What Are The Top Innovation Strategies CPG Brands Should Implement?

You’ve identified your brand’s core strength, understood your market, and are ready to innovate. Now what? Before you leap into the exciting world of product development, there’s one more reality check to make: innovation is full of both opportunity and risk.

Innovation isn’t linear; it’s a game of risk and reward. To visualize this dynamic, let’s borrow a familiar board game — Snakes & Ladders.

On this board:

- Ladders represent thoughtful innovation strategies that elevate your brand, like aligning with consumer trends or extending a product line into adjacent categories with clear white space.

- Snakes are the costly mistakes that can quickly send you on a downward spiral, like chasing fads, launching without clear differentiation, or moving into categories that don’t align with brand identity.

Just like in the classic game, success depends on more than luck. It requires planning, awareness, and knowing which moves are most likely to pay off.

Innovation Is Not One-Size-Fits-All

It’s important to note that no innovation archetype or “ladders” is inherently better than another. Each one can drive meaningful growth, if it aligns with your brand’s core competencies and market realities. The success stories we’ve seen across our data come from brands that understood where they were starting from, what their consumers valued most, and where the white space was in the market.

In the following section, we’ll break down each of the four innovation archetypes in detail:

- Core Expansion

- Sideway Stretch

- Attribute Adjacency

- Category Contenders

And while some brands may grow confidently from Core Expansion to Category Contender status, others may thrive by perfecting their Sideway Stretch. What matters most is not how far you stretch, it’s how clearly your innovation reflects who you are and what your consumers love about you.

For each strategy, here’s what will be covered:

- What defines each strategy

- How to spot them in the data

- What makes them work

- The risks to watch out for

By the end, you’ll have a clear framework to guide your next innovation move with confidence and clarity.

Archetype 1: Core Expansion

Widen Your Offerings While Staying “Close to Home”

What it is:

Core Expansion focuses on increasing your brand’s presence within your existing category. You’re not moving into new parts of the store, you’re going deeper into your lane. That might mean:

- New flavors or variants

- Different pack sizes (e.g., multi-pack vs. single)

- Slight tweaks in format (e.g., bar to bite-sized versions)

When it works best:

This strategy is ideal for early-stage or smaller brands that already have strong-performing products but a limited assortment. It allows brands to:

- Increase shelf presence

- Drive incremental sales

- Attract new consumers without straying from their core

How to spot the opportunity in the data:

Look for these two signs:

- Low item count vs. competitors – If you have far fewer SKUs compared to top brands in your category, you may be under-represented on shelf.

- Strong velocity – If your current items are performing well (i.e., selling fast), it’s a signal that the market is responding positively to what you’re offering.

The combination of strong but narrow is the green light for Core Expansion.

Caution:

Don’t expand for the sake of expanding. Ensure new variants offer real value to the consumer and reflect your brand identity. Avoid cannibalizing your own SKUs with too-similar offerings.

