Introduction

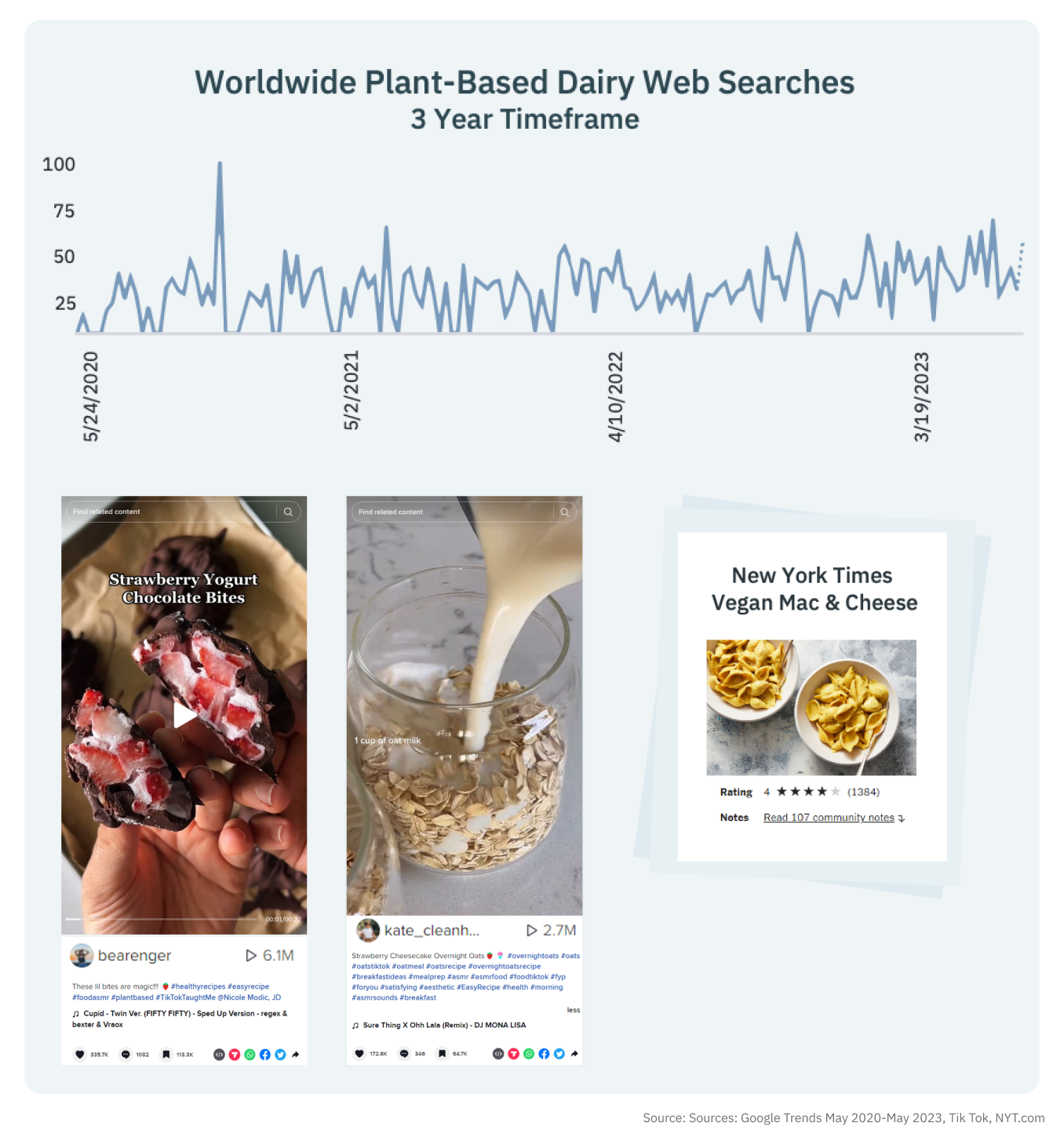

The plant-based category, particularly the plant-based meat category has had a tumultuous year with large brands in the space having to lay off workers due to changing market conditions and lower sales. However, despite a slump over recent months, the global interest in plant-based products remains high online, with Australia, Ireland and the U.S. leading the search interest. Social media platforms like TikTok and Instagram continue to showcase plant-based recipes, affirming the growing market opportunity for plant-based products.

As we dive into the plant-based category, we’ll look at subcategories like plant-based milk, creams & creamers, meat alternatives, and more. We’ll explore how the overall category is doing, what new technologies have made some headways, and highlight some bright spots in the plant-based industry.

