The Natural Products Industry is a Force

If you tune into the annual State of the Union address, you are almost certainly going to hear “the State of the Union is strong” regardless of the current situation. At this year’s “The State of Natural” presentation at Expo West, leaders from SPINS, New Hope Network, and Whipstitch Capital delivered an overview of the industry’s status. Their resounding message: the natural products industry is a force—and the data proves it.

Watch the full State of Natural presentation and discover even more insights.

Watch NowNatural Is the Mainstream

Since 2007, the natural and organics product industry has grown from $97 billion to over $300 billion—more than tripling in size and showing volume growth every year. Growth slowed to an estimated 4.7% last year, but U.S. natural and organic industry consumer sales hit $302B in 2023 and the projected growth outlook for 2024 is 5.1%. This momentum is in part due to how central natural and organic products have become to consumers across demographics. Natural has moved beyond niche and established itself as mainstream.

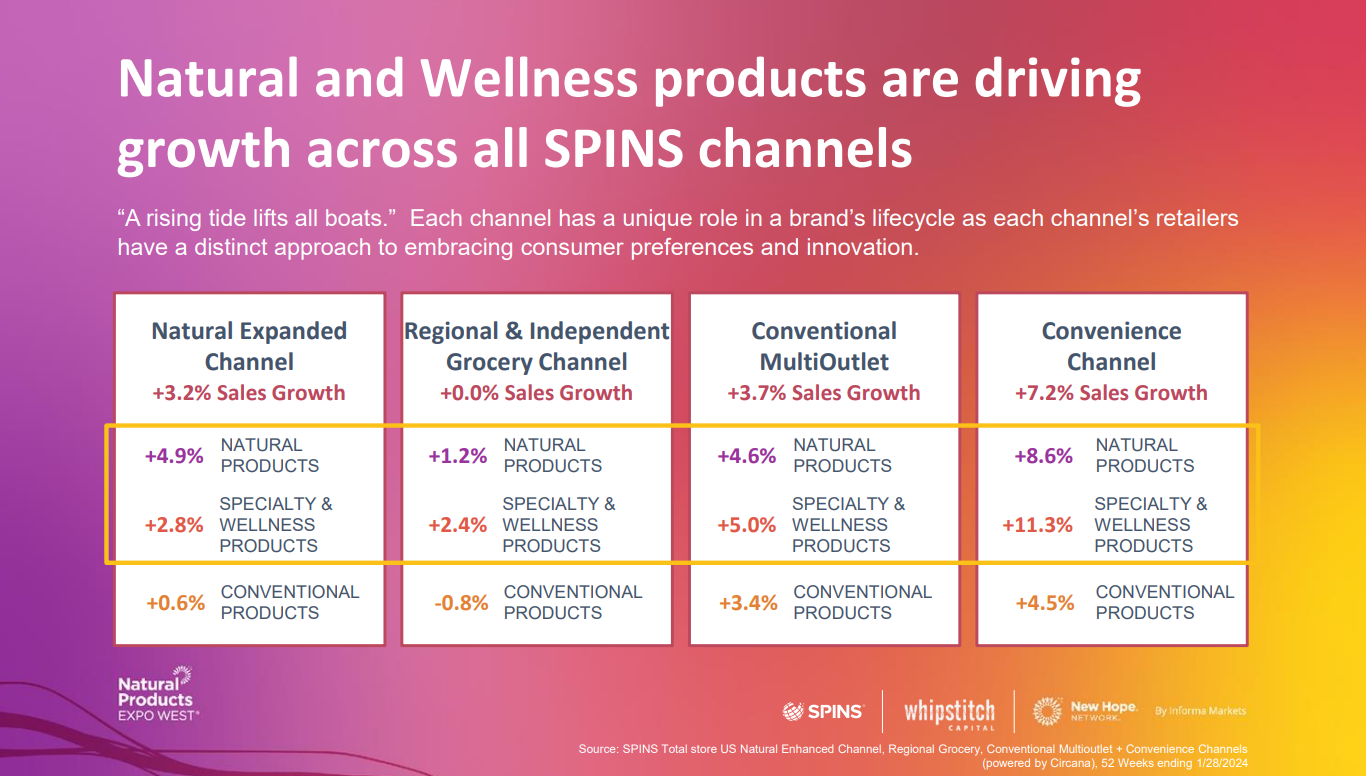

This strong performance is manifesting in several ways:

