Introduction

This article was produced by Anthony Balderrama, Senior Content Manager, SPINS and Sarah Marzano, Director, Retail, Circana

Although pets have long been part of the family, their role as cherished family members continues to evolve. Terms like “granddog” have emerged to indicate pets are loved as much as grandchildren, for example. Anyone who’s scrolled through social media recently has likely seen Instagram accounts written from animals’ points of view and TikTok videos of pets enjoying painstakingly crafted meals while wearing formal attire (and they have hundreds of thousands of followers). Our collective love for animals has humanized pets in a way the industry has not seen before.

“The culture around pets has shifted. Pet owners are doing their research, reading labels, and setting high standards just like they do when buying their own groceries,” says Jeffrey Kamholz, who oversees the SPINS Pet Channel as sales director and has a black Lab named Ginger. “The pet industry has been paying attention and now offers the innovation and quality that they’re demanding. That work needs to continue because these pet trends — just like other health and wellness trends — are not static and will continue to evolve.”

The Current State of the Pet Industry

According to data from the SPINS Pet Channel, dollar growth for the pet food category rose 8.9% year over year, with cat food growing 9.3% and dog food growing 9.1% over the 52 weeks ending April 23, 2023. (Data from Circana for the same period showed average prices for pet food increasing by 18% amid an environment of extreme inflation). Despite similar growth rates, dog food is the primary driver of category growth because it accounts for 78.8% of the category share, compared to cat food’s 18.0% share.

Conventional and specialty brands showed strong growth for that same time period: Specialty/wellness sales grew 16.6%, with conventional growing 11.7%. While natural products grew 5.0%, it’s worth noting that natural and specialty/wellness products account for 88.5% of all sales in consumables. That emphasis on natural and specialty products points to pet owners — or pet parents, as some prefer to be called — who shop for their pets like they shop for their human family members.

Although positive dollar growth is a promising indicator, retailers, and brands that sell pet products are facing a multitude of challenges. Dollar growth is primarily driven by price increases, and consumers are operating amid a continually difficult economic landscape. Exacerbating these factors in pet is that unprecedented changes in lifestyle and behavior during the COVID-19 pandemic contributed to a surge in pet product sales (partially driven by increased pet adoption rates) that will be increasingly difficult to comp in the coming months and years. Given these hurdles, understanding which product innovations are sparking consumer interest will be critical to drive demand.

Here are four ways that the humanization of pets is showing up in stores:

1. INNOVATIVE FORMULAS

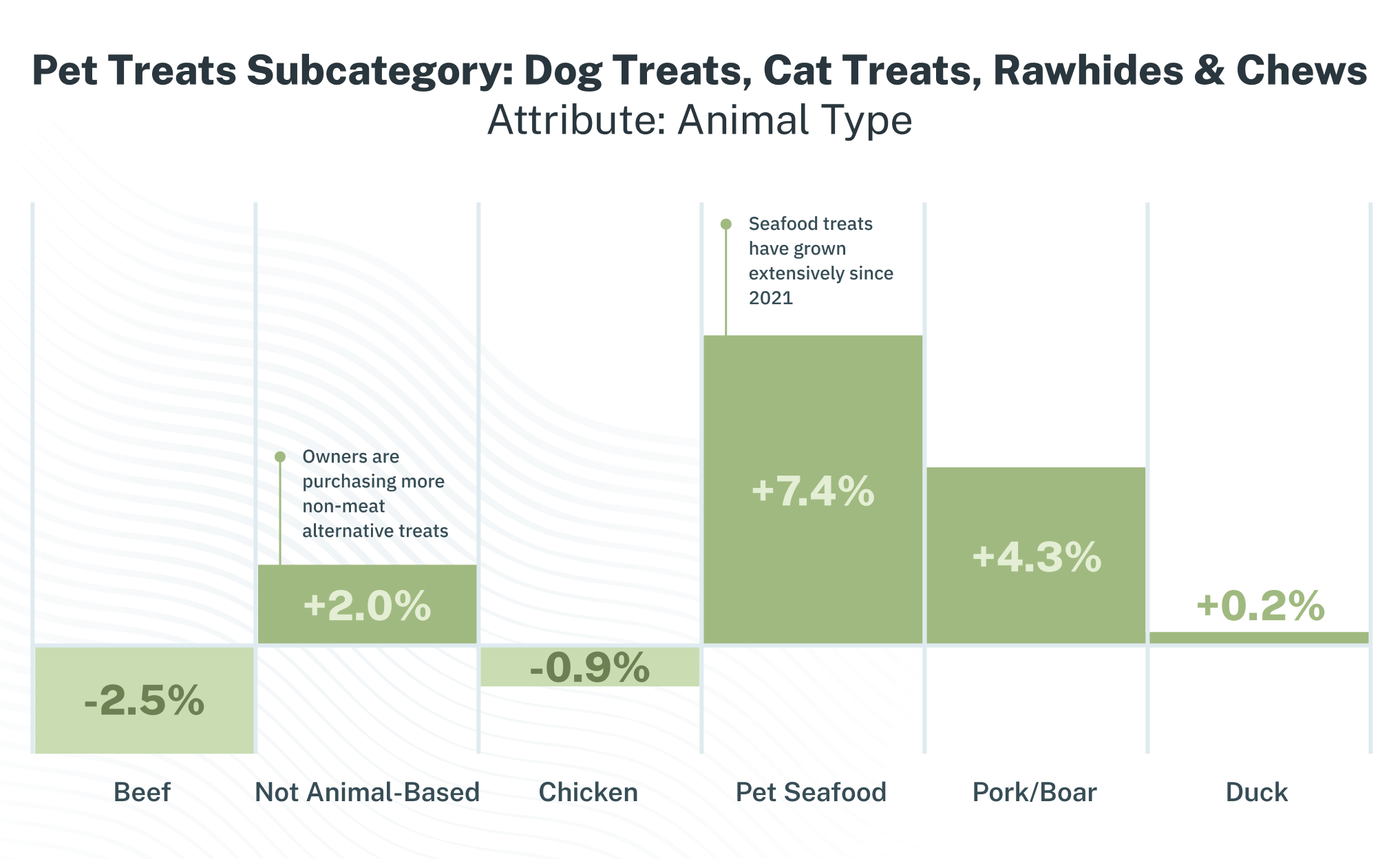

Few things bring pets more joy than getting treats, and pet owners are beginning to think differently about what they reward their favorite four-legged friends with. While the pet treat subcategory had a modest 1.9% growth over the last year, alternative protein sources to beef and chicken are gaining steam. Pet seafood treats are up 7.4%, and pork/boar treats are up 4.3%, while both beef and chicken saw modest declines. Perhaps most interesting is the 2.0% increase in non-animal-based treats, suggesting pet owners are bringing increasingly popular plant-based and flexitarian diets to the nonhumans in the household.

Pet Treats Subcategory: Dog Treats, Cat Treats, Rawhides & Chews

2. ALTERNATIVES TO DRY KIBBLE

While shelf-stable pet food still dominates the food and treats category with 93% of dollar share and 6.5% dollar growth, new options are gaining traction. Frozen pet food accounts for 6.7% of category dollar share and saw a 3.6% increase, while refrigerated food is a much smaller share (0.3%) but saw a strong 28.8% growth. This is notable for a couple of reasons: Frozen and refrigerated products are often sold at a premium price compared to shelf-stable items, and they require more effort to find and properly store. Pet owners who opt for these types of products are willing to go an extra step for their pets. In “The Top 3 Trends Shaping The Pet Care Industry,” Circana analyst Sarah Marzano cited a trend of increased in-store visits for pet food purchases alongside significant growth rates for frozen and refrigerated dog food.

3. NUTRIENT-DENSE FOODS

Since 2021, freeze-dried food and treats have established themselves as staples in pet pantries. Many pet owners prefer freeze-dried treats and foods because they can preserve vitamins and minerals better than traditionally made foods and possibly lead to more health and wellness benefits (e.g., healthier diets and shinier coats). Freeze-dried treats experienced 11.6% growth, outpacing other forms of treats. Raw-positioned food and treats also showed strong growth at 8.4%. As with frozen and refrigerated options, freeze-dried foods and treats are often sold at a higher price point.

4. FUNCTIONAL INGREDIENTS

Functional ingredients, which are ingredients that give a product an extra benefit, have been gaining popularity with human diets for several years. Think of beverages with vitamins or chips with added protein. It’s a convenient way to get more out of products you’re already enjoying. Pet owners are doing the same for their dogs and cats, with options for products that benefit immunity, gut health, inflammation, and more based on these top-performing ingredients:

- Hemp seeds and derivatives (as anti-inflammatories) are up 35.5%

- Collagen products (for skin and coat health) are up 32.9%

- Thiamine (for overall wellness) is up 23.2%

- Probiotic supplements (for gut health) are up 16.6%

(Based on SPINS Pet Channel, Categories: Pet Treats, Pet Care & Wellness for the 52 weeks ending April 23, 2023.)

What the Humanization of Pets Means for the Future

The evolution of pets from man’s best friend to having their premium food stored in the freezer has been gradual, but it’s been constantly moving in this direction, especially in light of the pandemic lockdown. Suddenly, office workers were home with their pets around the clock, and even if they have returned to the office, their heightened connection to their companions has remained. There’s no reason to think that pet owners are going to shift mindsets anytime soon and deprioritize the health and happiness of their dogs and cats.