Market Dynamics

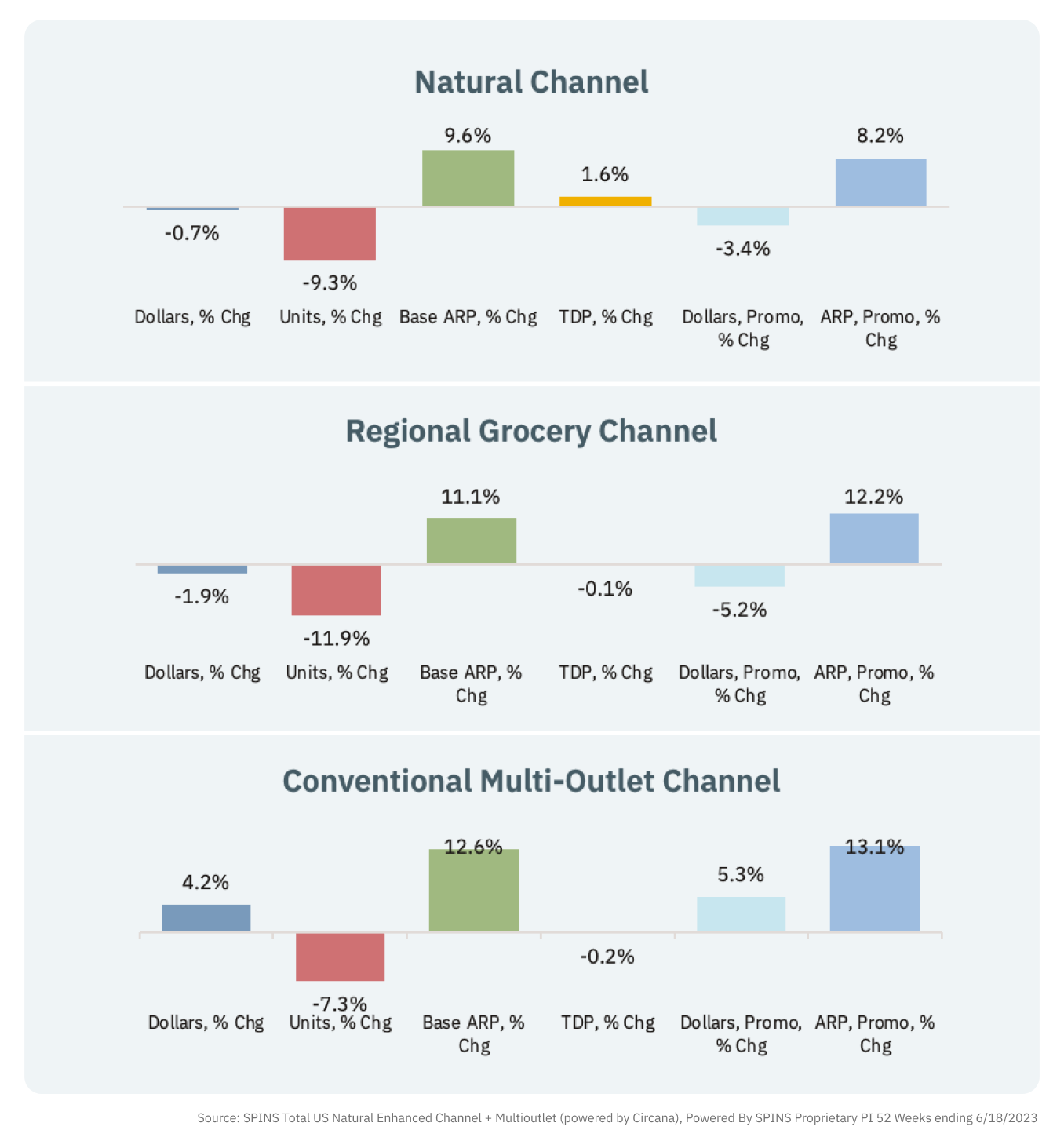

Examining metrics like dollar sales, unit sales and average retail price across channels revealed that in conventional channels, the plant-based category showed growth in dollars but declined in units. This is likely due to inflation and the increase in promoted dollars.

Meanwhile, in natural and regional channels, the category is seeing a decline in both dollar and unit sales. What’s key to note here is that in the natural channel, the base average retail price did not see as large of an increase. Moreover, distribution overall has expanded more in the natural channel versus the conventional channel.

