Introduction

Natural Products Expo West is almost here and we’re excited to see you there. That’s why we wanted to help you make the most of the year’s biggest show. With thousands of vendors in several halls, you might feel intimidated trying to take it all in and overwhelmed enjoying all the samples. Especially right now, with everyone talking about inflation and supply chain issues and changing regulations.

As you head to Expo West, remember that natural products are still connecting with shoppers, especially as health and wellness becomes a top priority. In fact, shoppers are remaining true to their values and buying natural products at an increasing rate, outpacing other product sales growth—and brands are responding. Wellness-positioned brands were the primary source of CPG innovation and market growth based on SPINS data. When you walk into Expo West, you’re walking into the center of innovation.

That’s why we’ve put together a comprehensive Natural Products Trend Guide that helps you understand the trends that are emerging, the products to keep an eye on, and the brands to check out as you walk the Expo floor. We’ve even organized it by segment so you can find the information most relevant to you.

Here are just a few highlights from the guide:

Snacks and Beverages

Innovative ingredients, especially functional ones, continue to drive growth for top-performing snacks and beverages. Super mushrooms have been a hot ingredient in recent years due to their association with several health benefits ranging from reduced inflammation to lowering cholesterol and addressing anxiety. Versatile mushrooms like reishi, lion’s mane, and turkey tail have experienced a dip within the vitamins and supplements category (down 2.6% year over year), but they are finding an audience in snacks and beverages (up 28.6% year over year). Many brands are including these mushrooms as differentiating ingredients.

Within the snack and beverage department, these categories are showing the most growth for super mushroom ingredients:*

- Ready-to-drink shelf-stable tea and coffee (321.0%)

- Shelf-stable cookies and snack bars (61%)

- Wellness bars and gels (48.4%)

- Kombucha and other functional beverages (46.2%)

- Creams and creamers (42.3%)

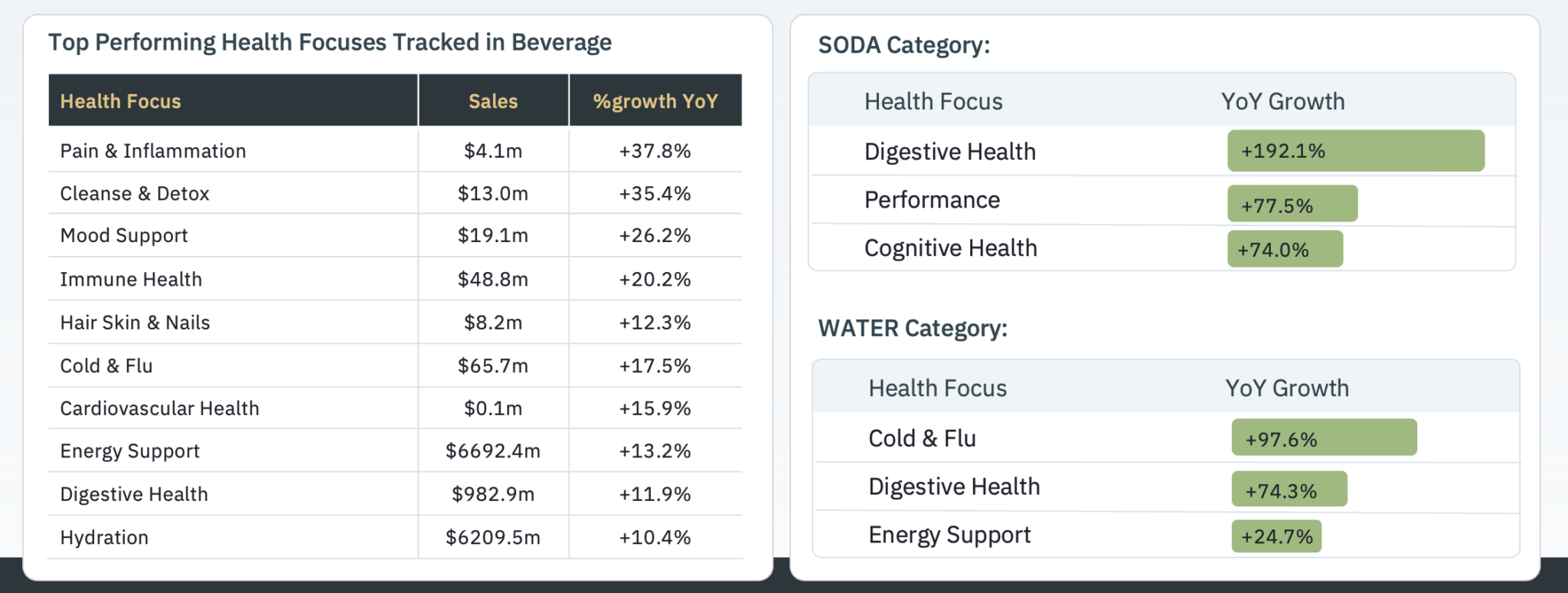

Beverages aren’t just for quenching thirst anymore. For many shoppers, beverages are an opportunity to maintain personal wellness or combat a specific ailment. Within beverage categories, digestive health-focused products experienced 192.1% growth in sodas, while cold and flu-focused items saw 97.6% growth within water.*

