coffee to gluten-free desserts in most retailers. These attributes have become so popular that many retailers now include them in their own private-label offerings. Fragmented audiences are collectively raising the awareness level of these products.

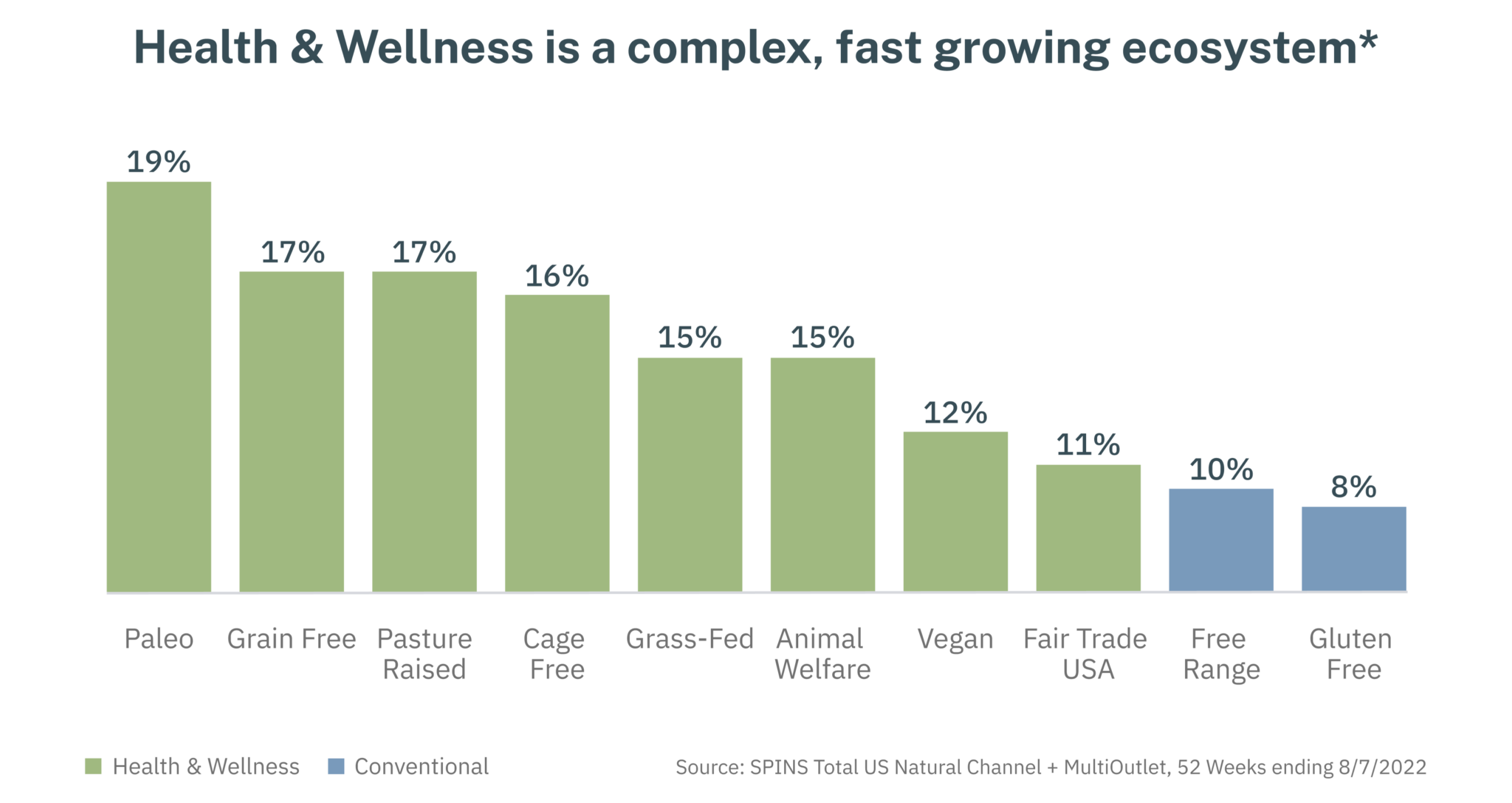

In 2022, SPINS saw strong growth in sales of products with specific health and wellness attributes:

- Paleo items grew 19%

- Grain-free and pasture-raised products each grew 17%

- Cage-free items rose 16%

- Products with grass-fed and animal welfare attributes each saw a 15% increase

SPINS Total US Natural Channel + MultiOutlet for the 52 Weeks ending August 7, 2022.

THE RISING COMPLEXITY OF IDENTIFYING TRENDS AND DELIVERING AGAINST THEM

Another layer of fragmentation comes with the rise of eCommerce, which has enabled shoppers to shop for a product in any store in the world from the convenience of their phone or laptop. Not only are brands and retailers trying to deliver against an array of shopper preferences, but they are also competing with online retailers and brands. Shoppers can go directly to Direct-to-Consumer brands, browse massive online marketplaces, or even order items from a delivery app. Standing out and earning customer loyalty are increasingly difficult challenges.

The same convenience that allows shoppers to search for and purchase an item with a few phone taps also allows them to research any issue that can shape their values-oriented shopping. A shopper who has recently been diagnosed with diabetes can easily educate themselves on best practices for a healthy lifestyle and discover the array of products suited for their needs. The same is true for any number of priorities shoppers care about. Education is fantastic for everyone, but it does shake up the industry as we know it.

Informed shoppers who know the kinds of products they need are the ones helping to create new trends and being adventurous by trying innovative products. That also means many products fall out of favor with those shoppers. For example, a shopper who is focused on clean-label products is now avoiding a large swath of store staples, and they will seek out the stores and brands that deliver on those expectations. That is the complexity of modern commerce but it’s also a sign of the progress health and wellness have made.

RELATED: Product Intelligence for Brands

Adapt Alongside Innovation with Product Intelligence

The challenge of modern commerce can feel overwhelming, but it doesn’t need to be. Retailers and brands are turning to Product Intelligence to simultaneously respond to shopper preferences and leverage them to the benefit of their business. Understanding and adapting to shopper preferences allow retailers and brands to drive sales, increase shopper loyalty, and boost profitability.

For retailers, Product Intelligence can help differentiate and optimize assortments to increase basket sizes and meet shopper needs via:

- Optimization: Ensure that what’s in stock is what’s selling

- Differentiation: Why shoppers should visit one retailer versus another

- Discovery: Connect shoppers to the products they’re looking for

For brands, Product Intelligence enables informed product development and positioning to bring product stories to life through:

- Development: Produce differentiated goods that shoppers actively look for

- Positioning: Maintain consistent narratives across all touchpoints to ensure shoppers see how products deliver against their needs and values

Learn more about SPINS Product Intelligence and download the Product Intelligence and the Future of Modern Commerce eBook.