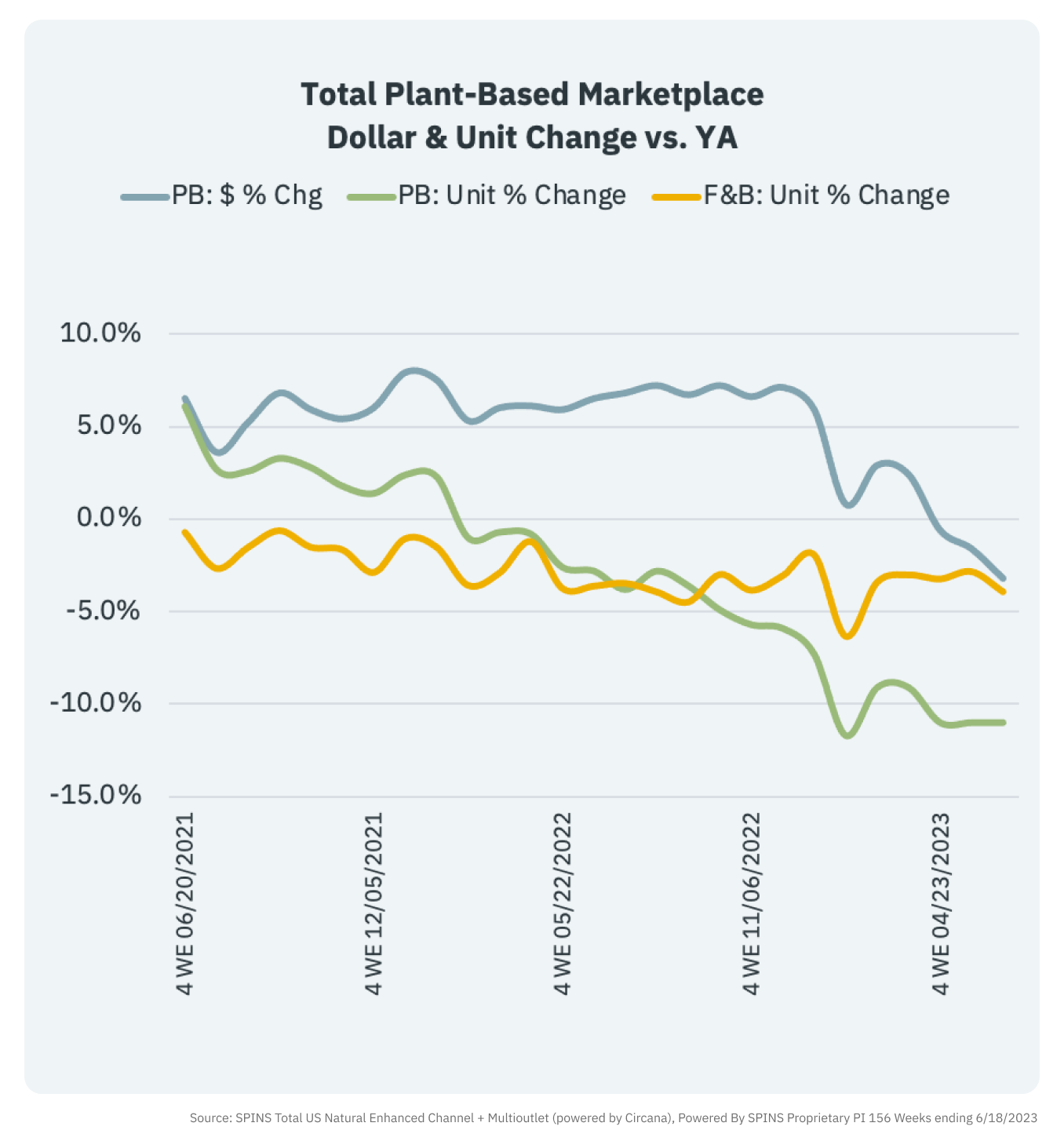

Looking at sales of the plant-based category over a two-year period, we see that by July 2021, plant-based units began pulling away from total dollar gains and started swinging downwards into the negative territory. More recently, dollar sales have started to follow that trend while overall food and beverage has remained relatively flat to slightly down in dollars.

