Context & Methodology

In November 2024, SPINS fielded a brief survey to C-Suite executives across the Natural Products Ecosystem. The survey aimed to assess areas of interest, investment, and organizational readiness for 2025, and beyond.

In advance of the event, SPINS fielded a brief survey (to both attendees and others in the SPINS network) to assess areas of interest, investment, and organizational readiness.

Highlights

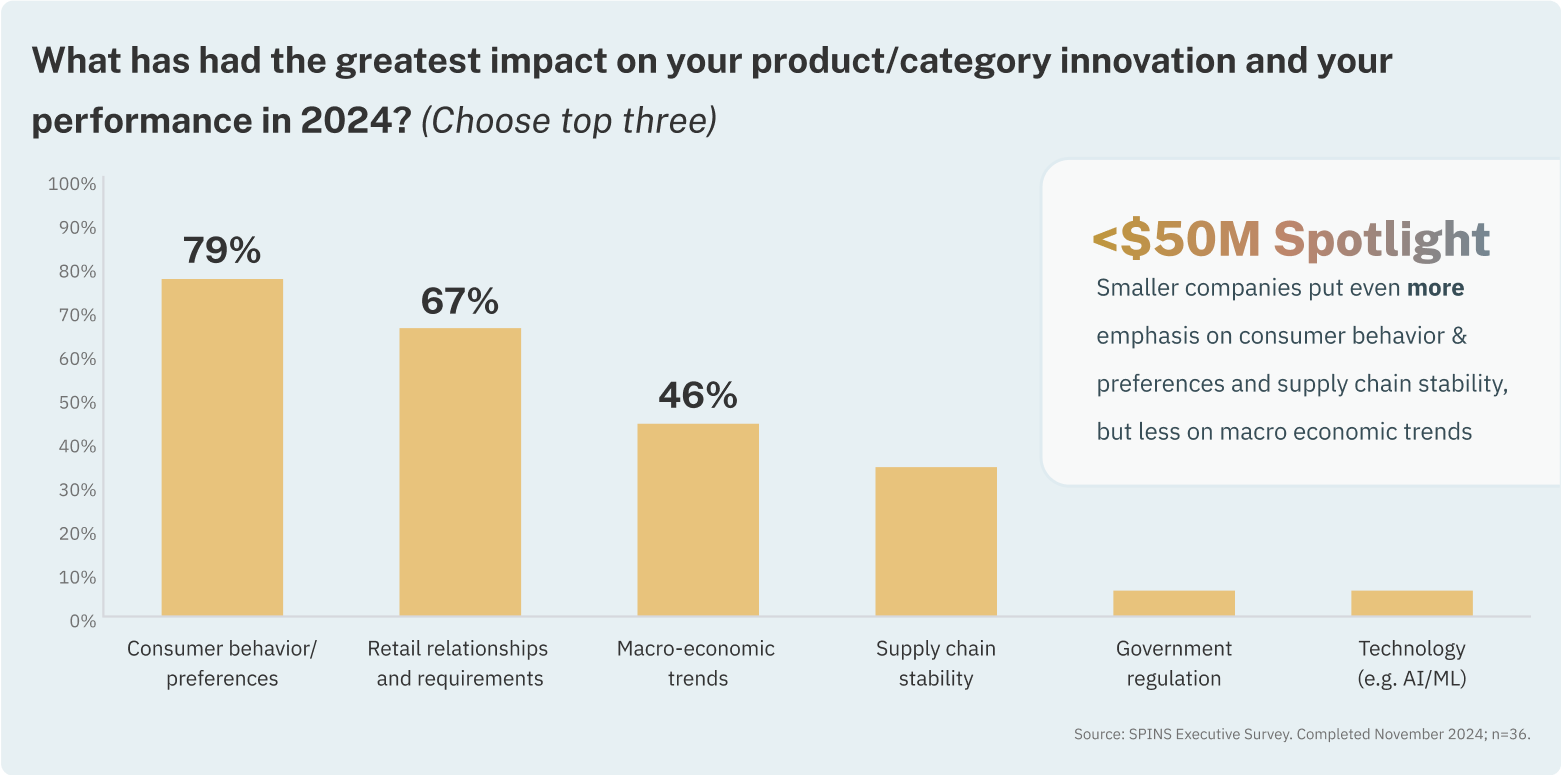

- Across all size segments, respondents identified consumer behavior and retail relationships as key levers for innovation and performance in 2024; smaller companies felt slightly higher pressure from consumer behavior, and (surprisingly) lower from macro-economic trends.

