Navigating the Confectionery Industry

The confectionery industry, known for its ability to evoke nostalgia and provide moments of indulgence, is undergoing significant transformation. Driven by shifting consumer preferences, economic factors, and innovative product developments, the market is evolving in unprecedented ways. This comprehensive analysis delves into the current trends, growth drivers, and future opportunities in the confectionery sector.

Sizing the Confectionery Landscape

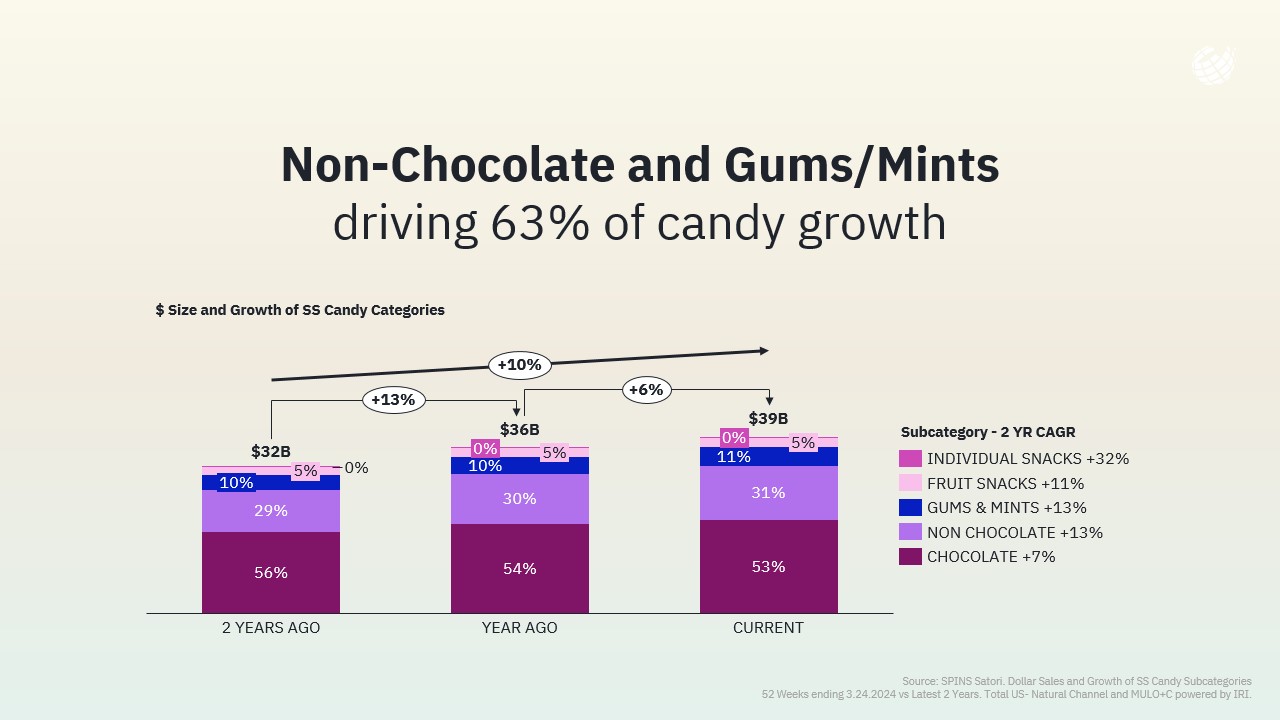

The confectionery market is broadly categorized into five key subsegments: chocolate, non-chocolate, gums & mints, fruit snacks, and individual snacks. Over the past three years, the market has shown remarkable resilience and growth. According to SPINS, the category experienced a 6% growth in the past 52 weeks, reaching a market size of $39 billion. Although this represents a deceleration from previous years, the growth trajectory remains positive, especially when compared to other sugary snacks like frozen novelties and cookies.

Non-chocolate and gums & mints are currently driving a significant portion of this growth. Non-chocolate candies have gained a 31% share over the past year, while gums & mints have grown by 13% over three years. This shift highlights a broader trend towards diversification within the confectionery market, as consumers explore new and varied options beyond traditional chocolate products.

