Today’s Growth Drivers: Innovative Ingredients and Accelerating Trends

Health and wellness have been hot topics this year, with some shoppers becoming more invested in eating nutritiously and mindfully than they did before the pandemic. As you know, however, the wellness trends driving growth over the last year aren’t new. In fact, they are longstanding dietary and lifestyle habits that are bolstering the natural market and spurring more innovation.

In the last year, organic, non-GMO, and gluten-free products consistently outperformed their analog counterparts across a variety of categories, whether it was coffee and tea or plant-based meat alternatives. Organic shelf-stable seasons grew 66.3% vs 37.0% for non-organic; label non-GMO baking mix, ingredients, and flour grew 124.43% vs 24.1% for products without the label.

Recently, SPINS experts analyzed SPINS shopper-centric attributes to identify the ingredients that are driving this growth across the health and wellness ecosystem. Here are 3 of the leading growth drivers in today’s market.

Superfoods: Unprocessed, Nutritious, and Convenient

Some ingredients have been dietary staples throughout the world for thousands of years, and many of them have gained popularity with wider audiences in today’s grocery stores. These heritage ingredients are not only essential components of many longstanding diets, but they also fit in with today’s newer dietary and lifestyle trends, such as clean eating, paleo, and grain-free.

Clean eating trends have proven how many shoppers are looking for foods that are not processed, have no artificial ingredients, and pack a nutritional punch. Superfoods have become sought-after items on shopping lists for this reason. Shoppers can find superfoods in the food and beverage aisles—and they certainly are if you look at sales over the last 3 years. The focus on superfoods increased in early 2020 as COVID took center stage for shoppers looking to stay healthy any way they could—particularly via diets.

For example, mushrooms are a superfood that has been rising since last year and found an even larger audience in 2020. With a wide range to choose from, shoppers have boosted sales of various mushroom types by more than 50% year over year. This array of options has also translated into innovation, with functional mushrooms now in shelf-stable creams and creamers, desserts and dessert toppings, and hot cereals. Emerging trends are also benefitting from the rising popularity, with year-over-year dollar growth up nearly 1200% in shelf-stable drink mixes and concentrates containing functional mushrooms.

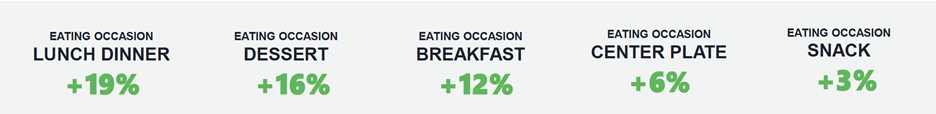

The prevalence of superfoods in a variety of products means shoppers can test them out easily by buying one can of a functional kombucha or a box of pasta. This convenience means superfoods can gradually become part of a weekly diet without a long-term commitment that other dietary or lifestyle trends require. The increased sales in products containing superfoods across all eating occasions (or meals) highlight the versatility and convenience they bring to the table—literally.

Heritage Ingredients: Time-tested Ingredients Continue to Attract New Shoppers

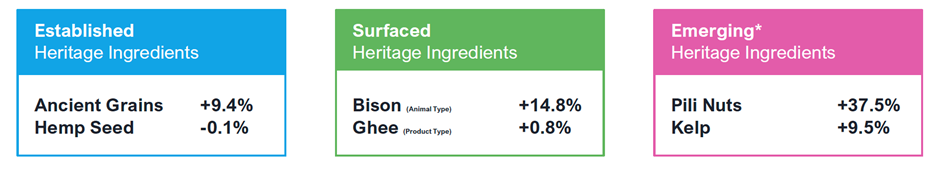

Some ingredients have been dietary staples throughout the world for thousands of years, and many of them have gained popularity with wider audiences in today’s grocery stores. These heritage ingredients are not only essential components of many longstanding diets, but they also fit in with today’s newer dietary and lifestyle trends, such as clean eating, paleo, and grain-free.

Over the last year, these ingredients have experienced sales growth, with pili nuts up 37.5%, bison up 14.8%, and ancient grains up 9.4%. Much like superfoods, heritage ingredients suit a wide range of shopper needs, from wanting to eat healthier to addressing a specific concern. For example, wellness teas contain a wealth of heritage ingredients and shoppers—especially in light of this year’s health concerns—are stocking up, with immunity-supporting teas up 25.1%, digestive teas up 20.3%, and stress/relaxation teas up 15.1%.

Sweeteners: Sugar Alternatives and Low Carbs Gain Popularity With Evolving Diets

Many shoppers have turned away from foods containing added sugars in an effort to eat well, stay healthy, and lose weight. Some popular diets heavily restrict sugar intake while others push for natural options. Fortunately, grocery store shelves and freezers are filled with products containing a wide range of sugar alternatives that even the most discerning shopper can enjoy.

Look no further than the sustaining popularity of the keto diet, which limits net carbs to 50g per day. SPINS looked at products containing 6g of net carbs or less to see how these keto-friendly items performed over the last year: Shelf stable baking mix, ingredients, and flour grew 382.3%, shelf stable cold cereals grew 34.8%, and shelf stable cookies and snack bars grew 34.2%. Notably, this growth easily outpaced that of similar items containing more than 6g of net carbs.

Lower carb content is only part of the sugar story. Innovation is also driving growth as shoppers don’t want to give up their favorite foods even as they reduce their sugar intake. Beverages with sugar alternatives have experienced strong year over year growth. Beverages sweetened with a combination of monk fruit, sugar alcohol, and stevia are up 41%, while beverages with just monk fruit are up 17%, and those with just sugar alcohol are up 12%.