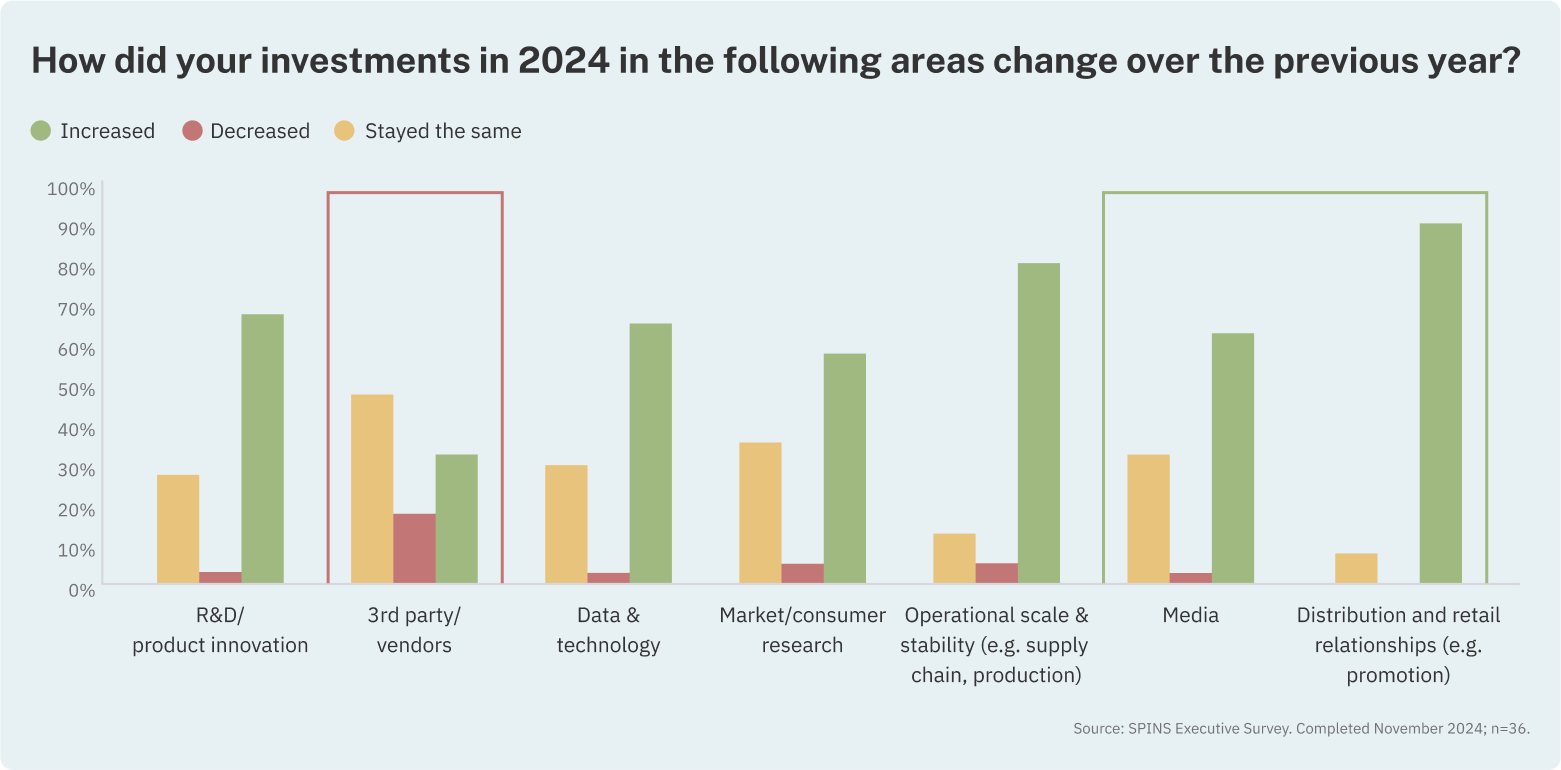

- 67% decreased or maintained their investment in 3rd parties and vendors in 2024.

- 64% increased spend on media in 2024, but 54% feel minimally confident in their organization’s readiness to navigate change in this area.

- Social platforms are a focal point of growth strategies for all organizations in the next 3 years, but especially for sub $50M brands.