Archetype 2: Sideway Stretch

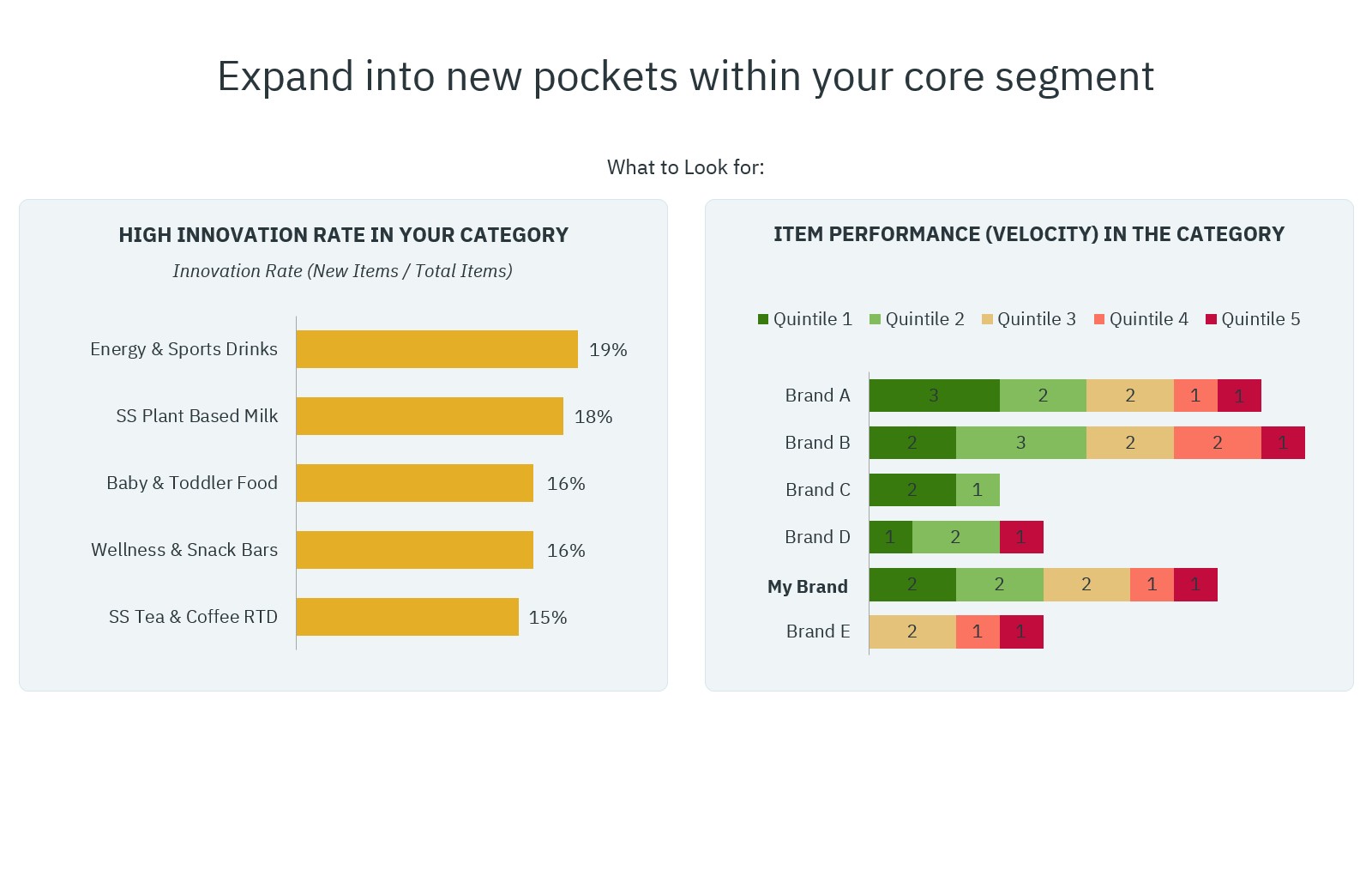

Expand into New Pockets Within Your Core Segment

What it is:

Sideway Stretch goes one step beyond Core Expansion. It involves branching into new subsegments or unmet needs within your existing category. Rather than just more of the same, you’re addressing gaps in the category that align with emerging consumer preferences.

A great example:

Take Chobani. They had already saturated the yogurt aisle with flavors and formats—but when consumer demand for low- and zero-sugar products surged, they launched Chobani Zero Sugar. It stayed within yogurt, but unlocked a new segment of health-conscious consumers who might have otherwise left the brand.

When it works best:

This strategy is powerful for established brands looking to grow within their existing category by:

- Tapping into emerging health trends

- Filling white space in product attributes

- Capturing new consumer segments without leaving the core aisle

How to spot the opportunity in the data:

- Look for categories with high churn and frequent innovation, like snack bars or beverages—categories where consumers are open to trying new items.

- Identify underrepresented segments within the category (e.g., low sugar, high protein, allergen-free) and assess whether your brand has permission to play there.

Caution:

Just because a segment is trending doesn’t mean it fits your brand. For instance, a better-for-you cereal brand like Magic Spoon should not enter the sugary cereal segment, even if it’s growing, because it violates the brand’s foundational promise.

Key question to ask before launching:

Does this innovation stay true to our brand ethos?

If the answer is no, it’s not the right move—no matter how hot the segment is.

Archetype 3: Attribute Adjacency

Leverage Your Brand’s Ethos in Adjacent Segments

What it is:

Attribute Adjacency is about taking what your brand stands for, its defining feature or core promise, and extending it into a new product category where that attribute is still underrepresented but showing signs of growth.

You’re leaving your “home court,” so to speak. That means new competitors, new merchandising rules, and possibly new pricing and promotional dynamics. But you’re still bringing something familiar to the table: your brand’s trusted point of difference.

When it works best:

This strategy fits brands that:

- Have strong brand recognition and loyalty

- Are seeing diminishing returns from new flavors or formats in their core category

- Have built equity around a standout attribute (e.g., high protein, low sugar, sustainable, allergen-free)

What to look for in the data:

- Categories where your core attribute is growing in consumer demand

- Low attribute share (suggesting whitespace)

- High growth potential (suggesting timing is right)

Example:

Kodiak Cakes started with protein-rich pancake and waffle mixes. Once saturated, they moved into cereal bars — another breakfast-adjacent category — bringing their high-protein positioning along. The result? A natural, logical expansion that didn’t dilute the brand’s identity.

Caution:

Make sure your attribute has real credibility in the new category. You’ll face new competitors, and consumers must see your brand as a legitimate solution in this space.

