Market Overview & Trends

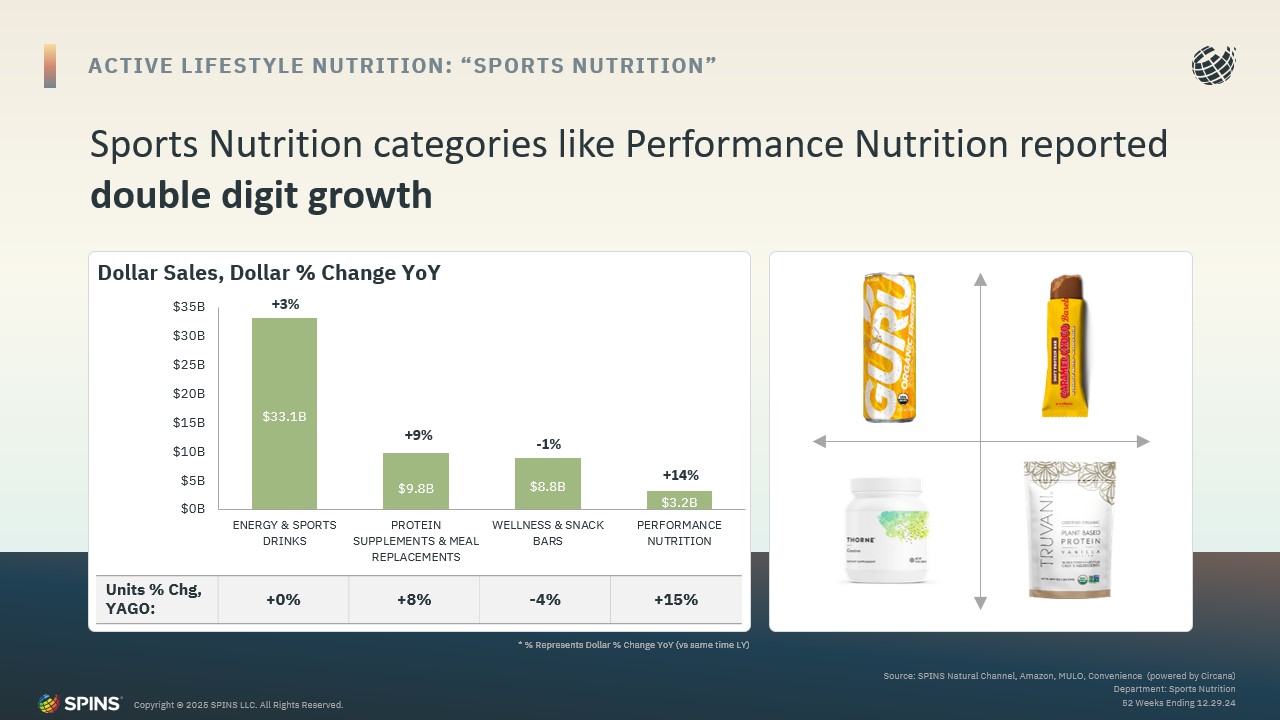

The active nutrition market has been on a remarkable growth trajectory, with Performance Nutrition leading the charge.

