Why Millennial Pet Owners Are Choosing the In-Store Experience

Now that pandemic lockdowns are appearing in the rearview mirror, what does the state of the pet industry look like? We know millennial pet owners are leading the way in new pet ownership and natural-sourced diets. Plus, the pet retail market is experiencing a 3.7% dollar growth year over year. It’s clear that pet products did well over the last year and are poised to ride that wave in the foreseeable future. But how will it evolve?

To help brands and retailers keep a finger on the pulse of the pet retail landscape, we take a look at 3 pet retail trends defining today’s pet market:

1. Internet Shopping for Pet Products Levels Off as Cities Reopen

The pandemic caused many pet owners to trade their in-person shopping carts for virtual ones. Between health concerns and retail restrictions, online shopping became the more efficient and convenient option—and retailers responded by adding a variety of options. When we look at internet shopping we’re including eCommerce sites as well as click-and-collect and delivery options.

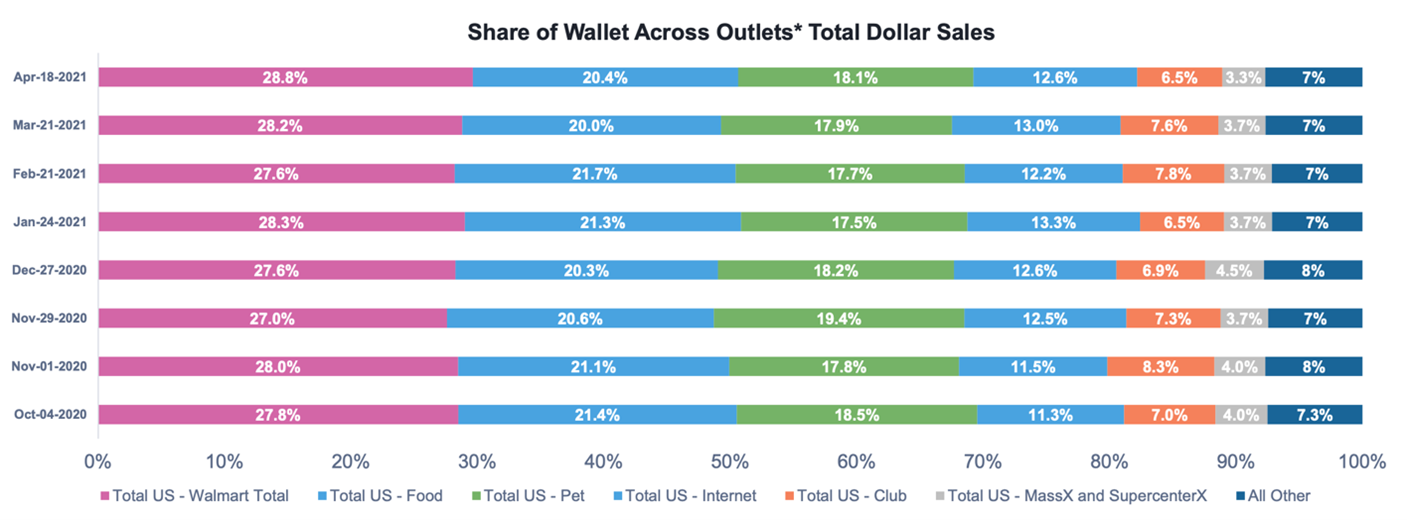

In October 2020, internet purchases comprised 21.4% of the share of wallet across all outlets, and in the subsequent months has tapered off little by little—with April’s share coming in at 20.4%. (Data based on Source: IRI All Outlet Panel, Enhanced with SPINS Product Attribution. Quad Weeks Ending April 18, 2021.) This small decrease suggests a slight leveling off as more customers return to the store but don’t expect a return to pre-COVID levels now that customers have gotten used the having multiple options.

2. Innovative Pet Products Bring Back Customers

Pandemic shopping—if you were willing to head to brick-and-mortar stores at all—often meant consolidating trips to minimize the amount of time you were masked up and trying to avoid bumping into fellow shoppers.