Archetype 4: Category Contenders

Introduce Your Brand’s Right-to-Win Into Far-Away Areas of Opportunity

What it is:

This is the boldest innovation play and often the riskiest. Category Contenders bring a brand’s ethos into completely new parts of the store, often as a first mover. You’re not just entering a new category, you’re redefining it with something the market hasn’t seen before.

When it works best:

- You’ve maxed out your current and adjacent categories

- You have strong brand momentum and loyal customers

- You’re confident in your attribute’s ability to disrupt a stagnant category

What to look for in the data:

- “Sleepy” categories with low growth or differentiation

- No or few products with your core attribute

- Consumer demand rising in related health, convenience, or values-driven trends

Example:

Olipop launched a prebiotic soda into the familiar soda category, a space with little momentum and no real presence of functional and better-for-you offerings. They introduced a new tier of product entirely, built around gut health AND no added sugar. It was a leap, but it gave them a first-mover advantage and helped them redefine what soda could be.

Caution:

This strategy is not usually for early-stage brands, though, as Olipop has shown, it is not entirely impossible. It requires deep operational readiness, strong brand awareness, and exceptional execution. If done right, it can position you as a category leader. If not, it’s an expensive lesson.

Innovation Pitfalls: 5 “Snakes” That Sabotage CPG Success

Product launches aren’t cheap. And failed innovations can do more than burn budgets—they can erode brand credibility. Innovation can elevate a brand to new heights—or send it tumbling back to square one.

Now, it’s time to get specific. Here are five common and costly pitfalls that CPG brands encounter when innovating without clarity, discipline, or customer alignment:

- Copycat Syndrome

- Trend Turmoil

- Novelty Overload

- Over-Engineered Ego

- The Gut Gambit

These “snakes” may be tempting paths to chase, but they often end in wasted resources and consumer confusion. Let’s take a deep dive into each pitfall and look at examples that can best illustrate them.

