Introduction

The beverage industry has seen remarkable changes and growth in the first half of the year. From the rise of functional beverages to the introduction of unique flavors, the following sections detail the key trends and insights shaping this exciting market.

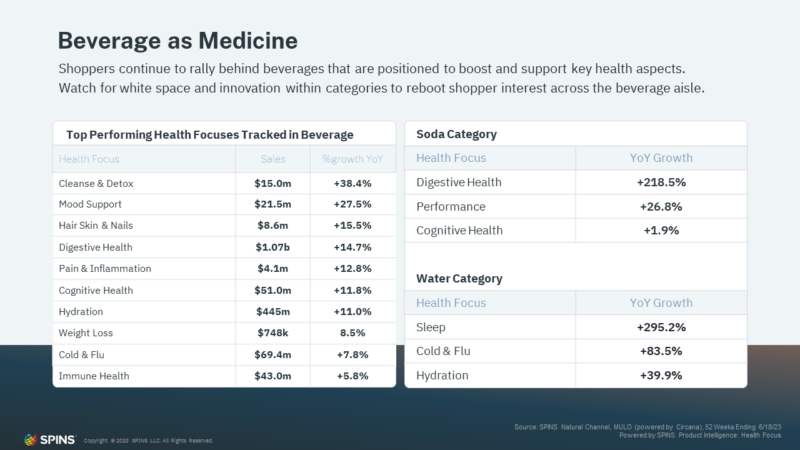

The top line sales figures for the beverage industry show an interesting conundrum. While beverages are up cross-channel by 10% and up in every channel, unit sales are down across the board. This means that the growth in the beverage industry is predominantly driven by price increases as is the case across many categories within grocery. However, consumers continue to pay for functional beverages and beverages in general at increased price points as the concept of “beverages as medicine” continues to grow.

Beverages as Medicine: A Growing Trend

You’ve likely heard of “food as medicine,” but the idea of “beverage as medicine” continues to grow as well. Beyond whole foods as medicinal options, beverages are taking the lead in this space. We’ve seen the VMS to Beverage pipeline grow stronger in recent years. Typically, as certain functional ingredients (such as Ashwagandha or Cordyceps) become popular in supplements, we see that its first steps into the Food & Beverage world are typically on the beverage side. These functional ingredients first show up in beverages, see some success, and then get adopted on the food side, often showing up in snacks first.

Going deeper into a category view, we’ve seen the exceptional rise of functional sodas. Soda, often considered junk food, has seen a remarkable transformation spearheaded by the introduction of prebiotic and probiotic sodas. Many consumers are turning to these sodas as an easy way to help with their gut health as these products are not only functional but tasty and familiar. However, digestive health isn’t the only thing on the consumer’s mind. Performance is also a health focus that’s gaining steam.

In the enhanced water space, beverages that target sleep, immunity, and hydration are growing in the double and even triple digits. Sleep, in particular, continues to be a concern that is top of mind for consumers, and many are gravitating towards enhanced water products containing functional ingredients like Magnesium or Melatonin to help them wind down and get ready for bed.

Energy and Sports Drinks: High-Octane Growth

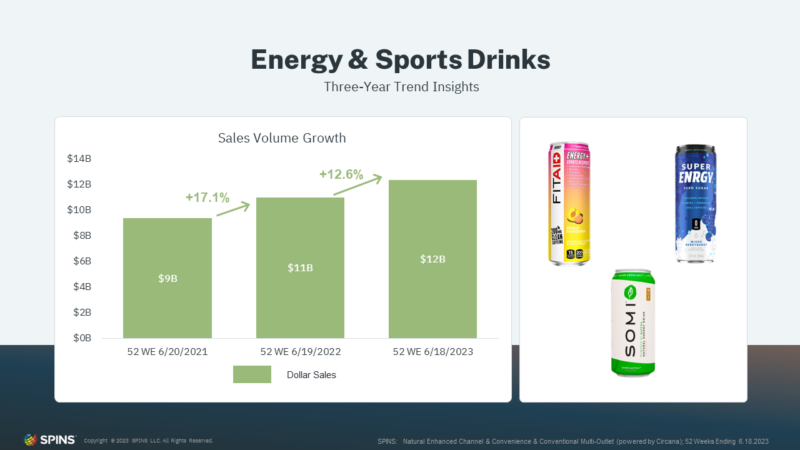

Energy and sports drinks have been a major growth driver, seeing double-digit growth and unit increases. New brands have carved out significant market shares, even as caffeine content has crept up with many energy drinks having about 200mg of caffeine, while some have even 300mg of caffeine. For reference, the FDA cites that a person should consume no more than 400mg of caffeine daily.