Confectionery Price and Growth Trends

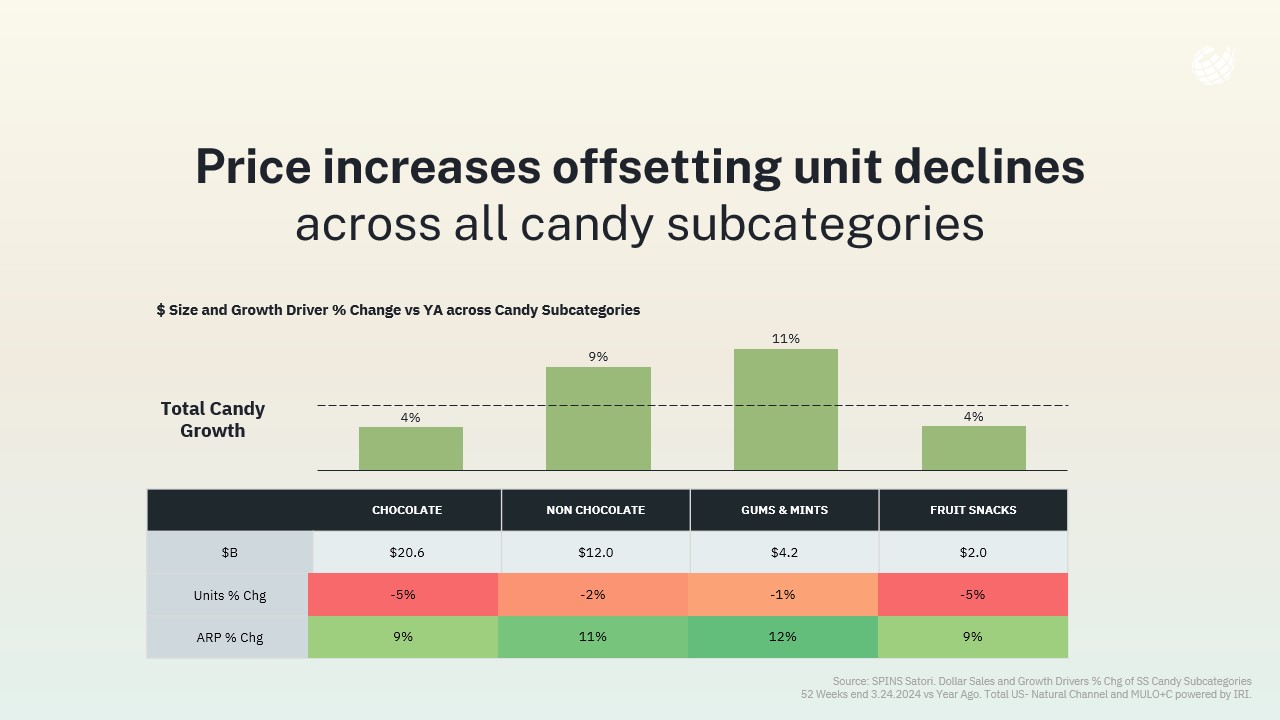

Price increases have played a pivotal role in sustaining growth across all confectionery subcategories. As costs for key ingredients like cocoa have risen, brands have adjusted prices to maintain profitability. For instance, chocolate, despite facing the most significant unit percent change decline, continues to see dollar sales growth due to these price adjustments.

Gums & mints have shown the highest price-driven growth, underscoring their growing importance in the market. The ability of these subcategories to maintain and even grow their market share amidst rising prices demonstrates strong consumer demand and brand loyalty.