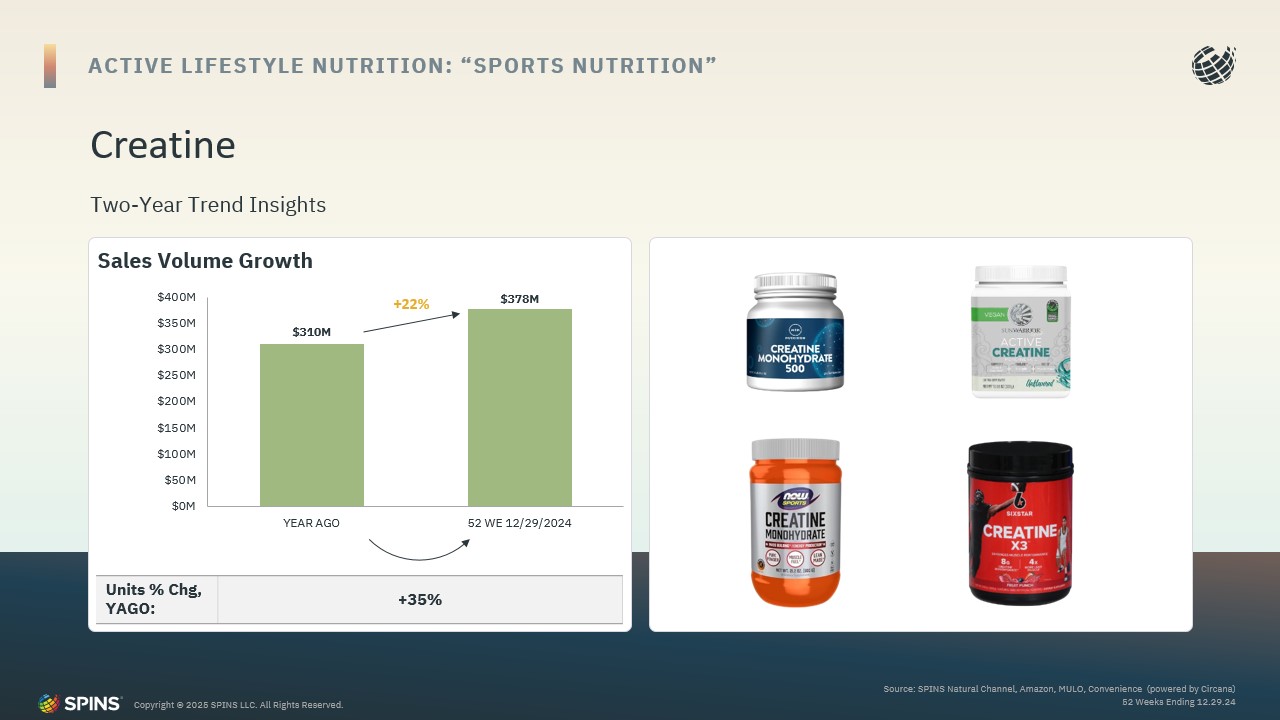

[PDF] Active Lifestyle Nutrition: Sports Nutrition

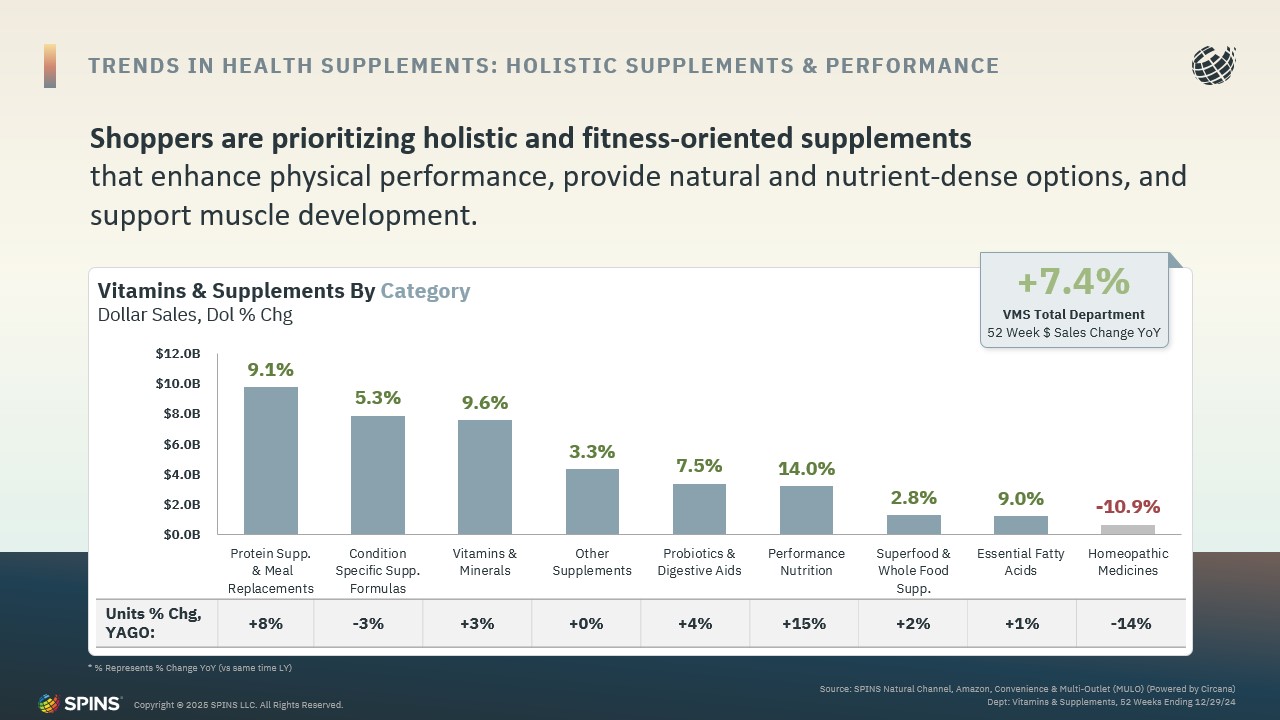

Access the full reportOver the past 3 years, this category was the top growth category within Vitamins and Supplements, maintaining a growth rate of 14% year-over-year (YoY), which is double the