The beverage industry is undergoing a transformation, and at the heart of it is a simple question: How can we modernize traditional beverage segments to meet the needs of today’s consumers? As consumer preferences shift toward wellness, convenience, and functionality, brands are finding new ways to innovate within familiar formats.

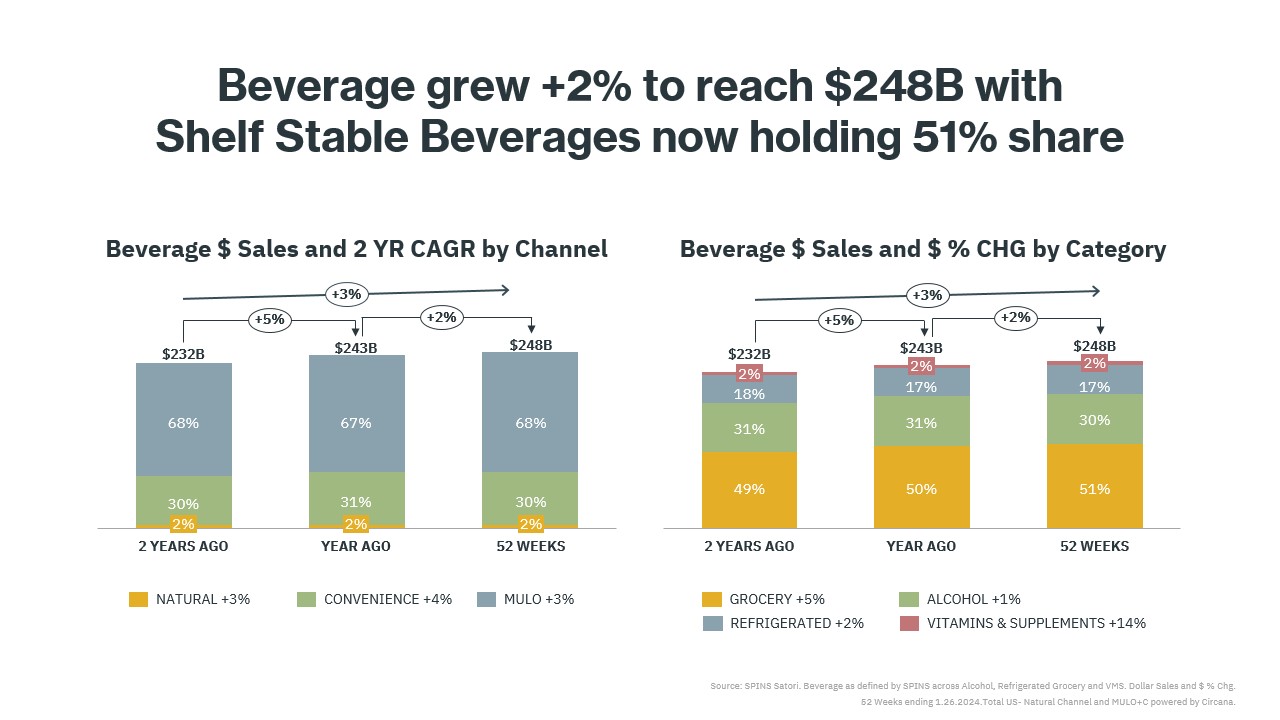

Although the overall beverage category grew 2% to reach $248 billion, this growth represents a slowdown compared to the previous year, highlighting the need for a strategic assessment of channel and segment growth drivers. While it only holds a 2% share of Total Beverage, Natural is the only channel showing unit-driven growth, fueled by adventurous retailers and evolving consumer tastes.

Shelf-stable products now command over half of industry sales, and we continue to see Alcohol growth softening, resulting in a 1 pt. of share loss over the past two years.

