Introduction

Keeping up with what’s going on a daily basis and emerging trends is a lot of work, particularly in the natural food and wellness market, which has not had a slow day since the pandemic hit. Trying to look ahead and plan for the coming months as the pandemic continues and even after it begins to fade away is tricky. You can’t just look at the usual Q3 and Q4 data to figure out how to move forward.

To help you navigate the future during an unusual time, we’ve been tracking emerging trends to understand what the current market looks like and forging new partnerships and innovations to provide tools that businesses need to grow and compete. Based on what we’ve seen through in data, here are ways you can start planning for the future:

Look at 2008

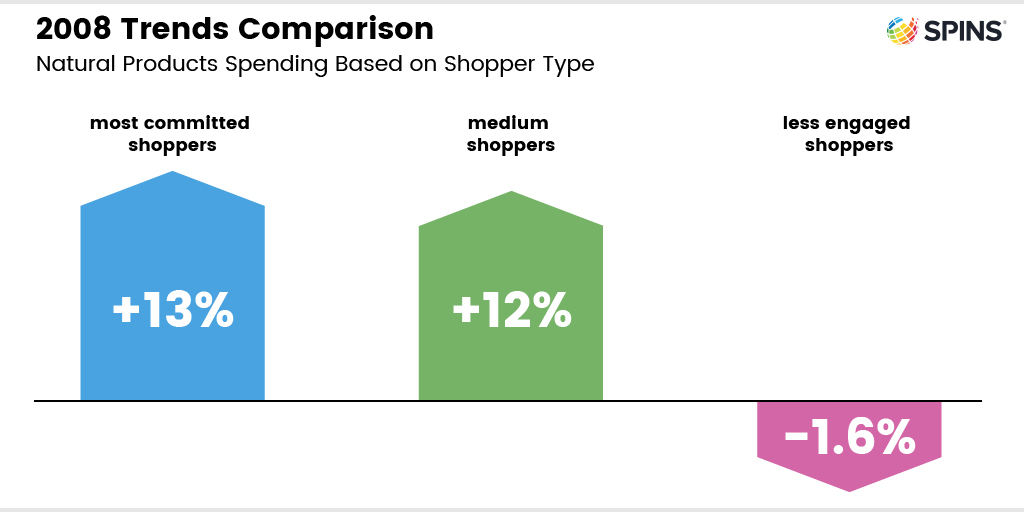

The financial crisis that let down the previous recession wasn’t identical to what’s happening now, but those consumer trends are a good indicator of what you can expect to see. In 2008, the natural and organic market continued to grow despite economic concerns among consumers. From 2007 through 2009, natural sales by dollar remained positive. You can expect shoppers to repeat that pattern but likely retain even stronger sales than we saw in the last recession because they are taking proactive health measures in light of the pandemic.

In 2020 we’ve seen shoppers purchasing natural products at high levels before, during, and after the initial pantry loading phase. Since then, committed natural consumers have continued to grow both in the number of shoppers and dollars spent. These are the customers who will continue to return and invest in natural products even after the economy recovers and pandemic are behind us.

