The Rise of Sweetener Substitutes

The average American consumes 19.5 teaspoons of added sugar every day, translating to almost 60 pounds of added sugar per year, according to experts. That’s easy to understand when you realize that an estimated 74% of packaged foods have added sugars and there are 61 different names for sugars on nutrition labels. The CDC estimates that 1 in 10 Americans has diabetes, and 1 in 3 American adults has prediabetes. Added sugars are prevalent in the American diet and so are the associated health risks.

While Americans have taken efforts to reduce their added sugars consumption over the last decade, the number of new diabetes cases in adults has been increasing since 2020. But statistics suggest that Americans are paying more attention to the sugar on nutrition labels and ingredients lists before they head to the checkout line.

Alternative Sweeteners and Innovation

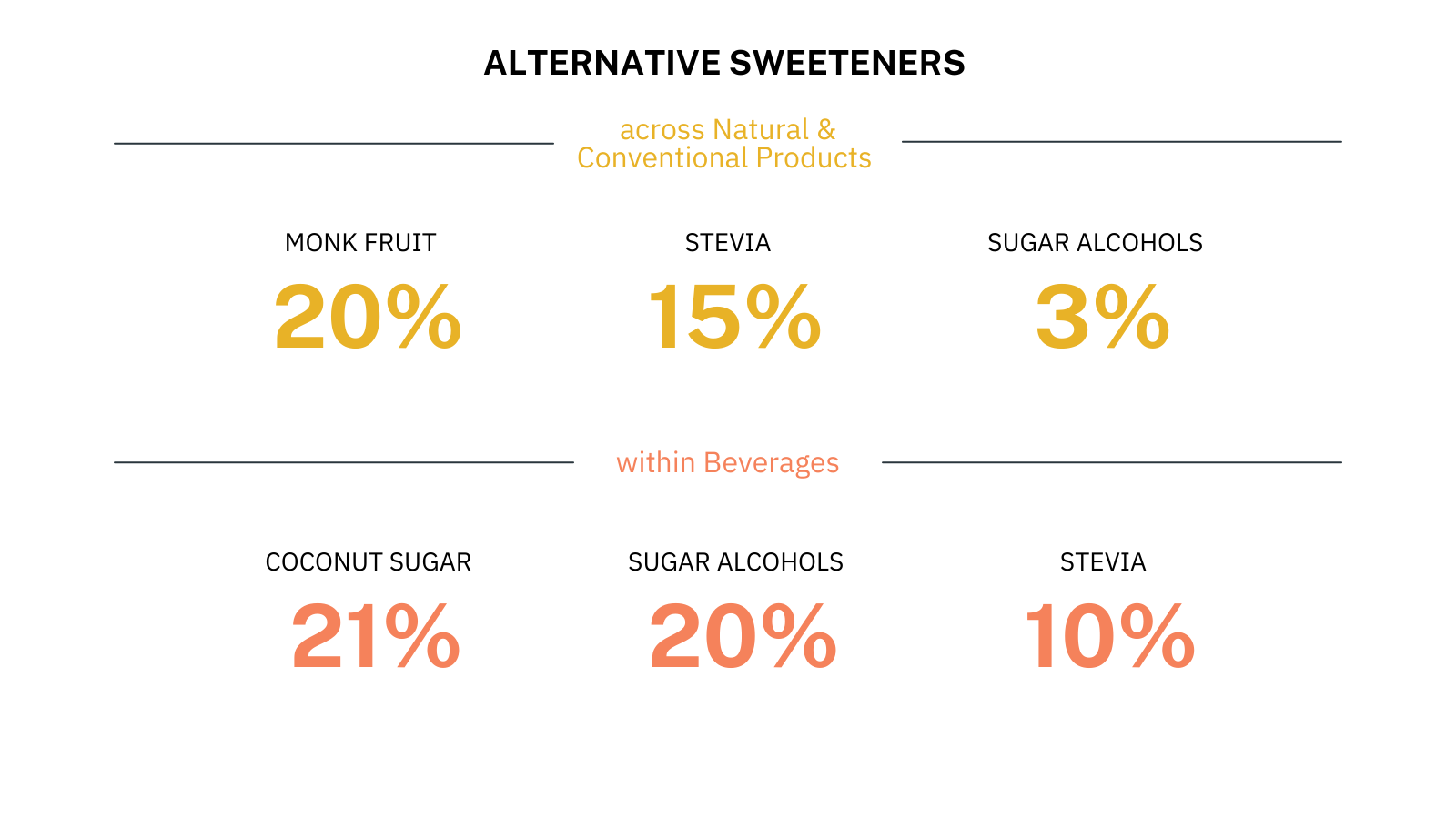

Just because consumers are shying away from added sugars doesn’t mean they’re turning away from desserts and sugar entirely. Naturally occurring sugars are important components of a healthy diet, so the goal isn’t to replace sugar with synthetic substitutes. Brands have learned that shoppers are interested in keeping sugars in their diet, but they want them to be derived from natural sources. Innovative approaches to sweeteners are resonating with shoppers: When looking at year over year sales, monk fruit has grown 20%, stevia is up 15%, and sugar alcohols are up 3%.

Beverages are considered one of the leading sources of unsuspecting added sugar consumption for Americans. Now that added sugars are a popular topic, wary shoppers are opting for beverages with alternative sweeteners. Looking at year over year dollar sales for a 52-week period, SPINS data finds that sweetener alternatives are resonating with beverage buyers: Coconut Sugar is up 21%, sugar alcohols are 20%, stevia is up 10%, and unsweetened and monk fruit are up 1.3%. Emerging brands in functional beverages are beginning to bring products with lower sugar content to the market.