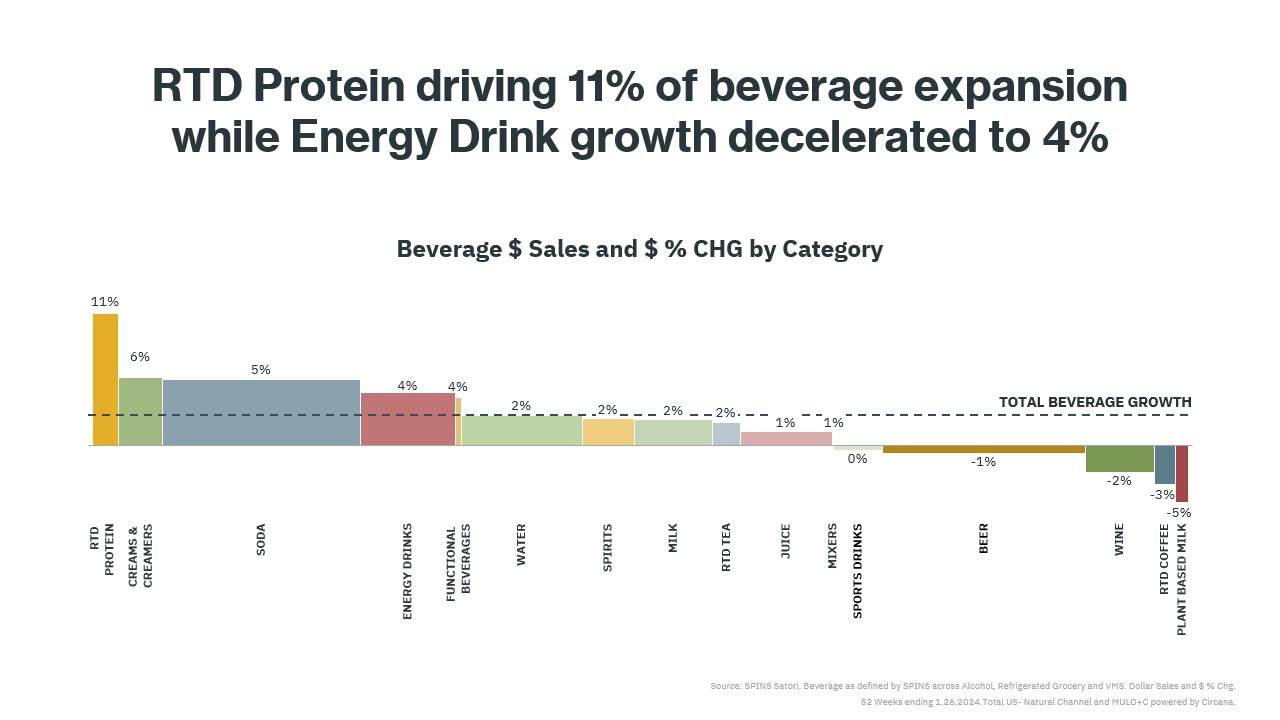

Within this landscape, categories like ready-to-drink protein and diet or alternative sodas are outperforming the beverage industry, thanks to their alignment with modern health trends and functional benefits.

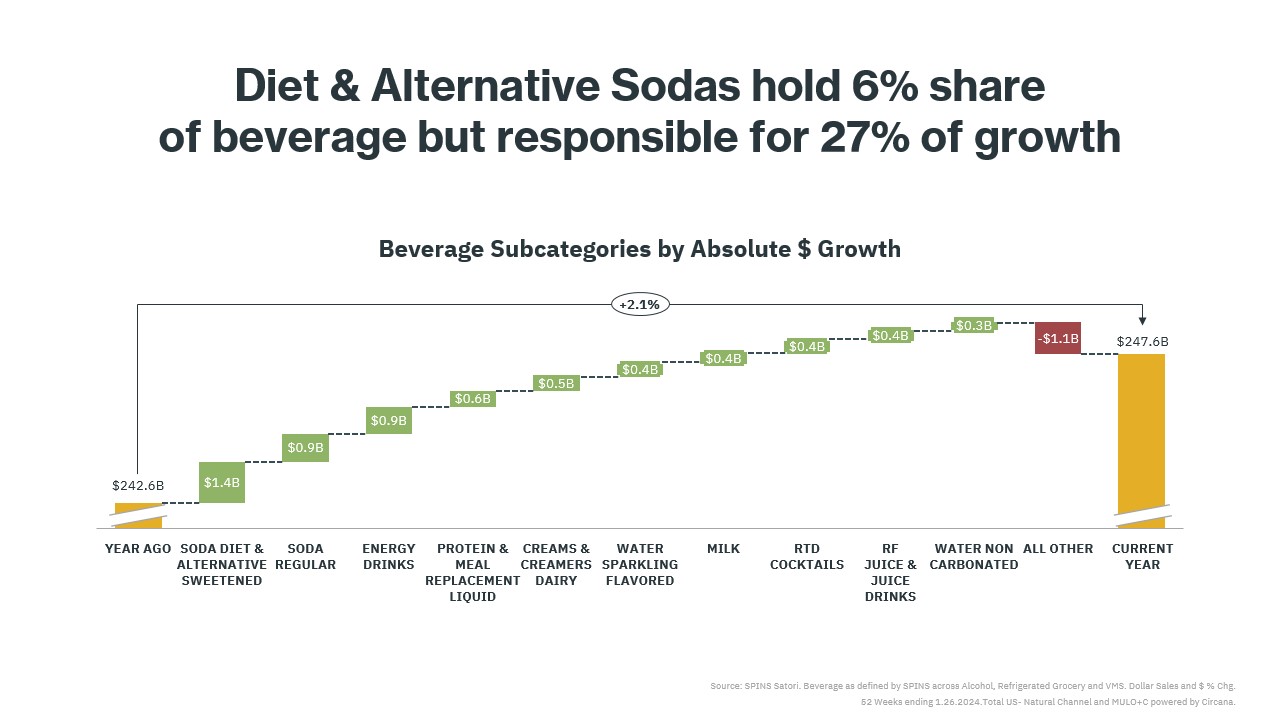

We can go even more granular and look at the subcategories that are driving growth. We can see that diet and alternative sodas, where we have prebiotic and fiber-laden products, currently only hold 6% share of the total beverage market, but are driving 27% of growth.

This is an over contribution relative to its size, a prime example of refreshing the familiar—breathing new life into established categories by addressing emerging consumer needs.