Watch for Growth in Natural

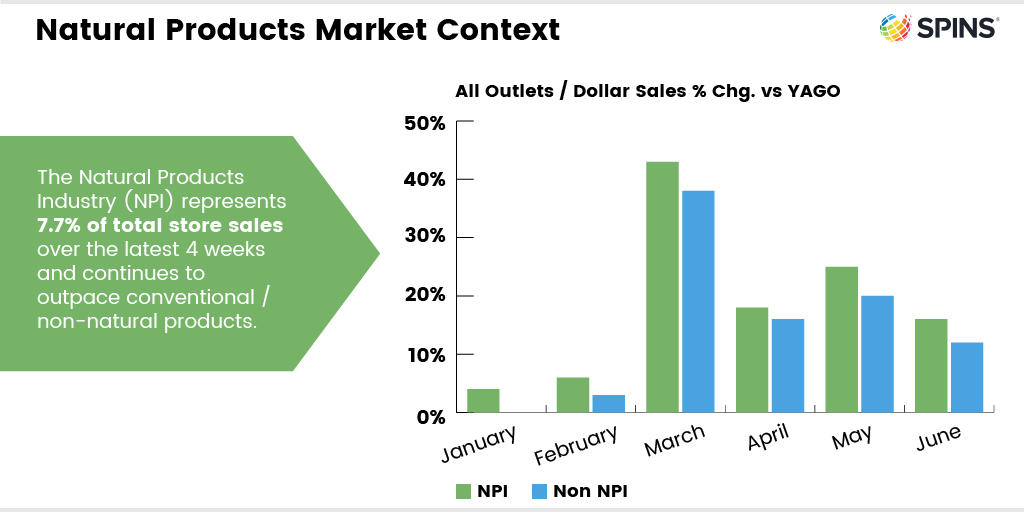

Not only have natural shoppers been faithful throughout the year, but the overall natural market is outperforming its conventional counterpart. The Natural Products Industry (NPI) has become 7.7% of total store sales in the 4-week period leading up to June 14.

Perhaps more impressively, natural for the first half of the year natural has repeatedly outgrown conventional/non-natural products each month. Although the pantry loading phase had the most aggressive growth for both natural and conventional, with 43% and 38%, respectively, the subsequent months have remained strong. As recently as June, natural was still up 16% compared to a year ago. Expect this to continue as some states re-open and others slide back into lockdown once again.

Holiday Staples Are Still In Demand

Since the start of COVID-19, we’ve had a few food-centric holidays, including Memorial Day and the 4th of July. We know that customers stocked up on grill-friendly items, especially plant-based meat alternatives and conventional meats, signaling a desire to retain their annual traditions even during a pandemic (and with more natural products than they might have in the past). Looking forward to Labor Day, expect to see BBQ items once again perform well for the unofficial end of summer holiday. We don’t yet know if large family gatherings and cross-country traveling will happen during the winter holidays, but the meals will still happen.

As we head into the final stretch of the holidays, items like stuffing mix, poultry, vegetables, and soups will still be go-tos for shoppers.

Focus On Customer Concerns

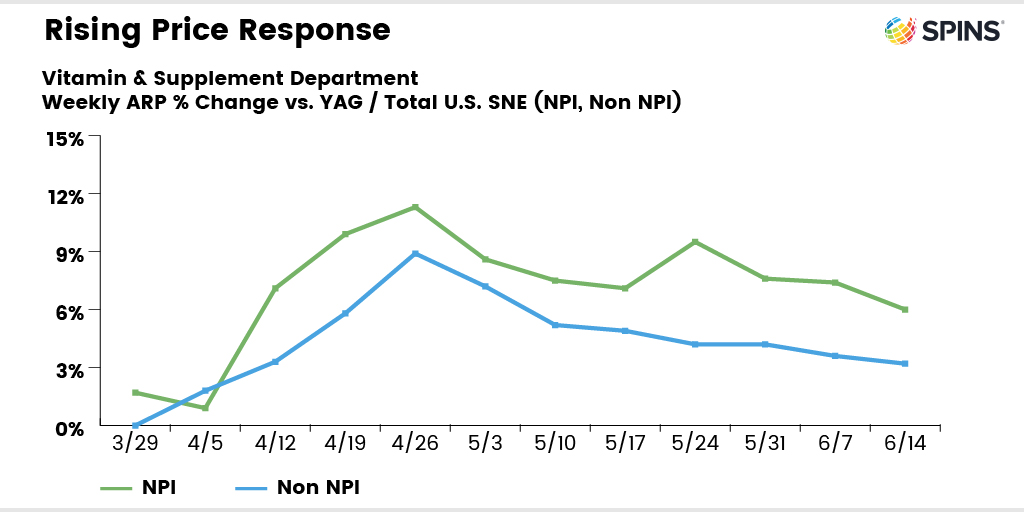

Average retail prices are increasing, promotions have decreased, at-home meals require more purchases, and financial concerns are real. These factors create a complicated situation for consumers who are committed to purchasing natural and wellness products. As you work with your retail partners, think about how you can address these concerns and appeals to consumers to show that your products are the right fit for their price points and focus on wellness in a stressful time.

SPINS is here with the insights and data to help you succeed today and in the future. If you’re interested in finding out more about how we can help your business grow, contact us today.