Introduction

Over the past few years, the pace and volume of CPG acquisitions have accelerated significantly, especially among emerging, health & wellness brands. With deal headlines popping up regularly, we wanted to go beyond the noise and dig into what’s driving investment decisions, what common traits define acquired brands, and how fast-growing, early-stage brands can better position themselves for investment.

Research Methodology

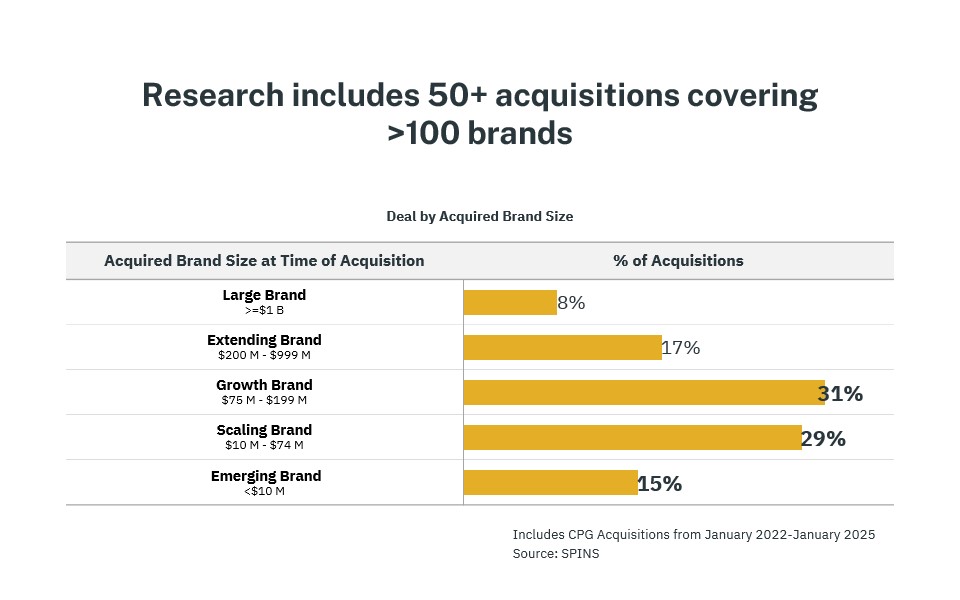

To uncover these patterns, we analyzed over 50 acquisition events between January 2022 and January 2025, covering more than 100 U.S.-based consumer-facing brands sold through retail channels. The data excluded international brands, manufacturers, and minority funding rounds, focusing only on full or majority-stake acquisitions. We used point-of-sale data across natural, specialty, and conventional retail stores, and paired this with publicly available financial reports, investor insights, and market analyses. The goal: uncover the key acquisition drivers that matter most to emerging CPG brands.

Research Includes:

- CPG Acquisitions in 2022-Jan 2025

- Majority Stake Investment & Full Acquisitions

- U.S.-Based Consumer Brands

Research Excludes:

- Minority Investments and Funding Rounds

- International Brands, Food Suppliers, Manufacturing Companies

8 Traits that Position Emerging Brands for Acquisition Success

Size Isn't Everything, Opportunity for Growth Is

75% of recent acquisitions involved brands with sales below $200M, proving that high growth potential trumps scale. Buyers are increasingly focused on smaller, agile brands with strong consumer traction and category momentum – making fast-growing emerging players prime candidates for investment.

SPINS Ignite unlocks exclusive access to AI-generated retail insights, pitch deck support, and expert resources—all for free.

