“Our retail buyers…aren’t just distribution points, they’re strategic partners. Their feedback has shaped our formats, our packaging, even our innovation roadmap. We treat them like collaborators, not just gatekeepers.”

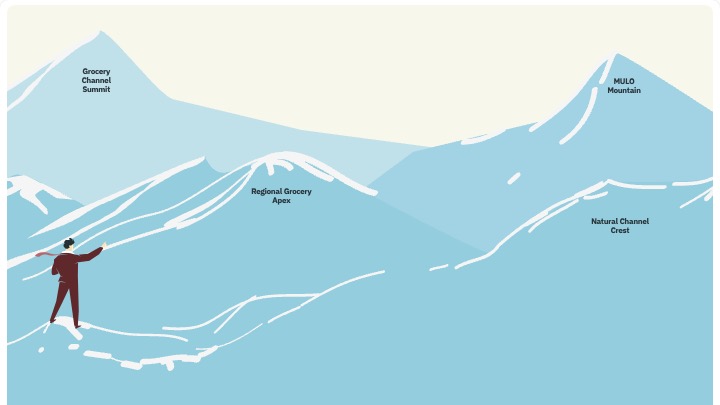

Millionaire Hill: Validation and a New Set of Questions

Crossing $1M proves that your product resonates. That’s not small, it’s validation. But it’s also a vantage point. From “Millionaire Hill,” you can now see the next climbs distribution beyond your first wins, more complex retailer ecosystems, and a bigger question: how do you 10x repeatedly?

The short answer: by changing how you operate. What got you to $1M won’t get you to $10M, and what got you to $10M won’t carry you to $100M. The rules of the game evolve, and to keep compounding, your mindset has to evolve with them.

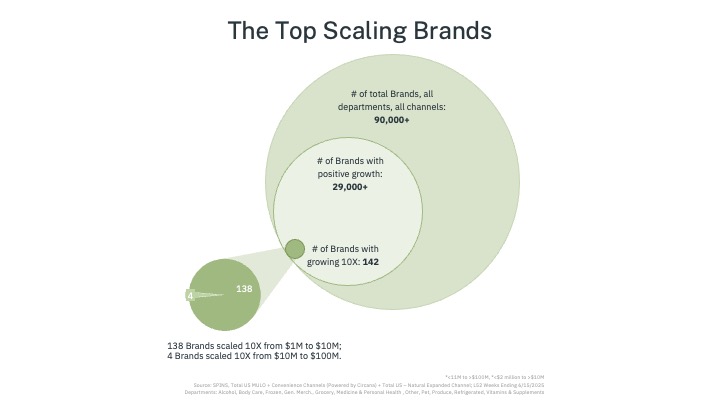

Growth vs. Scale: Why So Few Make the Leap

SPINS analyzed 90,000+ brands across Total US MULO + Convenience (powered by Circana) and the Natural Expanded Channel (L52 weeks ending 6/15/2025) and found that while 29,000+ brands grew, only 142 achieved true 10x scale from a base of at least $1M over a three-year span. Of those, 138 scaled from $1M to $10M, and just 4 scaled from $10M to $100M. Less than 1% 10x at all, and only a handful do it twice.

Scale, defined here as rapid, sustained 10x growth over three years, is atypical. Achieving it requires different strengths, different mindsets at different stages.

