GROWTH FEELS REAL

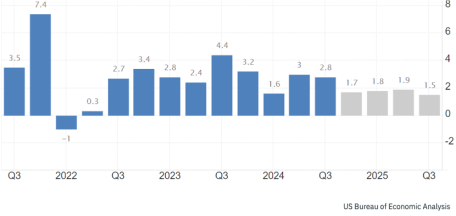

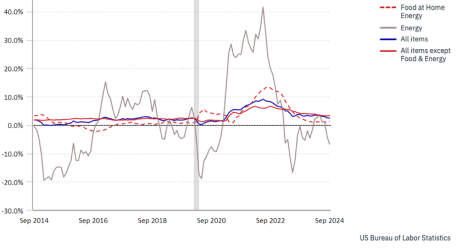

Q3 GDP came in higher than expected at 2.8%. Interest rates are starting to drop with another reduction expected end of ‘24.

IN THIS REPORT YOU’LL LEARN:

Consumer sentiment is finally improving, and the economy is solidly on the rise.

While still fragile, economists agree virtually all signs are positive of a flourishing economy. Capital should increasingly be freeing up and starting to flow in the months to come.

GROWTH FEELS REAL

Q3 GDP came in higher than expected at 2.8%. Interest rates are starting to drop with another reduction expected end of ‘24.

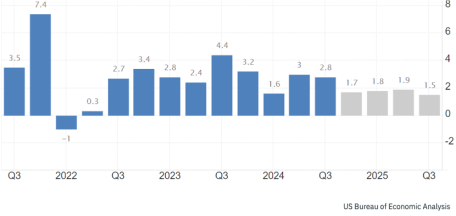

CONSUMER CONFIDENCE

Last month, Americans became more optimistic about the future of the labor market and the broader US economy. Fastest clip since Mar ‘21.

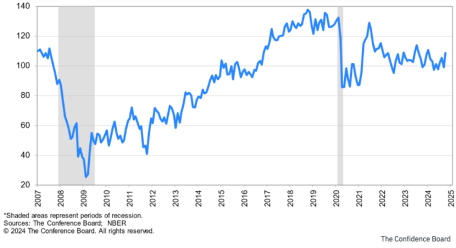

JOBS, FOOD & GAS ALL SOLID

Several months of strength in jobs and dropping gas and supermarket prices are putting more dollars in EVERYONE’S pockets.

Source: *Fed Funds rate on 11/21; up from 4% prior year; **52 week inflation in 10/23 via Food CPI ***SPINS Consumer Panel, 12 weeks ending 11/5/24

NPI Sales and unit growth are strong. Once again, the natural industry has resiliently weathered the storm!

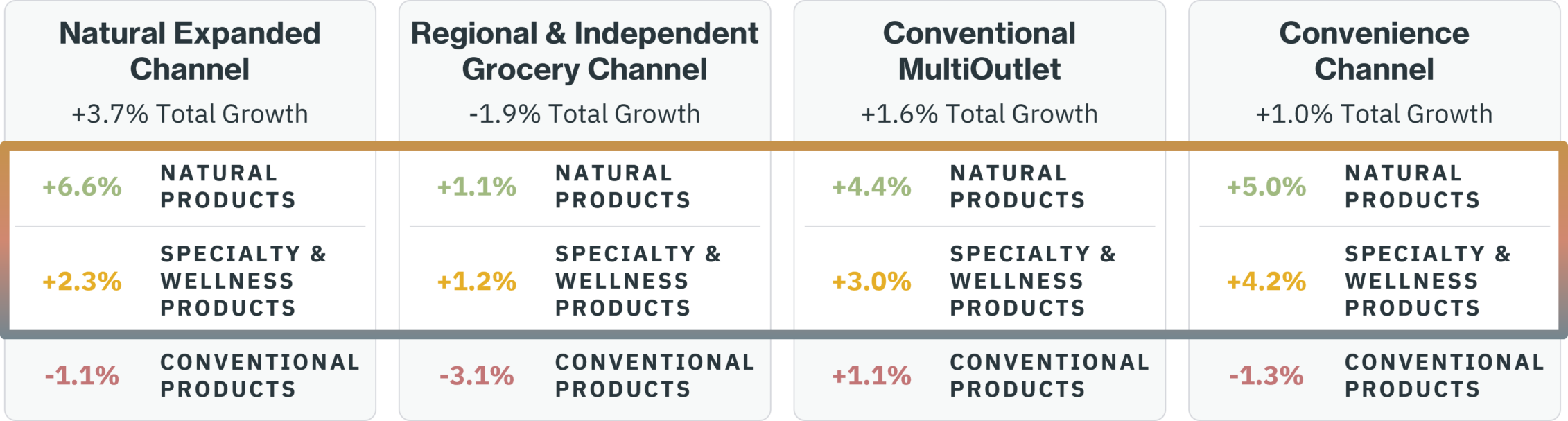

Natural product sales are again consistently outpacing conventional products. The Natural Channel’s growth is outpacing other channels. As more investment begins to flow, brands and retailers with profitable growth should benefit most.

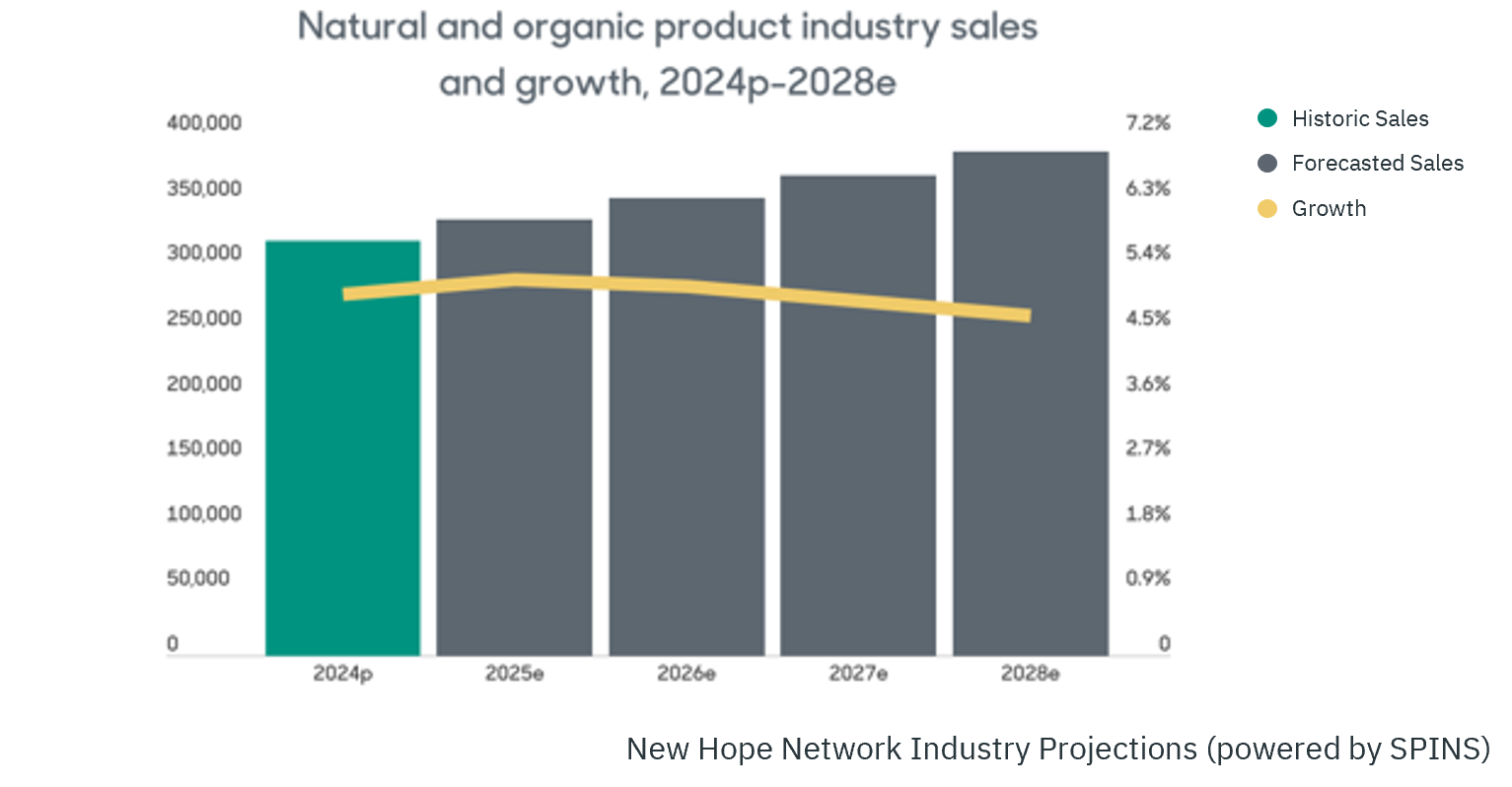

NPI CONTINUES TO EXPAND

NPI sales are expected to hit nearly $320B in 2024 with growth across virtually every department. Growth is expected at 5% per year hitting $384B by 2028.

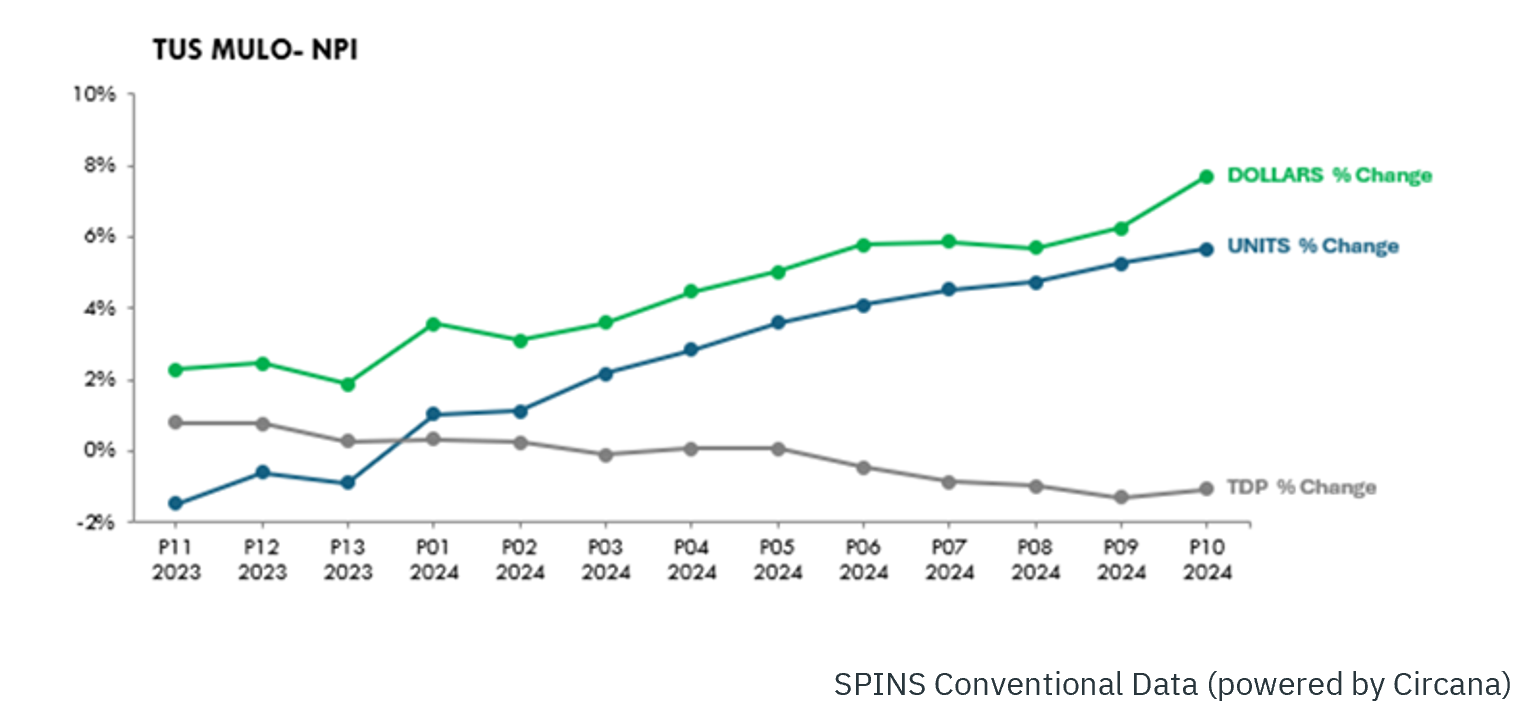

NPI DOLLARS & UNITS

Using MultiOutlet as a measure of mass-market consumer preference, both NPI dollars and units have been increasing in growth throughout 2024.

CHANGING LANDSCAPE

The challenging market of the last few years has required retailers to get smart about their investments and clear in their strategy: Mergers, closings, retail media, and technology.

Source: *Fed Funds rate on 11/21; up from 4% prior year; **52 week inflation in 10/23 via Food CPI ***SPINS Consumer Panel, 12 weeks ending 11/5/23

Natural products growth is outpacing conventional product growth in every channel. The Natural Channel has the highest overall growth rate and the highest NPI growth — a consistent recent month after month trend.

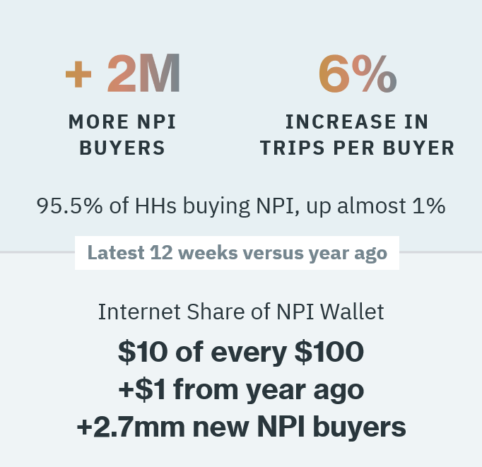

Within our industry, new values-based consumers are joining the movement. They are spending more and buying more often.

With younger shoppers even further favoring natural, wellness, and transparency, there are strong consumer preference tailwinds expected for years to come.

NPI IS BRINGING IN NEW SHOPPERS

While most shoppers are buying some NPI, over 2M new shoppers recently bought NPI brands. And buyers are increasing their NPI trips.

ECOMM FLOURISHES

Internet purchases have gained a full Share of Wallet point over the last year while Club and Walmart have both lost ground for the first time in several years.

YOUNGER SHOPPERS ARE BUILDING MOMENTUM

Younger Millennials and Gen Z are more values-driven than their predecessors and shop with their values. They are gaining purchasing power quickly.