Confectionery Channel Performance

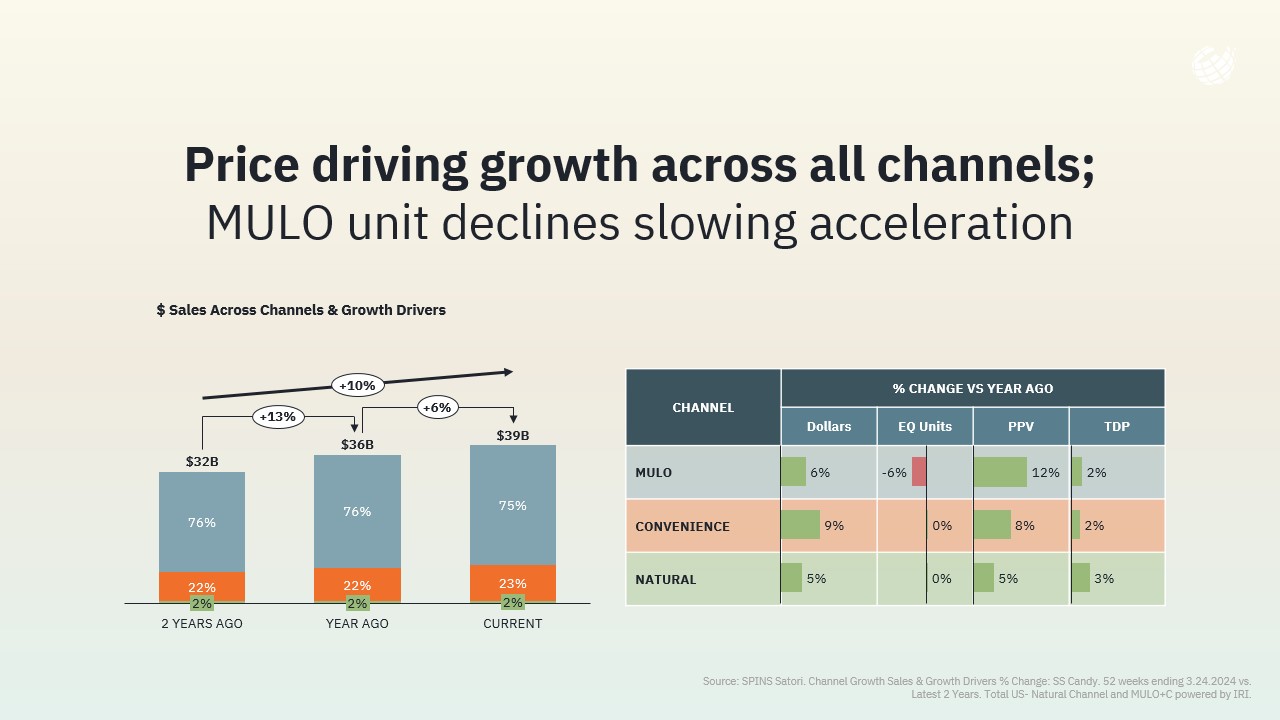

Sales channels play a crucial role in the distribution and performance of confectionery products. The MULO (Multi Outlet) channel remains dominant, holding approximately 75% of the market share. However, the convenience channel is emerging as a significant growth driver. Convenience stores have seen the fastest growth rate, driven by price increases and expanded distribution.

Gums & mints, in particular, perform exceptionally well in the convenience channel, showcasing their appeal as on-the-go indulgences. This channel-specific performance highlights the importance of strategic distribution in maximizing product reach and sales.

Four Main Consumer Mentality Shifts in Confectionery

Four major consumer mentality shifts are reshaping the confectionery landscape:

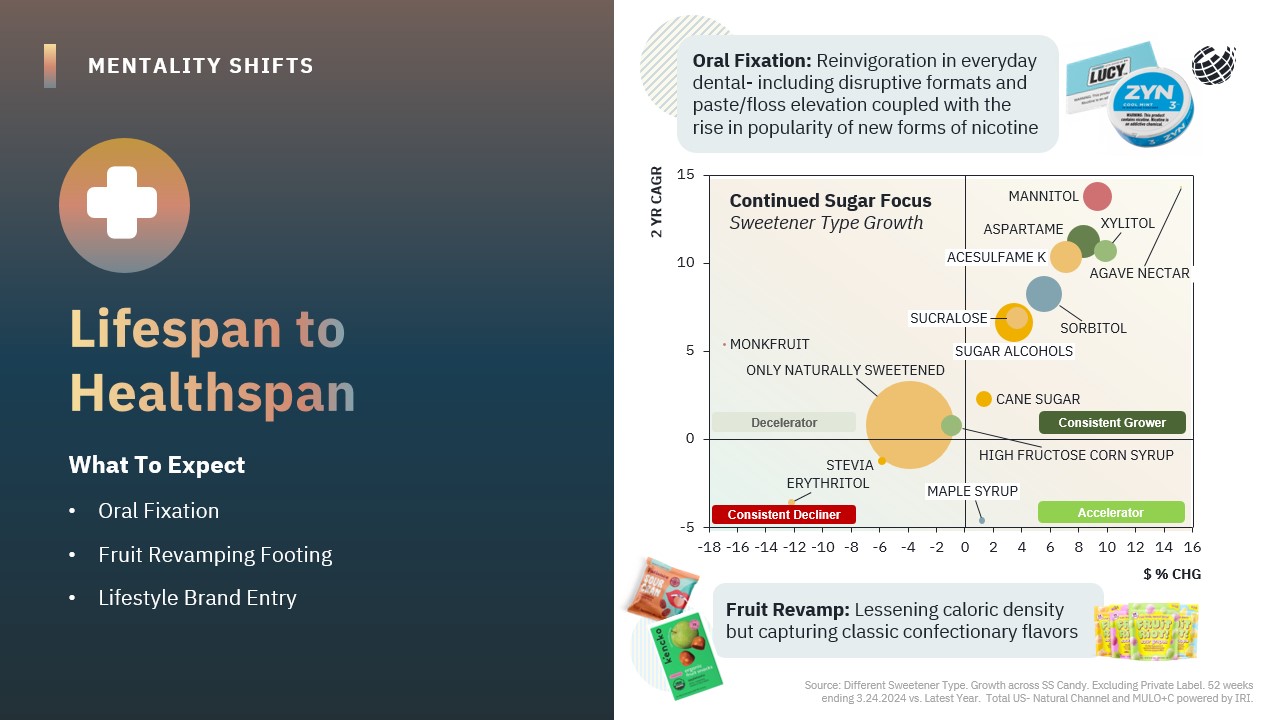

1. Lifespan to Healthspan

Consumers are increasingly seeking products that support their mental acuity and physical agility. This shift is evident in the rise of products that enhance oral health and incorporate functional ingredients. For example, xylitol, known for its dental benefits, is becoming more prevalent in gums and mints. This trend reflects a broader movement towards health-conscious indulgence.

2. Intentional Indulgence

Modern consumers are looking for ways to indulge without guilt. This has led to the emergence of “permissible indulgence” products that offer indulgence with fewer calories or added health benefits. Innovations in smaller pack sizes and lower sugar content are particularly appealing, allowing consumers to enjoy treats while adhering to their dietary preferences.

3. New Global Notions

The desire for unique and adventurous flavors is driving interest in international candy formats. Swedish candy and gelatinous textures popular in Asia are gaining traction, offering consumers a sense of gastrotourism. This trend towards global flavors and textures adds a layer of excitement and novelty to the confectionery market.

