The Rising Popularity of Frozen Foods

Frozen foods are popular kitchen staples for several reasons: a long shelf life, convenience, and an abundance of comfort food options. That’s been especially important in 2020, but the pandemic isn’t the only reason you can expect frozen foods trends to continue the upward momentum.

In a recent webinar, Reframing the Value of Frozen Foods, Kathryn Peters from SPINS, Claire Galiette from Nestle USA, and Shari Steinbach, MS RDN discussed how frozen foods are evolving with today’s rising dietary and lifestyle trends. In their discussion, several influencing factors were identified as contributors to the rising popularity of frozen foods and setting the stage for long-term growth that you can start preparing for.

The Pandemic Effect

Since March, most shoppers have been making meals at home, which translates into buying more ingredients to cook and more frozen entrees. That’s likely a key factor in the strong growth frozen foods is experiencing across all channels: Frozen foods are up 28% in Natural, 26% in Regional Grocery, and 18% in MultiOutlet, according to SPINS data in partnership with IRI.

Looking specifically at the year-over-year performance of natural frozen products for a 12-week period, we see them growing 28% in multioutlet stores, beating out their 25% growth in natural and regional grocery stores. For comparison’s sake, in the same 12-week period in 2019, natural frozen products only saw a 2.5% year-over-year growth.

Frozen foods are also a convenient way to ensure you’re getting a balanced diet. Over the last 12 weeks, natural frozen fruits and vegetables have had 41% year-over-year growth; in 2019 they experienced 3% year-over-year growth for the same period. All frozen fruits and vegetables had strong growth as well, with a 31% year-over-year increase compared to a 2% increase in 2019.

Appetizers and snacks, desserts, and plant-based meat alternatives are the natural categories with the next highest lift, suggesting that convenience matters no matter what course of the meal shoppers are looking for.

Dietary and Lifestyle Trends in Frozen Foods

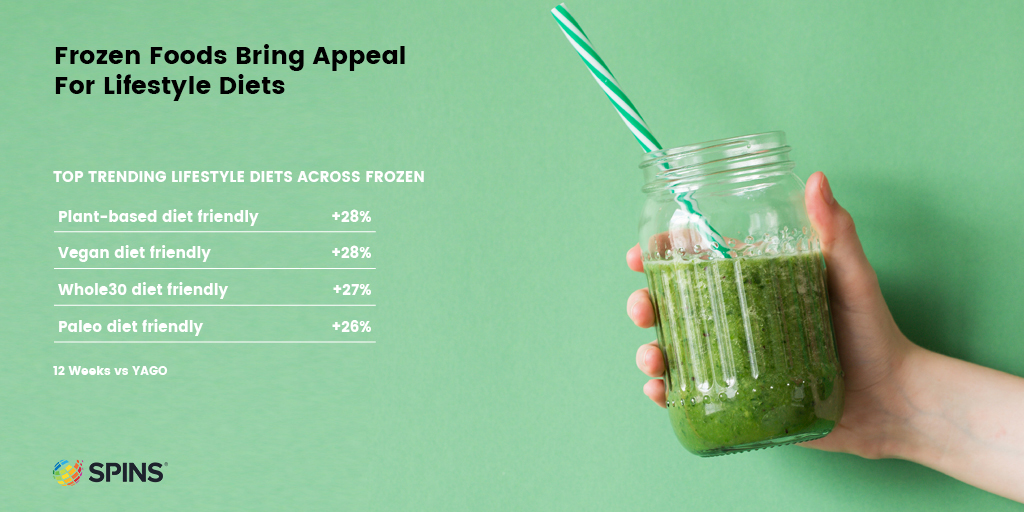

Although frozen foods bring convenience and a healthy share of comfort food options, they also bring a variety of options that align with today’s strongest dietary and lifestyle trends. When it comes to diets, consumers don’t seem to have separate standards for frozen and non-frozen items. Thanks to the convenience of preparing and storing frozen foods and the increase of at-home meals, consumers are having no problem adhering to their preferred diets. Focusing just on frozen foods in Natural and Regional Grocery channels:

- Plant-based diet friendly is up 28%

- Vegan diet friendly is also up 28%

- Whole30 diet friendly is up 27%

- Paleo diet friendly is up 26%

Attributes are telling a similar story. Within Natural and Regional Grocery channels, the highest performing attributes for frozen foods are in line with what we see in the rest of the store, particularly among items with certain certifications:

- Labeled allergy-friendly is up 36%

- Certified Paleo has grown 35%

- Non-GMO labeled is up 30%

- Fair Trade claim has grown 28%

- Labeled vegan is up 27%

- Non-GMO Project Verified has grown 26%

- Positioned plant-based is up +25%

Treat Yourself With Sweets, and Specialty Frozen Foods

Overall wellness has become increasingly important this year as our normal routines have been disrupted and our stress levels have gone up. Between concerns about COVID, trying to stay active, working from home, social distancing, and a myriad of other effects of lockdown, shoppers are trying to take care of their minds and bodies and turning to the freezer for help.

For proof, look no further than sweets. Over the last 12 weeks, frozen items with sugar as a sweetener have risen 23% year over year. Items with monk fruit, a healthier sweetener alternative, rose 27% in the same time period. The overall growth in both ingredients shows that desserts are very much in demand.

However, looking at how these ingredients are performing over a 52-week period tells an interesting story: Sugar experienced a healthy 12% year-over-year sales growth when over a 52-week period; monk fruit saw 55% year-over-year growth over that same period. Consumers still want to enjoy their desserts, and plenty is still indulging in their sugary favorites, but even more, are trying to find a more nutritious way to keep desserts on the menu.

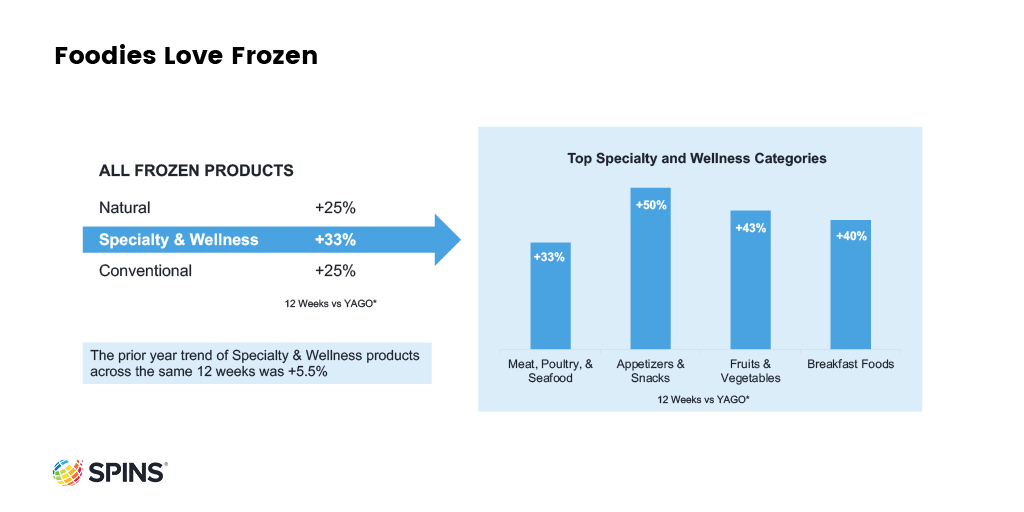

Shoppers with a sweet tooth aren’t the only ones enjoying frozen foods. Foodies with a preference for specialty items are finding their favorite items in the freezer. Specialty and wellness frozen products experienced 33% year-over-year growth over a 12-week period. Last year, however, specialty and wellness frozen products saw a less robust 5.5% growth in that same 12-week period.

Looking at the categories within the Specialty and Wellness channel over a 12-week period:

- Appetizers and snacks are up 50%

- Meat, poultry, and seafood are up 33%

- Fruits and vegetables are up 43%

- Breakfast foods are up 40%

Report: 10 Frozen Foods Trends in Today's Retail

While the success of frozen foods can partially be attributed to the factors that made 2020 unique—a need for long-lasting items, a renewed focus on healthy eating, and a desire for self-care—it isn’t fading away anytime soon. Even as some normalcy returns to the market in the post-pandemic future, strong category growth (such as plant-based, sugar alternatives, and allergen-friendly) will continue to drive upward movement in frozen foods.