Respondents

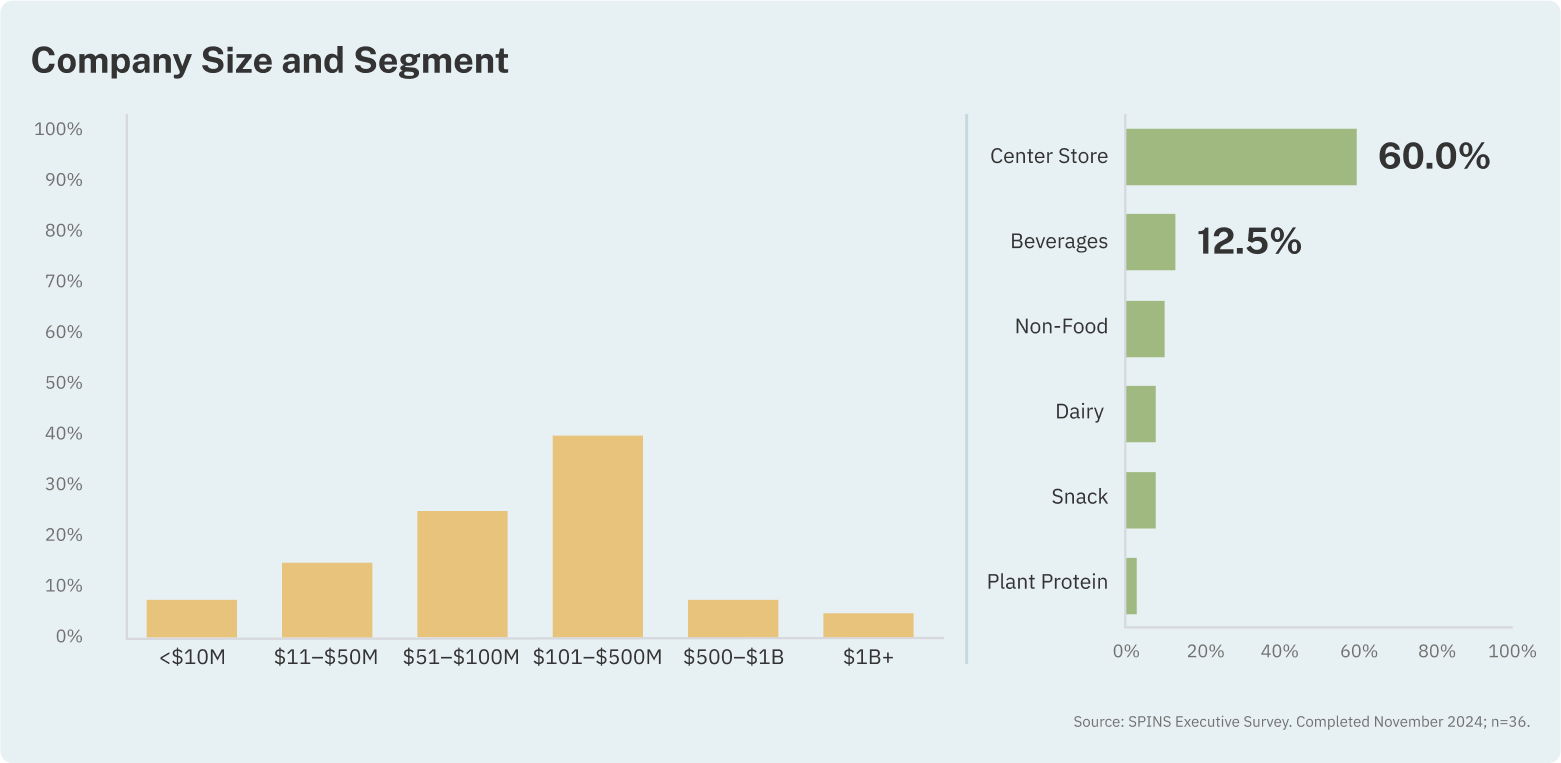

The majority of survey participants were from mid-to-large companies (by revenue); Specifically, about two-thirds of the respondents hail from companies with annual revenue between $51 million and $500 million. This is significant as it provided a perspective not only on what drives short-term growth but also on what is on the agenda for longer-term sustainability and relevance.