industry average. This sustained growth underscores the increasing consumer interest in enhancing physical performance and overall well-being.

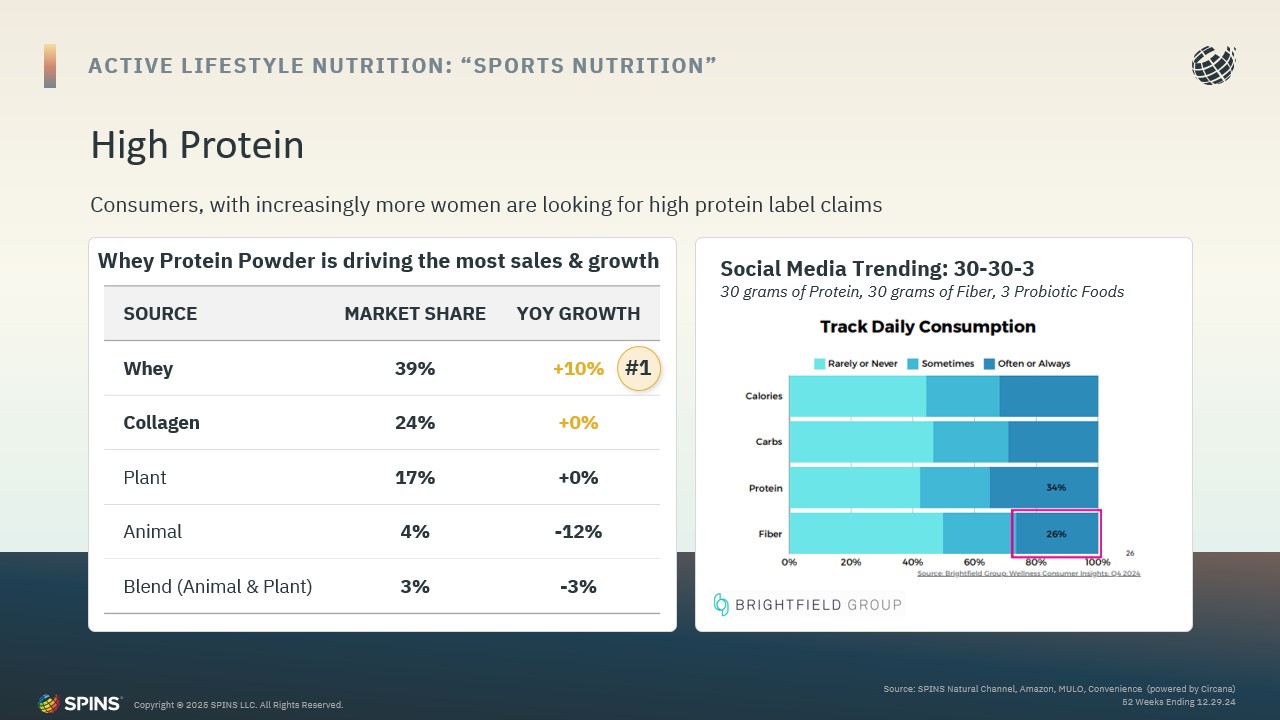

Protein supplements have become a staple in many households, with high-single-digit growth and penetration just under 50% of U.S. households.