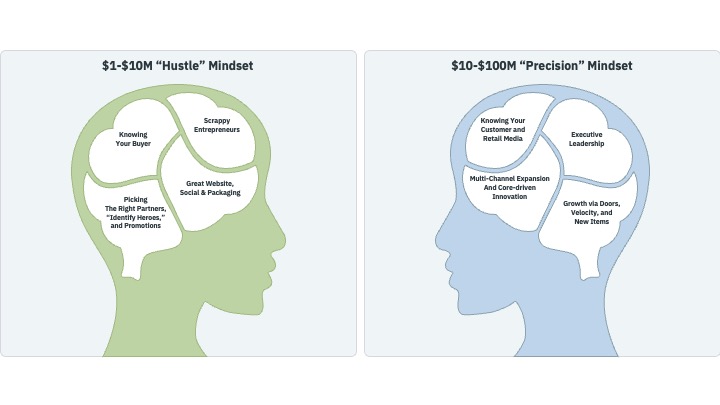

Mindsets That Scale

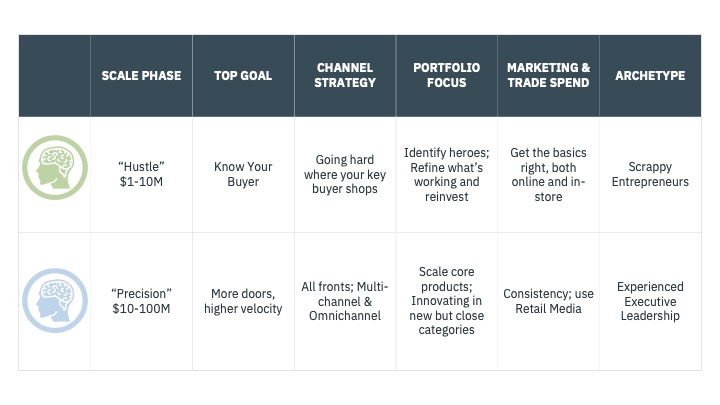

Scaling brands share a common architecture: clear goals, a coherent strategy, disciplined communication, and the right relationships at the right time. But the mix changes by stage. The $1–10M phase demands the Hustle mindset, one where you’re like a scrappy entrepreneur who’s trying to figure out who your buyer is, the right partners to get into, a promotional strategy, and nailing down your marketing strategy.

The $10–100M phase demands the Precision mindset, one where you either become or hire executive leadership that’s experienced. Those in this mindset tend to be focused on velocity, doors, new items, growing and scaling the core portfolio, as well as being obsessed with their customer.

Both require consistency and long-game discipline, but they emphasize different choices, priorities, and trade-offs.

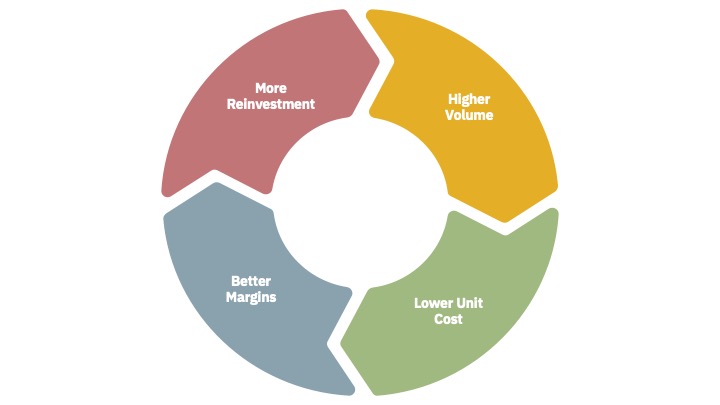

There’s one constant across both stages: scale requires margin as fuel. Success in the early “hustler” phase often sets the foundation for success later in the precision phase of growth, but there’s an important truth that applies to both. Growth and scale are not the same. Growth adds incrementally; scale is exponential, the kind of leap that feels like 10X expansion. To achieve that kind of scale, brands need fuel, and in the early stages, that fuel comes from margin. Emerging brands must “buy” velocity, awareness, and shelf space. That can mean investing in aggressive promotions, paying slotting fees, or taking calculated risks that squeeze margins in the short term. But these activities are what power the flywheel: as volume grows, unit costs drop, margins improve, and reinvestment becomes possible. Over time, the cycle compounds. More sales lead to more purchasing power, which strengthens your leverage not only with comanufacturers but also with major retailers like Kroger. It’s a cycle of margin, reinvestment, and efficiency that transforms scrappy hustling into sustainable scaling.