Source: SPINS All Outlet Consumer Panel (powered by Circana), 12 weeks ending .Oct 6, 2024

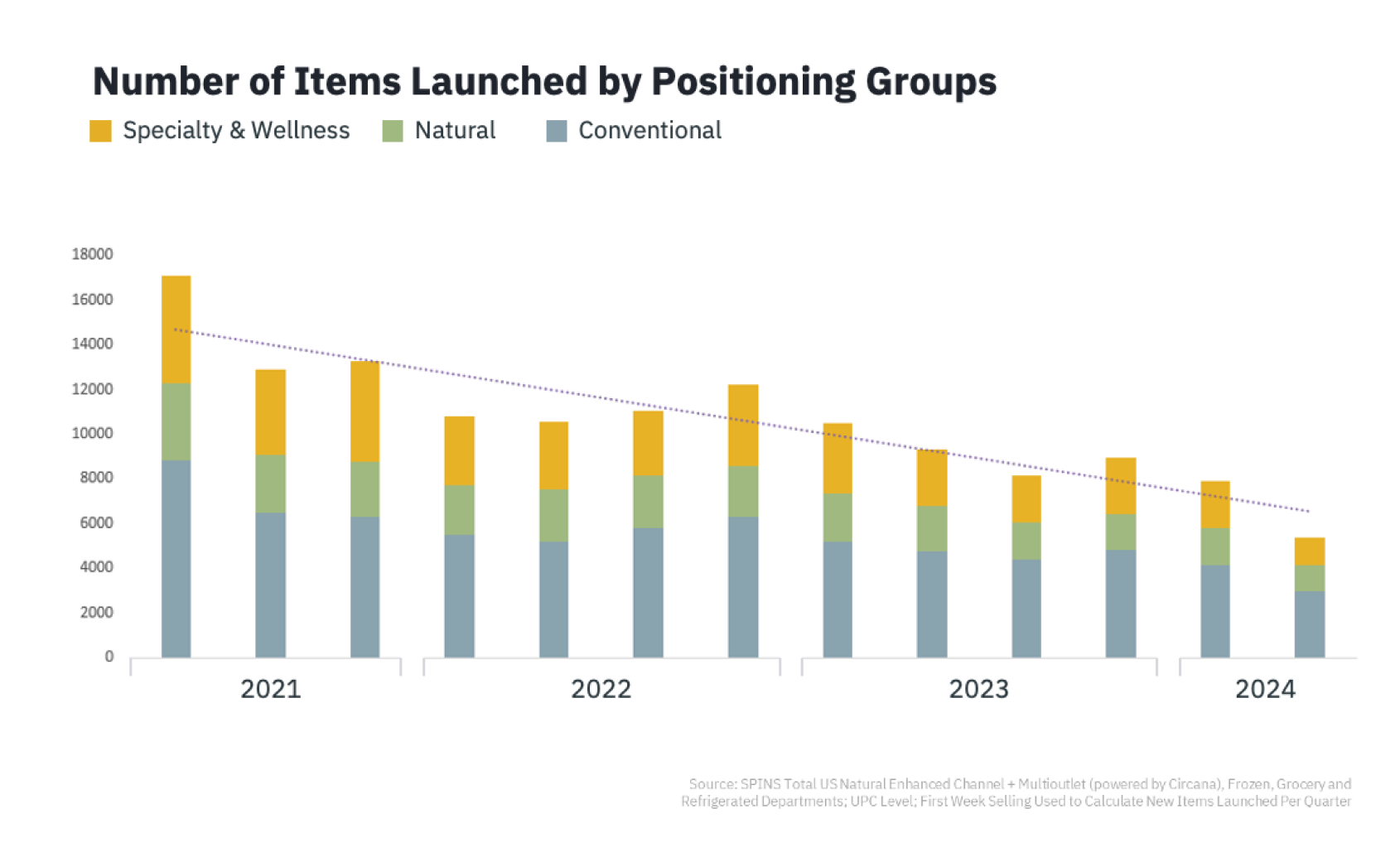

When looking at the number of new products launched in the F&B Department, we can see that it has been decreasing with each year. Coming out of COVID, many manufacturers chose to focus on their core products as they dealt with supply chain issues. As that began to abate, rising interest rates meant that investment dollars had begun to dry up. Thus, brands had to be more diligent around spending, causing a shift to a more profitable growth strategy and a more disciplined R&D strategy.

However, fewer newer products doesn’t necessarily mean less innovation. Rather, it means that brands are evolving.

R&D strategies have evolved with tight investment dollars, yet innovation is still critical to stay ahead. Approaching innovation with disciplined, quality brand launches, has proven to be a winning formula. This has led many to cut off the tail of their product lines and focus instead on possible new categories that might yield a bigger impact.