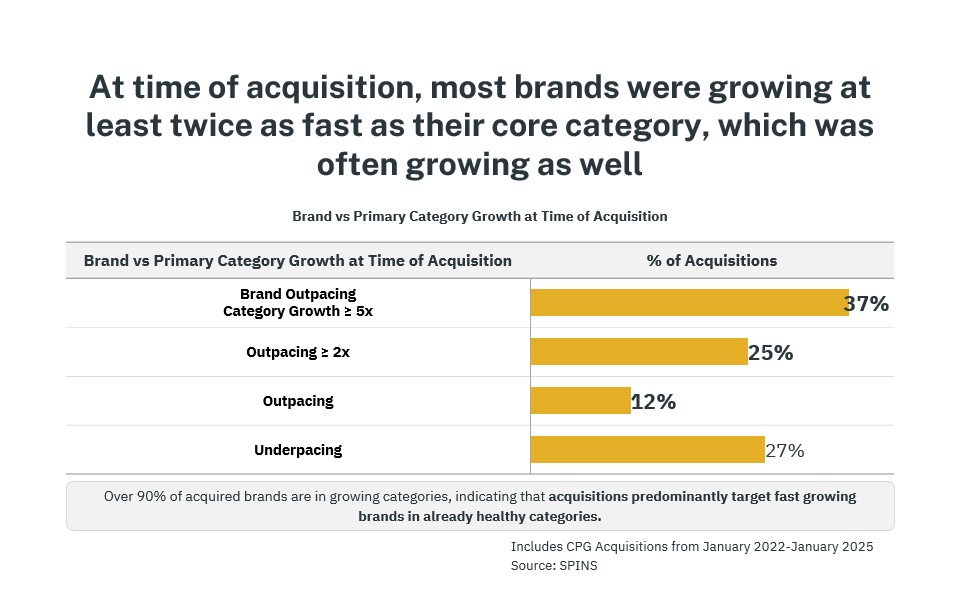

Join For FreeBreakout Growth Signals Acquisition Potential

The majority of acquired CPG brands aren’t just growing – they’re outpacing their category, often by two to five times. But growth alone isn’t enough; investors also prioritize brands playing in healthy, expanding categories. Together, these signals, brand-level momentum, and category vibrancy create a compelling case for acquisition. Buyers are actively seeking evidence of strong consumer resonance and scalable success.

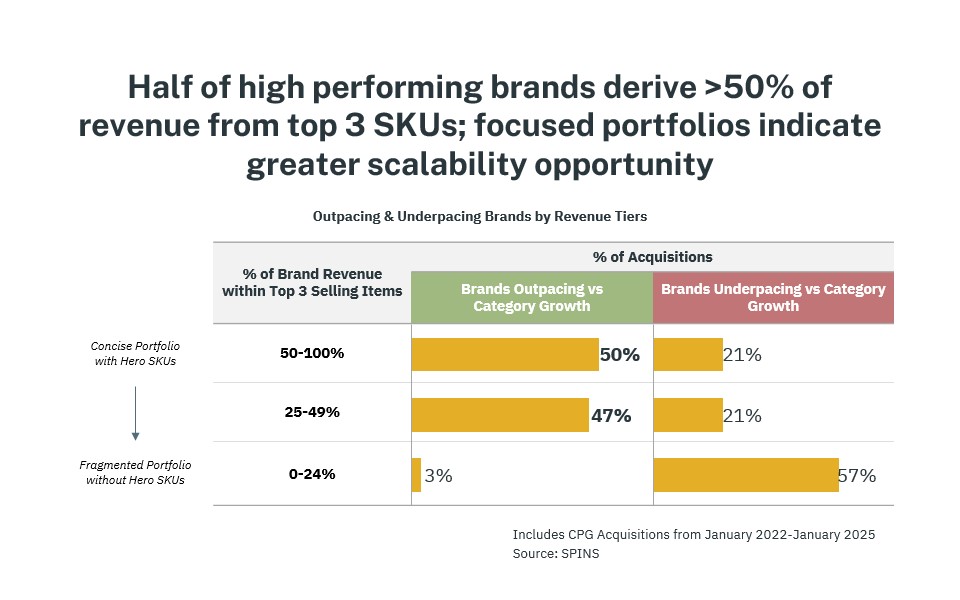

Leaner Portfolios, Stronger Growth Potential

Acquired brands consistently favored tight, focused product assortments. Brands that generate most of their revenue from a few high-performing SKUs demonstrate greater scalability and operational clarity – traits that resonate with investors. For emerging brands, a disciplined portfolio isn’t just efficient; it’s a signal of strategic maturity and acquisition readiness.

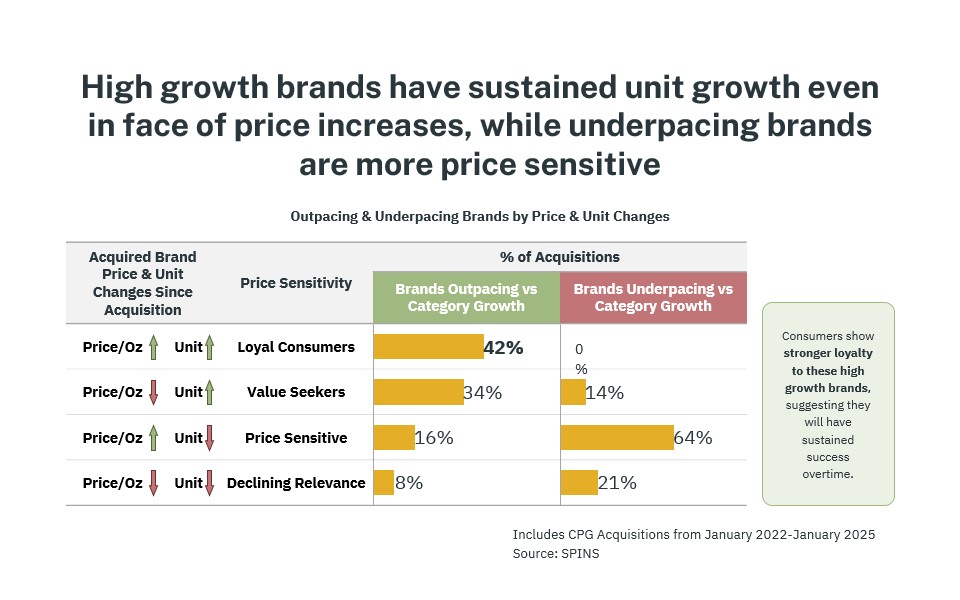

Loyal Customers Signal Long-Term Value

42% of high-performing brands maintained or even grew unit volume despite price increases, demonstrating strong consumer loyalty. For emerging brands, this resilience is a powerful indicator of lasting relevance and signals durability to potential investors.