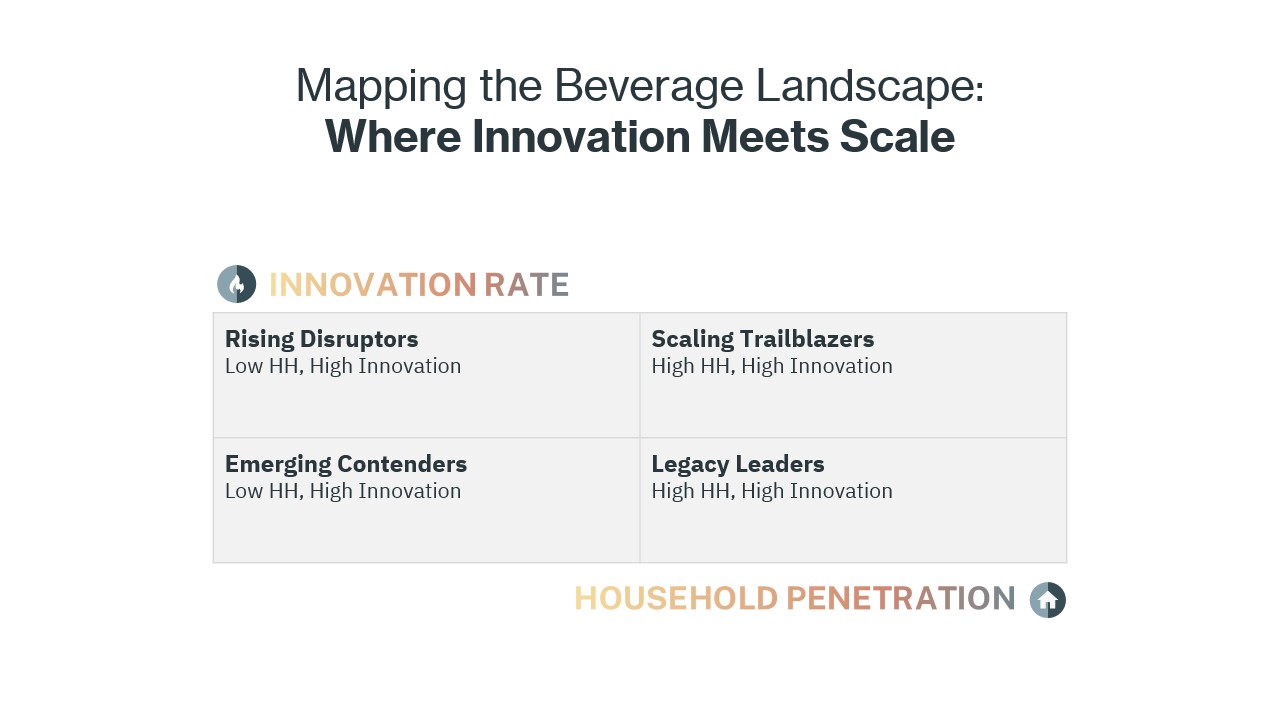

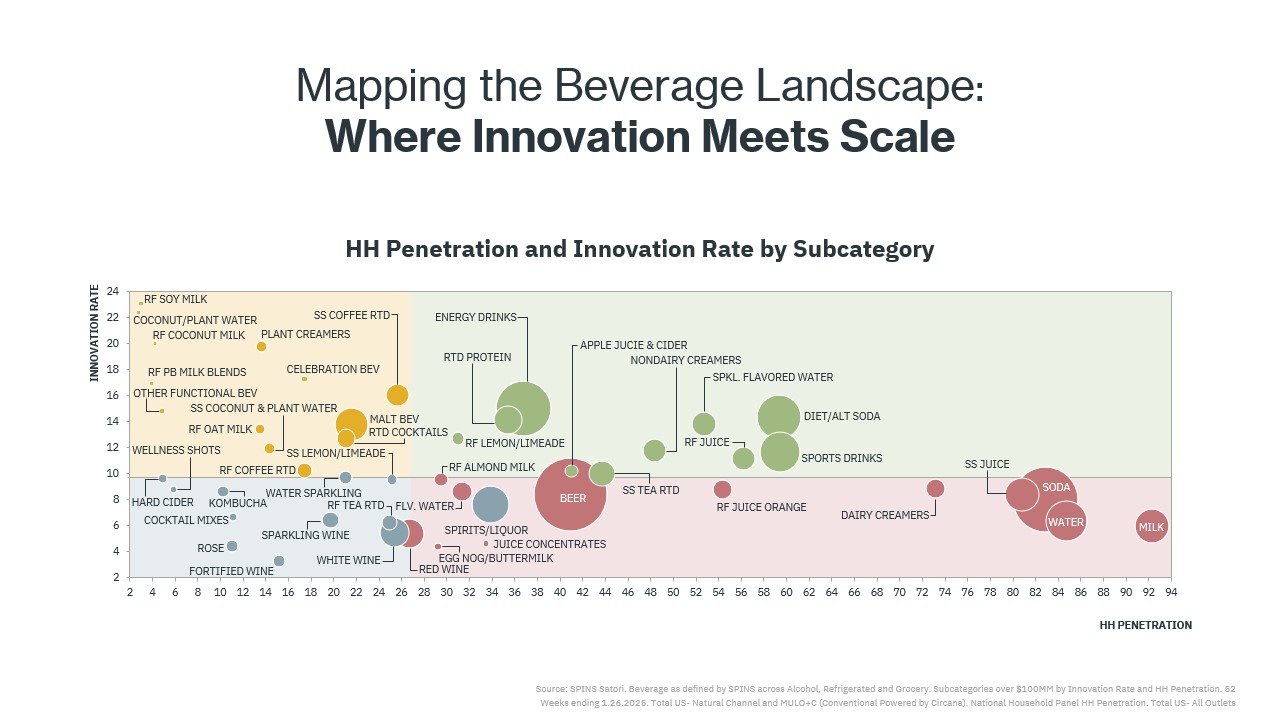

Taking this idea further, to understand how and where this innovation is taking hold, we can break the market into four key segments: Legacy Leaders, Scaling Trailblazers, Rising Disruptors, and Emerging Contenders.

Household Penetration measures how many people are shopping in this category, while Innovation Rate refers to how many new products are entering the category. We look at the innovation rate to understand how fast a category is evolving.

By measuring each category based on the two metrics, Household Penetration and Innovation Rate, we can see where they are within the quadrants.

Mapping out the beverage landscape this way helps us show where innovation meets scale. Each quadrant requires different levers to be pulled for brands to succeed and find new audiences, presenting distinct opportunities to meet consumers where they are, while shaping the future of beverage.