The Changing Face of the Plant-Based Segment

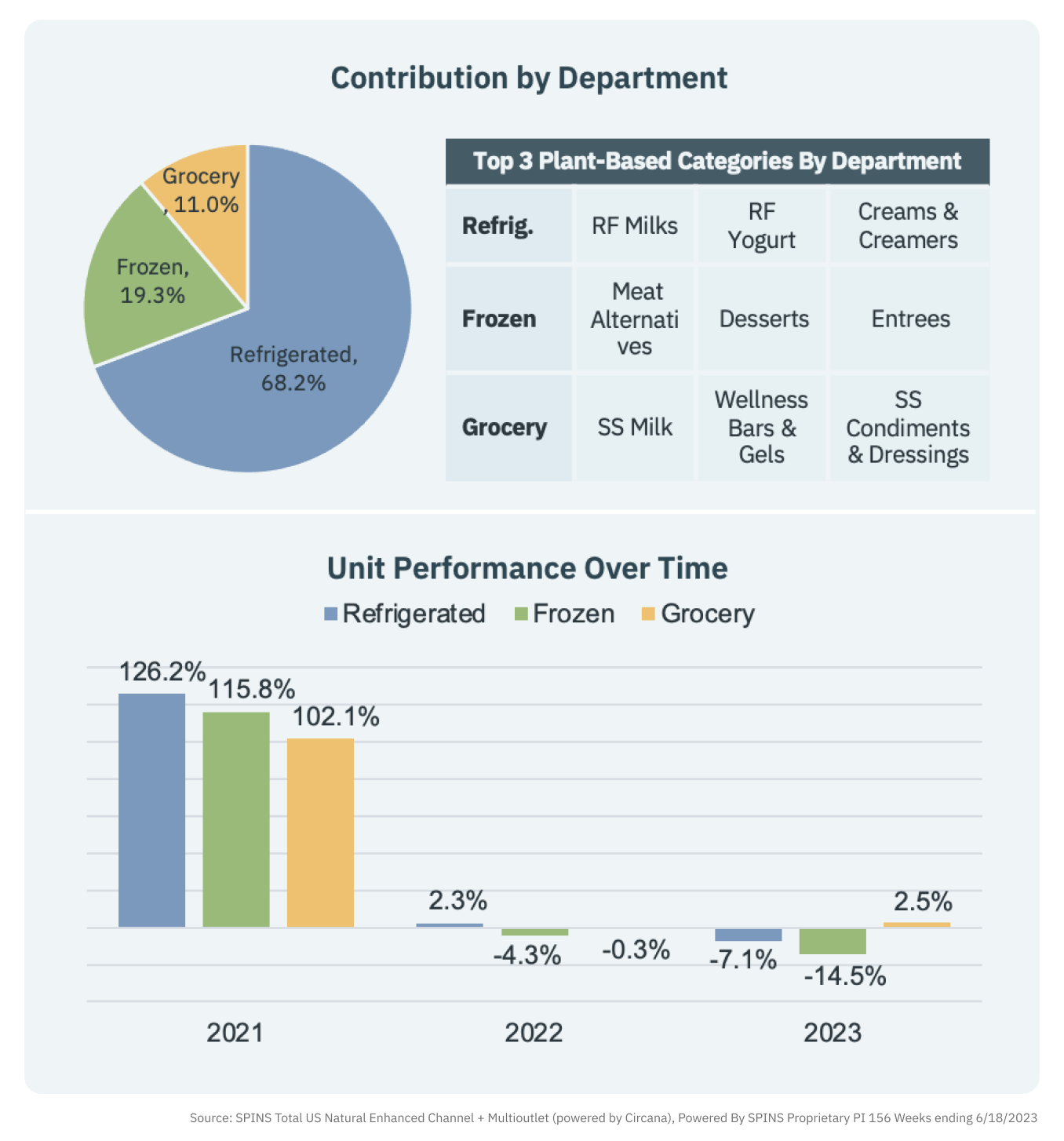

In the ever-evolving landscape of the plant-based sector, a downward trend has emerged due to several key factors including price parity with traditional options, health concerns, and continued higher costs. Examining the performance at a department level reveals that the majority of the plant-based sector consists of refrigerated and frozen products, with notable categories being refrigerated milk, yogurt, meat alternatives, and frozen desserts.

During COVID, there was a surge of interest in plant-based options among omnivores and flexitarians, due in part to fluctuating meat prices and supply issues. However, as meat prices began to fall in 2022 and 2023, and as some consumers found themselves dissatisfied with taste or texture, there was a decline in repeat purchases. Nevertheless, the grocery department has seen some success in 2023, particularly in natural products, which command a significant portion of the market. Refrigerated milk, frozen meat alternatives and creams and creamers are leading the way in specific categories. In short, refrigerated and frozen products continue to have the most significant impact on the overall plant-based segment, determining the direction of the entire sector.