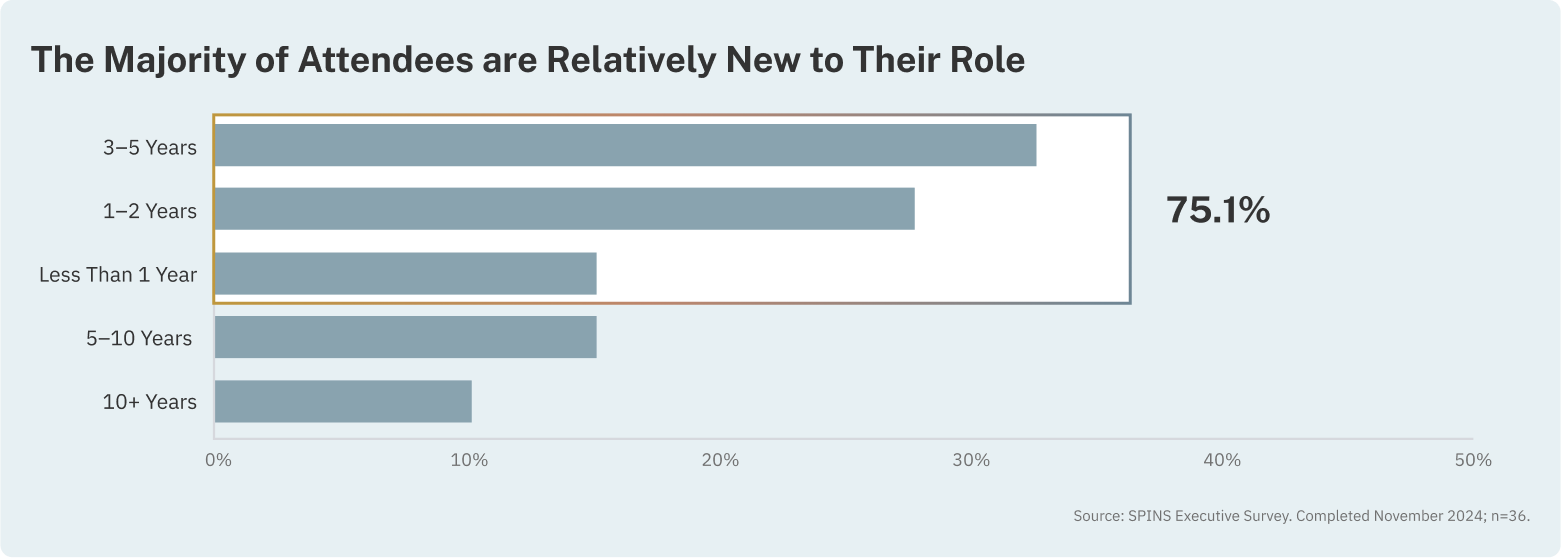

In terms of tenure, three-quarters of executives have been in their current role for five years or less.

Source: SPINS Executive survey. Completed November 2024; n=36.

The resulting data not only reflects the current state of the market but also signals potential trends and areas of focus that could influence future industry dynamics – particularly in center store and beverage segments.

1. When it comes to innovation, consumers and retailers are the critical catalysts.

For 79% of respondents, consumer behavior and preferences are the primary drivers of innovation. This majority highlights the ever-changing nature of customer preferences and the importance of staying aligned with emerging interests, demands, and trends to drive innovation.

Following consumer behavior, retail relationships emerged as the second most influential factor, cited by 67% of respondents, highlighting the strategic value of strong retail partnerships, which not only facilitate effective product distribution but also provide essential market intelligence.

Notably, macroeconomic trends – which can include inflation pressure on the price of food or interest rates limiting the availability of capital for growth – also played a considerable role in shaping strategies in 2024, though they fall slightly below the majority threshold at 46%.

These findings reinforce and validate a consumer-centric dynamic that has powered and differentiated the natural products industry for over two decades.

Source: SPINS Executive survey. Completed November 2024; n=36.

Question: "What has had the greatest impact on your product/category innovation and your performance in 2024 (choose top 3)."

2. Investment in 2024 set the stage for operational and strategic stability

As in any industry, investment priorities are in constant flux for brand leaders. In 2024, those priorities were clearly weighted toward distribution and retail relationships, including promotional activities. This is both a reactive and proactive signal; As retail requirements for in-store promotion, enhanced product discovery, and a generally more aggressive approach to velocity expectations take center stage, manufacturers are in turn facing pressure to keep up in order to stay on shelf and succeed on shelf (2). Beyond the requirement, though, is also the need to lay a thoughtful, proactive path for expansion – especially within the independent and regional grocer community, which has been such a wellspring of growth for natural products.

Additionally (and connected), there has been an uptick in investments in media and market research. These areas are receiving more attention as brands strive to enhance their marketing effectiveness and deepen their understanding of (and relevance to) consumer trends and preferences.

Operations have also seen increased funding, especially for larger brands that must improve efficiency and scalability to support growth and innovation.

These investment trends provide an indication of where industry leaders have chosen to allocate resources to adapt to market changes and consumer expectations effectively.

Source: SPINS Executive survey. Completed November 2024; n=36.

Question: " How did your investments in 2024 in the following areas change over the previous year?”