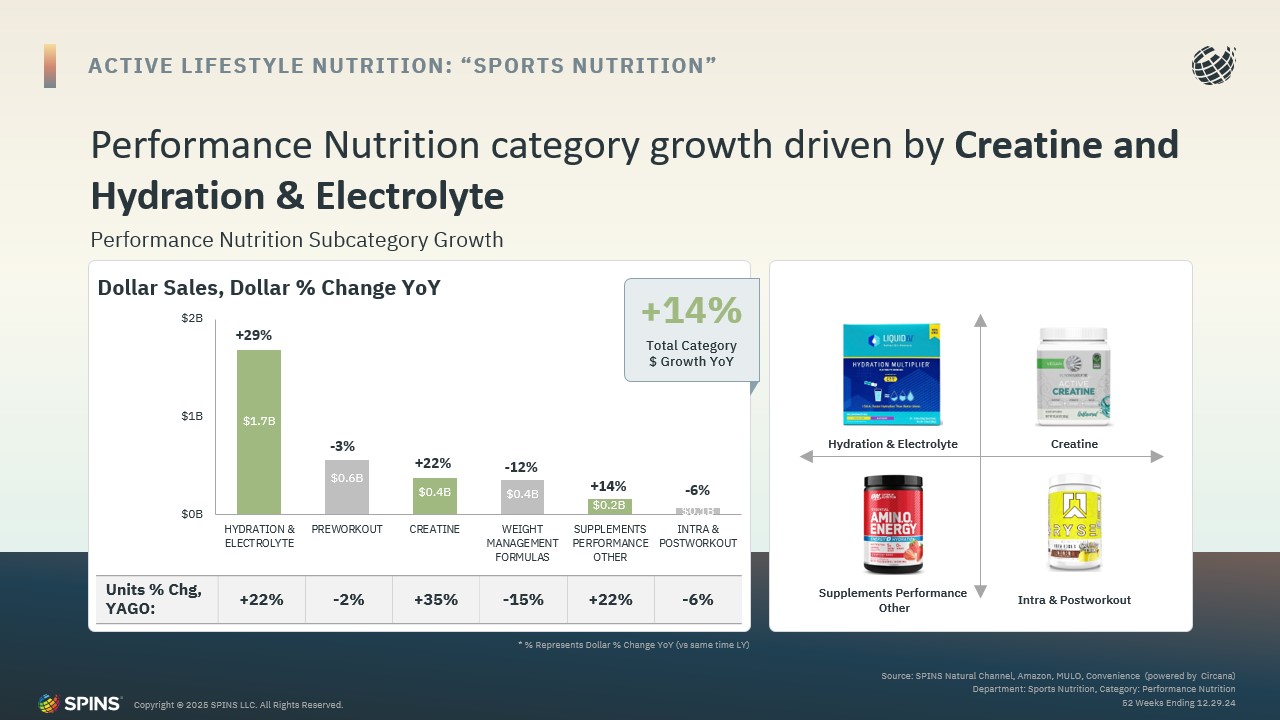

Notably, three-quarters of these purchases are from repeat buyers, highlighting the product’s effectiveness and consumer satisfaction. Meanwhile, hydration supplements (+29%) are outpacing traditional sports drinks (flat), which saw a plateau in 2024. Despite potential market corrections, the demand for hydration products remains robust.