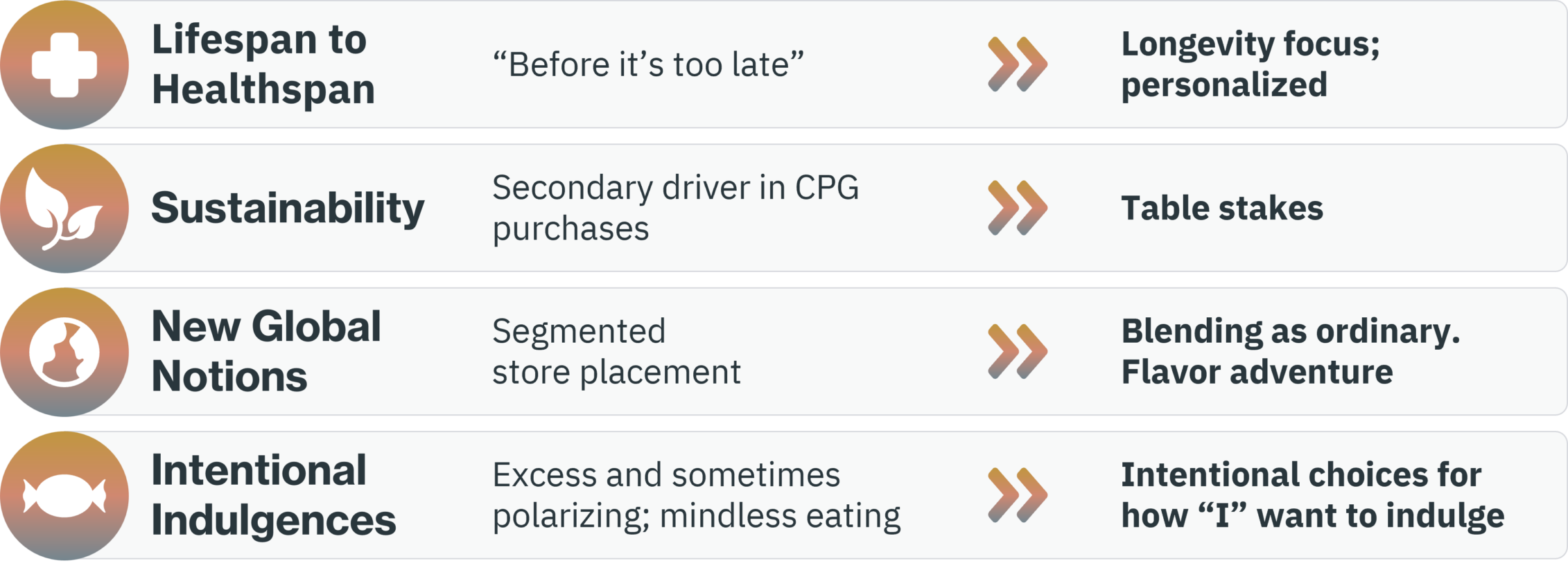

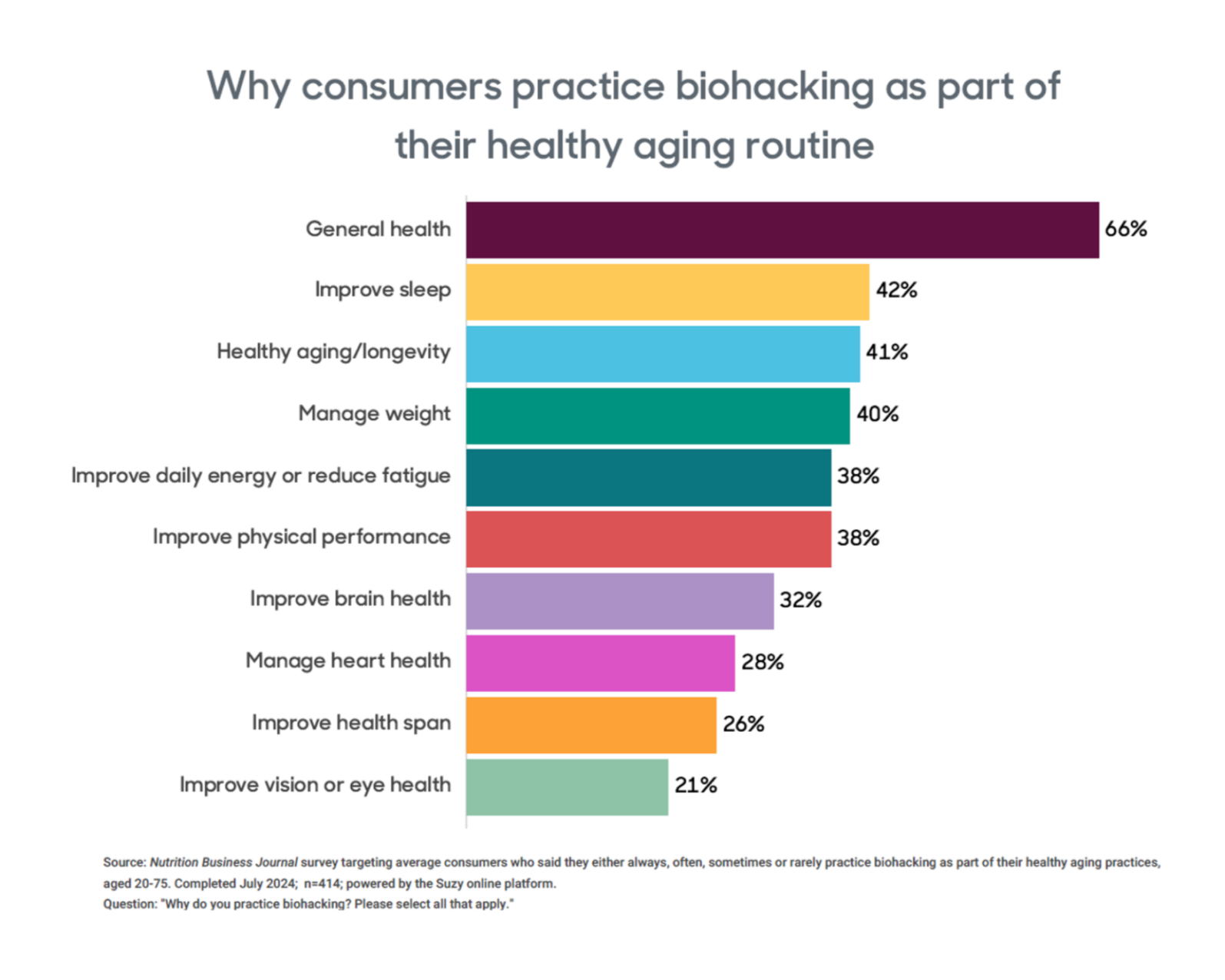

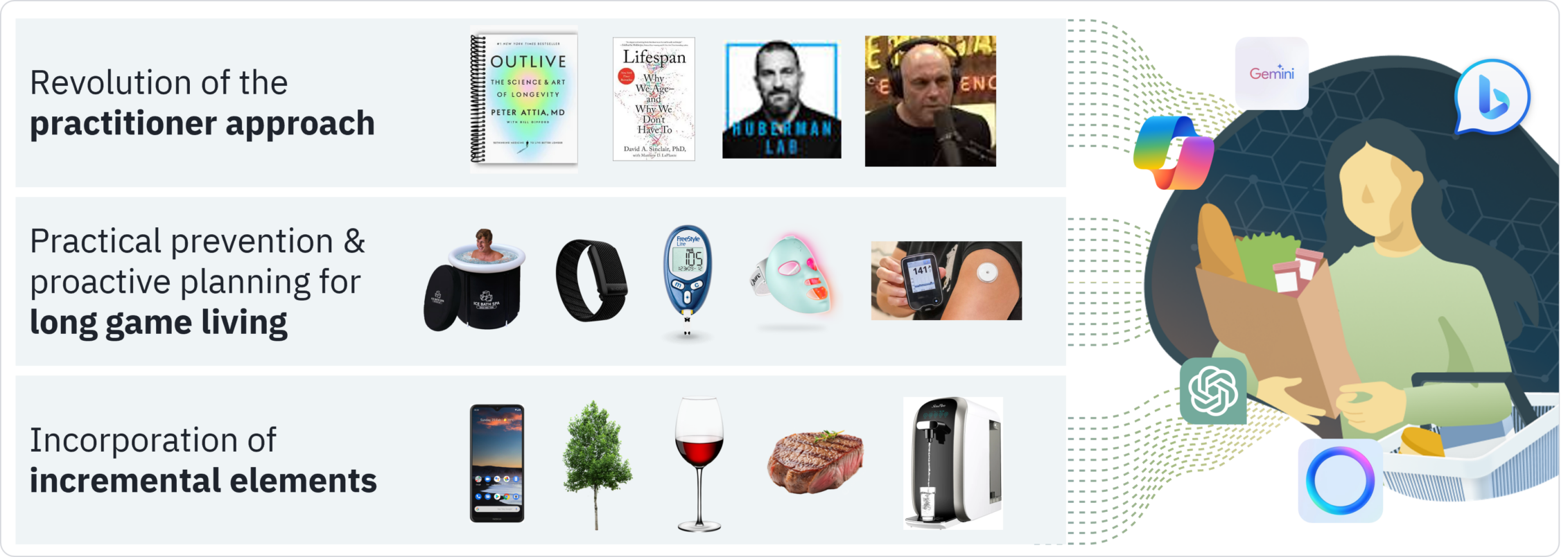

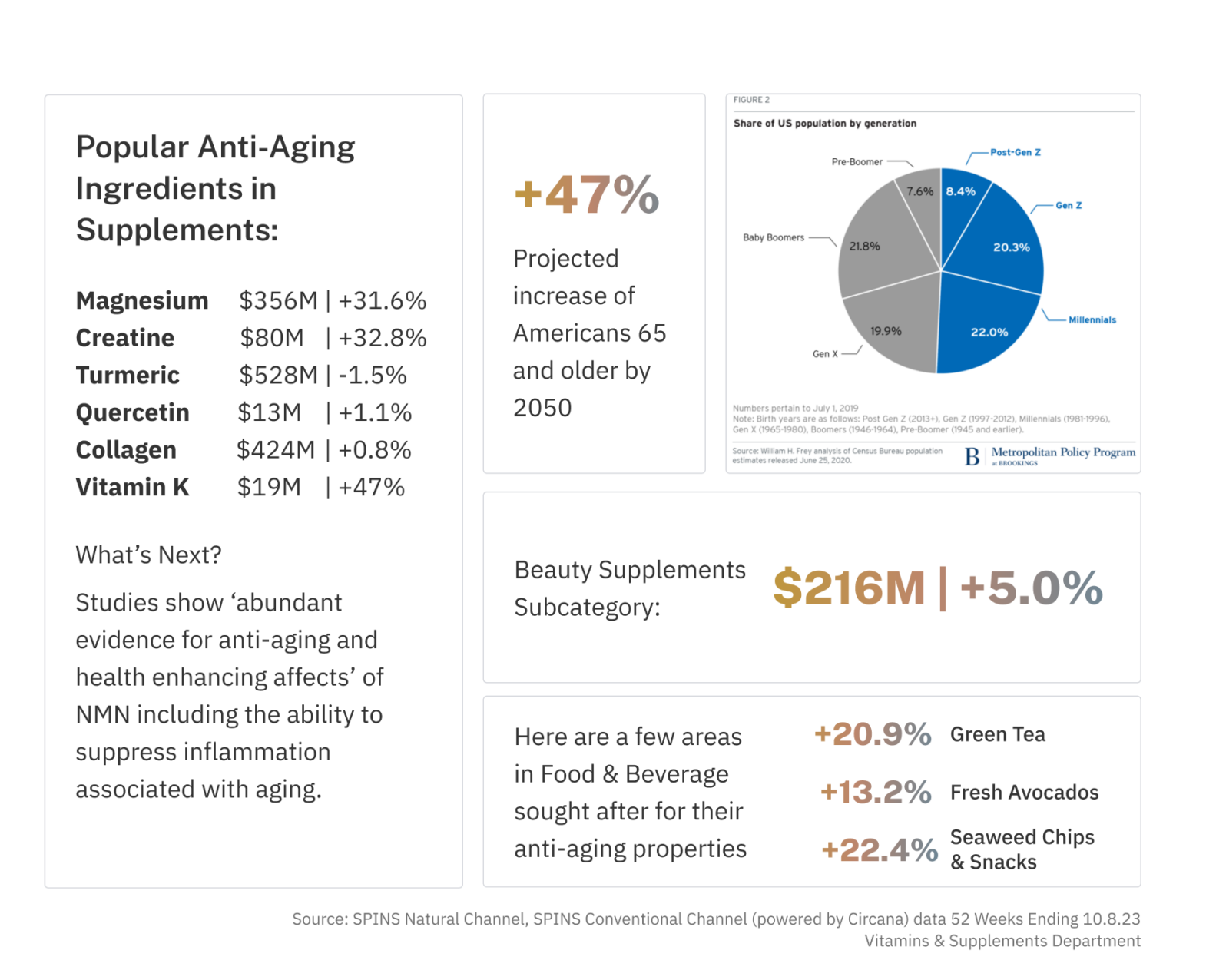

As consumers become drawn to the idea of healthspan, many are leaning into the idea of lowering their biological age – this can span from maintaining cellular health to ensuring they have strong muscles that can help them age gracefully and prevent falls.

Aging has mostly been talked about in the context of outward appearance, but consumers are now looking inward and optimizing for better functionality and performance as they age.

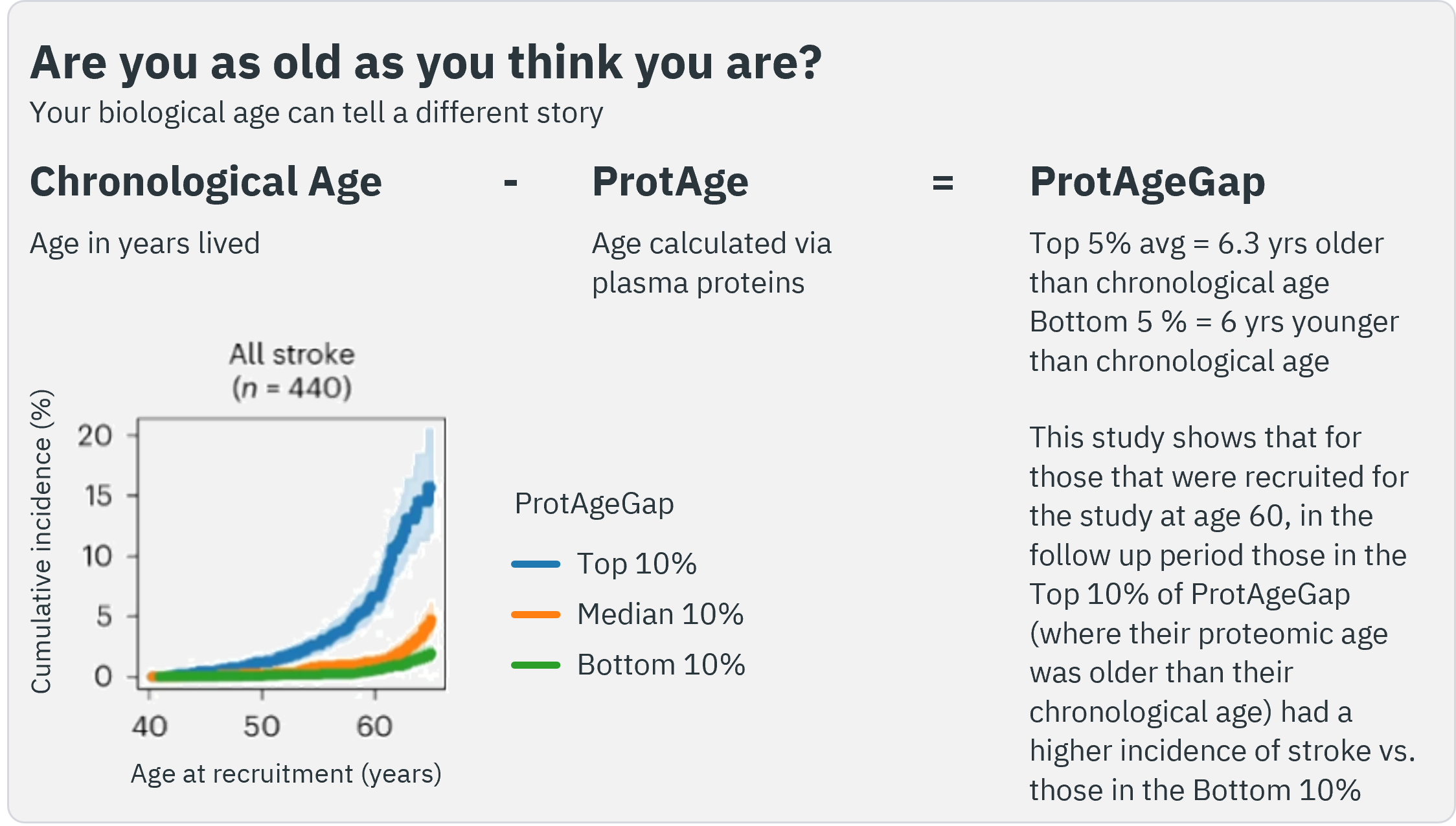

Though chronological age remains a strong predictor of chronic disease and even death, the idea of the ‘biological age’ could add depth to conversations around health.

From proteomic clocks to epigenetic clocks, these ‘omic clocks can be used to predict biological age. Based on DNA methylation, these clocks could one day in the future help with testing interventions that could extend longevity.

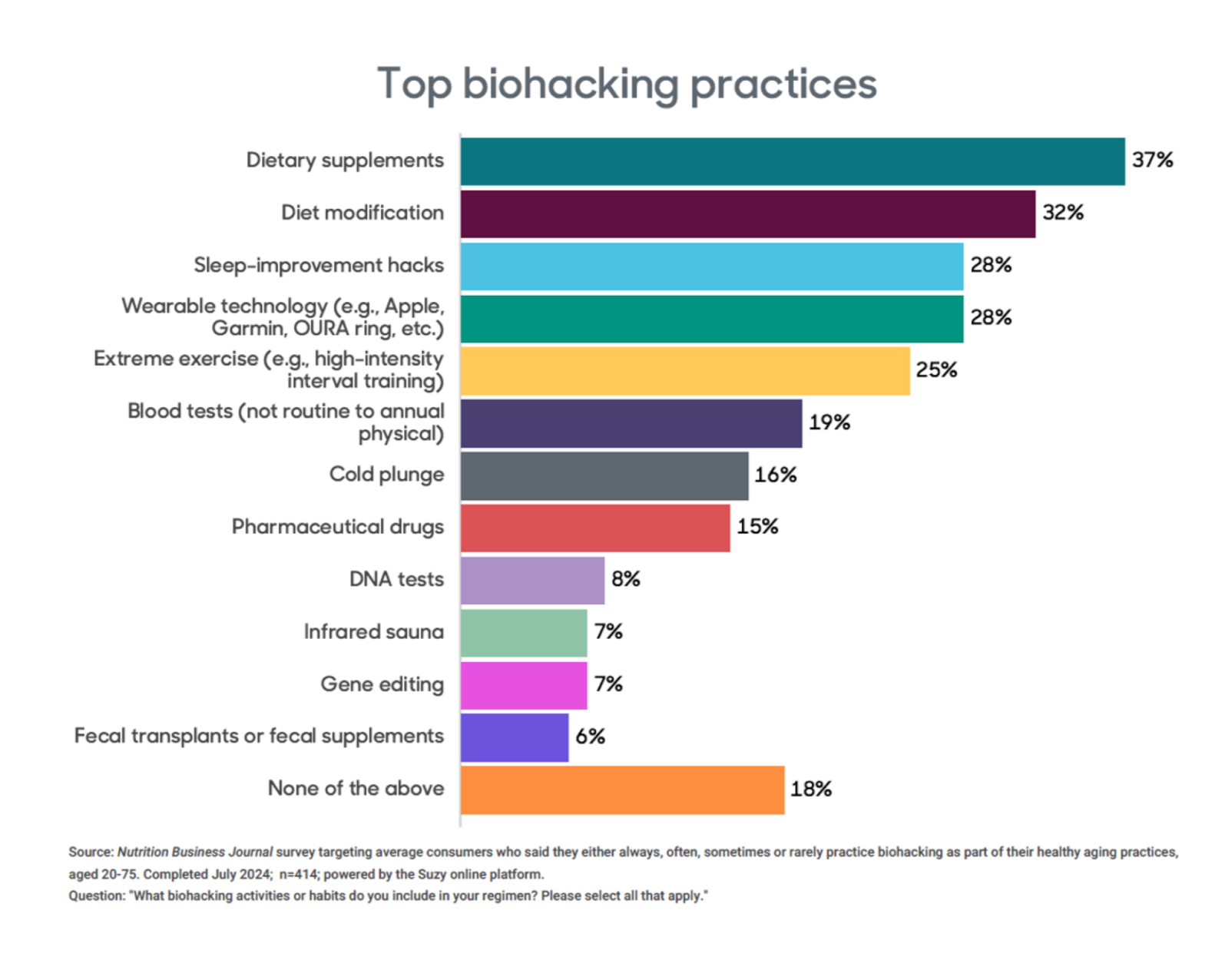

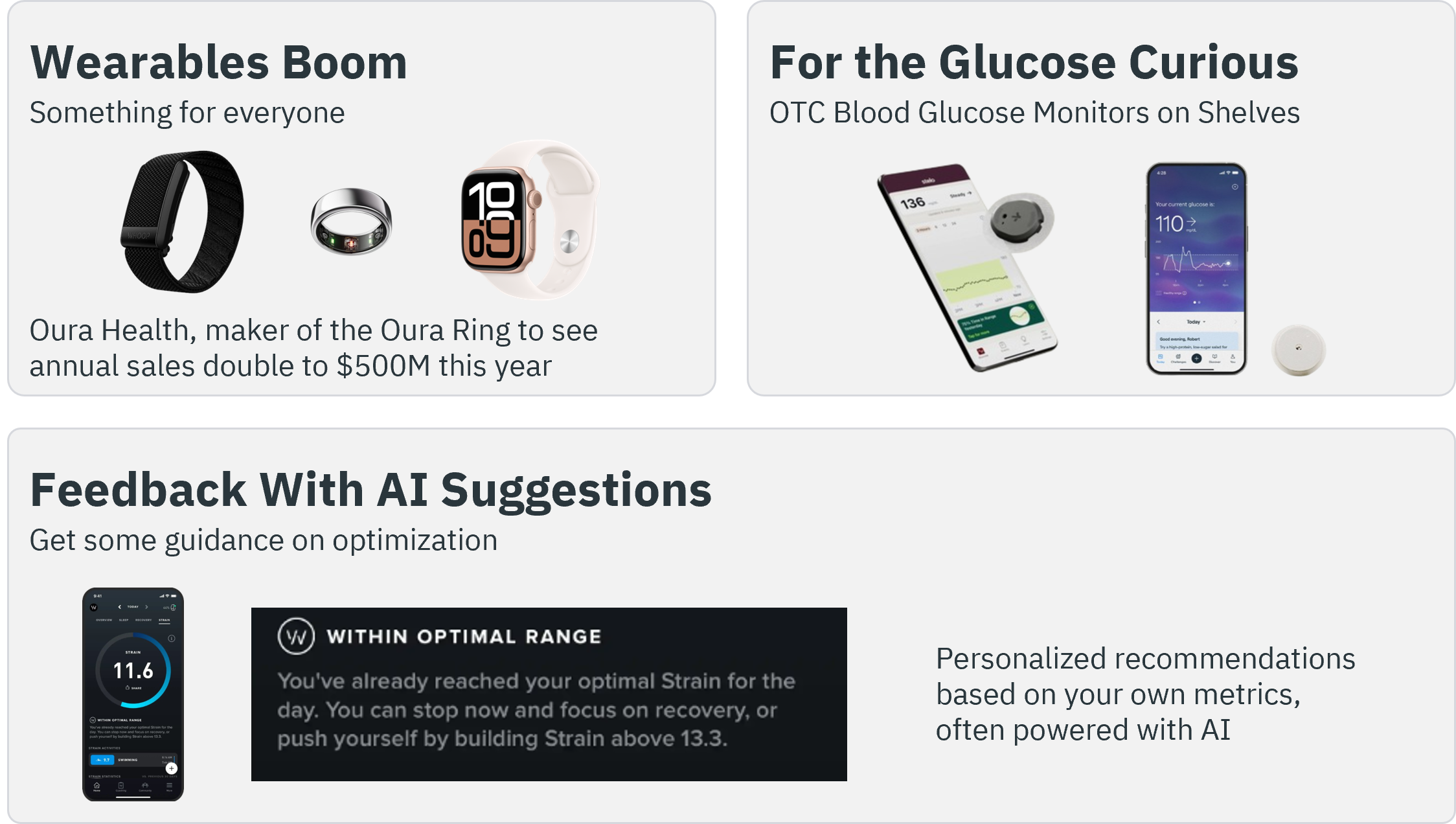

Consumers not only want to live sophisticated, but they want to maintain their health & body as they grow older. Now more than ever, there are ways to track metrics ranging from your hours of sleep to your blood oxygen saturation, all through a gadget that can be bought at the click of a button.

Consumers are finding ways to optimize their lives through the real-time feedback these health tech wearables such as fitness trackers, blood glucose monitors, etc. can provide. Plus, you can be sure that whatever you’re changing in your routine is working for you rather than following advice that is meant to work for the general population.