The Hustle Playbook

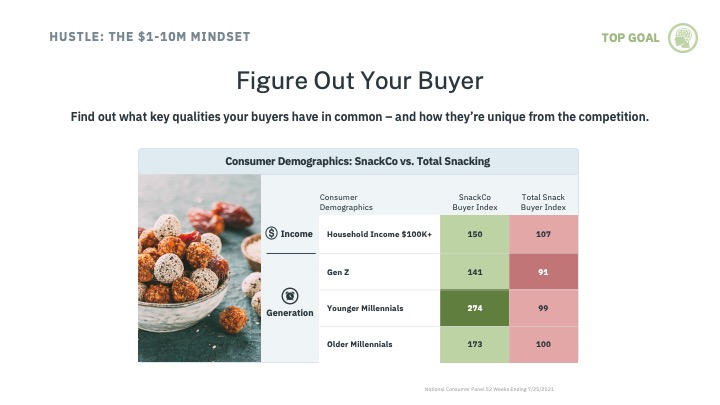

Figure Out Your Buyer

Everything starts with customer clarity. Use what you have: Shopify/Amazon analytics, post-purchase surveys, focus groups, and social listening to define who buys and why. That insight informs retailer targets, promo strategy, pack and price architecture, creative, and even your roadmap.

A powerful example is how Lentiful, an emerging brand, first came to market. Think of a lentil cup version of the ever-familiar ramen cup. Positioned as a healthy lunch on the go, the founder, Ben Bacon, thought that their main customers were going to be millennials who work in offices. However, after analyzing his Shopify data, he realized that their main customers were people who live in the Midwest and were in their mid-fifties or sixties.

Knowing this kind of information is very powerful as it allows you to pivot and ensure that you are deploying ads efficiently, improving targeting, and return on spend. Knowing your core customer group, even if they’re very different from what you initially thought, is extremely important.

When it comes to understanding your consumer, creativity goes a long way. There are plenty of unconventional ways to learn who your customer is. Setting up at a farmers market, for example, allows you to see firsthand who stops, samples, and shares feedback. If you’re able to launch on Amazon or Shopify, you’ll gain valuable insights about your buyers before ever stepping into retail.

This perspective is crucial: knowing who your consumer is should guide decisions like where your product belongs in the store. Many innovative brands struggle with placement because their products could fit in multiple aisles, but the key is to start with one location, the spot where your target shopper is most likely to find and purchase it.

At the end of the day, profitability comes from products moving off the shelf, so be intentional and focused. Stay open to evolving what you thought you knew about your consumer. Some of the most successful brands, like Lentiful, learned to challenge their assumptions and embrace new insights. That flexibility, paired with a creative approach to data gathering, can unlock more efficient and sustainable growth.

Where Do Those People Shop?

Prioritize banners that match your consumer and economics. Natural and regionals often have lower costs to play relative to big conventional, but every retailer entails upfront investments (promos, free fills). Treat buyers as collaborators, not gatekeepers. Their feedback will shape formats, packaging, and your innovation roadmap. As Megan Buick of Porta put it: “We treat [buyers] like collaborators, not just gatekeepers.”

Retail Fit Checklist to make the call:

- Are they aligned with your mission?

- Does your customer base shop there?

- What are the costs of getting on the shelf, free fills, minimum order quantities, demos, etc.?

- Do the margins work?

- Will you stand out on shelf, or get lost next to similar or bigger brands?

- Will your distribution network support them?

- Will working with this retailer close off opportunities with other retailers?

Note: It’s often not if but when. Deprioritize high-cost banners early and redeploy spend where you can learn faster and scale more efficiently.

Amazon as a Testing Ground

Amazon legitimizes your brand with shoppers and buyers and doubles as a lab for price, pack, and message. Expect a long runway: many brands plan to be in the red 1218 months as they invest across awareness, consideration, and conversion.

If you don’t sell on Amazon, chances are someone else will, and they might already be doing it with your product. That’s why it’s critical to get ahead of the platform early. While the upfront investment may not always show an immediate return, Amazon often plays an essential role in long-term brand awareness and growth. Of course, the challenges vary depending on your product: frozen goods face one set of hurdles, while fragile packaging like glass comes with its own. The key is to align your Amazon strategy with your broader business goals and understand the level of investment required.

We’ve seen many brands surprised to learn their products were already being sold on Amazon without their knowledge, something that can be a costly misstep if ignored. Beyond simply protecting your brand, Amazon data can become a valuable tool for growth. Even if you’re not yet in physical retail distribution, your e-commerce performance can serve as proof of consumer demand. Used strategically, this data can help you demonstrate traction to retailers and strengthen your pitch. No matter what stage you’re in, put every data point you can gather to work for your overall business strategy.