The convergence of active beverages with sports nutrition trends is another notable development. Brands are innovating by crossing into new functional spaces, often rounding out their product offerings by having both hydration and energy drinks, and incorporating both ready to drink and ready to mix powders. The Active Lifestyle Nutrition movement is also gaining momentum, with everyday consumers, not just athletes, adopting functional foods and beverages for health, energy, and longevity.

Key Ingredient Trends

Protein remains a cornerstone of active nutrition, with a notable shift back to whey protein as interest in plant-based proteins stabilizes. While pea protein continues to perform well, it is not at the forefront of consumer preference.

Creatine is expanding its reach beyond traditional bodybuilders to include women and older demographics. Innovative formats like creatine gummies and ready-to-drink (RTD) options are formats that have the potential to expand the reach of creatine to consumers who don’t like powder mixes. Interestingly, brick-and-mortar stores are gaining market share in creatine sales, while Amazon experienced a 3% YoY decline.

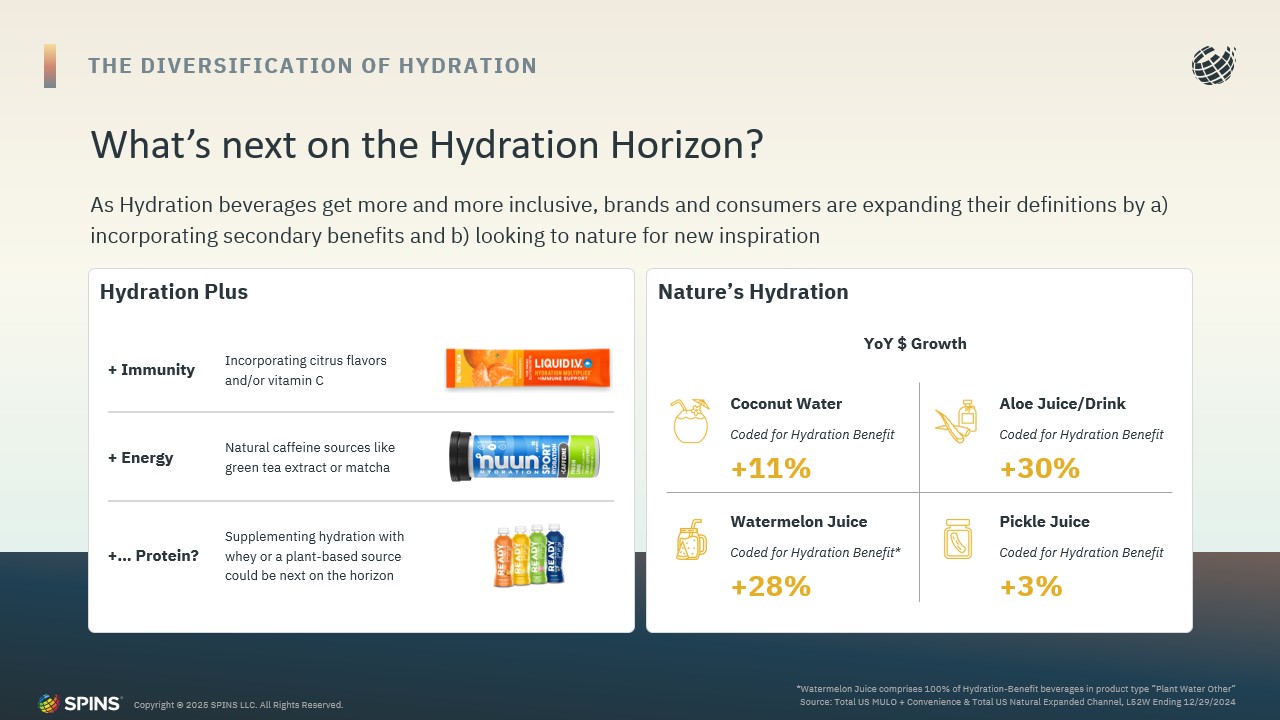

Hydration and Electrolytes have seen a significant 29% YoY growth, with trends like “Nature’s Hydration” (coconut water, aloe juice, pickle juice, watermelon juice) gaining popularity. Hydration has become a “hero” category, with brands expanding into combinations like hydration + immunity, hydration + energy, and even hydration + protein. Emerging delivery forms such as hydration drops (trace minerals, unflavored) and hydration gummies, are also entering the market.