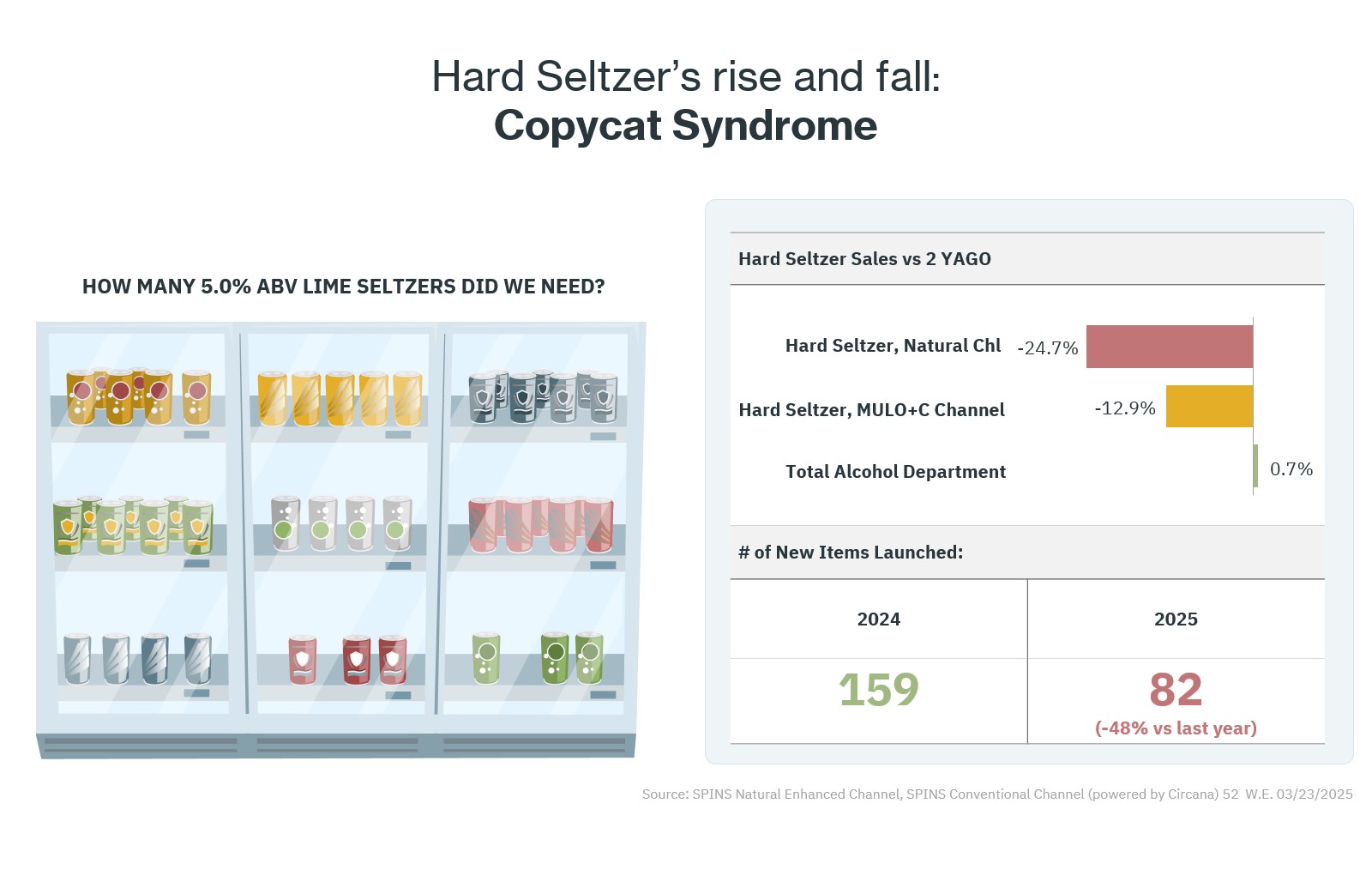

Copycat Syndrome

Trying to ride a trend without bringing anything new to the table.

Few trends illustrate this pitfall better than the hard seltzer boom. When White Claw dominated shelves from 2019 to 2021, nearly every beverage brand rushed to copy its formula. But instead of differentiating, most simply launched lookalike lime seltzers and quickly got lost in the noise.

The takeaway: If you’re just duplicating what others are doing, without any added value, uniqueness, or alignment to your brand’s identity, you become a substitutable good. Consumers don’t need another version of something they already like. They need a reason to choose you.

Trend Turmoil

Jumping on a trend without alignment, clarity, or credibility.

Crystal Pepsi is a classic case. Introduced in the ’90s to ride the “clean and clear” trend, it looked like a health-forward soda but tasted like regular cola. The cognitive dissonance unsettled consumers. Despite its transparent appearance, the product wasn’t any healthier than standard Pepsi. That misalignment created confusion and anxiety rather than excitement.

The takeaway: Subverting consumer expectations, especially without delivering meaningful value, can backfire. Don’t just look like you’re on-trend; make sure your product genuinely aligns with both the trend and your brand promise.

Novelty Overload

Chasing attention at the expense of consistency and brand trust.

During the late 2000s, Burger King leaned hard into novelty with items like bacon sundaes and black Halloween buns. These attention-grabbing launches turned their menu into a spectacle. Meanwhile, competitors focused on perfecting the basics.

While novelty can spark short-term buzz, it rarely leads to lasting loyalty, especially when customers fall in love with a product that disappears weeks later. The result? Consumer fatigue and eroded trust.

The takeaway: Don’t build your brand on stunts. If customers can’t count on consistency, you’ll struggle to retain them. Use innovation to build equity, not just buzz.

Over-Engineered Ego

Prioritizing complexity and tech for its own sake, not consumer value.

Enter Juicero, a $400 internet-connected juicer that only worked with proprietary juice packs. The catch? You could squeeze the packs by hand. When this revelation surfaced, the brand quickly became a cautionary tale in over-engineering. Despite raising $100 million in funding, Juicero collapsed after consumers realized the product added little actual value.

The takeaway: Innovation must be grounded in usefulness, not ego. Build products your customers truly need and appreciate, not ones that exist to show off technological prowess.

The Gut Gambit

Relying on intuition, executive whims, or anecdotal feedback instead of data.

We’ve all heard it: “My spouse loves it,” “My kid loves it.” This is the classic Gut Gambit—a product born from enthusiasm, not evidence. While conviction can be powerful, it’s not a substitute for validation. Too many brands go to market with pet projects that haven’t been tested or vetted, and fail.

The takeaway: You’re not a professional gambler, so don’t bet the business on luck. Aim to triangulate at least three data points, such as consumer research, market trends, and pilot performance, before making an informed decision. As the saying goes: Three stars make a constellation.

How to Succeed at Innovation: Learn Before You Launch

Having dived into how to succeed, it’s also important to understand how innovation can go wrong. Many brands fail not because their idea was bad, but because they skipped key foundational steps like market research, alignment with brand ethos, or a clear value proposition.

Too often, teams get caught up in the excitement of the new and forget to ask:

- Does this product reflect what we’re known for?

- Does it solve a real consumer need?

- Are we launching it at the right time and place?

Answering these questions is crucial before moving forward. Without doing the work up front, innovation becomes a gamble instead of a strategic growth lever. Going back to the snakes & ladders analogy, it’s time to take a look at the pitfalls, a.k.a “snakes,” that can set you back.

Know the Snakes Before You Climb

Every brand wants to grow. But climbing the ladder of innovation requires more than ambition; it requires clarity, self-awareness, and a firm understanding of what not to do.

By avoiding these common pitfalls, you increase your chances of launching innovations that not only land but last.

Get the full Report - Excellence In Innovation: How CPG Brands Can Find The Right Path

Download