Legacy Leaders

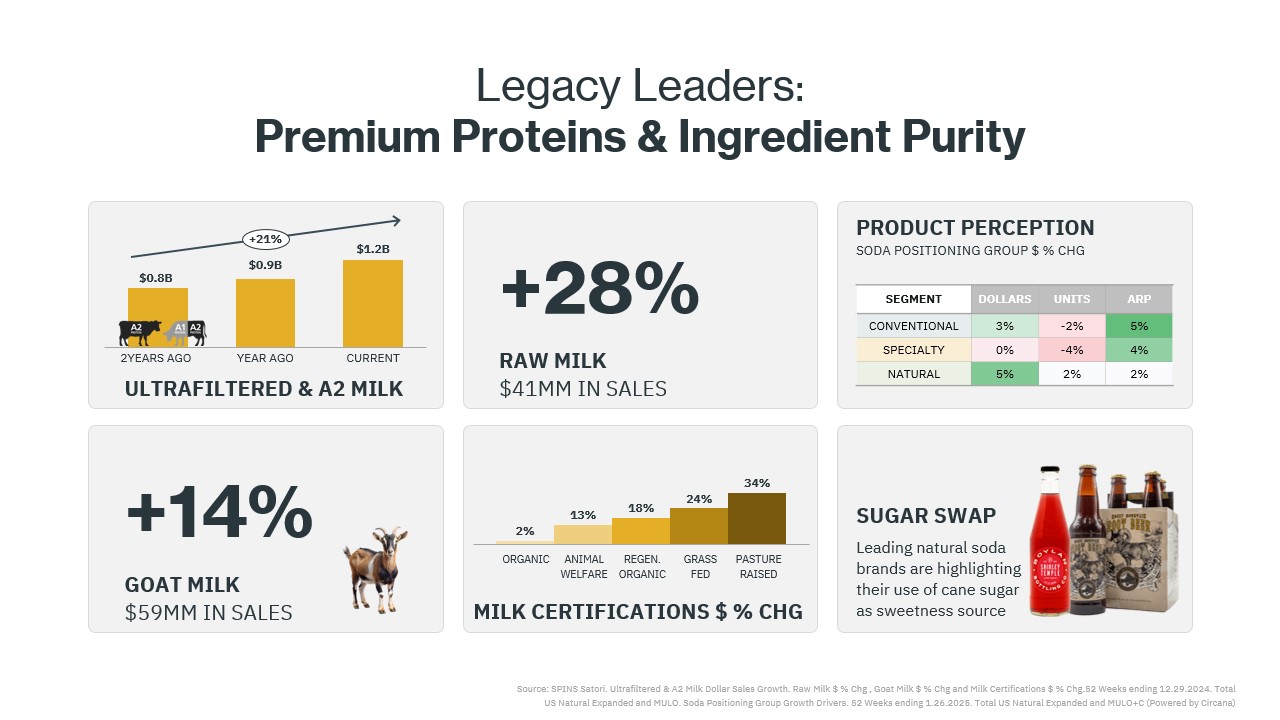

These are the foundational categories—milk, traditional soda, and shelf-stable juices—that have long defined the beverage landscape. But rather than fading into the background, these categories are finding new relevance through innovation in purity and protein diversification.

Brands in the Legacy Leaders quadrant are succeeding by elevating the everyday. For example, milk is experiencing a premiumization wave through A2 milk, ultra-filtered options, and goat milk—all geared toward not only improving nutrition but also digestibility, which allows them to target a broader audience.

Soda is also undergoing a renaissance. Brands are reformulating with real cane sugar to avoid the negative connotation of traditional high fructose corn syrup.