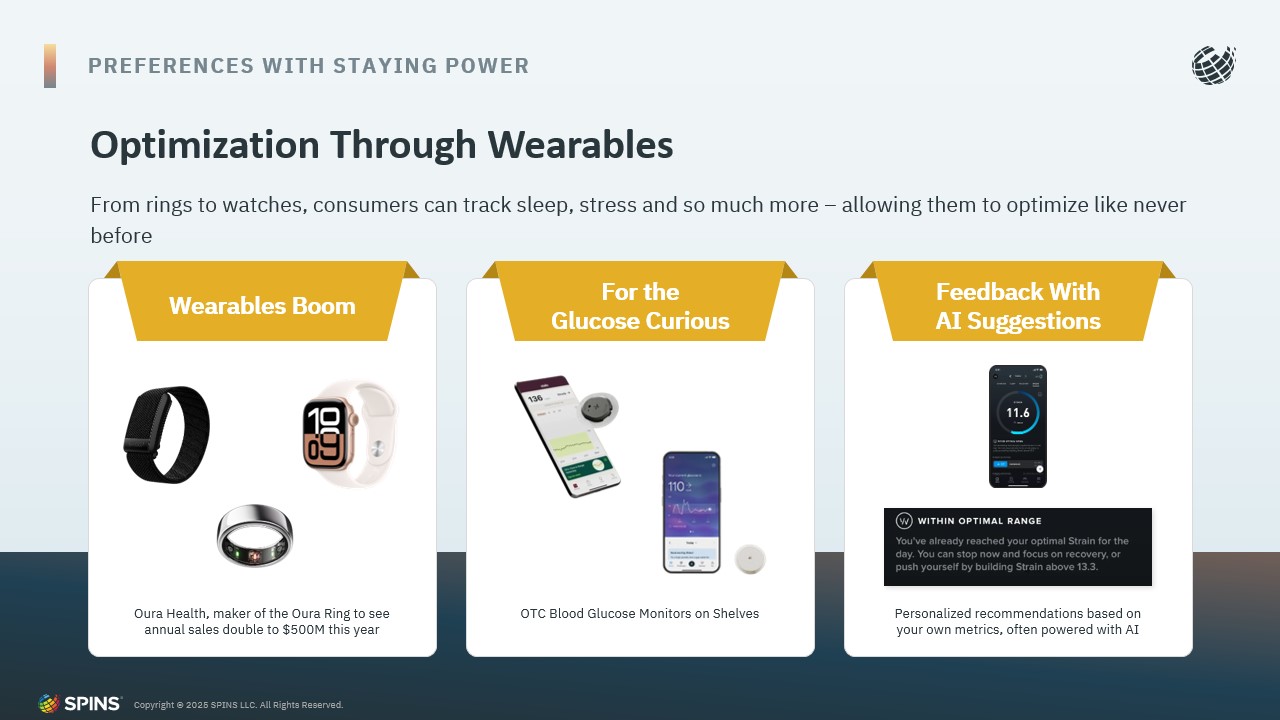

Anti-aging and Longevity is another burgeoning area, driven by the concept of “healthspan”—the period of life spent in good health. Ingredients like NMN, magnesium, quercetin, and beauty supplements are in high demand. With projections indicating that 82 million Americans will be over 65 by 2050, the demand for healthy aging solutions is set to soar. (1) Biohacking, supported by wearables that track biological age, is also on the rise, allowing consumers to adjust their diet and supplementation in real time.