As health tech wearables grow more sophisticated, we could enter a world where food, beverages, supplements, personal care, and more can be tailored to a specific person with the right dosage and combination to achieve a specific goal in mind.

These days we’re inundated with nutrition advice – eat more fiber, eat protein for your first meal of the day, think about slow and fast carbs and the list goes on and on. But, how can you know for sure that any of this is helping you?

Before, you could only rely on how you ‘felt’ that is unless you took a blood test or have been prescribed a blood glucose monitor.

However, in 2024 blood glucose monitors are available over-the-counter, enabling anyone to truly track how their eating habits affect their blood sugar.

This real-time feedback allows consumers to understand how their dietary choices affect them and make changes to their diets with more confidence.

Personalized diets could be seeing their next evolution as tech companies try to push the envelope next with no-prick blood glucose monitoring in the works.

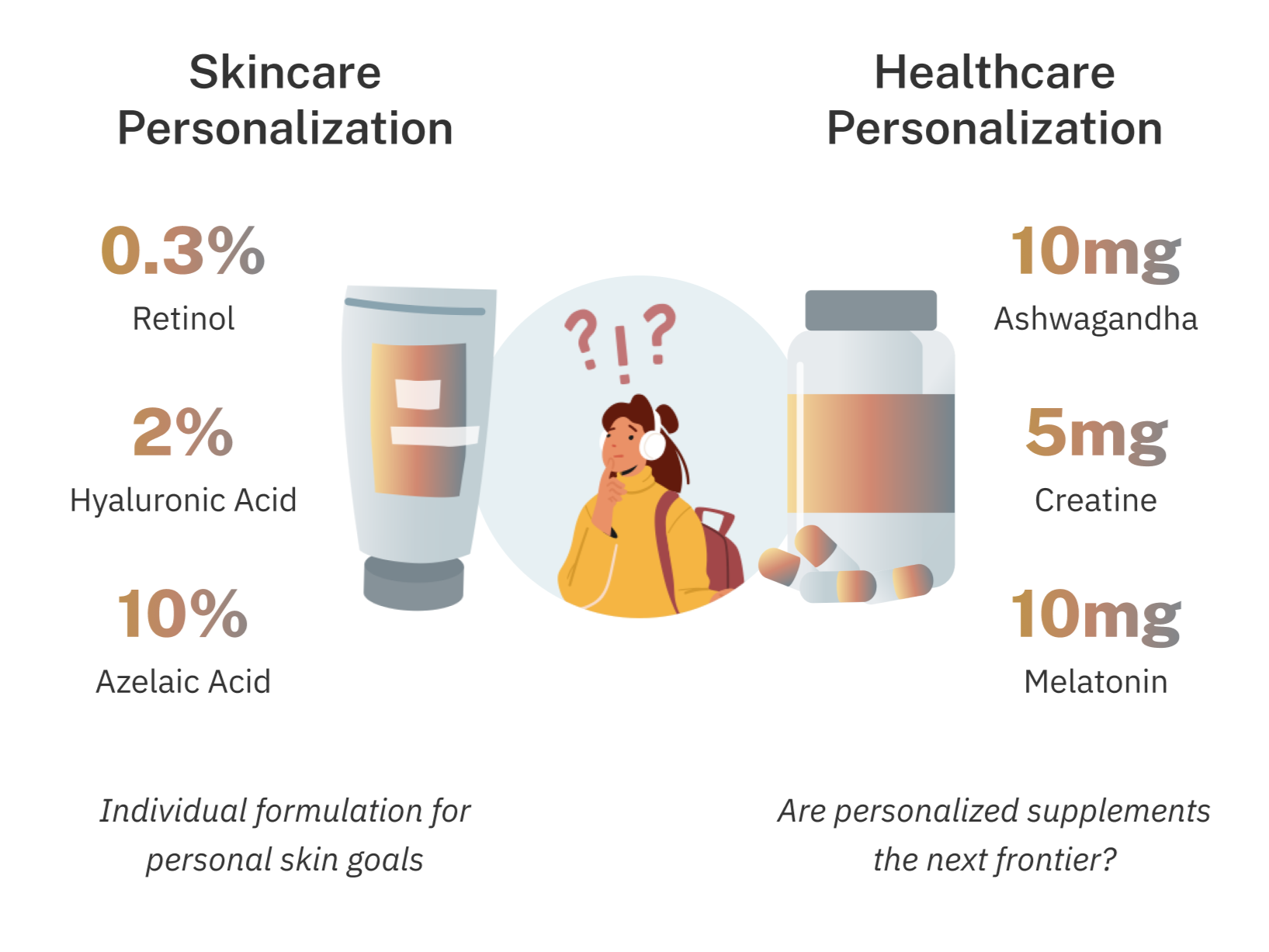

Personalization in the skincare sector has boomed in recent years. Aided by social media, consumers have become better educated on all things antioxidants and acids.

Just 10 years ago, salicylic acid and niacinamide were compound names that the average consumer might not be familiar with but fast forward to the present and consumers are getting these active ingredients down to specific percentage points when purchasing their skincare.

Will we reach that era of personalization with supplements soon? Will there be a day when consumers can buy a pill that has 5mg melatonin, 10mg ashwagandha, 5mg creatine, and so forth instead of the multivitamin that’s meant for the average person – it’s an all-in-one supplement meant for a specific person?

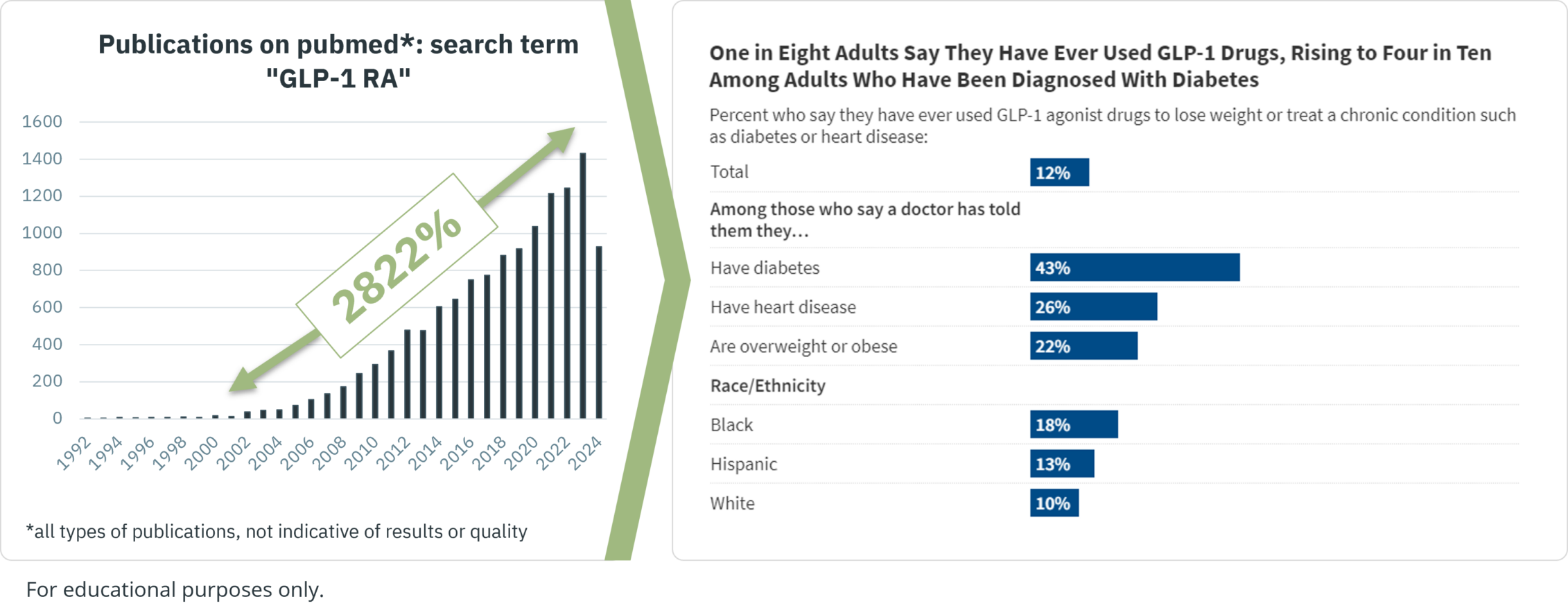

Source: KFF Health Tracking Poll May 2024: The Public’s Use and Views of GLP-1 Drugs https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/

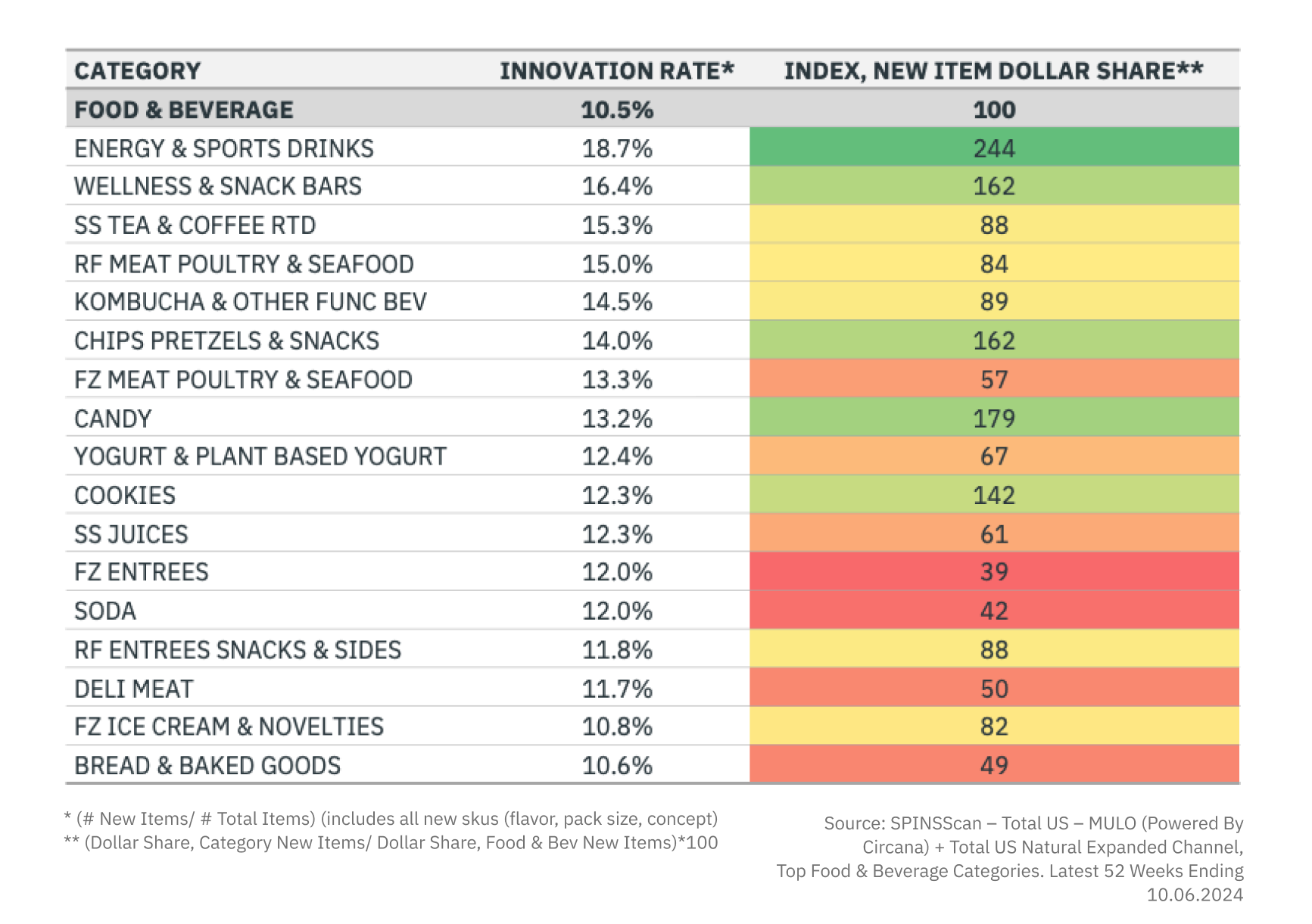

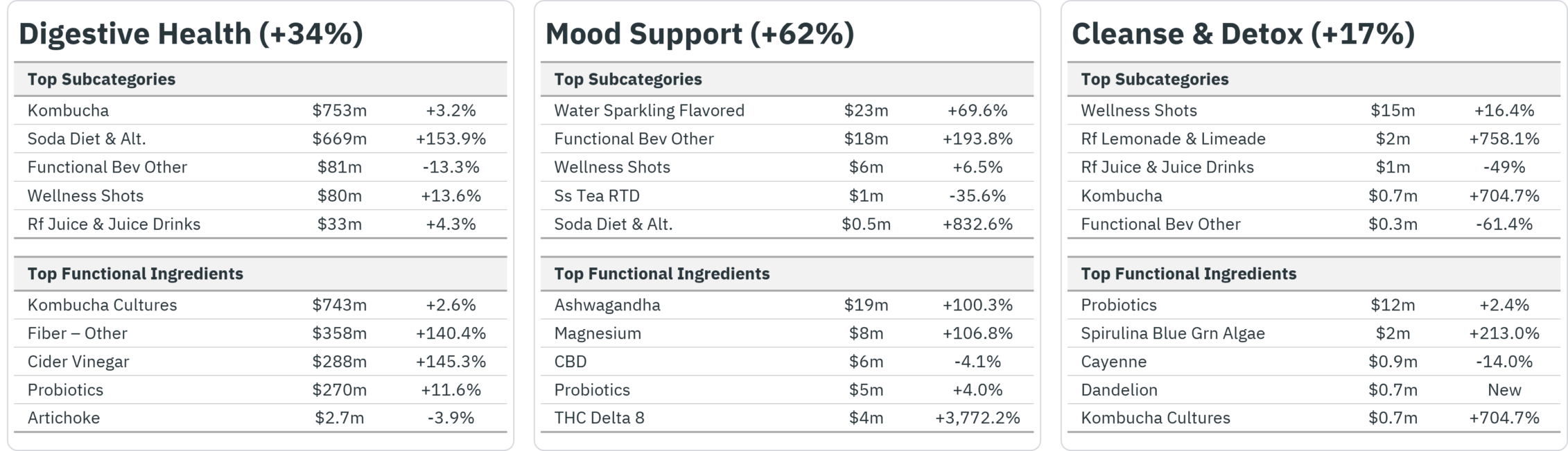

While functional ingredients have a storied and impactful presence within the health and wellness products industry, their impact on categories and their resonance with shoppers continues to change and evolve.

Let’s unpack key health trends to better understand how shoppers will approach functionality and nutritional profiles in 2025.

This can help uncover a lasting trend with broad marketplace appeal. Keep an eye on products that support these health trends as well as functional ingredients that combat the negative affects of unhealthy behaviors and risk factors of chronic disease.