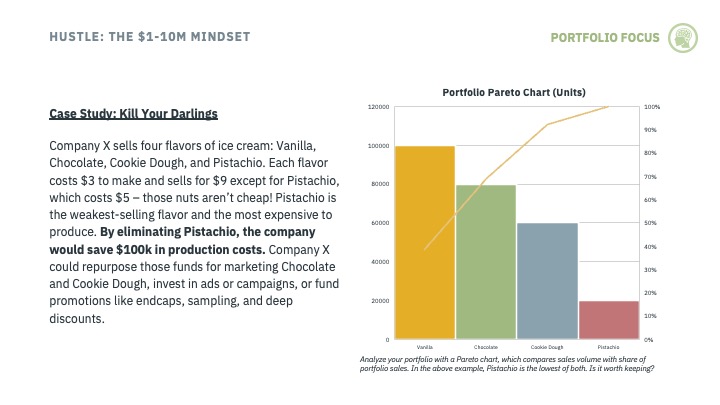

Find the Heroes, Then Tinker

“Find the heroes and kill the darlings” may sound dramatic, but it’s one of the most important lessons in portfolio strategy. Many emerging brands fall into the trap of believing they need a dozen UPCs to be credible, when in reality, what retailers and your bottom line need are one or two true hero products. These are the fast movers that pay the bills and give your brand a foothold.

The smartest brands don’t dilute their focus; instead, they refine their hero products, tinkering with packaging, sizing, or pricing to ensure they succeed at retail. Fly by Jing is a great example: after launching DTC, they had to tweak their bestsellers for retail shelves, adjusting details like pack size and price per ounce to resonate with shoppers.

On the flip side, brands must also be willing to “kill their darlings.” That means letting go of products that drain resources, even if you’re emotionally attached to them. For instance, if your pistachio ice cream flavor costs too much to produce compared to vanilla or chocolate, it might be better to cut it and reinvest in your winners. For scrappy entrepreneurs, this discipline is key: focus your energy on your hero SKUs, because that’s what will fuel growth and create the foundation for long-term success.

The math is straightforward. If your weakest, high-cost SKU soaks up capital and backend complexity, cut it and redeploy those dollars behind the items that already work promotions, displays, endcaps, content, and consumers will reward the focus.

Building a strong foundation requires more than innovation alone; it demands focus. Retailers don’t have the bandwidth to sift through 40 SKUs and figure out what fits; they need a clear, prioritized program that shows them exactly why your product matters and what they’re missing without it.

Once you’ve earned a spot on the shelf, the work doesn’t stop. Successful brands are always tinkering with packaging size, callouts, or design tweaks to ensure their products resonate in-store. This process often means letting go of sentimental favorites that don’t serve your long-term growth, no matter how personal their origins may be. By doubling down on identifying and elevating your hero products, you create the kind of focus and clarity that builds brand awareness, strengthens retailer relationships, and sets the stage for sustainable growth.

“We review customer data as a team every month. We look at feedback from reviews, support tickets, and online comments, and use that input to guide continuous improvements — whether that’s refining recipes, enhancing packaging, or making updates based on what our customers are asking for.”

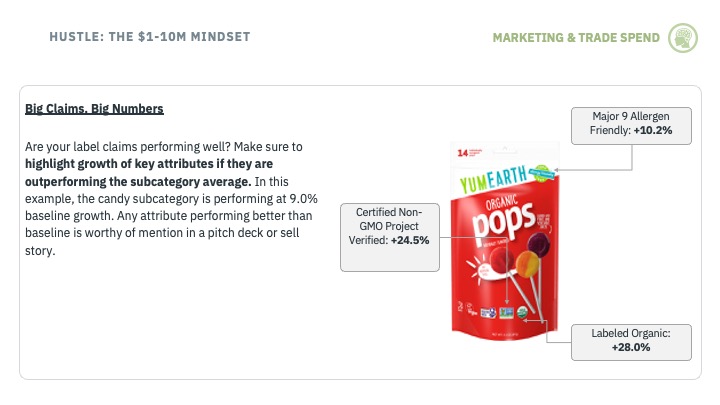

Marketing Focus: Website, Social, Packaging

Nail the basics. Keep your website current (with a store locator), invest consistently in one or two social channels, and let packaging do the heavy selling.