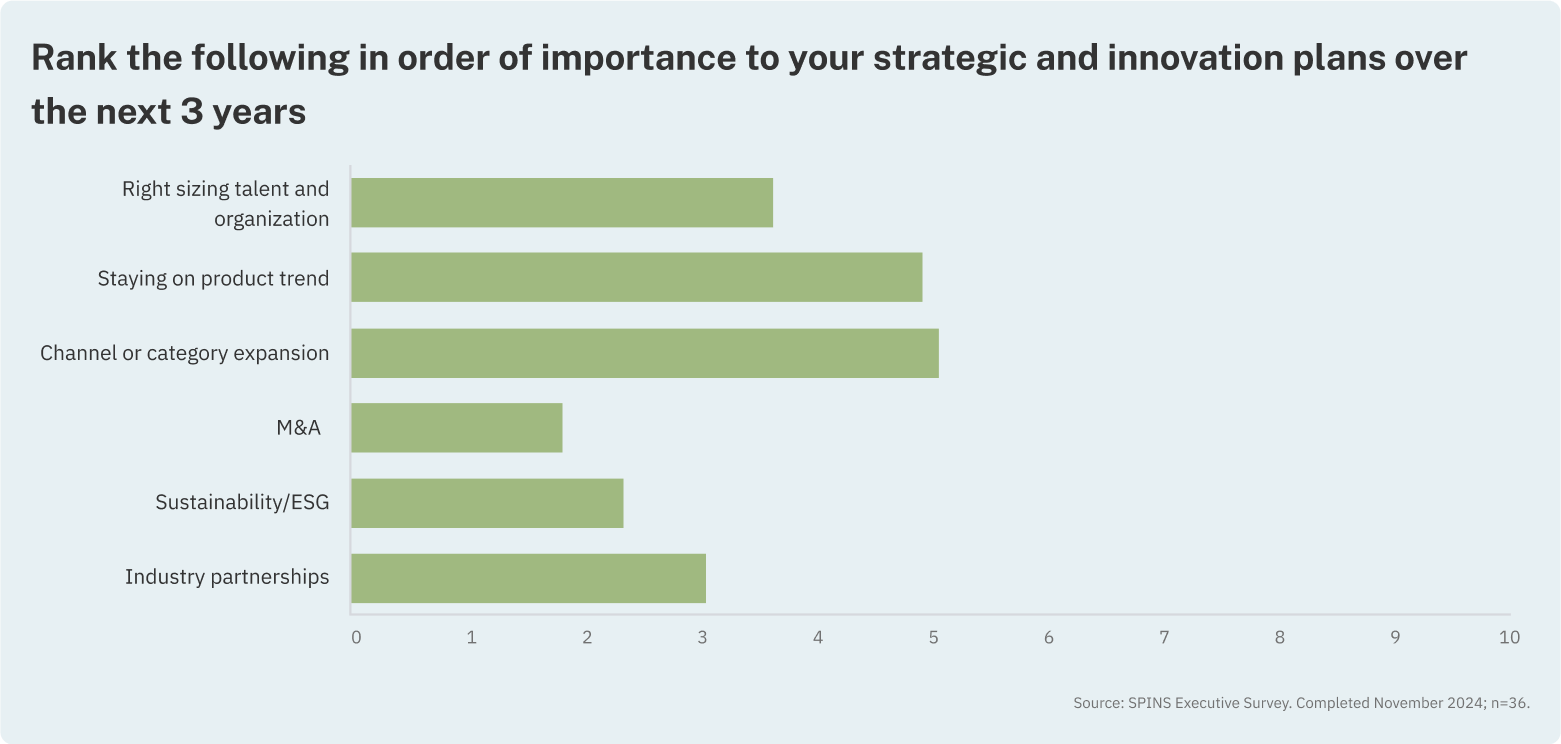

Looking towards the future, intentions remain largely consistent. Expanding products and portfolios, especially into new categories and retail channels remain the top priority for the next 3 years.

Conversely, mergers and acquisitions (M&A) and environmental, social, and governance (ESG) objectives were ranked of lesser importance within strategic areas over the next three years. This suggests that while these areas are still relevant, they may not be central to immediate strategic plans, possibly due to the current focus on direct growth and operational enhancements.

Source: SPINS Executive survey. Completed November 2024; n=36.

Question: " Rank the following in order of importance to your strategic and innovation plans over the next 3 years."