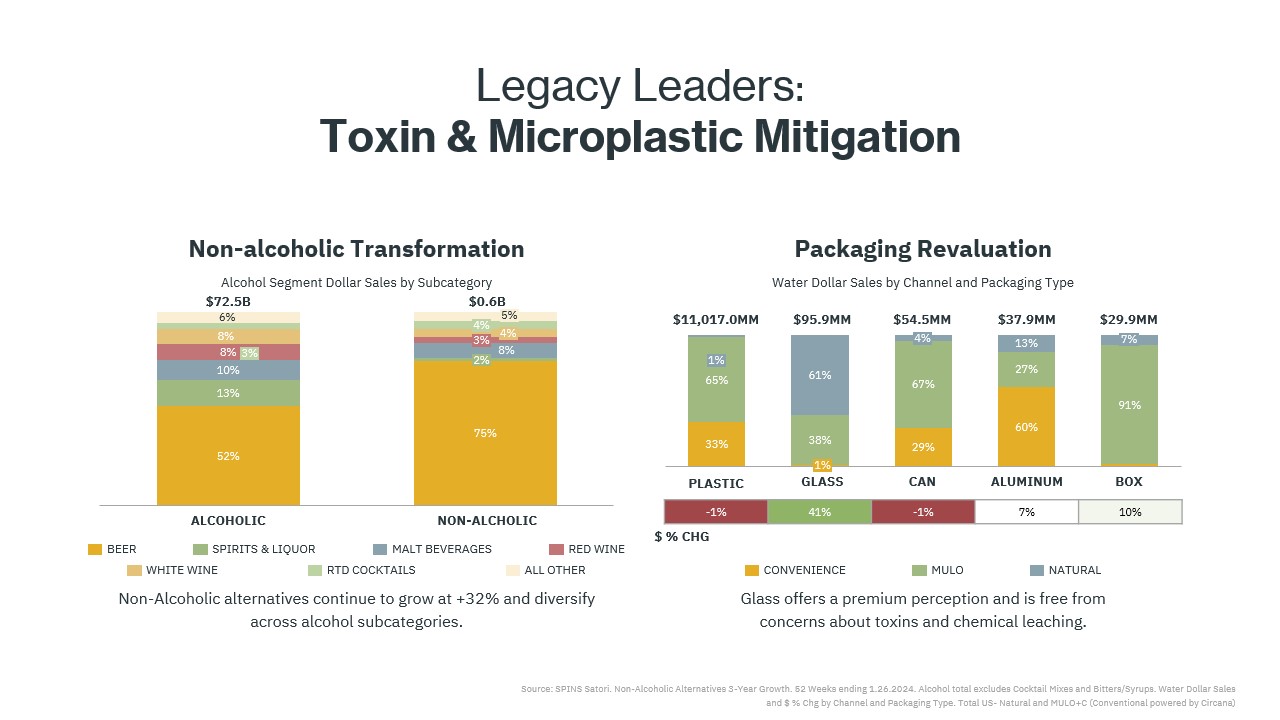

With base elevation, there’s also the opportunity for toxin elimination. Nonalcoholic alternatives are booming, up 32% year-over-year and surpassing $600 million in sales.

We see new entrants coming into this space and diversifying beyond just beer, the subcategory where this segment is really established. We anticipate this evolution will continue following the patterns of how consumers interact and drink alcohol. These alternative drinks enable ritualistic behavior that is associated with alcohol, without the worry of some of the health concerns.

Packaging is another key lever for Legacy Leaders. Glass bottles are being used to signal purity amid growing concerns surrounding microplastics and forever chemicals. Reinvention on this lever is helping brands earn trust and refresh their perception.