Source: https://www.cdc.gov/chronicdisease/resources/infographic/chronic-diseases.htm

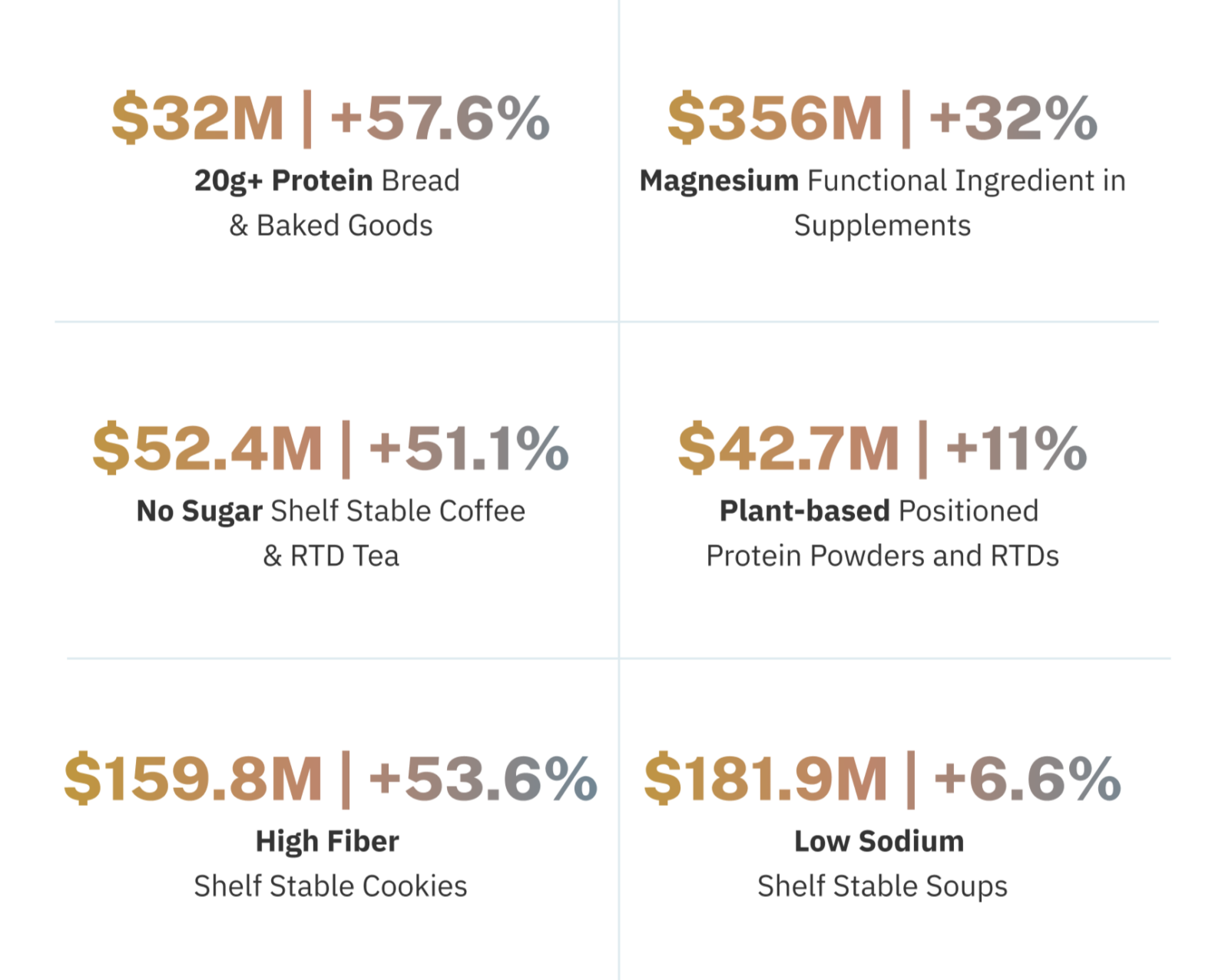

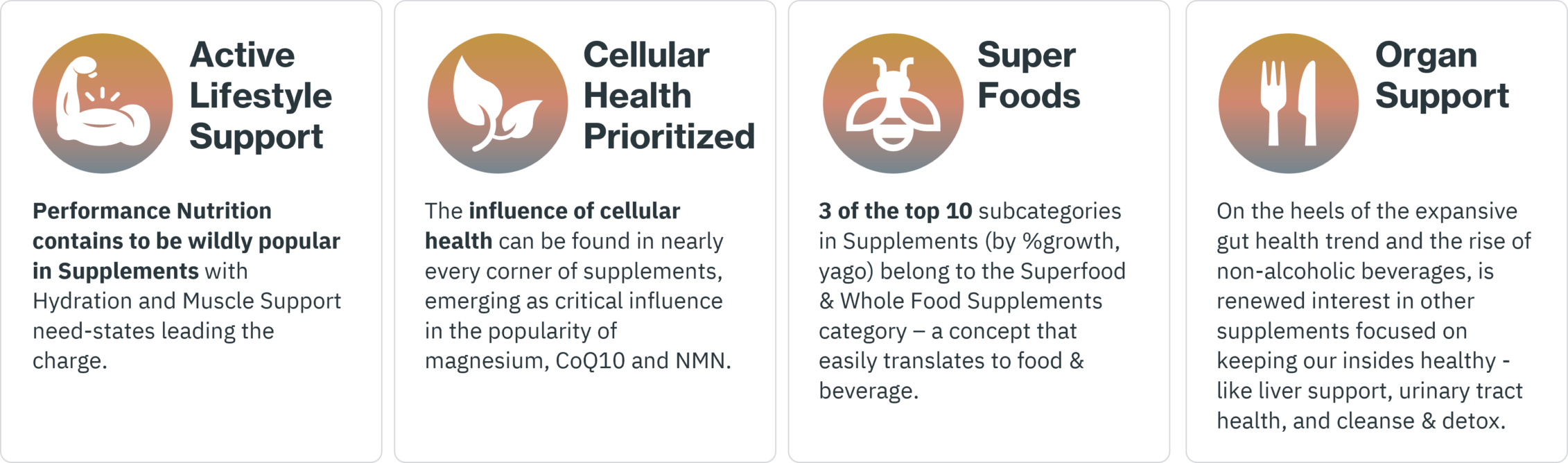

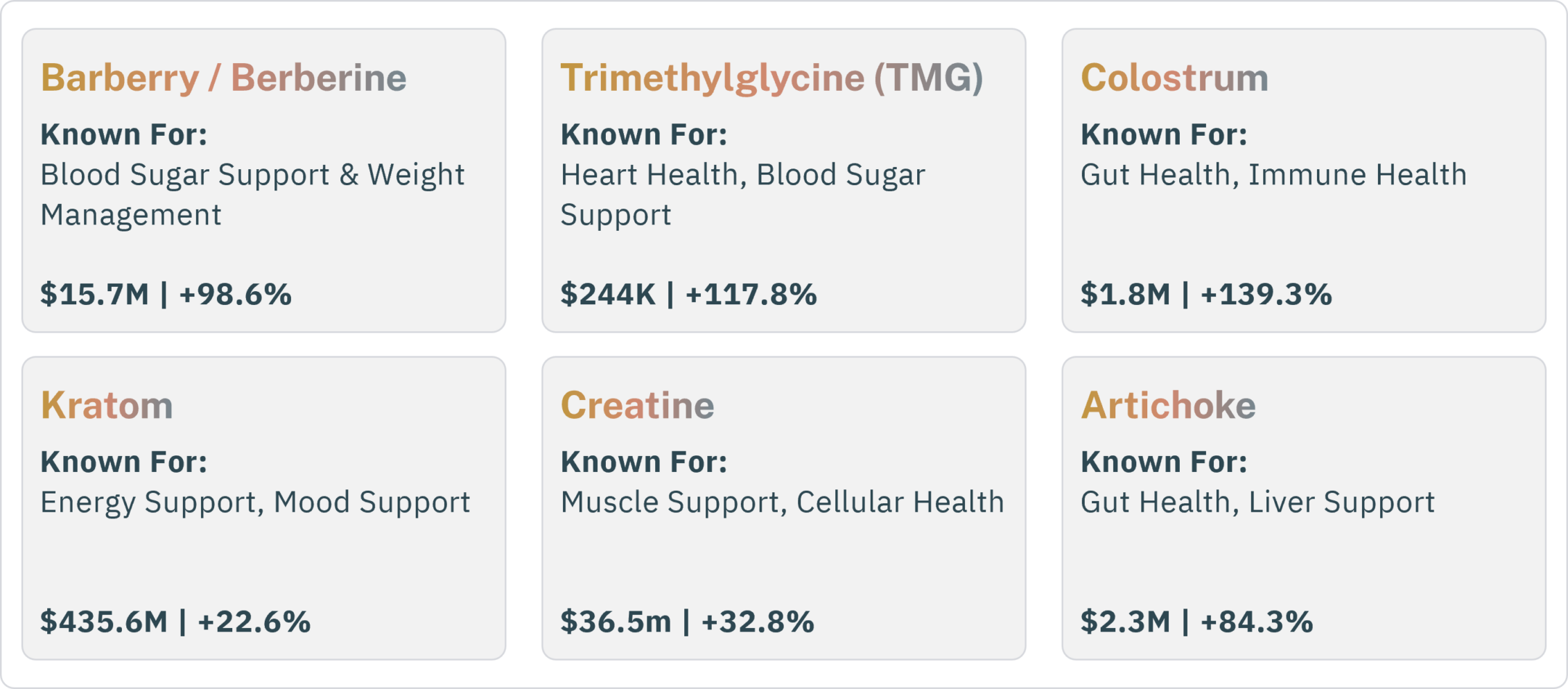

Trending need-states often take root in Vitamins & Supplements before crossing over to food & beverage. By looking at SPINS Supplement subcategories and Health Focus attribute, we can see some early signals begin to surface:

Source: SPINS Natural Channel, SPINS Conventional Channel (powered by Circana) data 52 Weeks Ending 10.8.24 Vitamins & Supplements Department

Knowing what shoppers are looking for in supplements helps unlock cross-over potential and formulation considerations.

What’s Fading?

What’s Breaking Through?

Look for Supplements, Ingredients, and Foods that Support Healthy Aging to Continue to Prosper in 2025 as the population gets older.