3.Disruptive forces change how (and where) to play

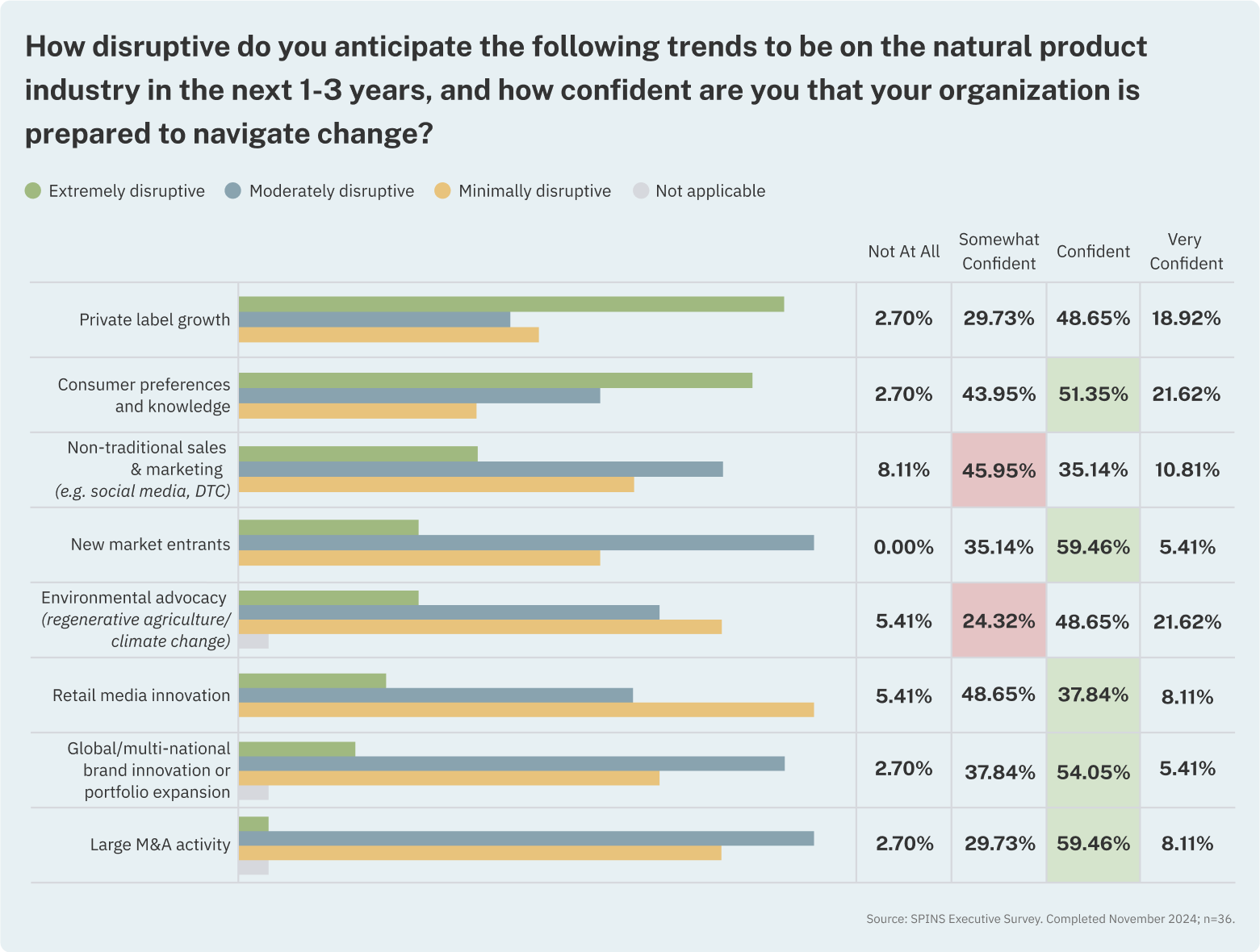

In exploring what industry leaders anticipate as the most disruptive factors over the next 1-3 years, the growth of private labels stands out as the most significant concern. This was closely followed by evolving consumer preferences and knowledge. Both factors were considered extremely disruptive, ranking significantly higher than all other options.