Insights on Plant-Based Milk

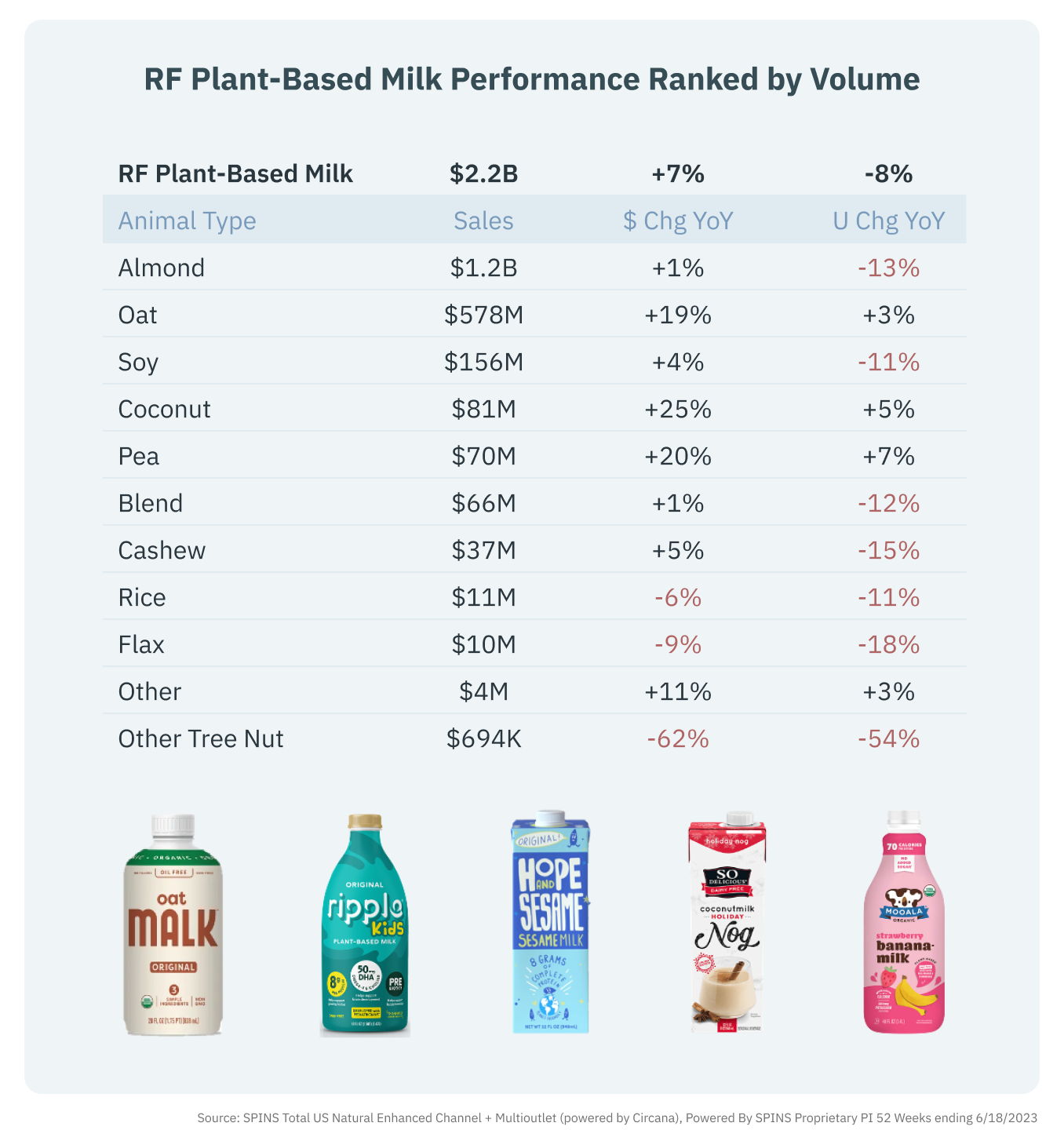

The overall growth of the plant-based milk is mainly being driven by inflation and almond milk which has the largest market share in this category is experiencing a -13% decline in unit sales. Meanwhile, oat milk continues its market expansion, growing in both dollar and unit sales at 19% and 3% respectively. Coconut and pea milk are gaining momentum, showing that consumer interest in trying different types of plant-based milks is still strong.

A marked preference is being seen for flavored milks as they are perceived as more approachable for children. Additionally, plant-based milks with higher protein contents or those that are on par with traditional dairy counterparts are seeing strong sales.

Taking a deeper dive into what attributes within the plant-based milk space are growing, we see that grain-free milk is experiencing unparalleled growth, mirroring a broader trend in the food and beverage sector over the last three years. Meanwhile, preferences for almond, cream, and probiotics are increasing, whereas Paleo-positioned, allergen-friendly products, and certain flavors like chocolate and fruit are witnessing a decline. These evolving trends highlight the complexity and nuanced changes within the milk category, demanding continuous attention from stakeholders.

Plant-Based Meat Alternatives: A Tougher Sell?