Packaging is your hardest-working salesperson. It’s on the shelf 24/7, silently competing for a shopper’s attention in the split second they glance its way. If your packaging doesn’t stand out, you risk losing the sale before the customer even considers your product.

Strong packaging goes beyond design; it’s about telling the right story with clear, resonant claims that connect with both consumers and retailers. For consumers, that might mean highlighting attributes that align with their values or stand out in a growing category.

For retailers, it often means backing up those claims with certifications because saying “non-GMO” without the official Non-GMO Project Verified seal, for example, could be the difference between being stocked or skipped. Certifications can be an investment, but if your target channel prioritizes them, it’s often worth it.

And here’s the reality: many buyers nitpick packaging because they know how important it is. They scrutinize labels, logos, callouts, and design choices. That’s why brands need to continually refine and invest in packaging that not only catches the consumer’s eye but also satisfies the retailer’s standards.

Marketing Checklist

- Website: Sounds basic, but – have one! And make sure it’s up to date. Store product locators are great for customers trying to find your product.

- Social Media: Pick a channel or two and feed it constantly. Paid ads, partnerships, sponsorships, and other content will help build up your customer education and loyalty.

- Packaging: Your packaging can always be better – fine-tune the messaging and call-outs. Make sure that your primary differentiator is the “hero” of the package, and the supporting differentiators are in the right spot. What truly makes you unique? It should be instinctively known after a single, brief glance.

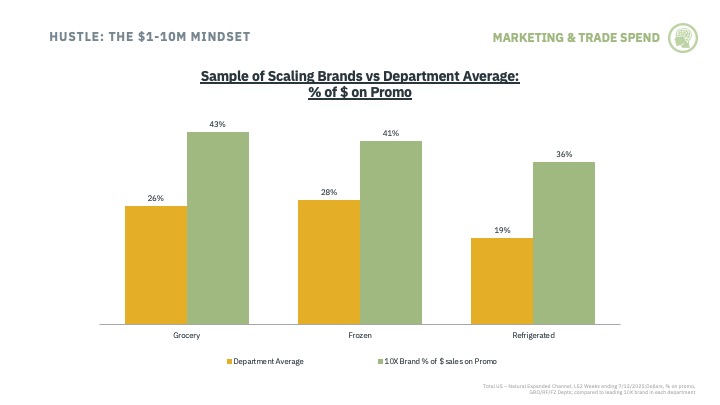

Plan for Heavy Trade Spend

Promotions fuel trial and velocity, expensive, yes, but essential. Budget aggressively and measure rigorously:

- Near-term read: promo lift and 12-week base change pre/post promotion

- Long-term proof: share shifts and brand switching studies

As an emerging brand, plan for 3545% trade spend during early scale to support doors, slotting, and price/velocity learning.

Once you get into enough retail doors and really start to understand how your pricing and promotional strategy compare to the competition in the set, you’ll start to create a recipe for success that you can continue to take to other retail partners to a certain degree.

One important factor to keep in mind as you scale is that your strategy can’t be one-size-fits-all every time. Your category matters, and so does your region. What works on the West Coast may look very different from what works on the East Coast, especially when it comes to pricing and promotions.

These nuances are critical to consider as you plan your growth. Just as important, you’ll need to budget upfront cash to fuel your product’s movement off the shelf. Without that initial investment in velocity, you risk poor sell-through and ultimately, discontinuation. And nothing stalls long-term growth faster than being cut from the shelf.

Hustle Speed Dial

Stay tightly connected to three partners: your co-manufacturer, your source of funding, and your sales agency/broker. Choose partners who believe in your long-term vision, bring category expertise, and have retailer trust. Seek a customized growth roadmap over one-size-fits-all promises.

Q: What qualities do you look for in a broker to help scale your business?

“We looked for partners who believed in our long-term vision — not just a quick win. We wanted people who understood premium, frozen, and differentiated products, and had the trust of key retailers.”

The Precision Playbook

Velocity, Distribution, Innovation: The Three-legged Stool

Velocity is the heartbeat of brand growth. It validates the retailer’s decision to put you on the shelf, proves that consumers are buying, and gives you the leverage to protect and expand your space. When trying to grow your brand from $10M to $100M, you need to keep a relentless focus on units per store per week, especially when you’re opening up new channels and launching new items.

