The Domino Effect for Category Management

COVID’s domino effect on shopping behavior didn’t just show up at the cash register, it also made its way to the top of the supply chain. With shoppers stocking up on pantry staples and making fewer trips to the store, retailers focused on keeping their shelves filled with reliable, in-demand items and didn’t experiment with as many new items.

Thanks to health concerns, retailers also pulled back on in-store demos and sampling. Along with those setbacks, a lack of trade shows prompted brands to hold back on introducing new products over the last year across our channels.

The Next Normal for Retail

Now, however, we’re entering a new phase—a new normal? A next normal? Whatever we’re calling it, it’s going to look different from 2020 and probably won’t look identical to the years before COVID either. Between hybrid workplaces and newly established buying habits, shoppers are ushering in a new era for business and retailers.

Fortunately, you don’t have to approach the future without the right tools. We looked at what shopping life was like in the time of COVID and how that behavior will affect plans going forward.

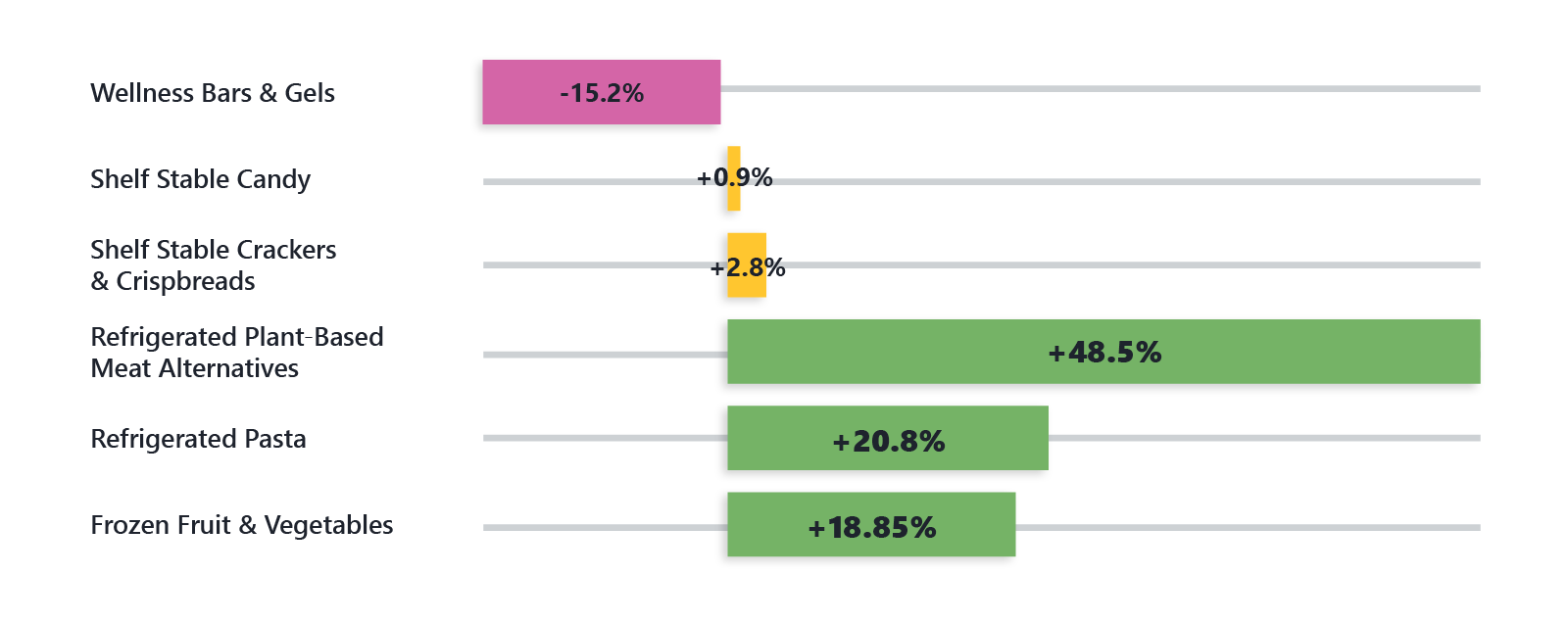

Gains and Losses in Food and Beverage Categories

A year of lockdowns and restrictions meant fewer office-based workers who were running between meeting locations, trying to beat rush hour traffic, and squeezing in gym visits. That’s why we saw some notable shifts in food and beverage performance when looking at year-over-year dollar growth.

Snacking slowed down with less need for office snacks and on-the-go bites:

- Wellness bars and gels decreased by 15.20%

- Shelf stable candy only grew by .90%

- Shelf stable crackers and crispbreads only rose by 2.80%

At-home meals and meal prep saw big gains as fewer people dined out:

- Refrigerated plant-based meat alternatives rose by 48.5%

- Refrigerated pasta grew by 20.80%

- Frozen fruits and vegetables increased by 18.85

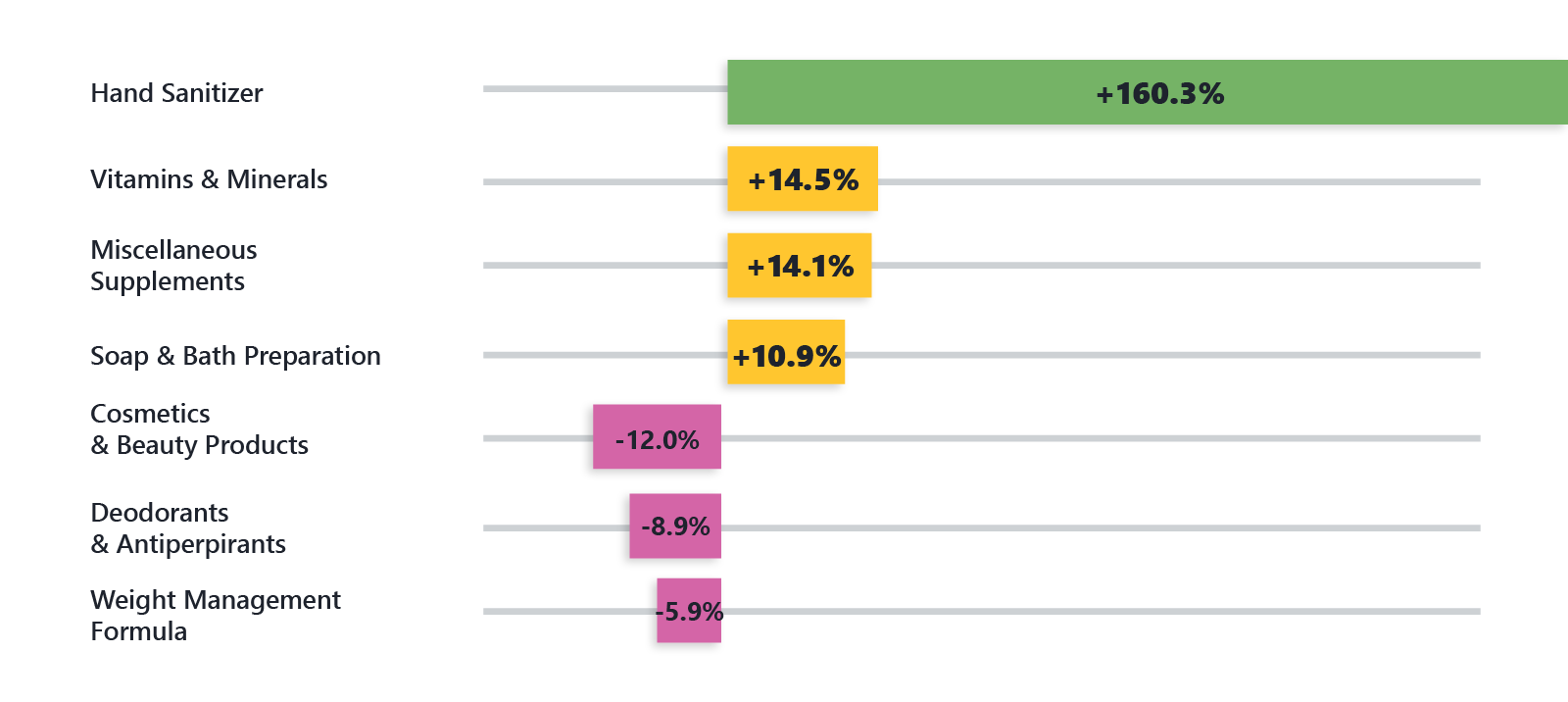

Body Care and Supplement Categories Reflect a Less Social World

Staying home meant shoppers didn’t need some of the everyday amenities that they valued when face-to-face interactions were the norm. Body care and supplements took on a more health-based focus, while more appearance-based items were left behind.

Health concerns took center stage for wary shoppers:

- Unsurprisingly, hand sanitizer showed unprecedented growth with an increase of 160.30%

- Vitamins and minerals helped shoppers focus on health, resulting in a 14.50% increase

- Miscellaneous supplements experienced a similar 14.10% increase

- Soap and bath preparation items grew 10.90%

Non-essential body care products weren’t as necessary between Zoom calls, at-home workouts, and masks:

- Cosmetics and beauty products experienced a 12.00% decrease

- Deodorants and antiperspirants decreased by 8.90%

- Weight management formulas took a 5.90% dip

Shoppers Turn to Functional Ingredients

A desire to stay healthy and out of the doctor’s office turned their trips to the store—or online orders—into quests for health-boosting ingredients.

Immunity and calming supplements became cart staples during uncertain times:

- Calmative herbal formulas increased 79.8%

- Supplements containing Vitamins A, D, and K grew 47.0%

- Vitamin C grew 20.0%

Performance supplements had a surprisingly good year despite (or perhaps because) people stayed home more:

- Other performance supplements grew 15.8%

- Performance nutrition grew 13.0%

What Category Managers Can Expect Post COVID

The return of everyday activities—even outside of the office—as we enter summer months will lead shoppers to adjust some of their lockdown-inspired habits. It will also reveal which new habits will stick around. Here’s what we think you should expect:

- Weight- and sports-related categories will retain their strong performance. While people were trying to stay healthy and active during the lockdown, they will need performance boosts as they return to summer’s outdoor activities, return to the gym, go on vacation, and work off their COVID weight.

- Performance supplements will show explosive growth in the coming year as shoppers gradually add social activities to their schedules.

- Shoppers won’t abandon their reliance on health and wellness products. Not only are we still emerging from the pandemic, but shoppers have begun to view these items as kitchen staples, and they won’t be quick to move away from them. Don’t be surprised if they embrace them even more.

How Category Managers Can Leverage Reporting for More Effective Planning

Retail partners who have access to SPINS reporting and product discovery solutions are able to identify, rank, and introduce new brands and products while shedding light on what to discontinue.

For example, Power Scores assign performance indicators to innovative items while hot item flags show what new items are outperforming the baseline growth of their category. These are just examples of how Category Managers can add some automation to identifying both conventional and differentiated items that matter to their local communities.