Consumer Behavior & Health Focus

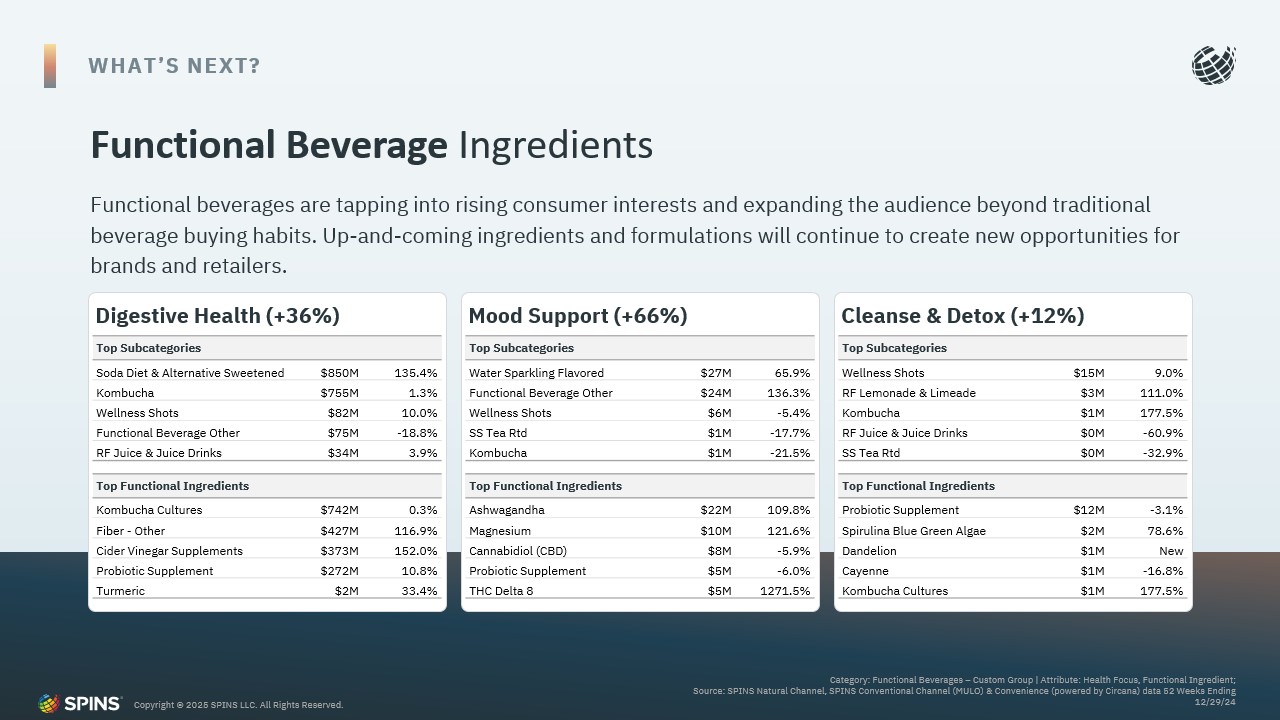

The evolution of functional beverages beyond traditional energy drinks is noteworthy, with mood-support beverages experiencing a 66% growth.

Consumers are increasingly seeking products with “acute effects”—functional drinks that deliver noticeable benefits quickly. While weight loss supplements are declining, GLP-1 medications (Ozempic, Wegovy) may lead to growth for companion products like multivitamins and protein supplements.

Personalized nutrition and health tech are reshaping consumer behavior. AI-powered recommendations and gamification, such as wearables and real-time health tracking, are becoming mainstream.

With 58% of US consumers using health or fitness apps or trackers and a staggering 91% of them buying an app-recommended supplement, sports nutrition product, or meal plan at least once a year, it’s clear that shoppers are in tune with products that fit them. (2)

Consumers are now turning to platforms like Reddit and AI chatbots for product recommendations, moving away from traditional Google searches. AI-driven search is replacing traditional SEO marketing, with Reddit and chatbot recommendations gaining credibility. This shift underscores the importance of authentic user reviews and real-time interactions in influencing consumer decisions.

The Future of Sports Nutrition & Functional Products

The sports nutrition category remains resilient, with high repeat purchases and non-seasonal demand.