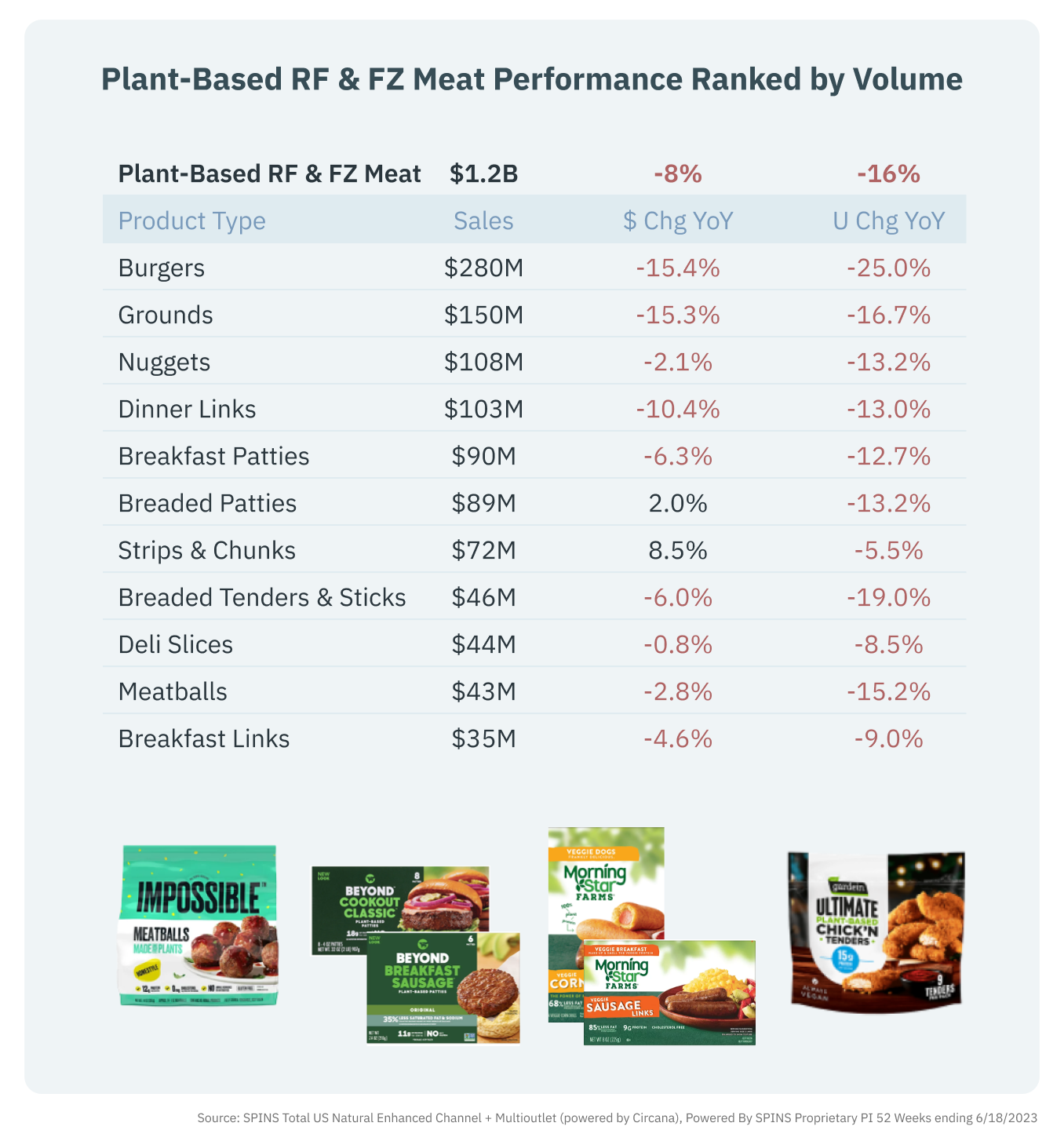

The plant-based meat alternative category has been one that has gained tremendous amount of funding and attention over the past few years. However, it seems that criticism around the category has only grown as both dollar and unit sales continue to decline. The meat industry has long been a large contributor to greenhouse gas emissions while plant-based meat alternatives were supposed to be a possible substitute to meat that wasn’t as damaging to the earth. For a moment in time, it seemed like more and more consumers were on board with switching to plant-based meats, but that interest seems to have waned – why?

During the COVID period, plant-based meats saw a surge in sales due to factors like cost-effectiveness in comparison to animal proteins and heightened interest. However, flexitarian consumers have expressed concerns regarding the increasing premium prices amidst inflation, leading some to revert to conventional meats. Additionally, issues about taste, health, and the perceived “processed-ness” of some products have emerged, with certain plant-based meats having higher sodium content and controversial additives than their animal-based counterparts.

Despite these challenges, not all hope is lost as select plant-based meat products continue to fare well in the market, particularly products from Impossible, Beyond Meat, Morningstar Farms and Gardein.

The Rise of Lab-Grown Meats and Dairy

An emerging trend within the broader meat and dairy space is the rise of cell-cultured or lab-grown meats. Technically, these products don’t come with the baggage of traditional meat, such as animal welfare, damage to the environment and so on. However, critics have voiced that nobody knows the long-term effects of eating cell-cultured meat, and that consumers should be wary of that.

Another technological advancement making waves is precision fermentation, a process of producing animal protein equivalents using yeast, fungi, and microalgae. This technology is being explored by over 100 companies worldwide and though this market is still in its early stages, it brings with it new questions about the role of technology in food production. As the industry evolves, it’s critical to remain open to these technological breakthroughs and their potential to address social, economic, and climate issues.