Strong velocity not only secures your current placement but also allows you to ask for more, whether that’s additional SKUs, more distribution, or prime eye-level placement during a category review.

Without it, even big wins can be short-lived; no brand wants to celebrate landing distribution only to be discontinued six months later because product movement stalled. Innovation and channel expansion remain important, but the brands that scale successfully are the ones relentlessly focused on hitting and sustaining velocity benchmarks within their category.

Velocity isn’t a one-size-fits-all metric; it varies by retailer, category, and even subcategory. That’s why benchmarking is so important. It can help brands track performance not just during category reviews, but before and after distribution gains, and throughout the entire product lifecycle. Still, many people misunderstand how velocity actually grows.

It’s not a perfect hockey stick curve. Instead, velocity often follows a journey: it starts low, spikes as awareness builds, dips when distribution expands into new and unfamiliar markets, and then climbs again as marketing, promotions, and word-of-mouth kick in. Over time, this cycle stabilizes into a stronger, more sustainable benchmark. The key takeaway? Velocity is dynamic and fluid, and brands need to continually monitor and nurture it to secure long-term growth.

Reasons To Improve Velocity

- Retailer Credibility: Sustained velocity proves consumer demand, helping maintain shelf space & justify expansion into additional SKUs or stores.

- Retailer-Specific Sell Story: Velocity benchmarks vary by retailer. Tailoring specific channel velocity story helps build trust & show you understand their business.

- Better Negotiation Power: Gives you leverage in category reviews (eye-level, buy level.)

Multi-Channel Expansion

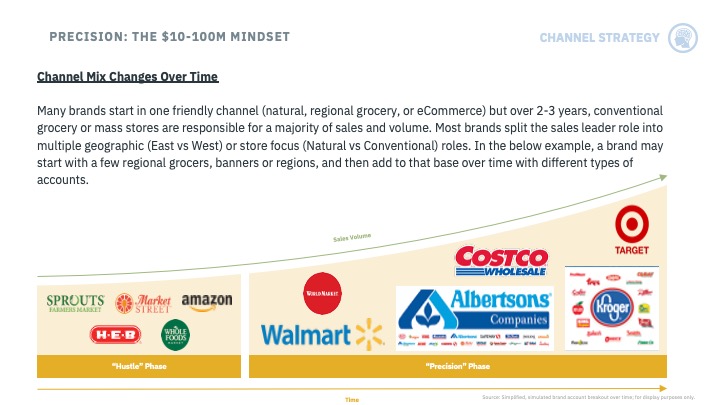

Distribution is one of the biggest levers for growth, but success requires a thoughtful channel strategy. Once you’ve built a solid base in your “hustle phase,” the next step is expanding into new channels and banners. This often means hiring sales staff focused on specific geographies or retailer types and using CRMA data to understand competitive dynamics and identify regional gaps.

The path typically starts in the natural channel, where category reviews are more flexible and retailers are eager to partner with emerging brands. From there, successful brands expand to regional grocers, then into larger conventional grocery chains. Only after establishing a strong foothold in these core channels should brands consider more complex retailers like Costco, Walmart, or club and dollar stores.

The key is to treat each channel as unique: what works at Sprouts may not work at Dollar General. Pack sizes, pricing strategies, and even product assortments often need to be tailored to the channel. Growth isn’t about plugging one formula into every retailer; it’s about building a deliberate, scalable strategy that ensures long-term success.

“Early success in the natural and eComm channels and partnering with our best-in-class agency partners helped us to take our story to new heights.”

From E-commerce to Omnichannel

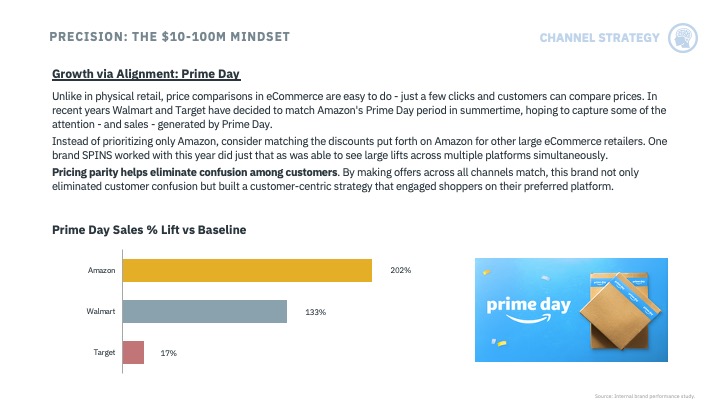

Before diving deeper into scaling, it’s worth pausing to talk about e-commerce and the rise of omnichannel shopping, where consumers can buy anything, anywhere, at any time. In today’s environment, precision also means consistency.

