Introduction

In recent years, the beverage industry has seen an explosion of innovation and growth, particularly in the energy and sports drinks segment. Here’s a rundown of how this booming market has evolved, the current trends, and what to expect in the future.

A Spurt of Evolution

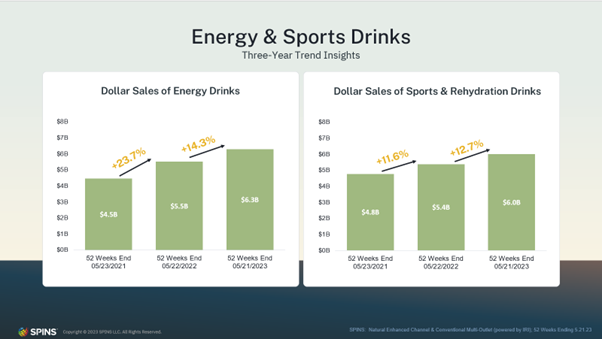

From the days when Red Bulls were for partying and extreme sports to today’s casual office worker grabbing a daily Celsius for a little pep in their step, we have seen a whirlwind of innovation in the Energy and Sports Drinks category. Both categories also continue to see year-over-year growth in sales. Energy Drinks saw a 14.3% increase in year-over-year sales while Sports & Rehydration Drinks saw a 12.7% increase in year-over-year sales based on sales data for the last 52 weeks as of 05/21/2023.

What began as basic concoctions has evolved into an array of options and varieties for consumers, for different occasions. The most prominent shift has been the rise of smaller, newer brands at the forefront of innovation. Often emerging from the sports nutrition segment, these brands have shown an innate ability to stay close to consumer needs, driving rapid experimentation and development.

The Consumer at the Center

Today’s market is marked by an abundance of choices, driven by consumer preferences. Brands are racing to offer unique and exciting options. The result is a plethora of flavors, ingredient combinations, and variants that previously didn’t exist. In the race of innovation, energy drinks are leading, likely due to the broader scope of possibilities for product differentiation compared to sports drinks.

The Caffeine Chronicle

One element that has evolved significantly in energy drinks is caffeine content. The early days saw modest caffeine levels, with Red Bull containing around 80 milligrams. Today, however, some brands boast a caffeine content in the range of 200-300 milligrams. This trend highlights how brands are pushing the boundaries to meet the ever-changing demands and preferences of consumers. In some ways, some of the newer drinks have been able to bring new customers into the category or even convert faithful coffee drinkers.

From Pre-Workout Powders to Ready-to-Drink Energy Boosters

Brands that began with pre-workout powders are transitioning to ready-to-drink versions and rebranding them as energy drinks. The convenience factor of the RTD format allows consumers to just grab and go and is more approachable to a wider audience beyond fitness enthusiasts. However, this also makes the market more saturated, mandating innovation for brand visibility in terms of flavor and ingredients.

Towards Natural Ingredients and Healthy Choices

A noticeable trend is the shift towards unique ingredients such as super mushrooms and nootropics. Consumers are looking for healthier options, and brands daring to experiment with natural and unconventional ingredients are catching attention. Many energy drinks still use ingredients and sweeteners that aren’t typically found in natural channel retailers. For core natural consumers, alternatives like tea-based or coffee-based energy drinks are expected to drive innovation. To cater to this market, we may see hero brands emerge, competing in the natural channel with healthier alternatives like energy drinks made with allulose, monk fruit, and non-carbonated bases such as tea and coffee.

Specialty Stores: Breeding Ground for Innovation

Stores like Vitamin Shoppe and GNC have become innovation hubs for performance energy drinks. Catering to exclusive clientele, they are playing a critical role in brand growth and the establishment of niche markets. Typically brands gain popularity in these specialty stores first, or they build a following in DTC online stores before expanding into specialty stores, then only are they picked up by other retailers.

Hydration and Wellness

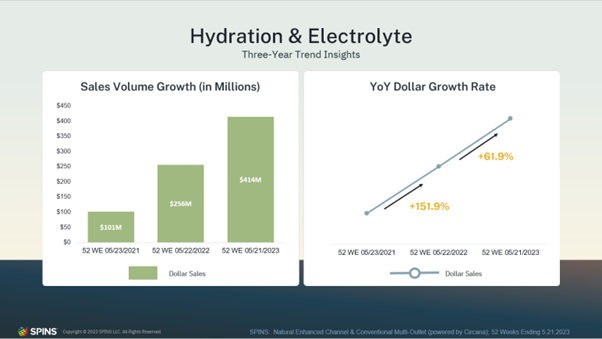

There’s also the swift rise of hydration supplements, not just for athletes, but for everybody – with brands like Liquid I.V doubling down on this type of messaging. Companies have really leaned into more relatable marketing showcasing that hydration products are for those going about daily activities, for people who dance or are at the beach. All of this has led to the hydration category growing over 61% in the last 52 weeks as of 05/21/2023 and over 150% in the 52 weeks prior to that.

Hydration products are now simply for those who aren’t drinking enough water, and apparently, that’s a large segment of the U.S. population. Of course, the part that isn’t said out loud by many brands is the fact that hydration products have gained popularity as hangover remedies. On social media, you can find many videos of influencers talking about how they drink hydration products for hangover prevention, and let’s not forget the viral BORG drinking trend among college goers.

Brewing Companies Enter the Scene

Traditional brewing companies, witnessing a decline in market share, are diversifying into energy and sports drinks through investments and partnerships. This mutually beneficial collaboration allows energy drink brands to grow more quickly and expand their distribution. Many in the space may be familiar with Ghost’s partnership with AB InBev which has truly taken the brand to new heights in terms of opening doors for retail distribution.

Democratization and Personalization

Once considered a male-dominated category, energy drinks have become more inclusive. Through targeted marketing, flavors, and other strategies, products are now appealing to various groups, including different genders and ethnicities. When comparing a brand like Celsius to Monster, looking at its marketing and package design alone one could see how a brand like Celsius may appeal to a broader audience regardless of age or gender simply because of their more neutral approach to marketing. Meanwhile, Monster might largely appeal to a more narrow audience – generally, someone who is male and perhaps a gamer, maybe even a construction worker.

The Celebrity Factor

From The Rock’s ZOA to Logan Paul and KSI’s Prime – more and more celebrities are launching or endorsing energy and sports drink brands. While some find success, others don’t, but the allure of being associated with a growing industry keeps them coming. Many look to the successes and see it as perhaps an easy way to capitalize on their fame, but as many in the industry know, the CPG space can be cruel sometimes and success might not come as easily as some think.

Beyond Energy: Focus on Cognitive Enhancement and Functional Ingredients

Energy drinks have evolved from being associated with parties and gyms to integrating into daily routines. Formulations now include ingredients like L-theanine and nootropics, enhancing mental focus and cognitive functions. This diversity caters to new demographics, including those looking for productivity boosts. As brands continue to innovate, it will be interesting to see which ones may succeed and which ones may fall behind.