Introduction

In today’s competitive CPG landscape, understanding consumer behavior is no longer optional—it’s essential for survival and growth. Consumer panel data provides the critical insights needed to make informed decisions about product development, marketing strategies, and retail partnerships.

However, not all consumer panel solutions are created equal. This guide explores the key differences between panel data providers, helping you identify which solution aligns best with your brand’s unique needs and goals.

DOWNLOAD THE CONSUMER INSIGHTS GUIDE

DownloadWhat Is Consumer Panel Data?

Consumer panel data tracks the purchasing behaviors of consumers over time, providing insights that go beyond simple sales figures. While point-of-sale (POS) data tells you what was purchased, panel data reveals the crucial who, why, and how behind those purchases.

Key benefits of consumer panel data include:

- Demographic profiling of your buyers

- Cross-retailer shopping behavior analysis

- Brand loyalty and switching patterns

- Consumer purchase frequency and repeat rates

- Basket dynamics and affinity insights

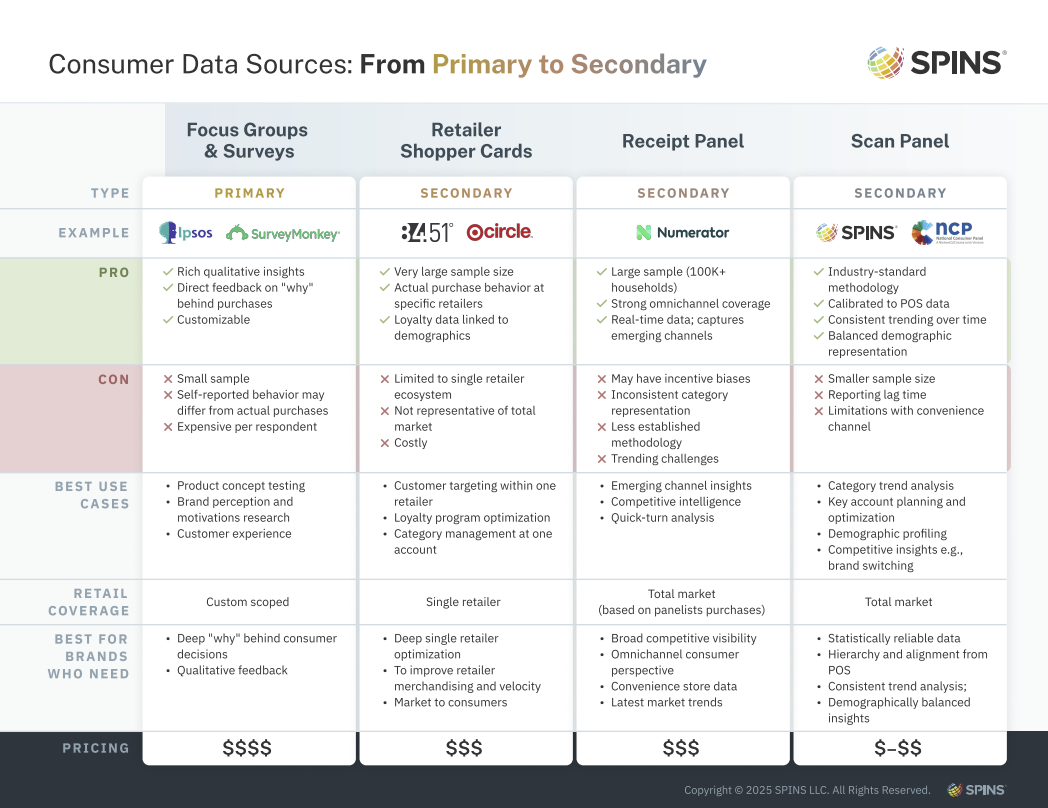

Types of Consumer Panel Solutions

The National Consumer Panel (NCP)

The National Consumer Panel (NCP) has been the established industry standard for consumer behavior measurement since the late 1980s. This panel employs a methodical approach to data collection:

Key characteristics:

- UPC scanning methodology, where panelists scan every product they purchase

- Rigorous demographic balancing to match U.S. Census data

- Calibration against POS data to ensure accuracy

- Comprehensive capture of all retailers and channels

Advantages:

- Highly accurate product identification through UPC-level data

- Consistent quality across categories due to balanced panel recruitment

- Cross-channel visibility that includes all retailers

- Subbrand-level analysis capabilities when the sample size allows

Receipt-Based Panels

Receipt-based panels are a more recent development in consumer insights. These panels collect shopping data by having consumers upload photos of their shopping receipts.