Delivering a seamless, consistent experience across the digital shelf not only strengthens your brand but also makes it easier for consumers to choose you. Take Prime Day as an example: what started as a novelty has become a retail holiday, with other major players like Walmart and Target now participating. Smart brands create pricing parity across platforms during these events. Why? Because it’s effortless for shoppers to cross-check prices online, often easier than scanning options in a grocery aisle. If someone prefers shopping on Amazon over Walmart.com, make sure your pricing doesn’t give them a reason to switch brands. Consistency across channels builds trust and loyalty.

Scale Your Core Products

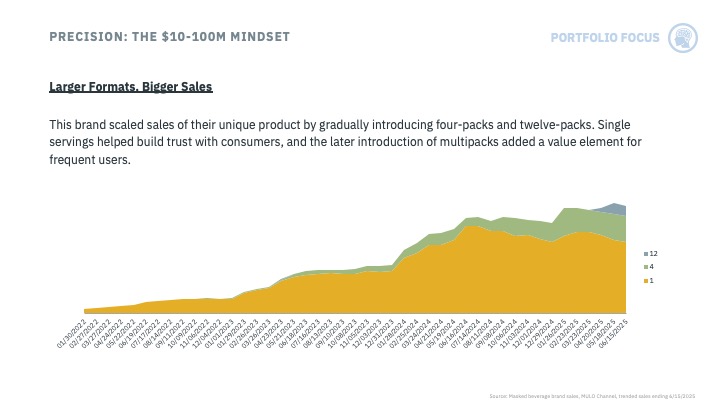

When it comes to growth, innovation gets a lot of attention, but scaling your core products is often just as powerful. Retailers want to see “new news,” but relying solely on new flavors or untested items won’t drive sustainable success. Instead, the smartest brands build off what’s already working.

A great example is a brand that started with single-serve items and later introduced four-packs and 12-packs. Over time, multipacks grew to represent a third of unit sales and an even greater share of dollar sales thanks to the higher price point. This trend took off after COVID, when consumers leaned into buying more in one trip, and it has stuck.

For brands approaching mass or club retailers, the key is to lead with your highest velocity SKUs, simply reformatted into larger pack sizes. From there, focus on balancing units and dollars: multipacks should protect margins while also delivering stronger dollar sales and bigger basket sizes, which retailers love. The trick is making the price-per-ounce feel like a value to the shopper, while still safeguarding profitability. Done right, multipacks can take a proven hero product and turn it into a major growth engine.

“Our packaging is also a differentiator. We have multiple sizes in each platform that all have fun and colorful packaging.”

Incremental Innovation

Innovation is exciting, but at scale it becomes a high-stakes game. For founders and executives leading brands in the $10M$100M range, the challenge is making the smartest bets possible.

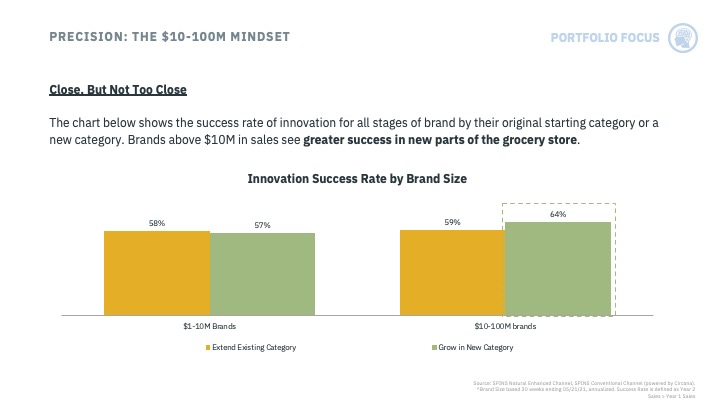

Data shows that brands in the $10M$100M range often achieve greater success with innovation when they expand into new or adjacent categories rather than relying solely on their founding one. While growth within the original category is still possible, there’s only so much to gain before you hit a ceiling. To unlock the next level, brands often need to step outside their comfort zone, exploring new spaces, formats, or categories that align with their identity so they can capture more value and reach a broader customer base.