Shoppers are also reevaluating the sweeteners they’re willing to consume. While ready-to-drink beverages are up 8.9% overall, beverages with natural and sugar alcohol sweeteners are driving the most growth. Beverages showing the most growth contain:**

- Coconut sugar (47%)

- Erythritol (26%)

- Sugar alcohols (23%)

- Natural low-calorie sweeteners (20%)

More controversial ingredients are also growing, but not quite as much:

- Artificial sweeteners, aspartame, and sucralose are each up 11%

- High fructose corn syrup is up 7%

Meat, Dairy, and Plant-Based Alternatives

Meat and dairy have been refrigerator staples for so long that they’re in Norman Rockwell paintings, but right now they are the face of grocery innovation and as far from old-fashioned as you can get. Look no further than the new generation of ingredients disrupting dairy. A process called precision fermentation results in animal-free dairy proteins that are considered sustainable alternatives and identical to animal-derived milk proteins. Dairy and livestock producers have taken a proactive approach as early adopters of a variety of sustainable efforts and “next-gen” items.

For example, regenerative organic products aim to restore and replenish soil health without the use of toxic chemicals. Looking at certified regenerative organic products:

- Refrigerated yogurt is up 1304.55%

- Milk is up 133.1%

- Refrigerated eggs are up 76.8%

The dairy industry isn’t giving up on animal-derived protein products, however. They are integrating sustainable production practices to appeal to shoppers—and it’s working:

The combination of values-driven consumers and innovative brands is bringing exciting changes to yogurt and meat alternatives. Today, shoppers can find dairy-free and keto-friendly plant-based yogurt as well as plant-based pork gyoza and even high-protein plant-based steaks.

Center Store and Frozen

The center store has been unfairly maligned as “unhealthy” and not for the wellness-focused shopper. While that characterization might have been true once upon a time, innovation has transformed center store options so that every type of shopper can find what they need—and they are!

Keto-friendly products are finding an eager audience:*

- Shelf-stable cold cereals have grown 47.7%

- Frozen appetizers and snacks are up 20.3%

- Bread and baked goods have grown 16.3%

Items with 15 grams of protein or more are also gaining steam:*

- Shelf-stable hot cereals are up 159.9%

- Shelf-stable cold cereals are up 35.6%

- Bread and baked goods have grown 26.1%

Pasta with functional ingredients offers high nutrition and great flavors and aligns with a variety of consumer preferences. Pasta with turmeric, chia seed, or chia oil is bringing functional ingredients to classic dishes. Similarly, oil that is made with alternative blends or cold pressed is offering shoppers better flavors without losing any of the nutrition. In addition, plant-forward ingredients are bringing nutrient density alongside convenience so that shoppers can continue to prioritize their needs without sacrificing their favorite items, including plant-based crust and focaccia, waffles with whole grain as the first ingredient, and cauliflower tortillas and flatbreads. These innovations meet shoppers where they are and dispel the notion that health-focused foods can only be found on the store perimeter.**

VMS and Body Care

Personal care products have gained a higher profile over the past few years for a number of reasons. The pandemic put health at the forefront of everyone’s mind. Self-care became a popular mantra for anyone dealing with stress. Social media has created influencers that focus on vitamins, supplements, and makeup. Plus, fitness and exercise remain important for shoppers, whether they’re going to CrossFit or running a 5K. (Look at the 99.4% increase in hydration and electrolyte for proof.) All those elements are shaping the VMS and body care landscape.

To identify emerging trends in VMS and understand what’s driving that growth, look no further than the Natural Channel. According to SPINS data, the functional ingredients showing some of the highest sales growth are associated with specific health benefits that are resonating with shoppers:

- Barberry (up 24%) is frequently used as support for blood sugar levels

- Quercetin (up 18%) is known for cardiovascular support, as well as allergy and respiratory management

- Lion’s mane (up 15%) is often used to boost cognitive health

- N-Acetyl cysteine (up 14%) is associated with improved immune health

This focus on natural within VMS and body care is important because natural products, as well as specialty and wellness products, are faring better than conventional products with regard to inflation.****

The combination of values-driven consumers and innovative brands is bringing exciting changes to yogurt and meat alternatives. Today, shoppers can find dairy-free and keto-friendly plant-based yogurt as well as plant-based pork gyoza and even high-protein plant-based steaks.

*Source: SPINS Natural Enhanced and MultiOutlet (powered by IRI) for the 52 weeks ending October 22, 2022

**Source: SPINS Natural Enhanced and MultiOutlet (powered by IRI) for the 52 weeks ending March 20, 2022. Energy Supplements at UPC level filtered by SPINS Product Intelligence – Positioning Group, ClearCut Analytics

***Source: SPINS Natural Enhanced and MultiOutlet (powered by IRI) for the 52 weeks ending January 29, 2023

****Source: SPINS Natural Enhanced and MultiOutlet (powered by IRI) for the 52 weeks ending January 29, 2023. Body Care filtered by SPINS Product Intelligence-Positioning Group

*****Source: SPINS Natural Enhanced and MultiOutlet (powered by IRI) for the 52 weeks ending January 1, 2023. Department: Vitamins & Supplements, Attribute: Health Focus and Gender: Woman Focused, and Health Focus Category: Other Supplements, Subcategory: Children’s Supplements, for respective data points