Newer brands that have more approachable and neutral marketing have broadened the audience for energy and sports drinks beyond the old days when these drinks were typically consumed by partygoers, laborers or athletes. Nowadays, it’s not rare to see an office worker reach for a canned energy drink instead of a coffee.

Though the energy drink space is saturated, Fit Aid and Super Energy are two brands that have caught our eye as they use natural sweeteners in their drinks instead of sucralose, which tends to be the sweetener that most brands in this space use. We also see potential in matcha-based energy drinks like Somi as matcha has naturally occurring L-theanine, which could prevent the caffeine jitters that some people struggle with. Moreover, matcha is a flavor that’s been seeing strong growth in the beverage category, as seen in the next section.

Flavor Explosion: Unique and Returning Favorites

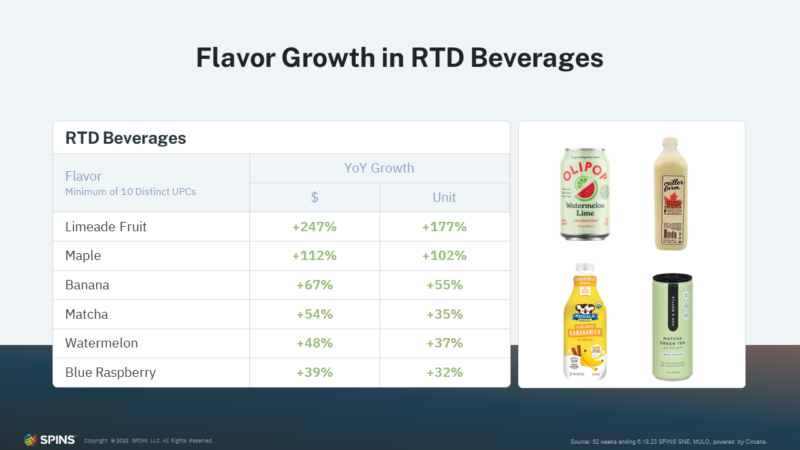

The beverage industry is also seeing a wave of unique and returning flavors, led by limeade, maple, banana, matcha, watermelon, and blue raspberry. Products with these flavors are not only showing strong growth in dollars but also in units, meaning that more consumers are genuinely picking products with these flavors, and price increases aren’t behind the increased sales.

Functional Ingredients: The Mushroom Boom

In terms of popular functional ingredients in ready-to-drink beverages, Magnesium is seeing the strongest growth with a 220% increase in dollar sales and a 219% increase in unit sales. The use of magnesium can range from helping with sleep, stress, and even cognitive health, making it a popular choice with consumers.

The rise of digestive health awareness across social media and beyond has seen gut health-related ingredients, including fiber and cider vinegar supplements, continue to grow in popularity in the RTD beverages space. Both ingredients have seen triple-digit increases in sales and units, pointing to the consumer’s sustained interest in getting their biotics through a tasty beverage.

Another standout ingredient in the beverage space is mushrooms. From Reishi, known for mood support, to Cordyceps, known for energy support benefits, mushrooms are becoming popular beverage ingredients. The trend started within the mushroom coffee space but now we even see it in sodas. According to Brightfield, a social listening company, the mention of Cordyceps in beverage-related conversations has grown 16.53% in compound monthly growth rate in share of volume over the time period 8/1/22 to 6/30/23, signaling the growing interest in the ingredient. It will be interesting to see if mushrooms as a functional ingredient will become a mainstay in the beverage space or fade away slowly.

Innovation in Functional Beverages

Kombucha: A Reimagining

Kombucha, the natural industry darling continues to thrive with room for innovation, including shelf-stable options, a cutback in the vinegary aftertaste, and more accessible price points. This allows it to play in a separate market beyond just a ‘premium’ beverage, making it more approachable for those who are used to beverages like soda. The emergence of kid-positioned kombucha adds another layer to this trend. Softer flavors and the fact that it is shelf-stable make kid-positioned kombucha an option for children’s lunchboxes.

New Ingredients: HMB and More

HMB (Hydroxymethylbutyrate) is a functional ingredient that is now entering the functional beverage space. It has long been used in sports and active nutrition for muscle recovery, but another use case has emerged as recent research has shown the role it plays in preserving muscle mass in the aging population. Maintaining muscle mass is important as one grows older as it can aid with stability thus reducing the likelihood of falls. This means that it can appeal to not just the gym-going crowd but those beyond that too. Super Nirvana is a brand that has successfully integrated HMB into a tasty RTD beverage, which some consider a feat because HMB supplements can smell like body odor.