Scaling Trailblazers

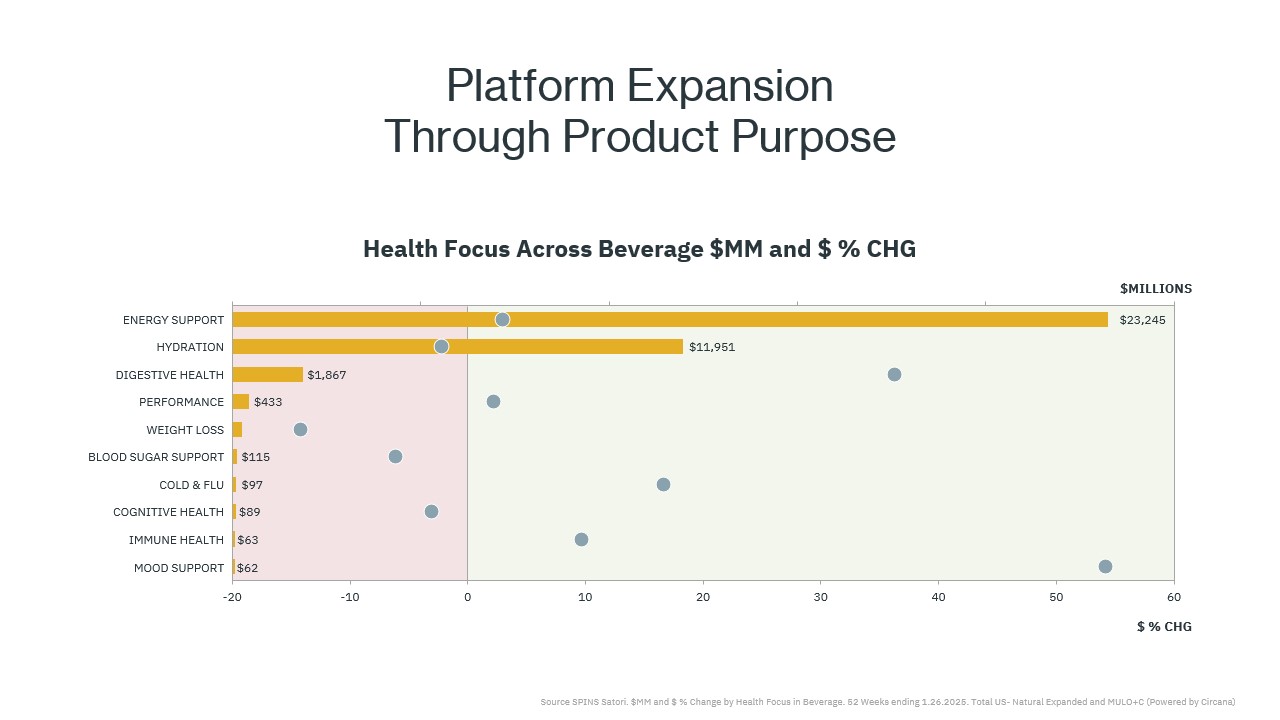

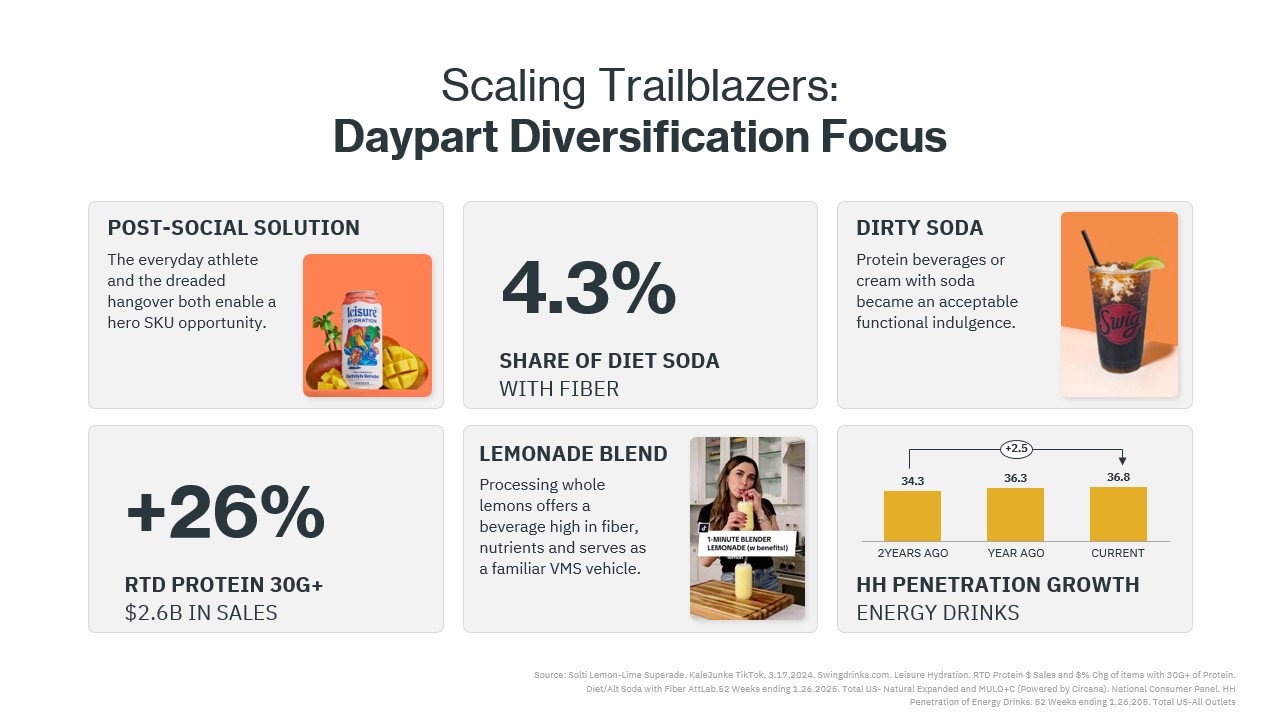

These brands are pushing beyond the basics by connecting to specific consumer need platforms like energy, immunity, and digestive health. This quadrant includes categories like sports drinks, diet sodas, and energy drinks, which have found renewed purpose through functional positioning.

Scaling Trailblazers are carving out new occasions and expanding usage across dayparts. From morning detox drinks to post-workout protein and evening relaxation beverages, these products are becoming indispensable to the modern consumer routine.

Success in this quadrant relies on aligning with wellness-oriented lifestyles and making function-forward beverages accessible and habitual. Brands in this space are also innovating through ingredients, formats, and positioning, ensuring they remain top of mind and cart.