- eCommerce sales grew an estimated 7.3% in 2023 (following dramatic drops in 2021 and 2022)

- Natural products are once again leading growth across all outlets (based on change in dollar sales versus the prior year)

- In 2023, organic sales outpaced non-organic in both dollars and unit growth, signaling consumers’ growing trust in the organic seal

- Natural and wellness products are driving growth across all SPINS channels

4 Macrotrends to Understand the Evolving Consumer Mindset

Because change is a constant part of the CPG industry, deciding which consumer trends will lead to meaningful shifts can be difficult. Are today’s hottest items going to be in demand next quarter? Is one product’s popularity indicative of a larger change? Some of the rising consumer trends point to a shift in mindset that will have long-term implications. These trends are going to move the natural industry in a new, exciting direction.

1. Lifespan to Healthspan

A shift from quantity versus quality is spurring consumers to reevaluate how they measure their later years in life. Lifespan, or how long someone lives, has historically been the metric used to define aging. Today, more people are focusing on healthspan, measured by personal satisfaction, and puts more power in consumers’ hands. Healthspan asks consumers to consider what they want their golden years to look like and how they want to get there. Nutrition is central to that.

Food as medicine has been gaining traction for many years and took center stage when the pandemic began and consumers wanted to improve their health via everyday habits they could control. They still want that power and are turning to functional food, beverages, and supplements to address their health and well-being, such as mood support, digestive health, and energy support.

Nothing illustrates this mindset better than functional beverages, which are beverages containing added functional ingredients to relieve anxiety, support mindfulness, and

create alcohol alternatives for social connectivity. As a result, non-alcoholic beer sales are up 28.5% despite the total beer category being down 0.6%.

2. New Global Notions

Several factors have made cuisines from every region in the world accessible to consumers no matter where they live. Social media, an increasingly diverse population, and the rise of the foodie are demystifying global flavors and bringing new energy to grocery shopping. SPINS data, for example, shows 160% growth in bao buns over a 52-week increase. This openness to new tastes has encouraged shoppers to embrace bulgogi, various culture butters, bao, chili sauces, and more. That wasn’t the norm 10 or 20 years ago. With younger shoppers more open to global flavors than older generations, this adventurous approach to cuisine is likely to continue.

3. Intentional Indulgence

Today’s shoppers are indulging strategically: so-called “cheat days” are about more than just eating foods normally enjoyed in moderation. Today’s shoppers are still treating themselves from time to time, but they’re opting for premium ingredients and products that align with their values. Kodiak’s microwavable flapjack mix makes a traditional carb-heavy breakfast convenient and filled with protein. Bachan’s Original Japanese Barbecue Sauce easily elevates a dish with clean ingredients. Tony’s Chocolonely selection of chocolate satisfies sweet tooths with the promise of exploitation-free manufacturing. Shoppers are thinking beyond just the taste of these products when they’re indulging in a bit of culinary self-care.

4. Sustainability

Sustainability continues to gain traction with shoppers, from upcycled to regenerative organic. Although planetary health is on consumers’ minds, shoppers still need education on sustainability’s various options and definitions. There are some clear signs of sustainability’s popularity, but there are also indications that other factors might be more important in store aisles. For example, certified upcycled snacks are up 115.5%, yet overall certified upcycled products are down 5.6%. Products labeled grass-fed are up 16.9% and certified regenerative organic products are up 8.6%, compared to a 3.5% increase in certified non-GMO Project products.

Some retailers are courting shoppers with their own sustainable practices and commitments. From requirements for pesticide avoidance to only stocking organic or fair/direct trade coffees, these retailers are giving shoppers a reason to choose their stores and shop with confidence.

The Industry Is Strong and Evolving

The data proves that the natural products industry not only continues to grow but that it also is a staple of mainstream culture. Natural products end up in shopping carts of everyone from vegans to busy parents packing lunches for their kids and making meals for picky eaters. As natural brands continue to offer products that meet a variety of consumer values, the industry will continue to grow and meet consumers where they are.