As discussed before, consumers are gravitating towards the concept of “beverage as medicine,” and it remains to be seen if consumers prefer a beverage that hones in on one health focus or one that targets a few. An example of an all-in-one beverage is CENTR’s enhanced sparkling water. The beverage includes adaptogens and nootropics backed by science like ginger for immune health, GABA for relaxation, citicoline for cognitive health, and more. Instead of having to take a variety of supplements, or drink several functional beverages, you can just get it all in one can.

Sweeteners: A Shift Towards Natural?

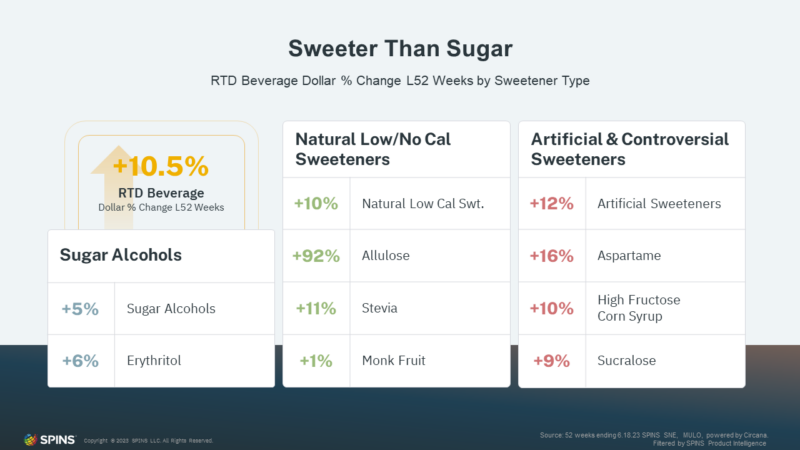

Recently, there has been a lot of chatter around the use of aspartame as a sweetener and many in the industry believe that consumers are trending towards avoiding artificial sweeteners. Though that may be the case in the long term, in the short term that does not seem to be the case. With rising prices, we may see consumers reach for products containing artificial sweeteners as they tend to be cheaper. That, however, doesn’t mean that natural sweeteners aren’t popular, with beverages containing allulose seeing a 92% increase in year-over-year sales.

Dry Nonalcoholic Sector: Specialty Without the Alcohol

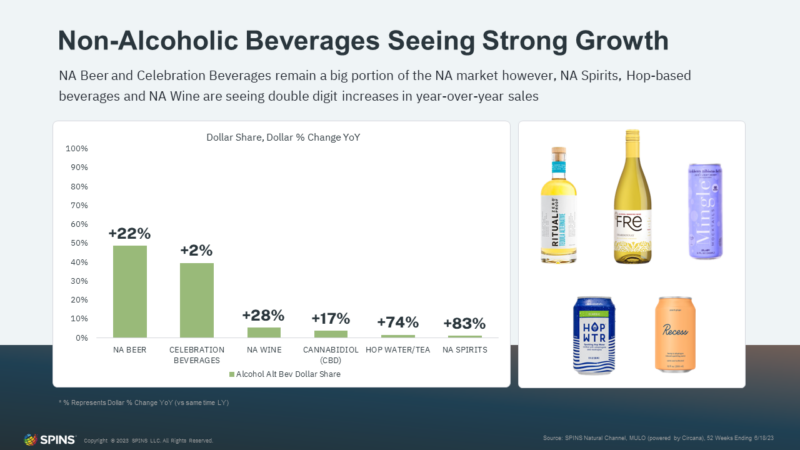

Non-alcoholic beverages continue to see strong growth with many subcategories seeing double-digit growth. NA Beer, NA Wine, and NA Spirits saw a 22%, 28%, and 83% increase in year-over-year sales respectively. Consumers who are choosing to cut back on alcohol or are sober-curious, now have a variety of options to choose from. These beverages allow those who choose to refrain from drinking alcohol during an event to have a special drink and fun versions of their alcohol counterpart instead of a soda or the infamous soda water and lime.

What to Watch

The mid-year trends report for the beverage segment paints a vivid picture of an industry in flux, reimagining old favorites and pioneering new paths. From the resurgence of energy drinks to the exploration of relaxing without booze, the beverage industry is full of opportunities and quick innovation.

Keep an eye on sweeteners and the innovation in functional beverages, as these trends are likely to shape the future of the industry. The battle between natural or low/no-calorie sweeteners, and artificial sweeteners will be an intriguing aspect to watch in the coming years.

With continued reimagining, innovation, and growth, the beverage industry promises to keep quenching our thirst for novelty and nourishment. Stay tuned to the pulse of this ever-evolving segment and enjoy the flavors of the season!