Sweets & Snacks Recap

Building on the trends reported in our Evolution of Snacking deck, we saw familiar and new trends play out on the Sweets & Snacks Expo show floor. Here’s what caught our eye at this year’s show:

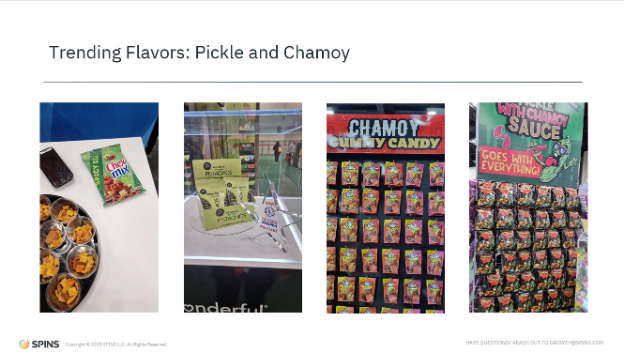

Trending Flavors: Pickle and Chamoy

Pickle has been an enduring flavor in the snack aisle, and this should be no surprise. For the past three or so years, we’ve seen more and more categories join the pickle frenzy – from chips to popcorn to nuts and beyond.

The amount of pickle-flavored products on the show floor is a testament to the sustained consumer interest in this flavor. Another flavor that’s seeing rising interest is chamoy. There were chamoy gummies galore at the show.

Chamoy pickles were trendy on TikTok last year and the want for more chamoy has stayed around. Building off that trend, an interesting product we saw on the show floor was pickle flavored cotton candy with chamoy – too far-fetched or right on trend? We’ll let you decide

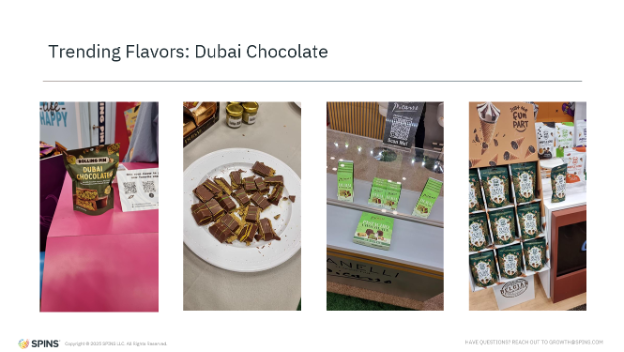

Trending Flavors: Dubai Chocolate

Last year, Dubai Chocolate took TikTok by storm with many consumers attempting to create their own version at home, as few options were available on the shelf, if at all. We’re seeing manufacturers catch up to the demand, as we saw Dubai chocolate in every shape and form at every corner of the show floor.

For those unfamiliar with Dubai chocolate, it is chocolate that is filled with pistachio cream and kadayif (a spun pastry dough) that gives the product a unique flavor and texture. This plays into a larger trend where we see that products that have novel textures in a familiar category have been seeing rising consumer interest. Many of the viral TikTok foods last year fell in this bucket, think: Tanghulu, cheese pickle, air-fried pasta chips, and more.

Many have raced to local cafes and stores to get a taste of Dubai chocolate, but it will be on more and more shelves soon. In fact, Trader Joe’s is joining the party with their very own version, too.

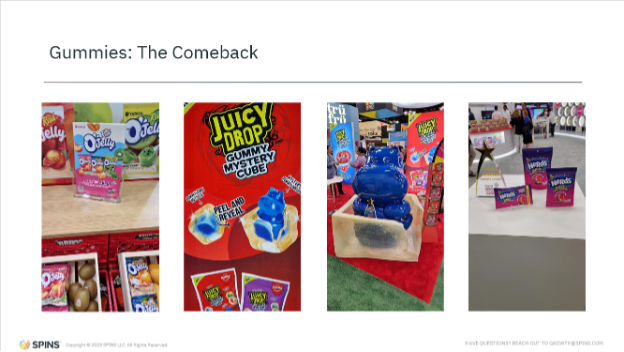

Gummies: The Comeback

Truth be told, gummies never really went away, but it’s undeniable that this category has seen renewed interest. The charge was led a few years ago with the advent of the Nerds Gummy Clusters, but newer products like peelable gummies, mostly from Asian brands, have gained consumer interest.

Both products, gummy clusters as well as peelable gummies again play with the idea of novel textures in a familiar category. Manufacturers continue to innovate in that vein with peelable gummies that reveal another gummy in the shape of an animal (we just had to include the image of the larger-than-life-size version that Bazooka had on display). Adding to that, Ferrara showcased their new Nerds Juicy Gummy Clusters – adding a liquid inside to the already popular product.