For many pet parents that meant shopping at conventional retailers where they were also getting their groceries or other household items. Now that the in-store experience is returning, so are the shoppers who miss the knowledgeable staff and wide selection of specialty items they can’t find at the big box stores.

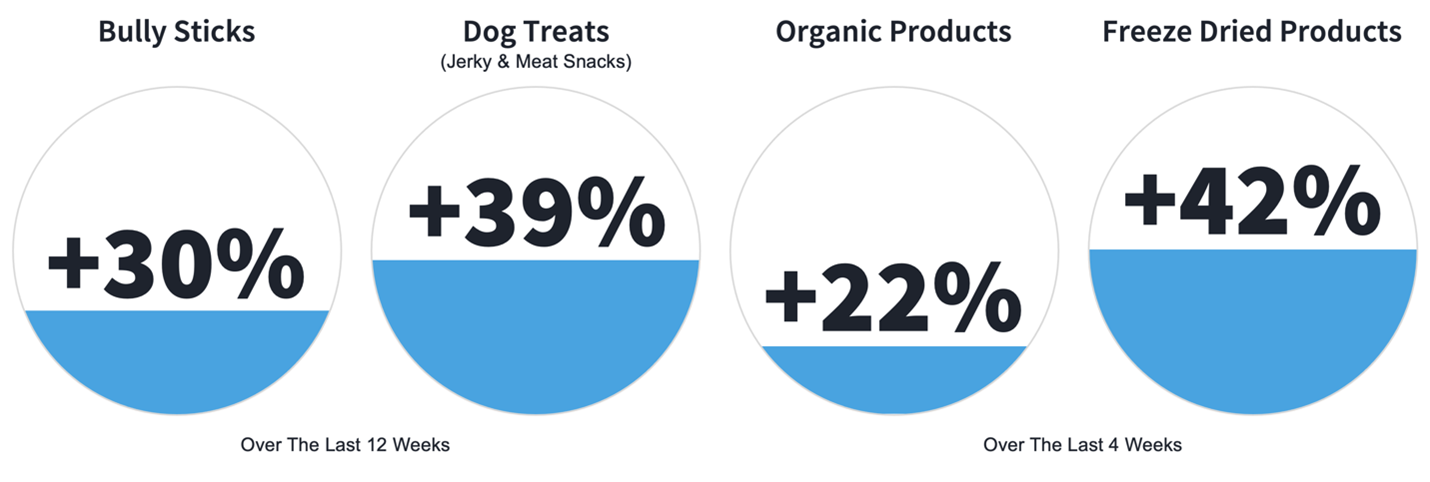

Looking at recent SPINS sales data, we can easily see how pet parents are reaching for high quality and differentiating items that regional and independent pet stores carry, such as organic and freeze-dried pet products:

3. Pet Vitamins and Supplements Drive Growth

Vitamins and supplements have been top of mind for pandemic-wary shoppers who want to update their diets and daily routines with any items that might boost their overall wellbeing. Pet parents are just as interested in rounding out their fur babies’ diets with vitamins and supplements to ensure a happier, healthier life.

For the last 12 weeks, SPINS Neighborhood Pet Channel data shows a 22% growth for items containing CBD. CBD is thought to help pets with joint pain, inflammation, anxiety, and a mix of other ailments. Other ingredients, like fish oil and glucosamine, are also making their way into more products and pet diets.

Ensuring a Long-Term Relationship with Pet Owners

Pet parents are as committed to their pets’ health as they are to their own, and that’s why they seek out unique, innovative products. As retailers look ahead, they should remember to balance the everyday needs of pet owners—such as online ordering for those busy days—with the specialty items that differentiate them from everyone else.

Contact SPINS to learn about our Product Discovery and assortment automation tools for independent and neighborhood pet retailers. Our solutions ensure a long-term relationship with shoppers and make it easy to compete with big-box and e-commerce retailers.