The key, however, is to stay rooted in your brand identity. Chobani moved from Greek yogurt into oat milk, creamers, and ready-to-drink beverages while maintaining its better-for-you positioning. KIND expanded from snack bars into breakfast and frozen treats without straying from its health-focused mission. MUSH, known for overnight oats, has extended into oat bars while tailoring formats to channels like Natural and Costco.

The common thread? They all innovate with discipline, staying true to what defines them while finding smart ways to scale. Innovation should never be about chasing the next shiny object; it should be about amplifying what your brand already stands for.

Pushing and Pulling with Retail Media

By the time your brand reaches this stage of growth, chances are you’ve brought in some marketing muscle, whether that’s a CMO, a marketing director, or an agency partner. These professionals set the strategy and deploy tactics that not only push product but also pull in customers. One of the most important tools in their arsenal today is retail media.

If you’re new to the concept, don’t worry, it’s still a relatively young channel, just over a decade old. At its core, retail media is about advertising directly on a retailer’s platform, whether that’s their website, app, or even in-store. Brands can target shoppers based on what they’ve bought, searched, or browsed, and then serve ads in product listings, category pages, or promotional spaces. The power of retail media lies in its closed-loop system: brands can track conversions and continuously optimize by adjusting targeting, creative, or budget.

Of course, like any advertising platform, retail media has its quirks. Targeting isn’t always perfect, you might search for an energy drink and get served a diaper ad, but its growing importance in brand strategy is undeniable. For companies looking to scale, retail media offers a direct line to shoppers at the moment of decision-making, making it an essential part of the modern marketing mix.

In the past few years, many brands have shifted their spend away from traditional tactics like TPRs and toward retail media and in-store merchandising, and for good reason. No matter how strong your digital marketing is, if your shelf execution isn’t right, those dollars won’t matter.

That’s why brands are investing heavily in fundamentals: making sure price tags are accurate during promotions, inventory is properly stocked in the backroom, and secondary displays are full while home shelves remain replenished. Once the in-store experience is buttoned up, retail media becomes a powerful next step.

Allocate about 10% of your total marketing budget to this channel, split evenly with 5% on sponsored search and 5% on banner ads. Not only does retail media deliver measurable ROI that excites sales teams, but it also strengthens relationships with retail partners, who increasingly expect brand investment in this space. Done right, balancing in-store merchandising with retail media spend ensures your brand captures shopper attention both on the shelf and online.

At this scale, retail media becomes an always-on lever that complements promotions.

Precision Speed Dial

Your priority relationships shift to your capital partner (PE/financier), your sales agency/broker, and your top customers. Seek vertically integrated partners who can align marketing, sales, ecommerce, insights, and in-store under a single plan of record. As Rick Pickering of YumEarth advises, treat agency partners as extensions of your team, built on mutual trust and deep customer relationships.

Q: What qualities do you look for in a retailer or broker to help scale your business?

“We look at agency partners as an extension of our company and sales team. It was important for us to have mutual respect and trust of each other. We also wanted a partner that was an expert in our natural space and had great relationships with our customers and within the industry.”

Hustle vs. Precision

The Hustle phase is about precision discovery: define the buyer, prioritize the right retailers, concentrate on hero SKUs, and focus scarce capital behind packaging, owned channels, and trade-funded trial. Expect to “buy” momentum, often running in the red for 1218 months on Amazon and planning 3545% trade spend while you shape a repeatable velocity recipe.

The Precision phase is about disciplined scale mechanics: protect and grow velocity, expand doors with channel-specific packs and economics, orchestrate omnichannel consistency (including price parity around key events), fund retail media (~10% of marketing) once in-store execution is airtight, and pursue incremental innovation adjacencies when your brand equity can carry them.