Better-For-You On The Rise

Better-for-you snacks have been seeing continued consumer interest, and we even see legacy brands like Doritos and Tostitos trying to carve out more of that market. Though the Simply line isn’t new, it seems like they might have dropped the organic part. It, however, still boasts no artificial colors or flavors.

The Simply Tostitos cooked with Avocado Oil is interesting, though, as more consumers become wary of seed oils. We saw a number of brands call out ‘cooked with avocado oil’ on their packaging as consumers sour on seed oils.

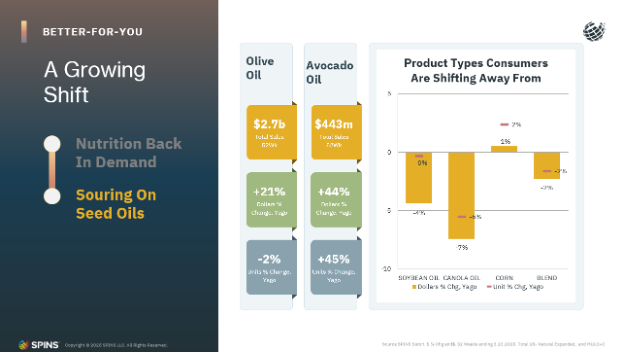

Seed oils have gained a lot of mainstream attention over the past year, and at a high level, the main concerns are that they are stripped of most nutritional value during processing and that they may contribute to inflammation due to their high ration of omega-6 to omega-3.

Looking at the shelf stable oil category as a proxy, we can see that we see an increase in sales for avocado oil and a drop for products like soybean oil and canola oil.

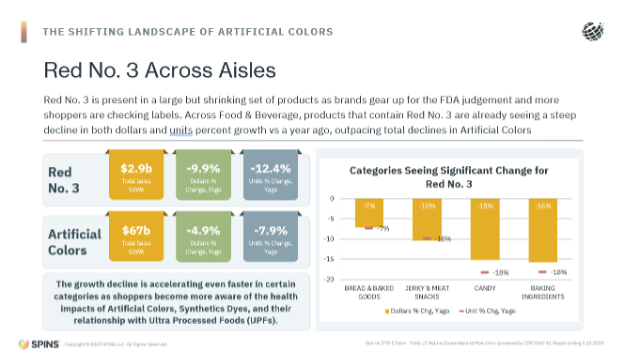

Another big trend at the show was calling out dye-free, especially now after the news of the FDA banning Red No. 3. The dye is popular in the snack aisle, particularly in products like candy, so it’ll be interesting to see how manufacturers navigate this.

The Renaissance of Jerky & Meat Snacks

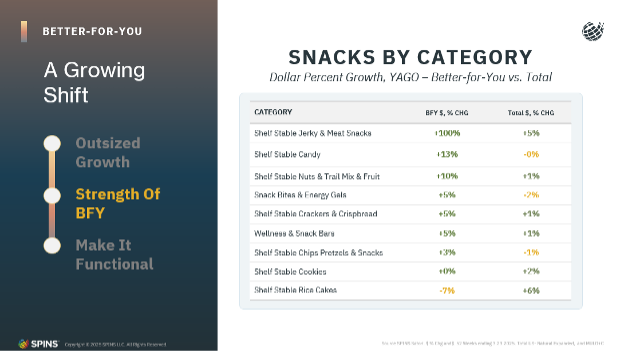

We saw the come up of Jerky & Meat Snacks at Expo West and the trend continues at Sweets & Snacks. Aided by the protein boom, this category is going through a renaissance period as better-for-you positioned products in this category continue to see strong growth.

Biltong and Carne Seca continue to carve out their share of the market as consumer interest soars for these air-dried counterparts, bringing a softer alternative to the tough jerky texture that many know.

Additionally, jerky crisps and chips have the opportunity to bring in new consumers into this category, who maybe they have typically avoided it due to not liking the tough jerky texture. These products are similar to chips or even crispy bacon, a more universally approachable texture for most.

In the flavor department, we were impressed by New Primal’s newest chicken stick flavor – Rotisserie. It just makes sense, and yet, we hadn’t seen it before!

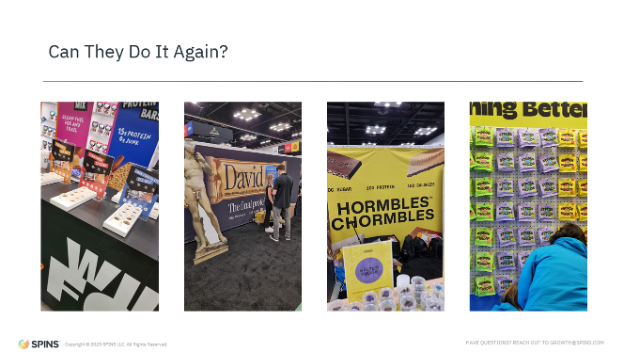

Can They Do It Again?