Key characteristics:

- Receipt image uploads through smartphone apps

- Typically larger panel sizes due to easier participation

- Varied incentive structures for participation

- Text recognition technology to identify purchases

Advantages:

- Often less expensive than traditional panels

- Can provide faster insights delivery

- May capture some retailers not covered by traditional methods

- Sometimes, easier user interfaces for accessing data

Is Your Brand Flying Blind on Consumer Insights?

Take SPINS' 5-minute Consumer IQ Assessment and discover exactly where your brand stands.

Comparing the Options: What to Consider

1. Data Quality and Representativity

NCP Approach:

- Demographically balanced to U.S. Census data

- Calibration against POS data for accuracy

- Consistent reporting across product categories

- Sample recruitment focused on quality over quantity

Receipt-Based Approach:

- Larger raw panel size, but potential sampling biases

- Potential gaps in product identification from unclear receipts

- Maybe incentive structures that encourage certain retailers over others

- Less consistent coverage across different categories

- Limited or no ability to calibrate against POS data to adjust these biases and gaps

2. Granularity and Accuracy

NCP Approach:

- UPC-level data capture ensures precise product identification

- Can be analyzed at the subbrand level when the sample allows

- Consistent methodology reduces noise in data

Receipt-Based Approach:

- Can sometimes struggle with item-level identification

- May have limitations in distinguishing between product lines

- Receipt text recognition can introduce errors or missing data

- Sometimes challenging to maintain consistency in tracking over time

3. Data Categorization and Attributes

NCP Approach:

- Comprehensive product attribute libraries

- Detailed hierarchies for product categorization

- Consistency with POS data categorizations is possible

Receipt-Based Approach:

- Varying quality of product attributes

- May have different category definitions than POS providers

- It can be challenging to maintain consistent trending

Learn More About Consumer Panel Data

Learn MoreMaking the Right Choice for Your Brand

Consider these questions when evaluating consumer panel solutions:

- What is your primary goal? Are you looking to understand broad consumer trends, or do you need detailed analysis of specific product segments?

- How important is accuracy vs. cost? Are you willing to trade some precision for lower costs?

- What is your internal resource capacity? Do you have team members with expertise in consumer insights who can interpret raw data, or do you need more support?

- Will you need to integrate with other data sources? Consider whether your panel data needs to align with your POS data.

- Are you focused on natural/organic segments? If these segments are important to your business, consider solutions with attributes specifically designed for these products.

Industry Perspectives on Panel Selection

Industry experts consistently emphasize that the panel selection should depend on your specific business needs:

- For established brands with sophisticated analytics teams: Either approach can work, though traditional panels typically offer more consistency and integration capabilities.

- For emerging brands with limited resources: Consider your priorities carefully. If budget is the primary concern, receipt-based panels may offer a more accessible entry point, though you may need to account for potential limitations in data quality.

- For natural and specialty brands: Look for solutions that offer robust attribute systems designed to capture the nuances of natural, organic, and specialty products.

Final Considerations for Natural and Specialty Brands

Natural, organic, and specialty brands face unique challenges in consumer insights:

- Natural consumers are different: They often have distinct purchase patterns and priorities that may not be captured in general panel data.

- Attributes matter more: Understanding factors like ingredient preferences, certifications, and sustainability choices requires specialized attributes.

- Competitive sets are specialized: The ability to filter to relevant competitive sets is crucial for accurate benchmarking.

- Retailer-specific insights: Natural and specialty brands often have different performance profiles across different retail environments.

Consumer panel data is an invaluable tool for understanding your customers and growing your brand. By selecting the right solution for your specific needs, you can unlock insights that drive meaningful business growth and competitive advantage.

About This Guide

This guide is designed to provide an overview of consumer panel options to help CPG brand leaders make informed decisions. It is not intended to replace detailed discussions with individual providers about their specific offerings.

For more information about consumer panel solutions and how they might benefit your brand, contact your preferred insights provider for a consultation.