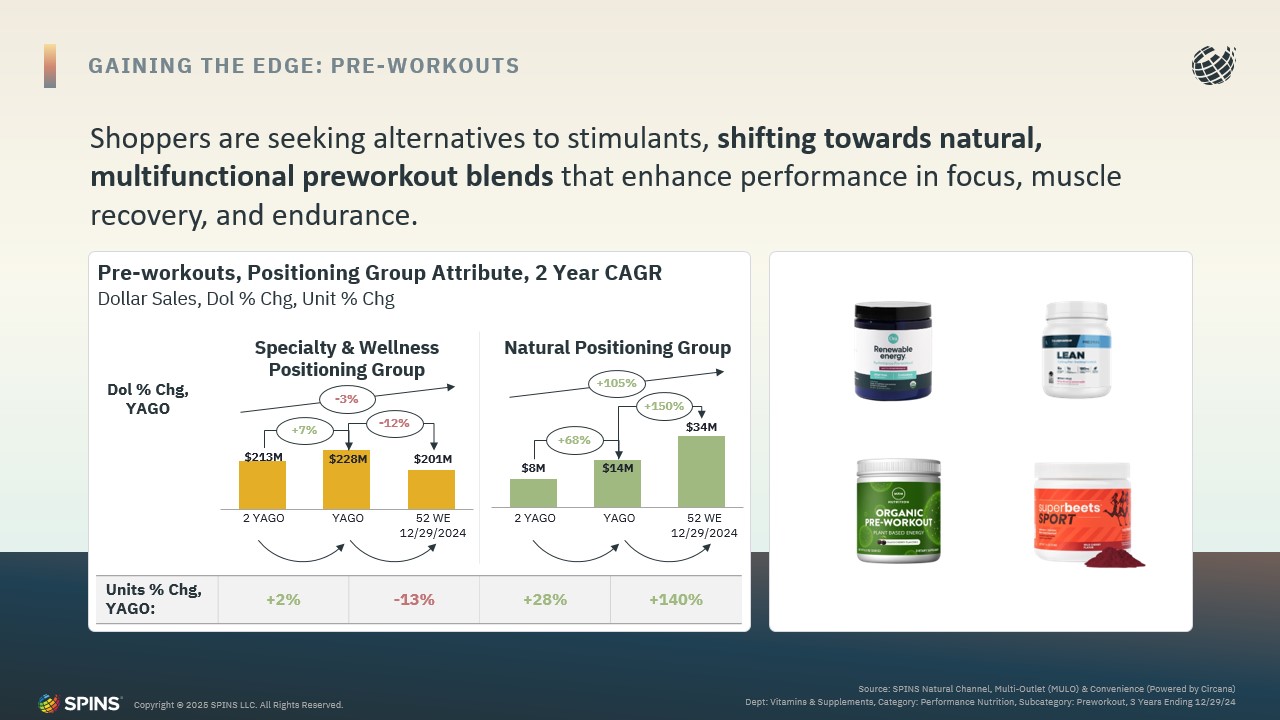

However, pre-workouts saw their first decline in years, possibly due to competition from energy drinks. There continues to be a white-space opportunity for “natural” pre-workouts without artificial sweeteners or colors, which saw growth at +150%.

2025 Outlook & Emerging Trends

The impact of GLP-1 drugs (weight loss injectables) on the supplement industry will be significant, with more companion products expected. Biological age tracking is becoming mainstream, influencing supplement and nutrition choices. Expect to see more functional snacks and beverages targeting longevity, immunity, mood, and hydration. Flavors and textures are also evolving, with a shift toward less sweetness and more salty, spicy, and sour profiles. Pack-size innovation will be crucial, with brands exploring multi-serve formats and premium packaging.

Sources:

Data referenced in this article sourced from SPINS:

Geography: SPINS Natural Channel, Amazon, Convenience & Multi-Outlet (MULO) (Powered by Circana), Dept: Vitamins & Supplements, Time Frame: 52 Weeks Ending 12/29/24

Other Sources:

- https://www.prb.org/resources/fact-sheet-aging-in-the-united-states//

- Global Nutrition Consumer Research conducted for NutraIngredients by Lumina Intelligence November 2024, N=6,000