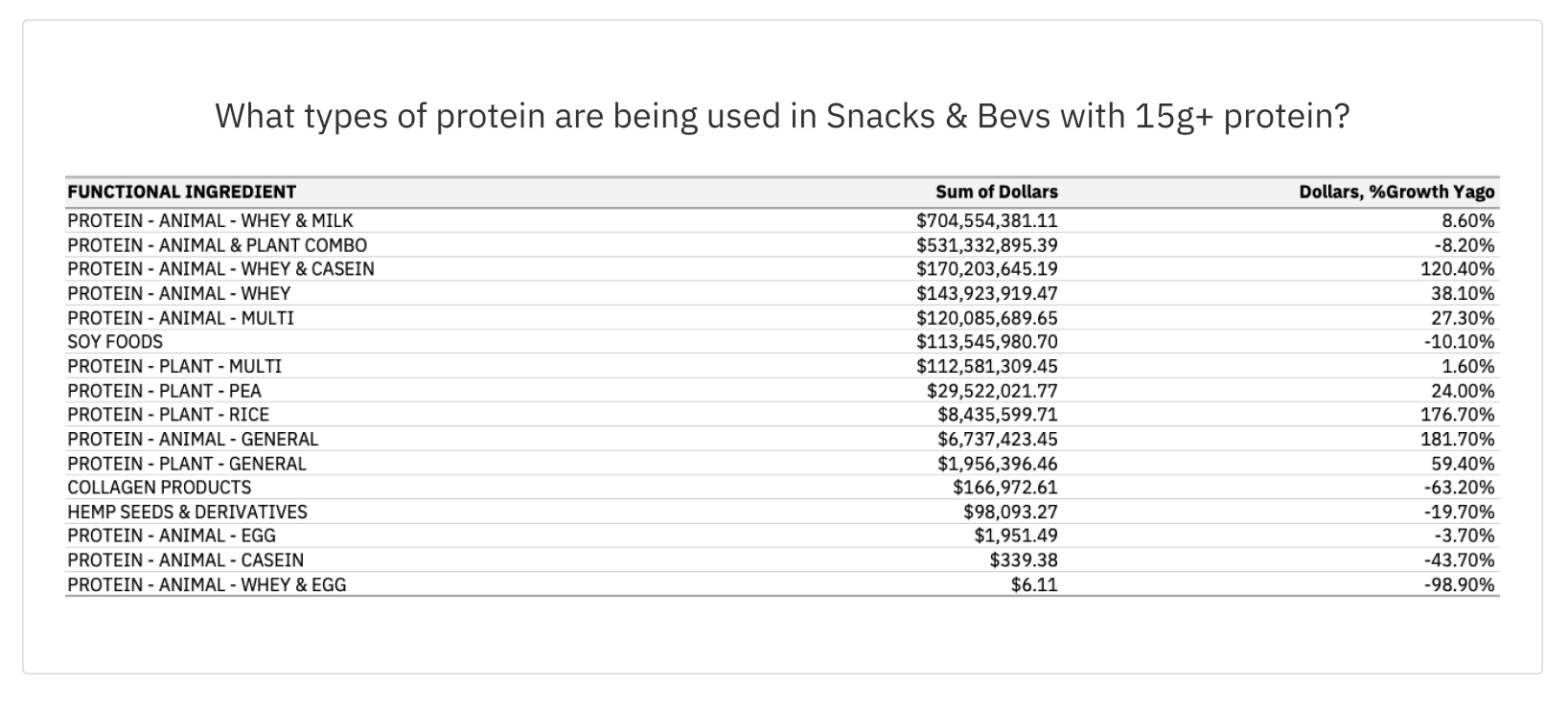

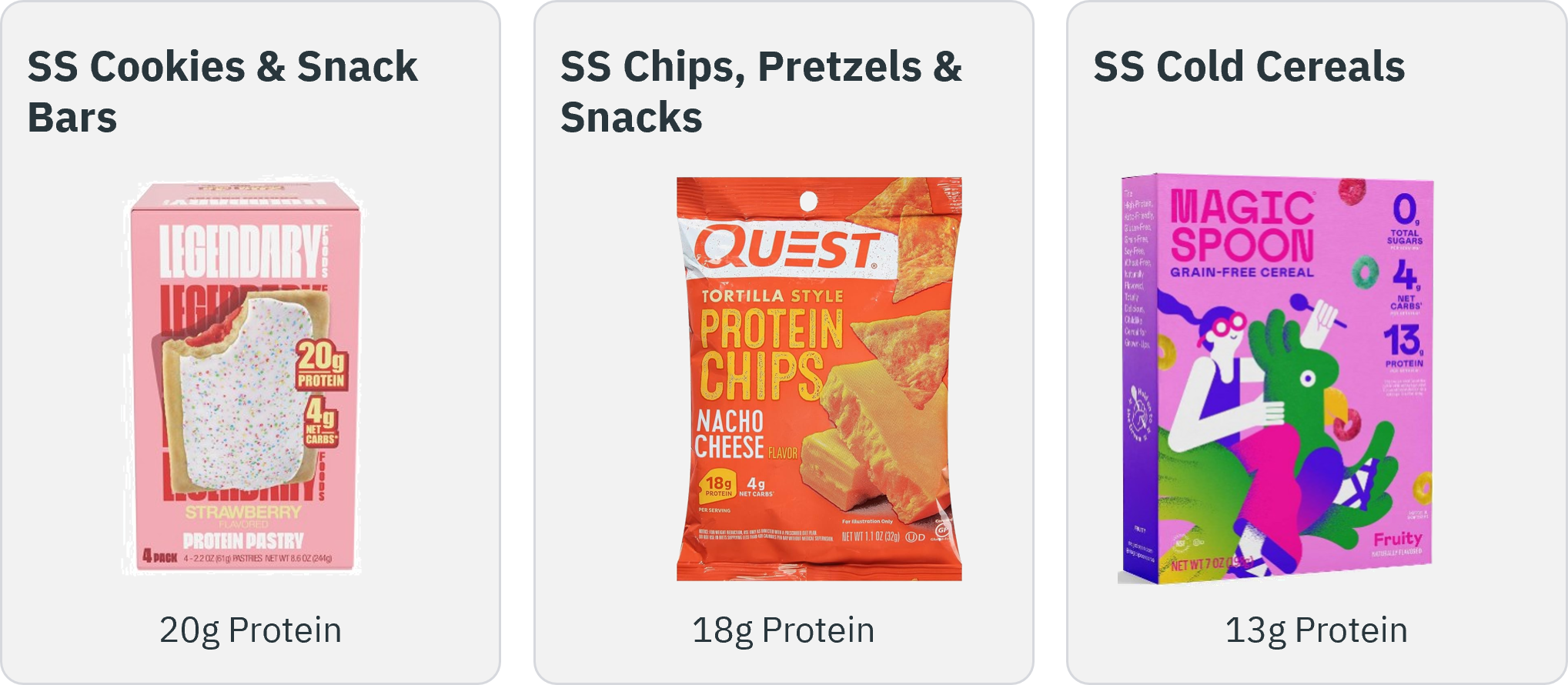

Products in the Snack and Beverage categories with 15g+ of Protein amount to $4.9B – that’s nearly 70% of the sales volume attribute to the Protein Supplements category. With 9.3% growth, we predict high protein innovation to continue across a wide range of categories – from pantry staples to frozen meals.

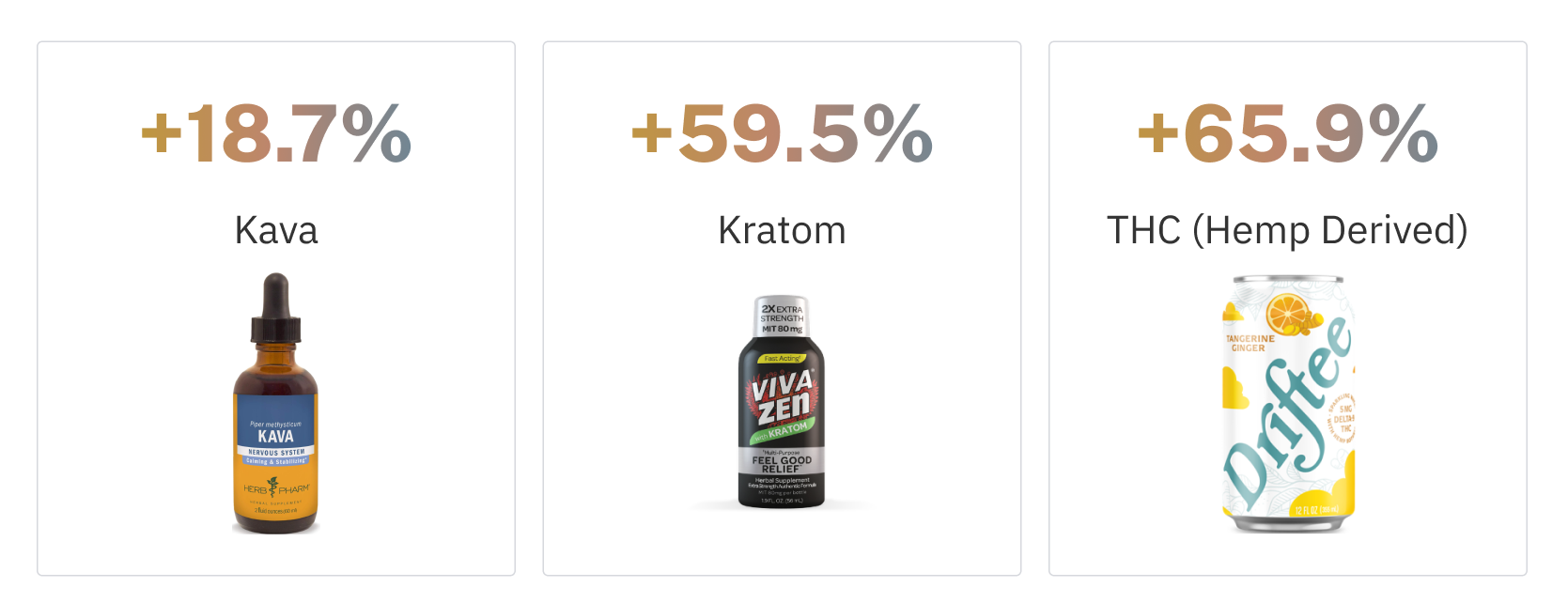

Functional beverages are tapping into rising consumer interests and expanding the audience beyond traditional beverage buying habits. Up-and-coming ingredients and formulations will continue to create new opportunities for brands and retailers.

Source: Attribute: Health Focus; Source: SPINS Natural Channel, SPINS Conventional Channel (powered by Circana) data 52 Weeks Ending 10.8.24

Hemp-derived THC regulations paired with more mindful consumption are breathing new life into the mainstream cannabis and euphorics market, specifically in Convenience.

Cannabis

Source: SPINS Natural Channel, SPINS Conventional Channel (powered by Circana) data 52 Weeks Ending 10.8.24

Look for more product formulations across the store that promote health and nutrition while curbing climate change.

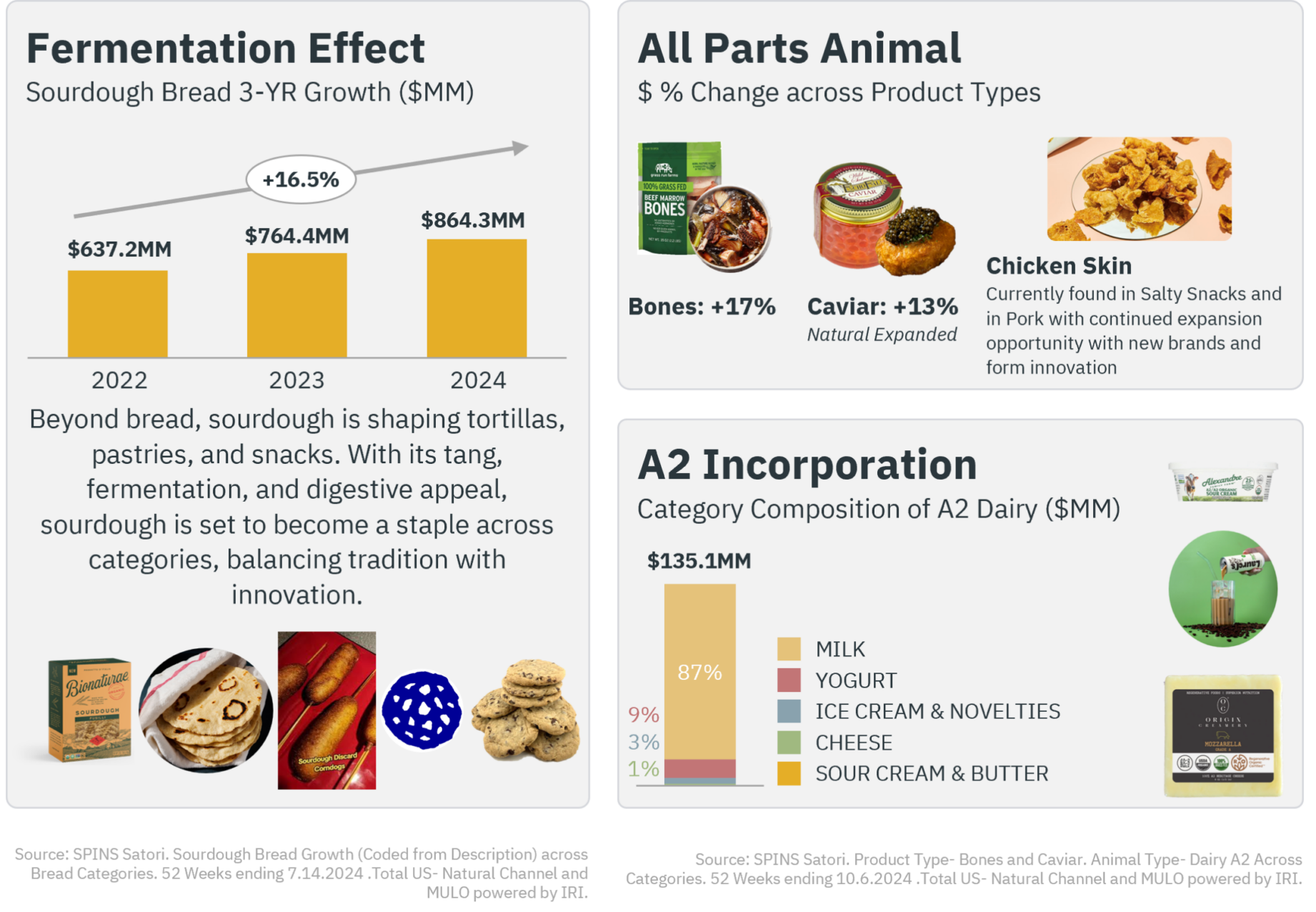

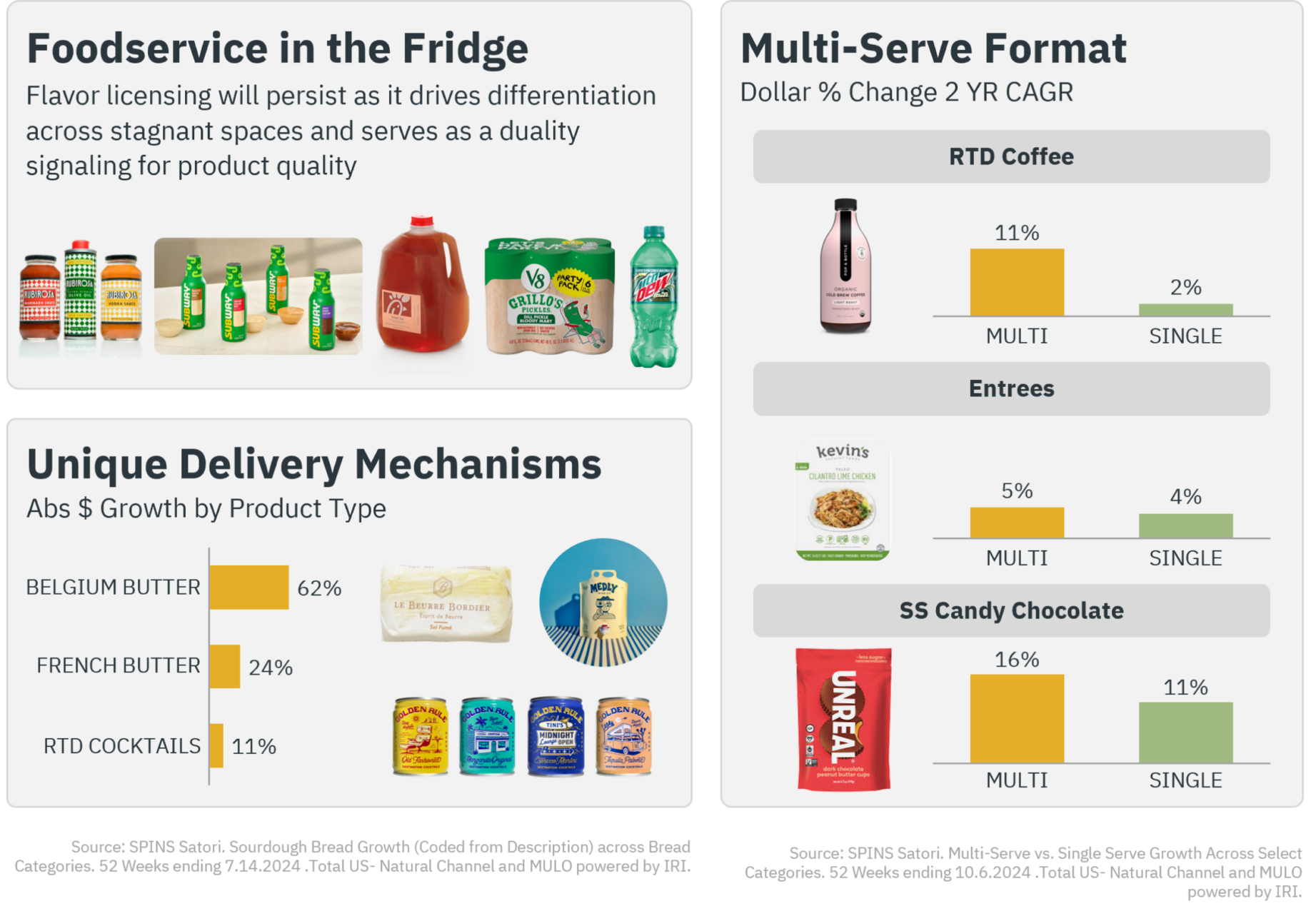

A known approach to innovation has focused on introducing natural or premium products within established and stagnant categories. However, this approach is evolving as consumers develop greater culinary knowledge and engage in more component-based cooking. Rather than relying solely on certifications, they are exploring individual ingredients that blur category lines and have new origin stories to craft exciting, customized meals, redefining their everyday routines.

This shift reflects an elevation driven by a diversification of product types and enhanced storytelling through packaging, as consumers seek both creative inspiration and meaningful connections with the foods they choose.

The American pantry is undergoing a reimagining as consumers redefine what constitutes “staple products”. No longer limited to basic essentials, shoppers are seeking premium products across traditional categories like dairy, condiments, meats, and carbohydrates. This shift is driven by a growing emphasis on functionality, with consumers prioritizing products that support specific health goals, aligning with the evolving mentality from maximizing lifespan to optimizing healthspan.

The pursuit of gastrotourism—the desire to experience global flavors from home—and the increased focus on honing culinary expertise have further reshaped the modern kitchen. As a result, pantries now feature artisanal sauces and ancient grains that blur the lines between indulgence and wellness, transforming everyday cooking into a space for experimentation and intentional nourishment.