The Surge in Plant-Based Creams and Creamers

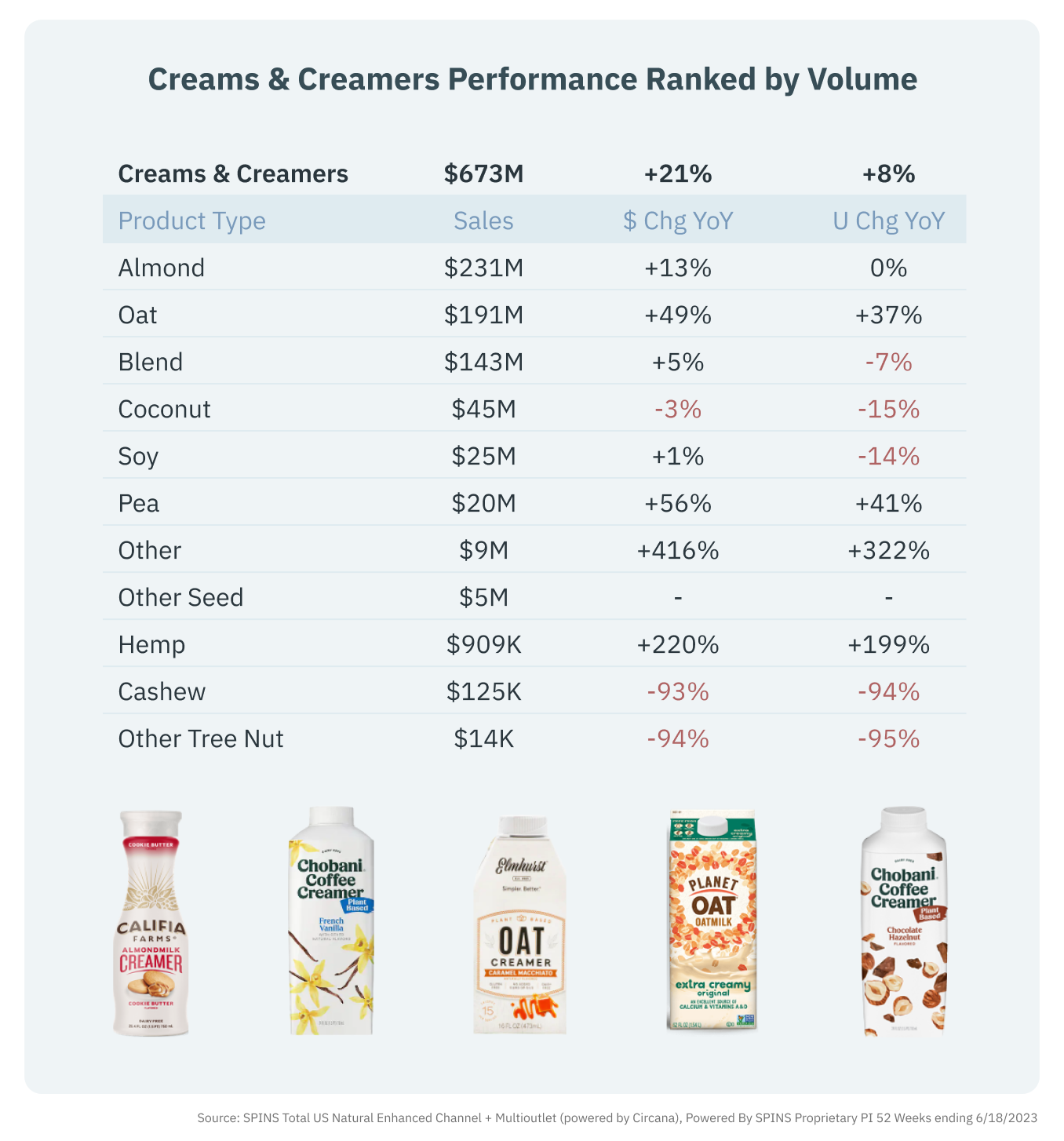

Plant-based creams and creamers is the second largest sub-category in the plant-based dairy sector and experiencing strong growth with a 21% increase in dollar sales and an 8% increase in unit sales. Almond and oat are leading the category, driving double-digit growth, while exciting new products in pea and hemp have reached triple-digit growth.

There’s a plethora of flavors such as cookie, chocolate hazelnut, and caramel macchiato that bring unique innovation to the market. However, as this category continues to thrive, retailers and brands must focus on finding key points of differentiation to avoid an oversaturated market where consumers are overwhelmed by similar products. Creating distinct profiles is essential in maintaining the continued growth and appeal of plant-based creams and creamers.

What’s Trending in the Plant-Based Frozen Desserts category?

The plant-based frozen desserts category is experiencing a decline in both dollar and unit sales. However, there are a few subcategories that are seeing double-digit growth. Non-dairy novelties, such as ‘ice-cream’ sandwiches, are seeing a 14.5% increase in sales and a 6.2% increase in units sold. Other non-dairy novelties, including mochi, are seeing a 14.1% increase in sales and a 14.8% increase in unit sales.

Though whipped toppings only represent a small portion of the plant based frozen desserts category, it is seeing strong double-digit growth of over 35% in both dollar and unit sales. These fun novelty items are driving momentum, capitalizing on the ability to bring health in a better for you alternative way in the dessert space and doubling down on popular non-dairy trends like coconut, oat, and fruit flavors.

