Introduction

When shoppers head into the grocery store, they’re bringing a trio of priorities with them: They want foods that are not processed, align with their diets, and include functional benefits. Fortunately, these are not conflicting interests. In fact, one ingredient is at the intersection of these 3 purchasing drivers: heritage ingredients.

Heritage ingredients have been dietary staples throughout the world for millennia. Naturally occurring and filled with health benefits, these ingredients have a storied past that has not only stood the test of time but also makes them appealing to today’s growing wave of conscientious shoppers.

Attributes Reveal the Strength of Heritage Ingredients

SPINS data shows that heritage ingredients are experiencing strong upward growth over a 52-week period thanks to their affiliation with today’s consumer needs. Using SPINS Product Intelligence, we focused on relevant shopper–centric attributes and found heritage ingredients were reaching customers in all 3 priorities, to varying levels.

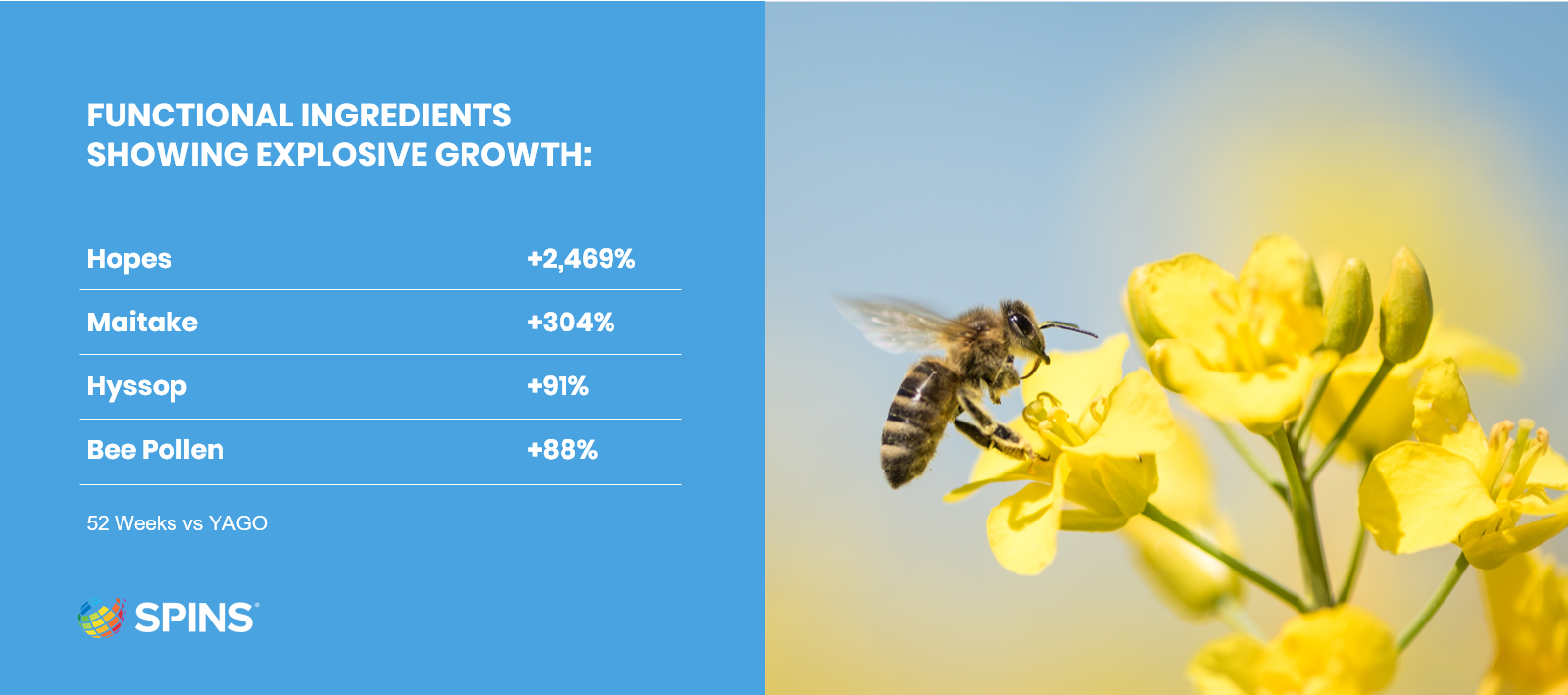

Overall, functional ingredients have risen 14% during this time period, but certain attributes have seen meteoric growth:

Two popular diets have helped boost sales of heritage ingredients:

- Paleo-positioned 37%

- Certified paleo 28%

Ingredients that have been minimally processed saw strong growth during the same period, although it was not quite as robust as the others:

- Sprouted 11%

- Grass fed 10%

- Superfoods 10%

- Ancient grains 8%

The Most Popular Heritage Ingredients

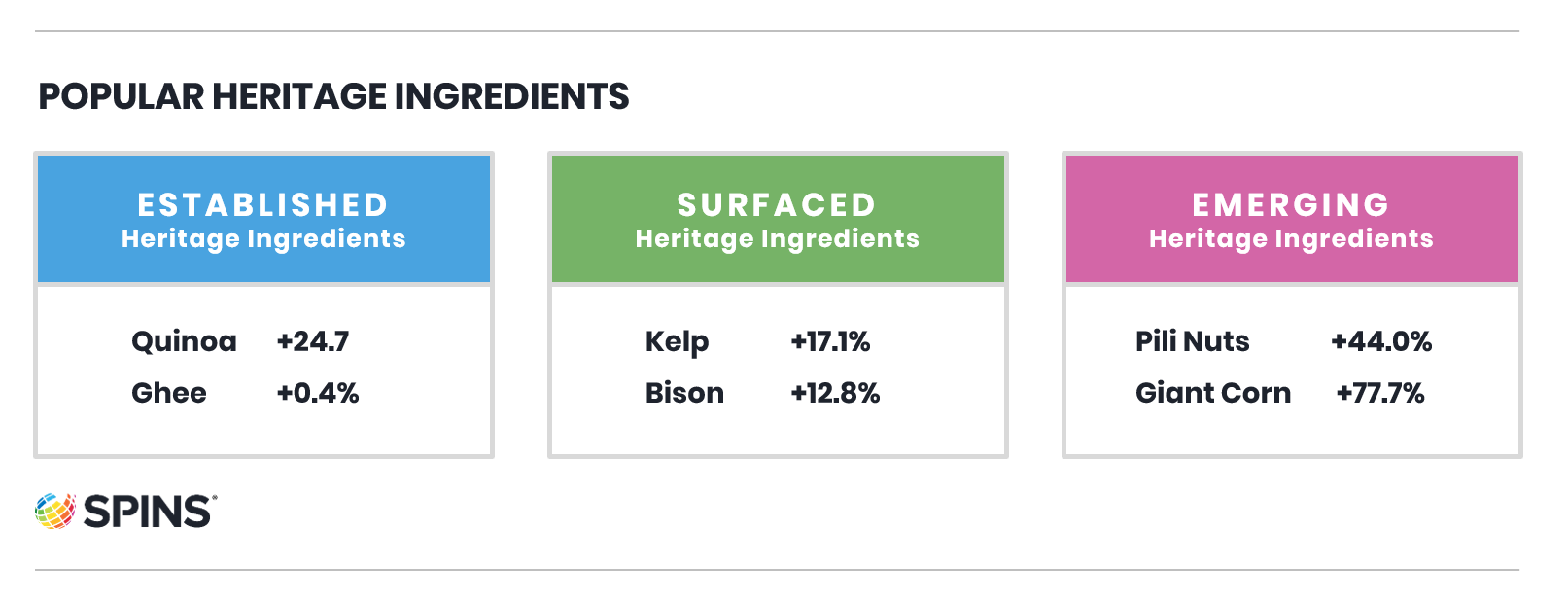

Heritage ingredients cast a wide net, and that means the group is seeing overall growth, certain ingredients are experiencing stronger growth than others—with a few even seeing decreases. For example, elderberry is up 91.6% and thyme is up 67.8%. While reishi mushrooms, which have seen a more modest 15.6% growth, are part of a gradual and long-term boost in mushroom sales.

Some items, such as quinoa, are not only ancient ingredients but they’re now established items that have been popular in contemporary culture for years now. Conversely, pili nuts (up 44.0%) and giant corn (up 77.7%) are gaining widespread attention in the mainstream and, despite being ancient, are behaving more like emerging trends.

Bring Heritage Ingredients to Your Customers

Heritage ingredients have been around for generations, and they continue to stay relevant to shoppers’ interests, and brands and retailers can help.

We know that shoppers are looking for items that match their current dietary goals, and positioning heritage ingredients as being diet compatible is effective. Although these items are not fads, aligning them with today’s trends gets them in front of eager shoppers. SPINS Product Intelligence can help by giving you more insight in attribute performances for today’s market so you connect your heritage ingredients-based products with consumer behavior.

Retailers can begin distributing the innovative brands whose products are delivering heritage ingredients in a contemporary way and reinforcing that connection with the right messaging and in-store merchandising.

Download the full emerging trends report to uncover more insights about heritage ingredients.

Brands: Deliver Ingredients Consumers Want

If you want to learn how SPINS Product Intelligence can help you bring these ingredients to your audience, contact us today.

Retailers: Discover What's Trending

SPINS proprietary Product Intelligence, included for all exclusive retail partners, offers the ability to see where these ingredients are trending and in which categories and subcategories. Then you can see which products are leading the growth of these categories. Contact us today about becoming an exclusive retail partner.