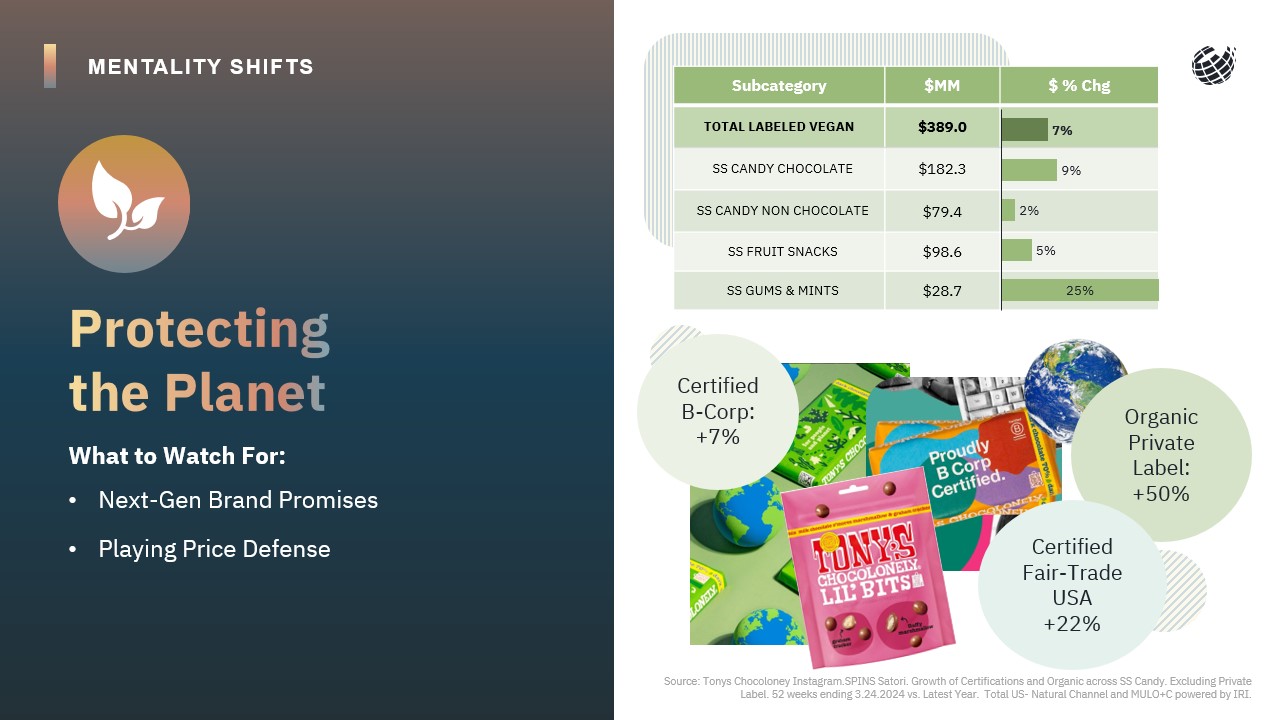

4. Protecting the Planet

Sustainability is a growing priority for consumers. Brands are increasingly focusing on certifications and transparent supply chains to appeal to environmentally conscious shoppers. The rise in organic and fair-trade products reflects this shift, with consumers willing to pay a premium for products that align with their values.

Product Positioning and Market Segmentation

SPINS’ proprietary product attribution provides valuable insights into market performance based on product positioning. The market can be segmented into three primary categories: conventional, specialty, and natural products.

- Conventional Products: These are staples and classic products with a large retail footprint. They still dominate the market, holding 87% of the share. However, their growth rate is slower compared to other segments.

- Specialty Products: These products are characterized by unique geographic origins and interesting flavor profiles. Specialty products are gaining distribution and showing significant price increases, reflecting their growing appeal to niche markets.

- Natural Products: Known for their elevated ingredient standards and clean formulations, natural products are growing at almost twice the rate of conventional products. This segment’s emphasis on health and sustainability resonates strongly with today’s consumers.

The segmentation helps brands identify opportunities for innovation and disruption. For example, while specialty products hold the largest share in the chocolate segment, there is significant potential for growth in non-chocolate and gums & mints within the natural and specialty categories.

Navigating the evolution of Confectionary.

The confectionery market is ripe with opportunities for brands willing to innovate and adapt to changing consumer preferences:

- Functional Ingredients: The incorporation of ingredients that offer health benefits is a growing trend. Ingredients like ashwagandha, known for its stress-relieving properties, are being integrated into confectionery products. This trend towards “confectionery adulting” blends indulgence with wellness, appealing to health-conscious consumers.

- Playful and Nostalgic: There is a strong demand for products that evoke nostalgia while offering new and exciting experiences. Brands should focus on creating fun, nostalgic products that provide escapism and indulgence. Innovations in flavors and textures can help brands capture this playful aspect of confectionery.

- Sustainable Practices: As sustainability becomes a more significant concern, brands that prioritize ethical sourcing and transparency will stand out. This includes obtaining certifications like organic and fair-trade, which assure consumers of the product’s environmental and social impact.

- Digital and Social Media Engagement: The rise of e-commerce and social media has transformed how consumers discover and purchase confectionery products. Brands should leverage digital platforms to engage with consumers, create buzz around new product launches, and drive online sales. The “Internet as the new impulse aisle” presents unique growth opportunities.

The confectionery market is experiencing a period of dynamic change, driven by evolving consumer preferences, economic factors, and innovative product developments. By understanding and adapting to these trends, brands can capitalize on new opportunities and drive further growth.