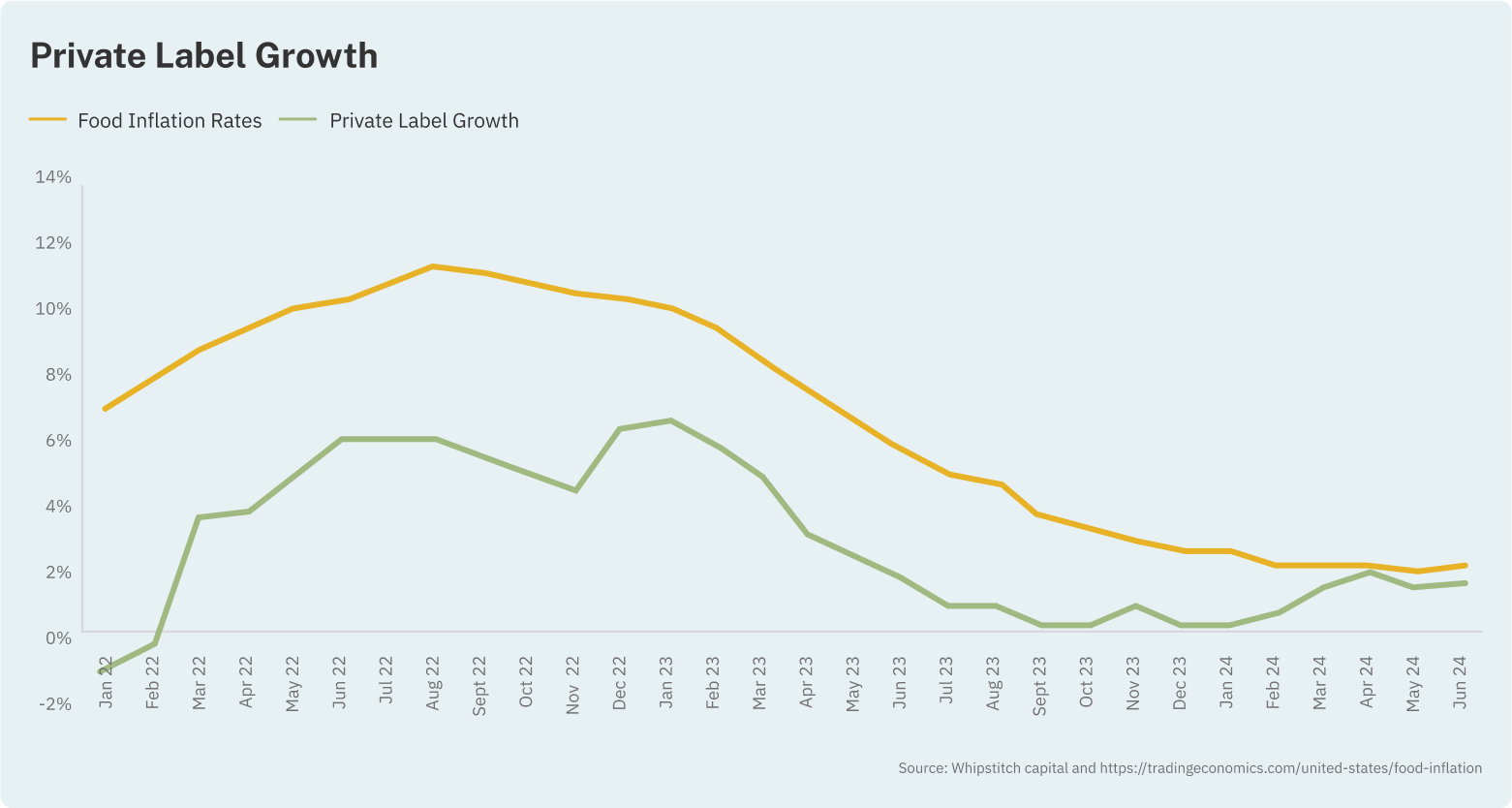

Private Label Growth: The ascension of private labels as a major disruptor reflects a documented shift in consumer buying patterns, where the perceived value often offered by private labels tends to grow as economic pressure increases. Private-label products saw increased growth over the past few years when inflation was highest (1).

Source: Whipstitch capital and https://tradingeconomics.com/united-states/food-inflation

This is a factor for consumers having changed their shopping patterns with 31% of saying that rising prices have made them switch to a lower-cost or discount grocer (3). Natural products are outpacing private label growth, but private label still exceeds total store growth.

Consumer Preferences and Knowledge: Close behind, the impact of consumer preferences and the increasing consumer appetite for knowledge about products and their origins reflect a more informed and discerning customer base. This demands that companies not only keep pace with preferences but also engage in more transparent and value-driven product development.

Both areas of perceived disruption demand new thinking about WHAT people are buying. But WHERE people are buying (or at least discovering) products is also emerging as force of change.