At the show, we saw founders throwing their hat back into the CPG ring after their first brand was acquired/sold, and the question some are wondering is, can they do it again?

We saw the founder of Kevin’s (acquired by Mars) debut his brand Wild Fox at the show, featuring trail mix and protein bars. Their protein bars are akin to marshmallow rice krispies but with 15g of protein and, in their words, with “0g junk”.

Then, we saw the co-founders of RxBar (acquired by Kellogg’s) take on CPG again with David and Hormbles Chormbles respectively. David is a protein bar brand with 28g of protein and only 150 calories despite the decadent flavors. While Hormbles Chormbles is a protein chocolate/candy bar brand, boasting 10g of protein, 0 sugar, and 100 calories a bar. Both products contain EPG (esterified propoxylated glycerol), a modified plant fat that cuts 92% of calories for each unit of fat replaced without any trade-offs in flavor or mouthfeel.

Going back to the protein piece, as evidenced by the three brands just mentioned, the show had protein snacks galore. Bars, chips, popcorn, puffs, candy – you name it, they had it. As consumers look to snacks as a way to boost protein intake outside large meals and protein shakes, we see brands try to fill in that space.

Finally, we have the co-founder of Olly Nutrition (acquired by Unilever) running it back with Tandy, a functional candy brand. The candies tackle health focuses like focus, stress, and mood support with functional ingredients like ginseng, GABA, and L-theanine.

Restaurant-Inspired Flavors and Fancy Dates

BBQ, Ranch, Caramel, Sea Salt – been there, done that. Don’t get it wrong, there’s nothing bad about the classic flavors but it was fun to see new, yet familiar flavors in the snack aisle.

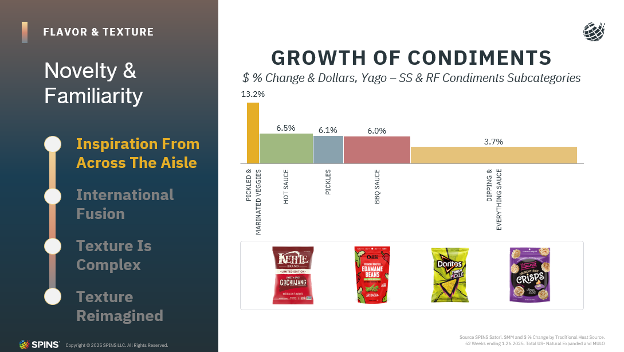

Nomad’s Pad Thai and Chimichurri popcorn brought restaurant favorite flavors to the humble popcorn, and it was a true delight. Calbee’s spicy hot pot flavored chips are so on trend as mala takes center stage in the restaurant world, as many consumers yearn for the numbing spicy flavor. The Sichuan peppercorn flavor has done well in the condiments aisle, and we’ve seen just how successful the condiments to snack pipeline has been in the past.

Influencers In The Snack Aisle

The CPG space is no stranger to influencer or celebrity-founded/related brands; thus, we saw a handful of them taking on the snack aisle at the show.

David Dobrik’s – Doughbrik’s Wavers features on-trend flavors in this crispy snack and builds off his pizza restaurant.

Khloe Kardashian, on the other hand, founded Khloud, a protein popcorn brand with 7g of protein per serving. The popcorn has a coating of milk protein isolate powder, which gives it an interesting texture.

Next, Mr. Beast’s collab with Jack Link’s on cobranded beef jerky and meat sticks. So if you’re a parent, perhaps you’ll find that your little one might be a little more interested in jerky than ever before. Though this is his first collaboration with a large CPG company, it’s not his first time in the snack aisle as he has Feastables, his chocolate snack brand, and… Lunchly.

Fruit Blox, on the other hand, is a fruit snacks company that is made in partnership with YouTubers that are popular with children, like Aphmau and more, who have over 20 million subscribers.

To our surprise, it is unrelated to Roblox, a gaming platform popular with children that boasts over 97.8 million daily active users. Brands are still figuring out the best way to engage the audience, but it is a space to watch. Roblox recently announced a partnership with Google on the ad side, which could make it one of the top places to reach a younger audience one day.

The Evolution Of Snacking

Sweets & Snacks Expo 2025 showed that manufacturers are responding to evolving consumer needs. Novel textures, global flavors, and better-for-you snacks continue to push innovation in this category. To learn more about these shifts in Snacking, read our latest report – Evolution of Snacking: From Impulse to Intention.