The Flat Trend in Yogurt Category

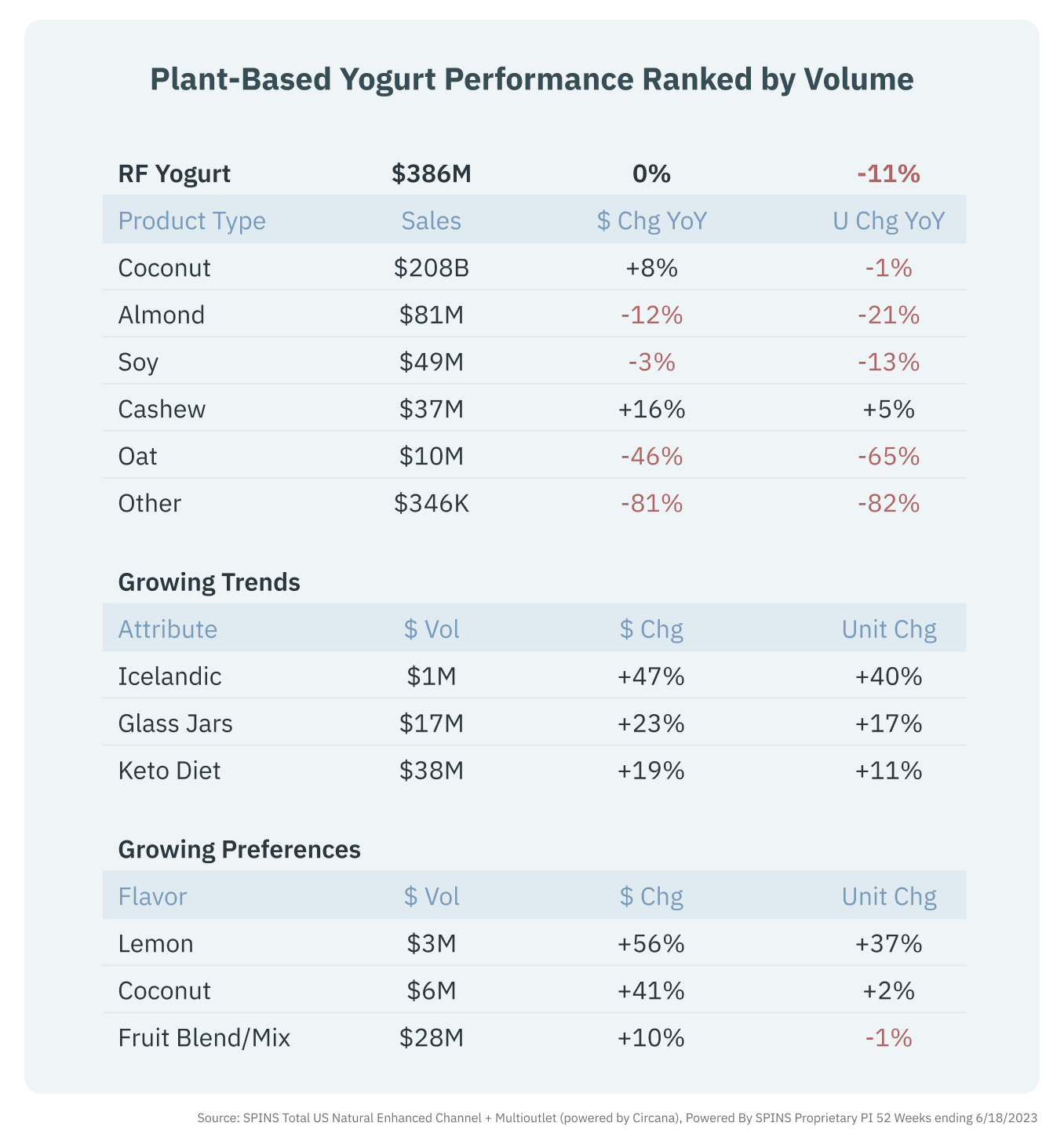

The plant-based yogurt category has established a prominent place in the market, but recent data has shown that units are declining. Despite a flat trend in revenue and declining unit sales for most types of plant-based yogurts, cashew-based yogurt stands as an exception, displaying a robust market presence with a 16% increase in dollar sales and a 5% increase in unit sales. Coconut and almond yogurts lead the category in terms of market share, but notably, almond is experiencing a severe decline, differing from trends observed in Milk and Creamers.

This challenging time for the category is contrasted by the success of Icelandic yogurt, glass jar packaging, and keto-friendly options, which have shown steady double-digit growth over the past year.

Bright spots within the industry reveal consumer preferences leaning towards innovative, sustainable and health-conscious choices. When looking at which flavors are consumers are gravitating towards, fruit flavors such as lemon, coconut, and blended options, are currently dominating the charts, reflecting the changing tastes of consumers.

Conclusion

The plant-based category has had a difficult year so far with the sector experiencing softness in units and dollars across most categories. However, categories like plant-based milks and creamers are still promising with high engagement. In the plant-based meat alternative world, the category isn’t meeting current expectations, but continued innovation and the future of cultured proteins could bring unique solutions to the sector.

As we continue into the second half of 2023, the plant-based segment remains a landscape of both opportunities and challenges. The continued interest in plant-based products opens the door for innovation and the potential for growth. By understanding consumer preferences and leveraging emerging technologies, brands and retailers can navigate this exciting space successfully.