The reimagining of the American pantry is also accompanied by an accelerated shift toward products with a design-forward look and feel. The market has redefined the contemporary visual identity, moving away from pastoral colors and rustic cues traditionally used to communicate quality and sustainability. Today’s consumers are drawn to packaging that feels current, with design becoming a critical part of the value equation.

Natural and premium brands must embrace larger pack sizes to offer better value and build routine use, helping fend off competitors.

Packaging will remain a crucial storytelling tool, with a growing reliance on materials like glass, which have gained renewed relevance due to concerns regarding microplastics and forever chemicals. Brands are now balancing design, and social responsibility to meet the evolving expectations of the modern consumer.

American consumers continue to shift away from sugar, seeking intense, satisfying flavors that offer depth without relying on sweetness. This has driven interest in sour and spicy combinations, introducing bold formulations that cater to evolving palates. At the same time, the awareness of umami continues to find new form factors, with the reappraisal of MSG leading to broader acceptance along with layered savory flavors.

Alongside this, we see a shift toward new sources of salinity—as exemplified by the rise of the dirty martini—which enhances familiar products in unexpected ways. Moving forward, these trends will converge, with products blending sour, spicy, and salty elements, offering adventurous, layered taste experiences that reflect the modern consumer’s desire for more complex and exciting flavors.

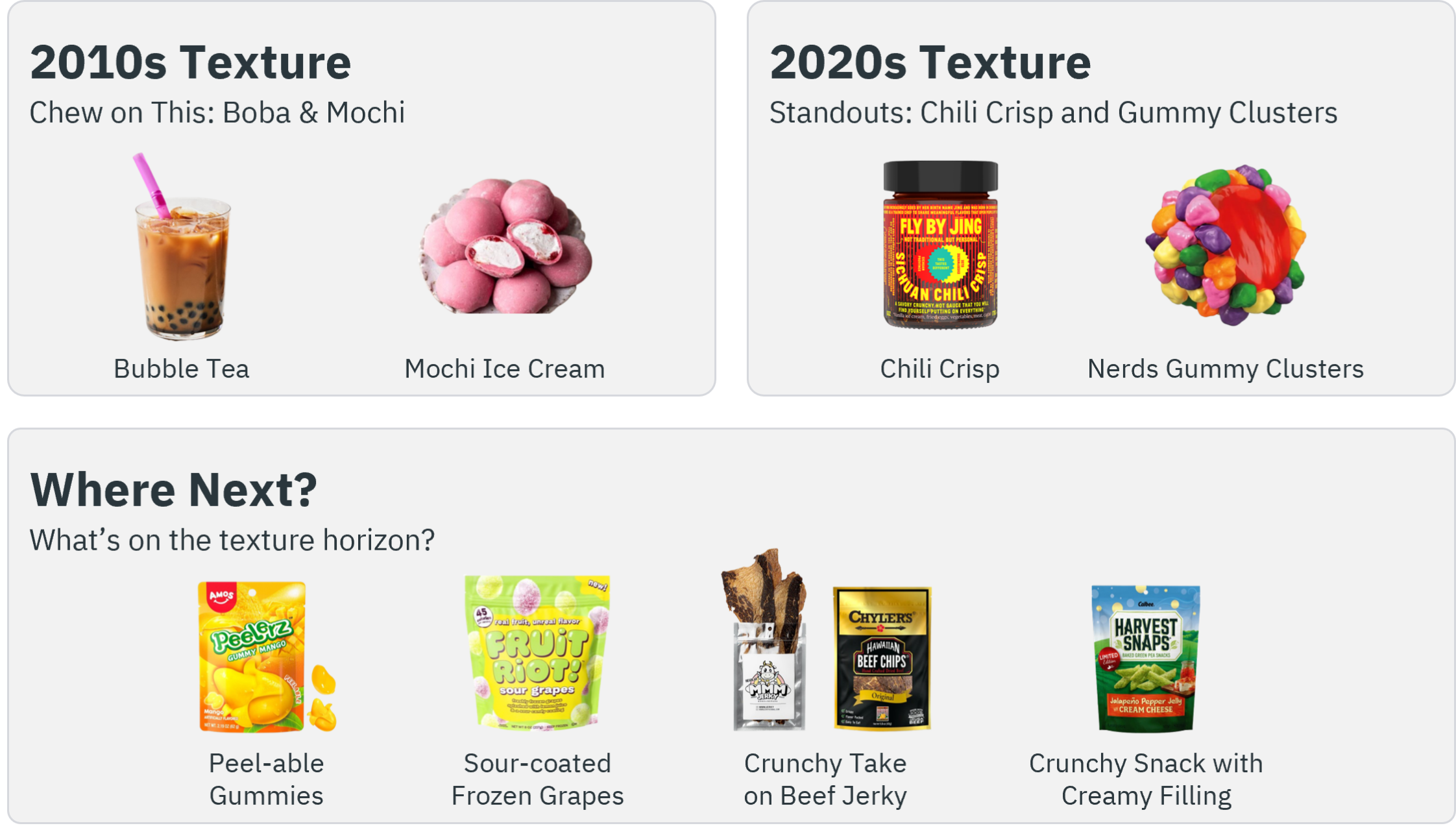

Texture in food is a way to shake up categories, often ones that haven’t seen much innovation.

Chili crisp for example brought a crunch to the condiments aisle that has been largely saucy or liquid-y in general, giving consumers a sense of novelty.

Gummy clusters, Nerds’ standout product combines nostalgia with novelty as they pair their classic beloved crunchy nerds with a gummy center. A texture that had not been seen in the candy aisle yet.

But, what’s next for texture? Well, the jerky category could be in for some disruption with chip-like products hitting the market, deviating away from the chewy texture of Jerky to a crispy, crunchy version. Additionally, there could be space for crunchy snacks with a creamy/jam filling as consumers look for antagonistic textures in their products.

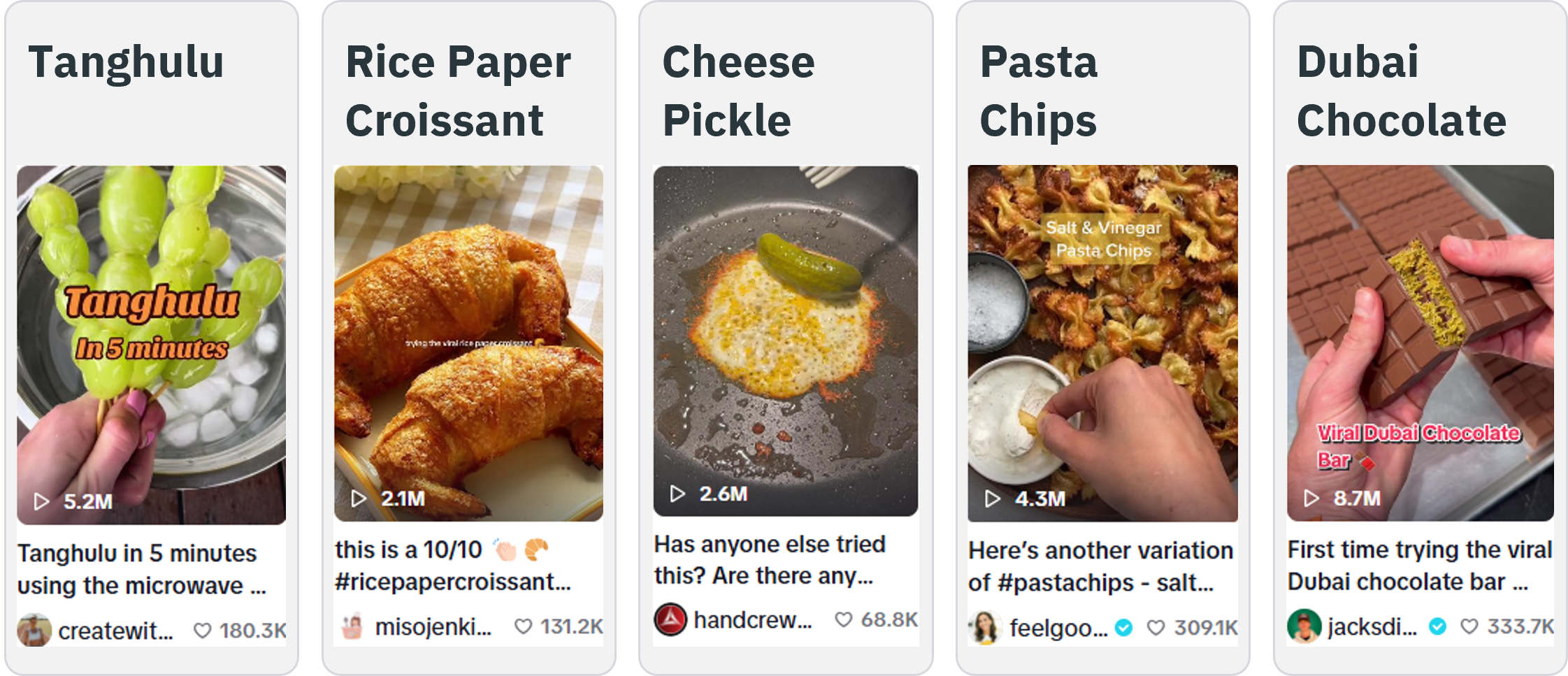

As consumers continue to explore with their food, texture seems to play a large part. The viral recipes this year seem to combine antagonistic textures or bring textures that are opposite of a familiar ingredient.

Tanghulu: A candied fruit dessert that has a glass-like sugar crunch on the outside and juicy fruit on the inside

Rice Paper Croissant: Air-fried layers of rice paper that result in a crispier croissant

Cheese Pickle, A fried single slice of American cheese with a pickle wrapped inside. If done right, the cheese is crispy and the pickle stays crunchy

Pasta Chips: Air-fried pasta that brings pasta into the snack category with a new crunchy texture

Dubai Chocolate: A milk chocolate bar filled with pistachio cream and kataifi (thin, shredded pastry dough)

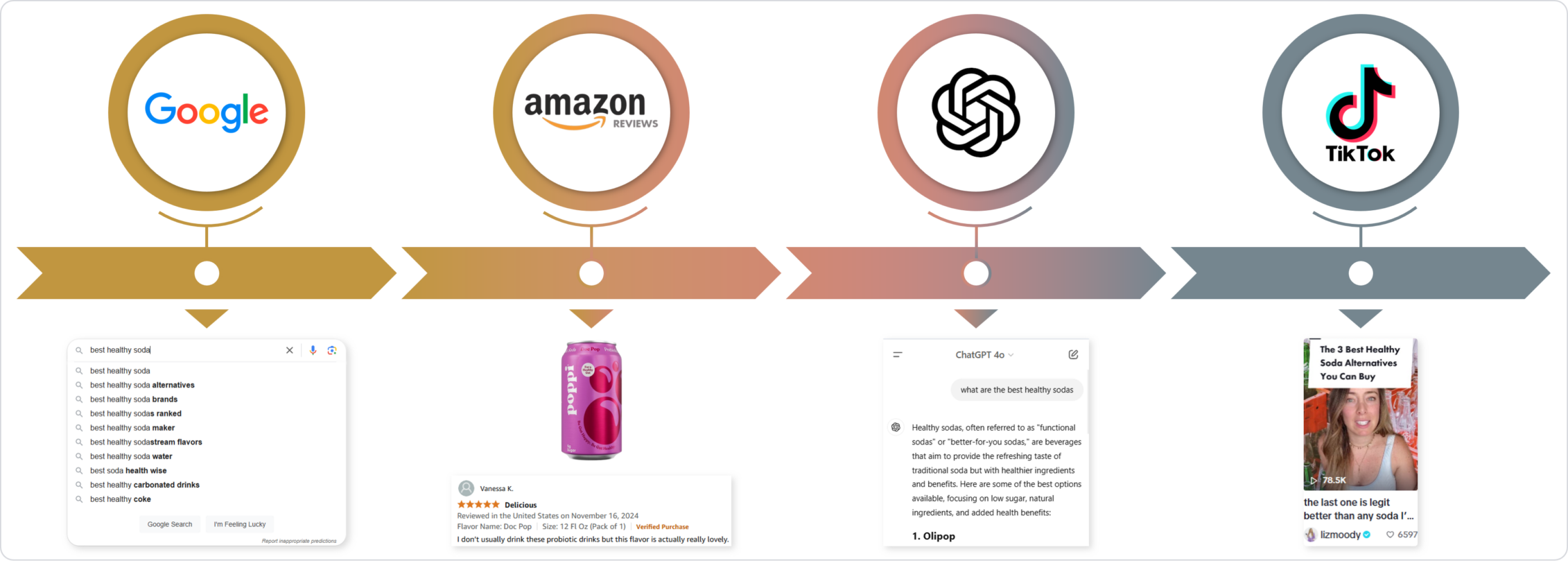

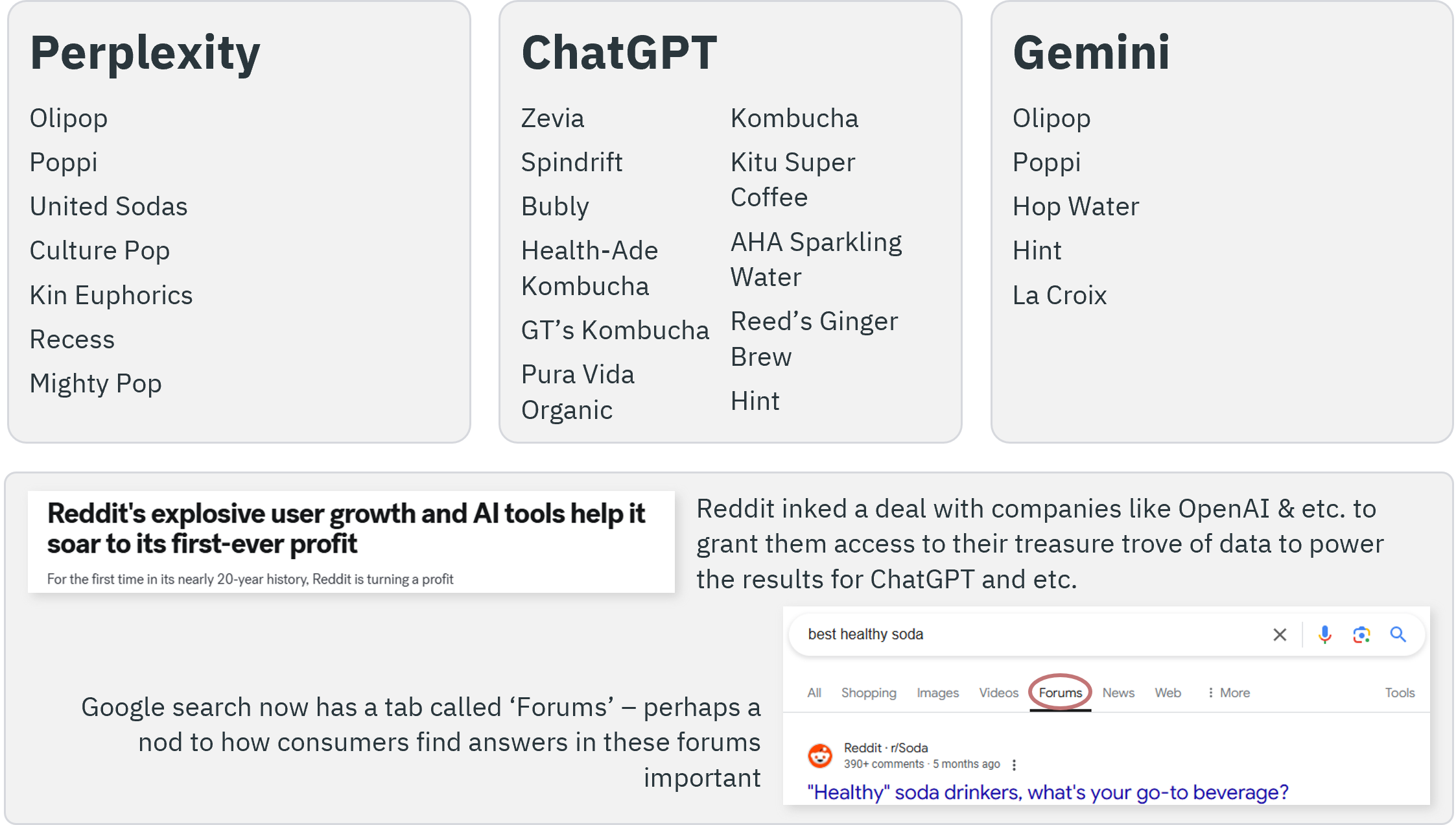

Search engines used to reign supreme but now, consumers have more ways to find the products they’re looking for.