Rising Disruptors

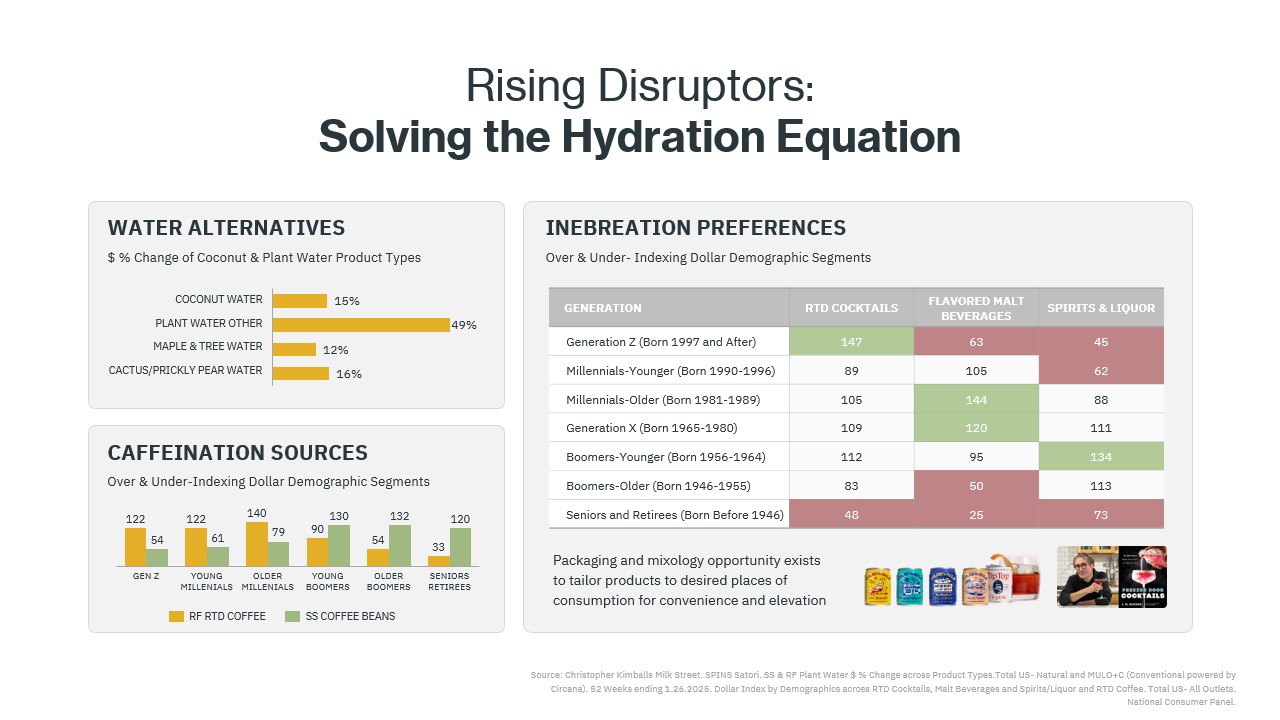

Bold, authentic, and often speaking directly to Gen Z and millennial audiences, Rising Disruptors are rewriting the beverage playbook. This includes ready-to-drink cocktails and coffees, as well as hydration-focused products like plant waters.

These brands are tapping into the hydration equation—if you’re not hydrating, you’re dehydrating. And for many consumers, hydration is about more than just water. It’s an opportunity for flavor exploration, cultural inspiration, and functional augmentation.

Generational preferences play a major role in this space. Younger consumers crave convenience and experience, gravitating toward drinks that can be consumed cold, hot, or even foamy, offering tactile, flavorful, and lifestyle-enhancing experiences. Rising Disruptors succeed by delivering those moments while maintaining a health-forward ethos.