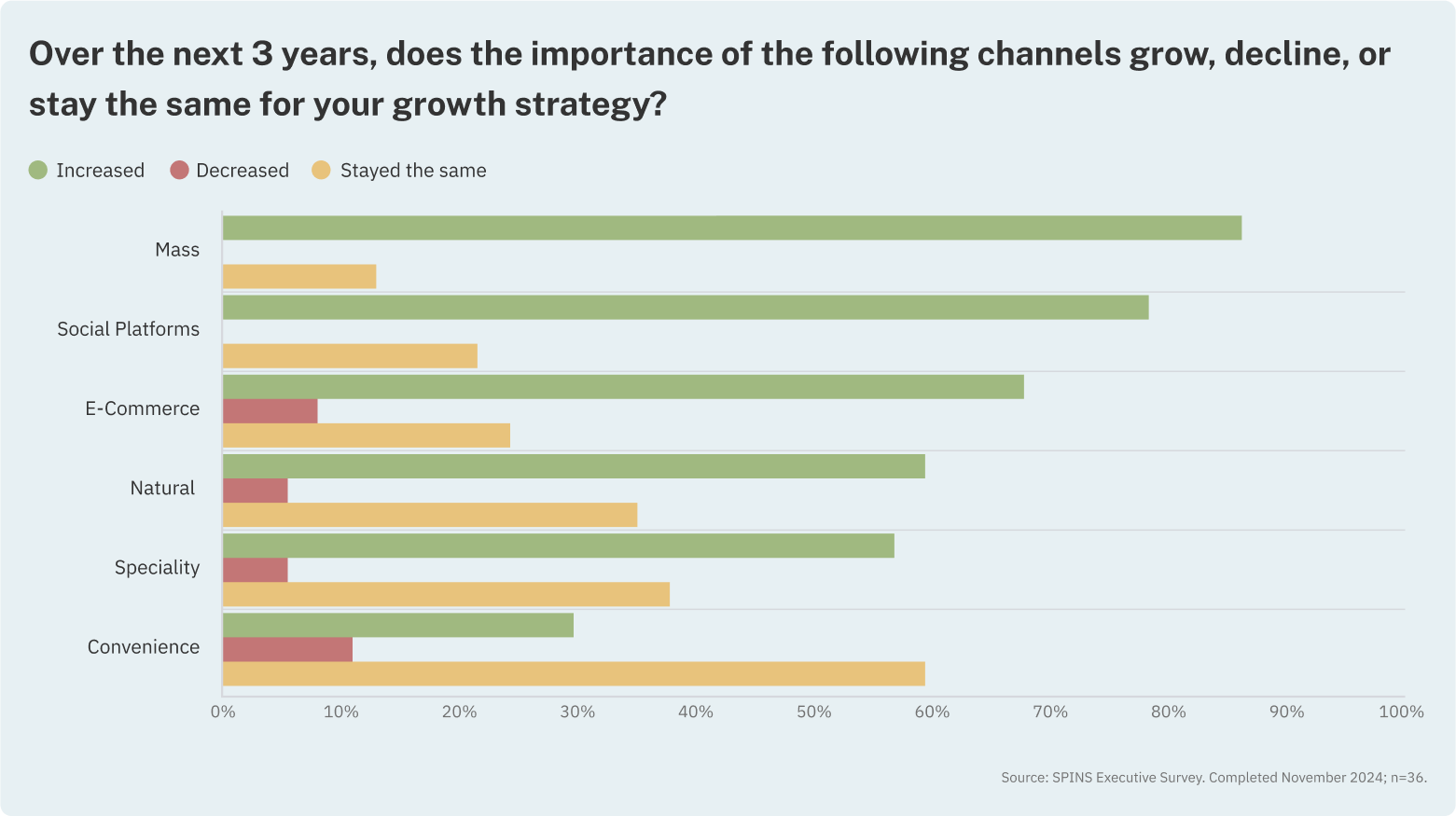

Without a doubt, natural and specialty channels remain critical; Approximately 60% of respondents indicated the importance of growing these traditional channels over the next three years, underscoring their continued relevance in distributing natural products. Traditionally, these channels have been innovation hubs and leading indicators for what will succeed in mass outlets.

However, these traditional avenues of growth are not at the front of the pack when it comes to attention and importance. Mass retail, social media, and e-commerce platforms were identified as the most important channels for growth – a powerful statement about where insights and engagement will come from in the coming years.

These findings illustrate a strategic focus among natural product companies on leveraging both new and traditional channels to optimize their market presence, while also being mindful of the limitations posed by certain retail formats as shoppers spend more and more time elsewhere.

Source: SPINS Executive survey. Completed November 2024; n=36.

Question: " Over the next 3 years, does the importance of the following channels grow, decline or stay the same for your growth strategy?"

Source: SPINS Executive survey. Completed November 2024; n=36.

Question: " How disruptive do you anticipate the following trends to be on the natural product industry in the next 1-3 years, and how confident are you that your organization is prepared to navigate change?"

When evaluating organizational confidence among leaders in navigating change, there were varied levels of preparedness across different areas of business operations. Leaders expressed high confidence in their organizations’ ability to adapt to significant changes such as mergers and acquisitions (M&A) activity, shifts in consumer preferences and knowledge, and expansions in big consumer packaged goods (CPG) portfolios.

Conversely, there was lower confidence in dealing with more modern challenges, specifically in non-traditional sales and marketing approaches, including social media, retail media, and other Direct-to-Consumer (DTC) marketing.

These insights and more will be further explored in upcoming reports from SPINS as we outline the broader trends governing growth, innovation, and maturity in the natural products industry in 2025 and beyond.

Appendix

- Whipstitch Capital and SPINS, MULO + Natural + Convenience. 4 WE 7/14/2

- https://www.grocerydive.com/spons/3-industry-trends-to-watch-for-the-second-half-of-the-year/724672/

- https://www.bcg.com/publications/2024/why-us-grocers-must-play-to-their-strengths