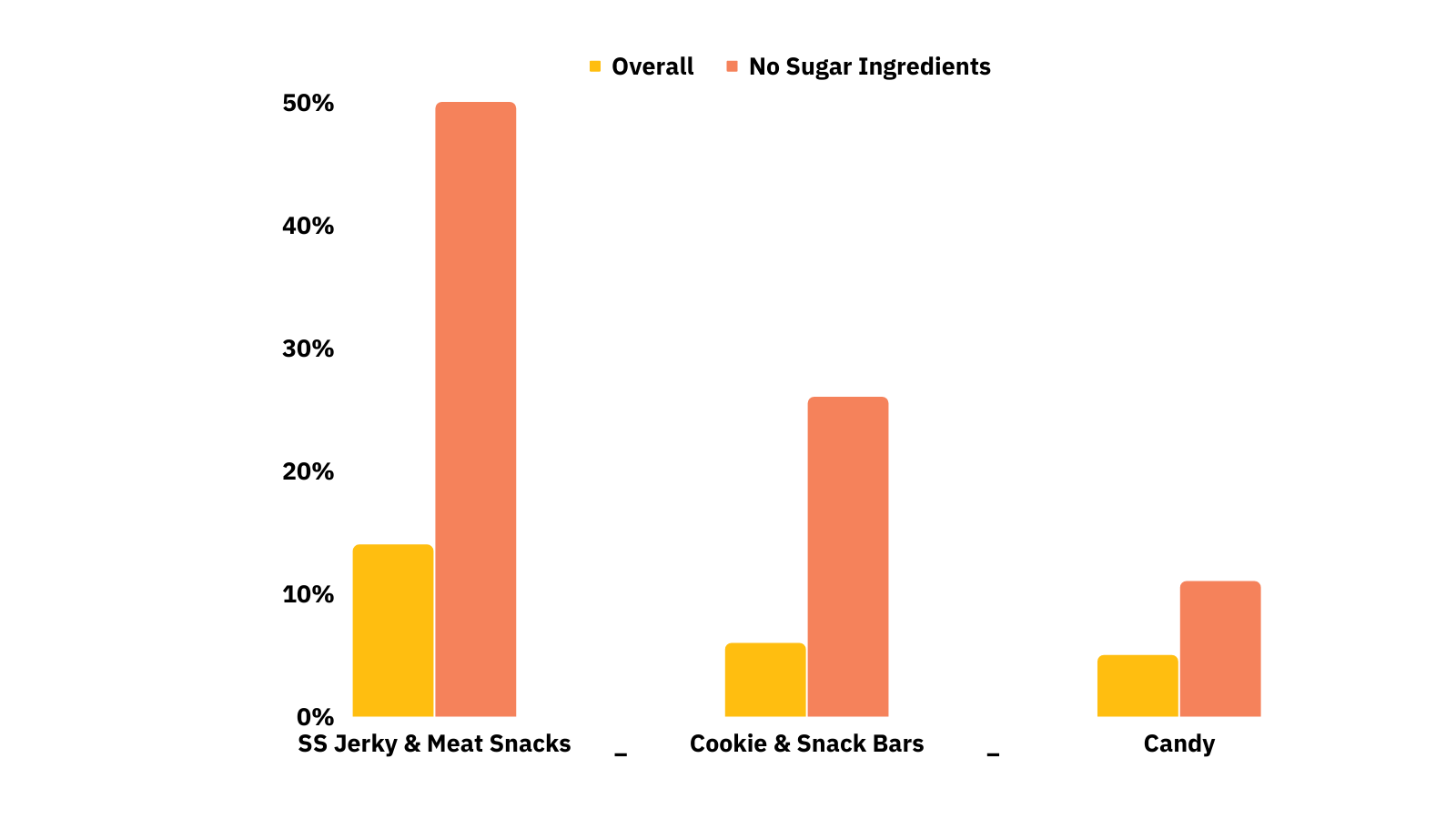

Shoppers are also aware of the high sugar content in jerky & meat snacks, cookie & snack bars, and candy. In each category, the products with no sugar ingredients are outpacing their standard (sugary) counterparts.

Less Sugar Aligns With Today’s Lifestyles

The war on sugar isn’t new, but it has been gaining ground in recent years, coinciding with shifting lifestyle habits that emphasize low-sugar diets. More shoppers have adopted diets, such as keto and whole30, that eliminate high-sugar products and focus more on proteins and unprocessed foods. From 2018 to 2021, certified keto product sales have grown by 14.9%.

According to SPINS data, keto items do not appear to be slowing down anytime soon as indicated by strong growth in the 3 most mature, top-selling categories:

Attributes Connect You With Customers

The move away from added sugars sounds simple, but there are dozens of ways to spot sweeteners on a label, and as more brands innovate that list will grow. Shoppers don’t always know that they’re opting for a specific ingredient over another—they just know that they’re avoiding certain ones. Whether you’re a brand or a retailer, though, you care about what they are buying, no matter what their reasoning is. That’s where shopper-centric attributes come into play.

SPINS Product Intelligence assigns attributes to products that are based on label claims and ingredients so that you can monitor trends and gain insights that simple transactional data won’t. This way, even if a product isn’t positioned as keto or free of added sugars, you can still track its sales because it falls under the sweetener-related attributes you care about. SPINS sweetener-related attributes include sweetener types (honey, aspartame, agave, and more), unsweetened (or only naturally sweetened), and diets (keto, paleo, whole 30, and more). The more you know about what shoppers are choosing and what dietary and lifestyle habits they’re adhering to, the better you can reach them with the right messaging, products, and promotions.

Brands: Gather Valuable Insights

If you’re interested in gaining more insights about the performance of sweeteners and associated diets, you can learn more here or contact us to discuss how our proprietary attribute data combined with insights and strategic analysis from our consulting team can help you make that determination.

Retailers: Deliver Customized Shopper Experiences

As a SPINS retailer, you have access to all of SPINS attributes, including sweeteners, unsweetened, and associated dietary category that you can use to deliver more customized shopper experiences through your digital and in-store channels. Learn more to create a better assortment strategy.