Emerging Contenders

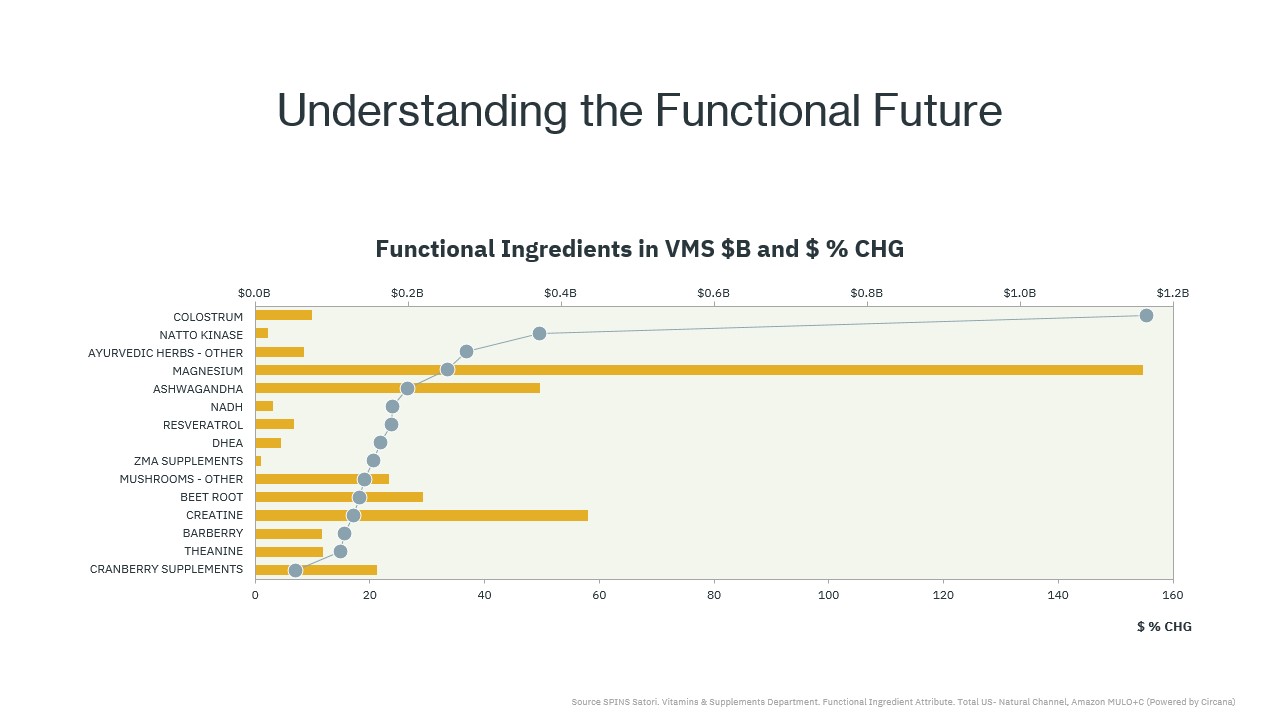

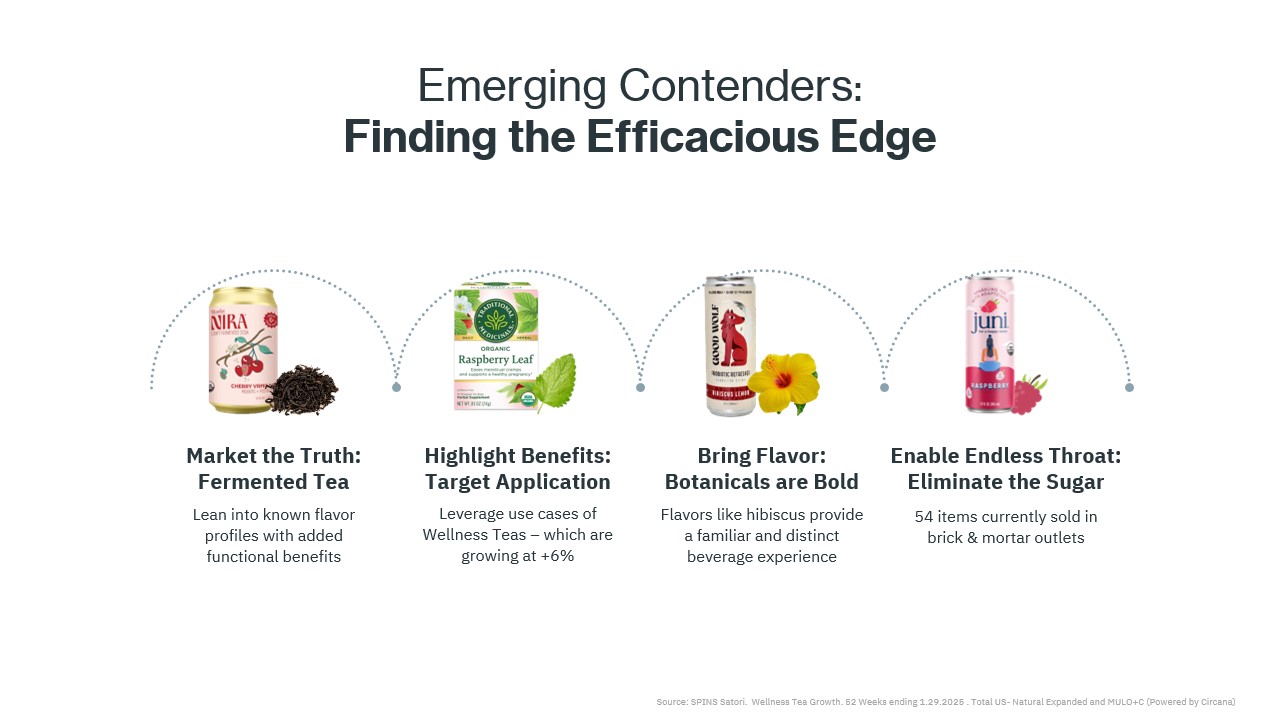

The final quadrant is where niche innovation lives. Categories like kombucha, wellness shots, and ready-to-drink teas are still small but packed with potential. These are function-first beverages, often emphasizing ingredients with proven health benefits—beets for circulation, colostrum for skin and hair, or botanicals for immunity and stress relief.

Ready-to-drink teas in particular represent a sweet spot between tradition and trend. They offer a canvas for fermentation, botanical benefits, and sugar elimination, creating a platform for continued innovation and differentiation.

Emerging Contenders may not yet be household names, but they’re poised to scale quickly as consumers become more educated and open to exploring beverages that deliver both flavor and function.

Creating the New Staple Assortment

When we think about these four quadrants where innovation meets scale, there’s opportunity for incremental growth in each of them. Every single brand has the opportunity to participate and become a mainstay.

Refreshing the familiar is really about understanding what people love and coupling that with modern mindsets to exceed expectations. Whether that’s through ingredient transparency, functional benefits, or packaging innovation, the opportunities are endless. As the beverage category continues to evolve, the question for every brand becomes: How are we shaping the next generation of staple beverages?