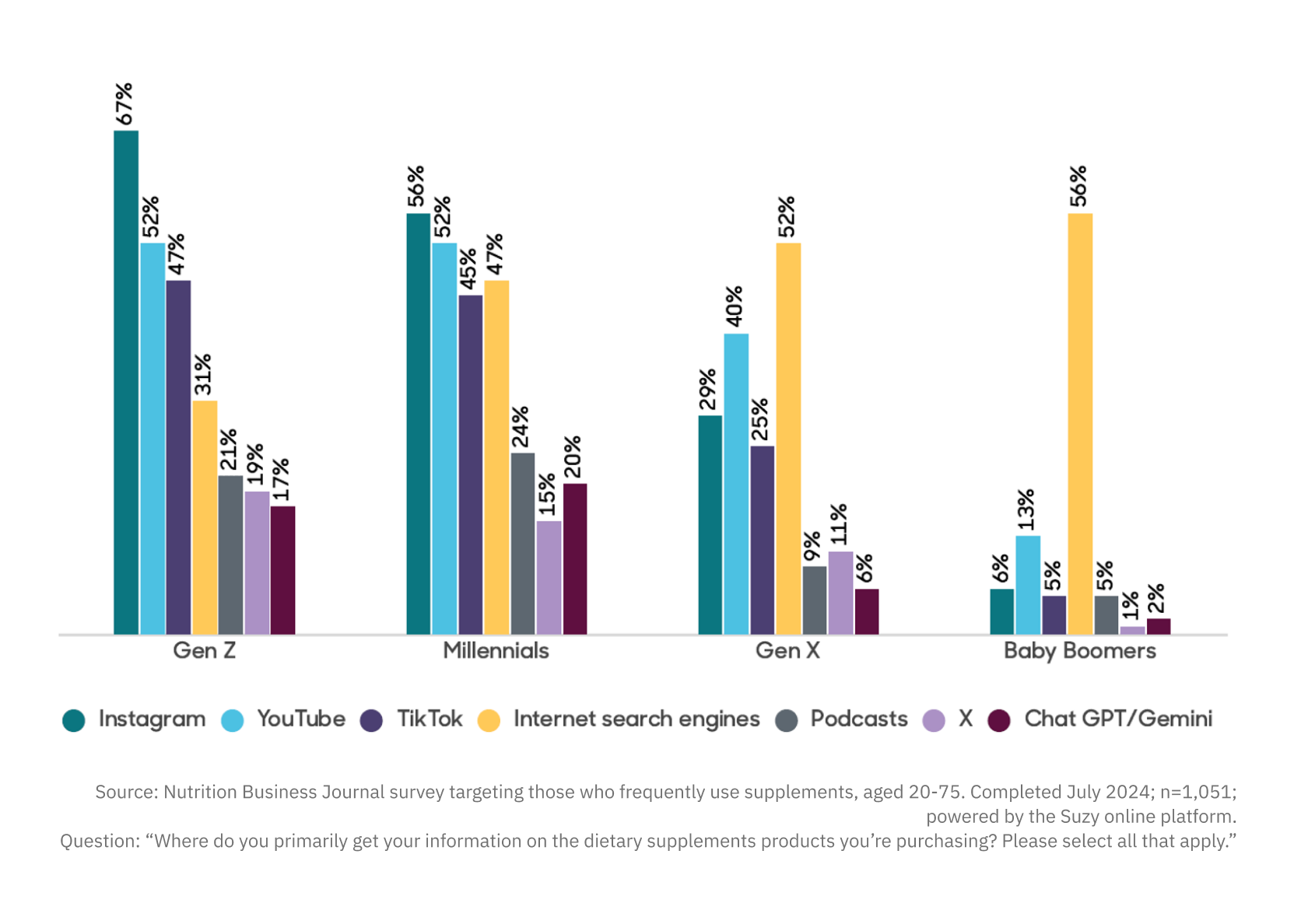

Where supplement consumers are primarily getting information on the supplements they’re purchasing.

AI, AI, AI. It’s all anyone talks about these days and as consumers integrate it into their search journey, it could change the ways brands choose to market their products online.

Some consumers have become unhappy with search engines like Google as low-quality spam articles and SEO-gamified articles show up in search results. Some have turned to AI chatbots such as ChatGPT and Perplexity to get their answers, so they don’t have to trawl through multiple pages themselves.

Now, consumers often add ‘Reddit’ (a forum site) to the end of their Google search so they can get relevant answers from what seems to be genuine people.

In fact, Reddit turned a profit for the first time in its history last quarter. This comes from high growth in users as well as the fact that Reddit now sells its data to OpenAI and others as they use it to power their models.

Want to buy a new shirt or visit that new restaurant? What do you do before doing either of those things?

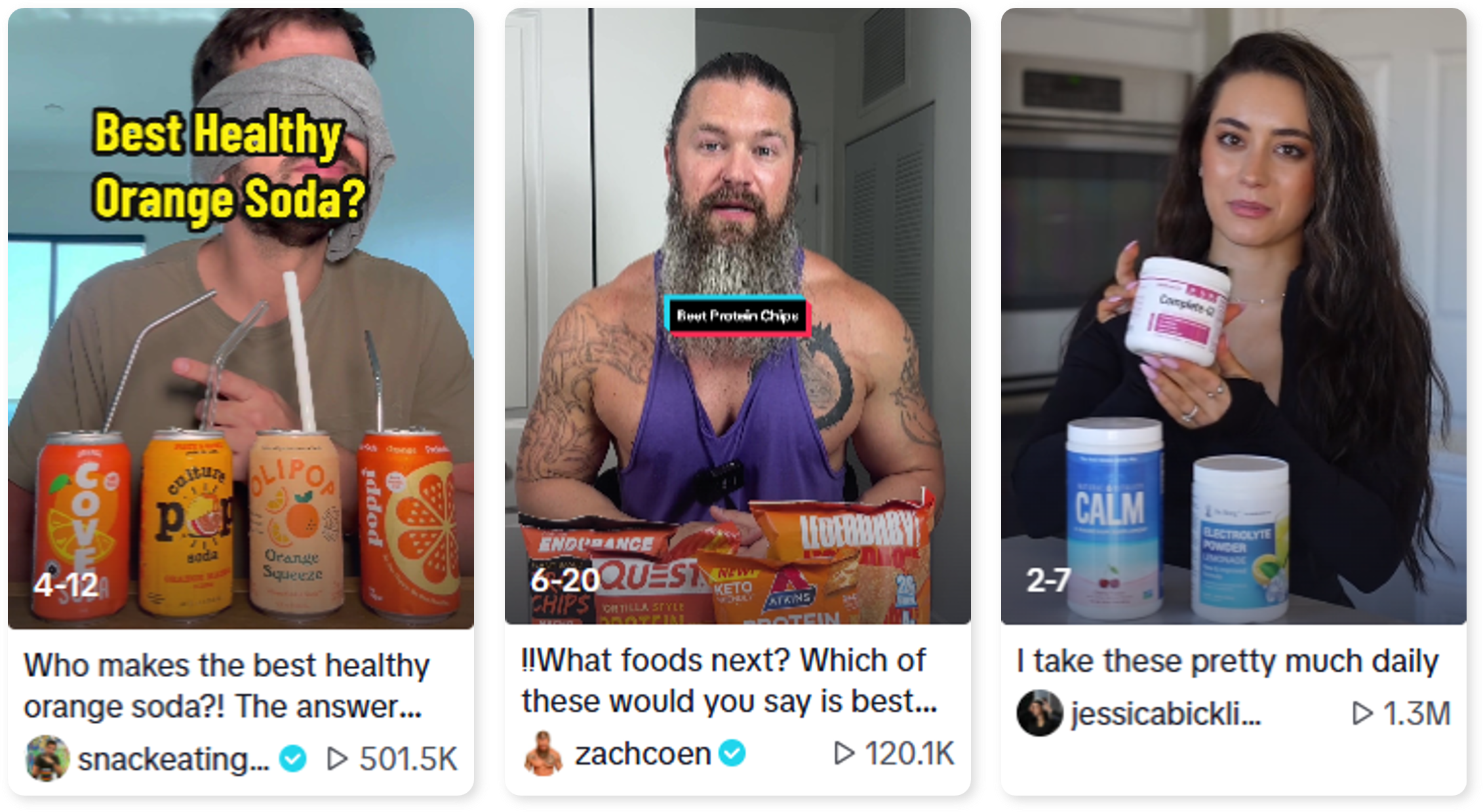

Perhaps you’d do a Google search, or maybe you read some reviews where available. But now younger consumers are increasingly turning to video platforms to learn more.

Now they can see the shirt on someone and hear their opinions on it or watch someone visit the restaurant and rate the dishes they tried.

The same can be said about CPG products, recipes, top snacks, and best supplements – consumers can now get recommendations on these video platforms. From taste tests to viral recipes, the video channel is fast becoming a way to discover and evaluate a product before buying it.

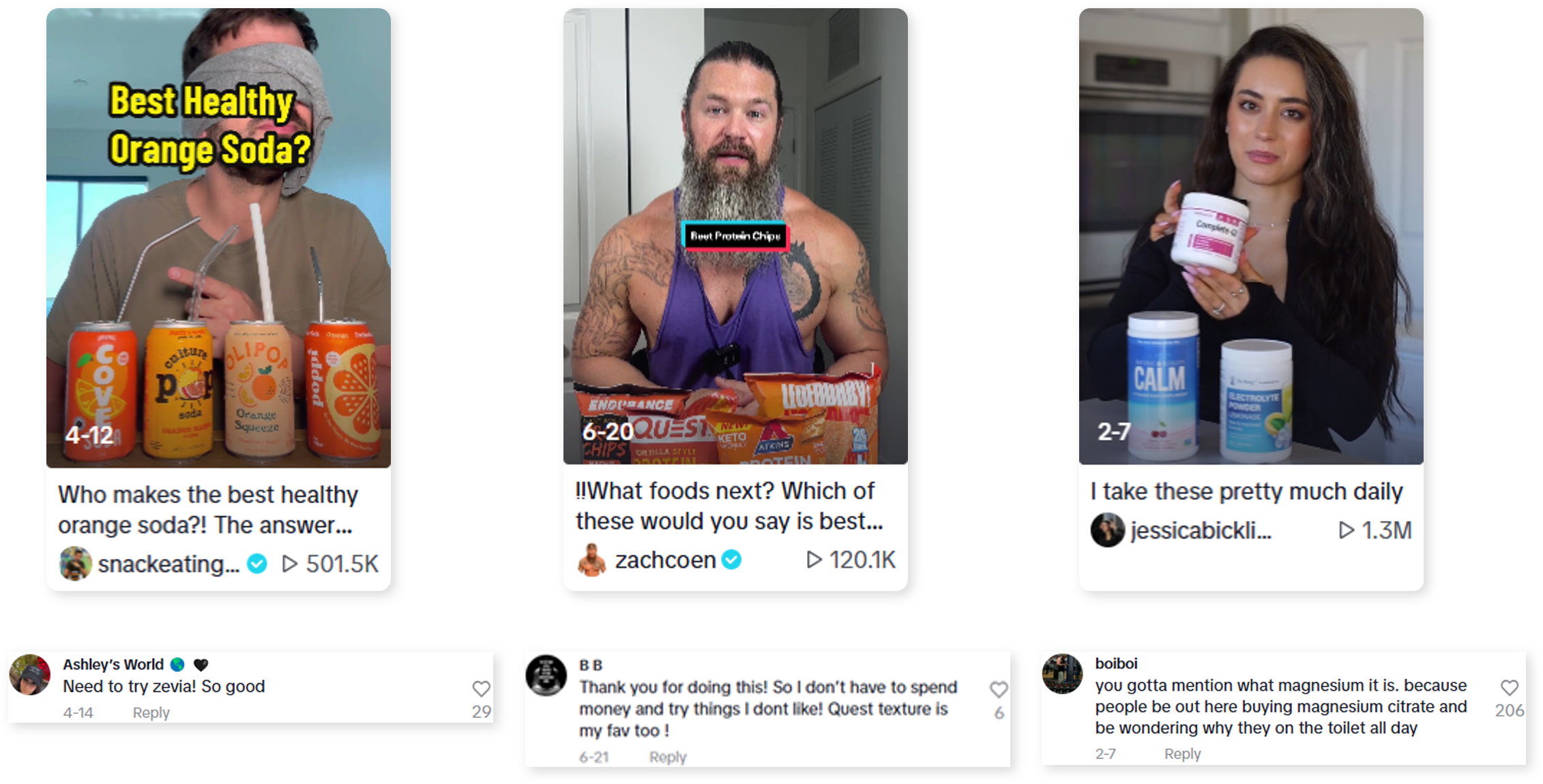

Comments have become a way to discover products and on short-form video platforms, it is no different. Becoming discussion forums of their own, social media companies have realized the power of comments in keeping consumers engaged with platforms like YouTube featuring top comments on video previews on the mobile feed.

There is no obvious way to tell if a comment is planted or is a genuine recommendation, but consumers engage with them all the same. Comments range from recommending similar brands not mentioned in the video, to confirming opinions expressed in the video and lastly, comments that cause further deliberation.

On supplement videos for example you can find consumers discussing dosage, what product they use, side effects, etc. – all of these are discussed in the comments.

Thank you for signing up

You will be the first to know about our latest articles, webinars and events.