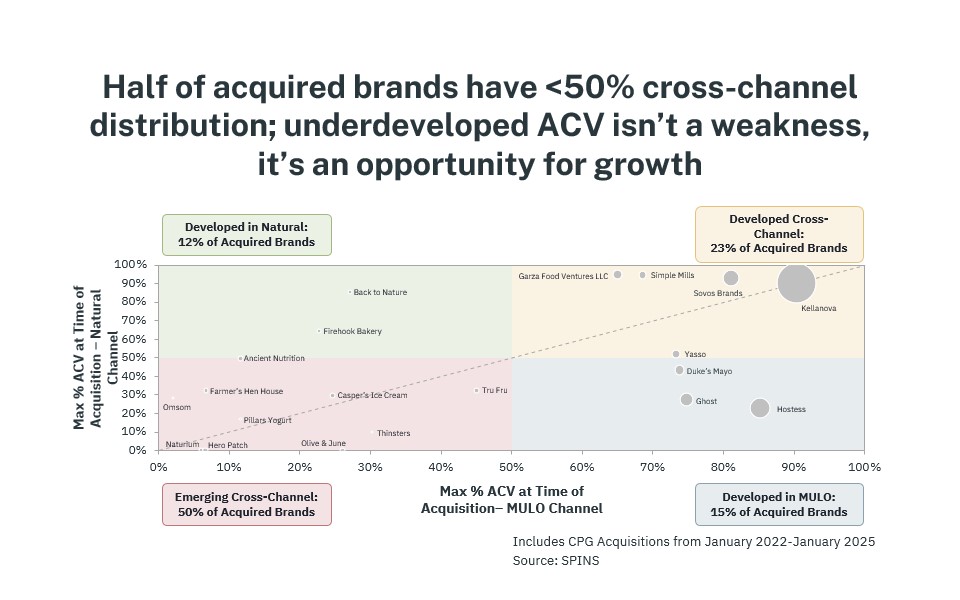

Untapped Channels Open Doors to Growth

Brands with limited presence in retail channels saw heightened acquisition interest. For emerging brands, underdeveloped distribution isn’t a weakness; it’s a growth lever that can amplify post-deal value.

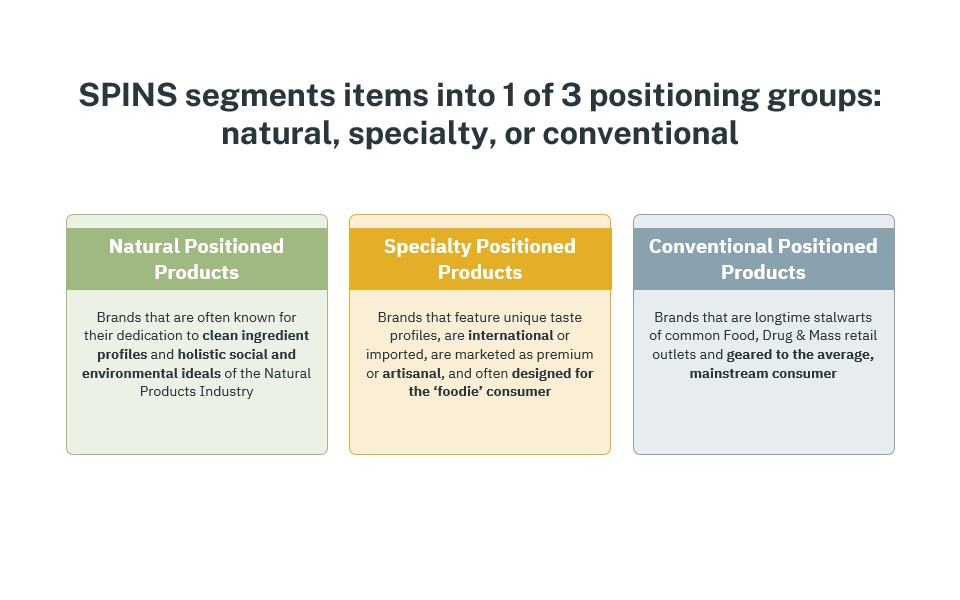

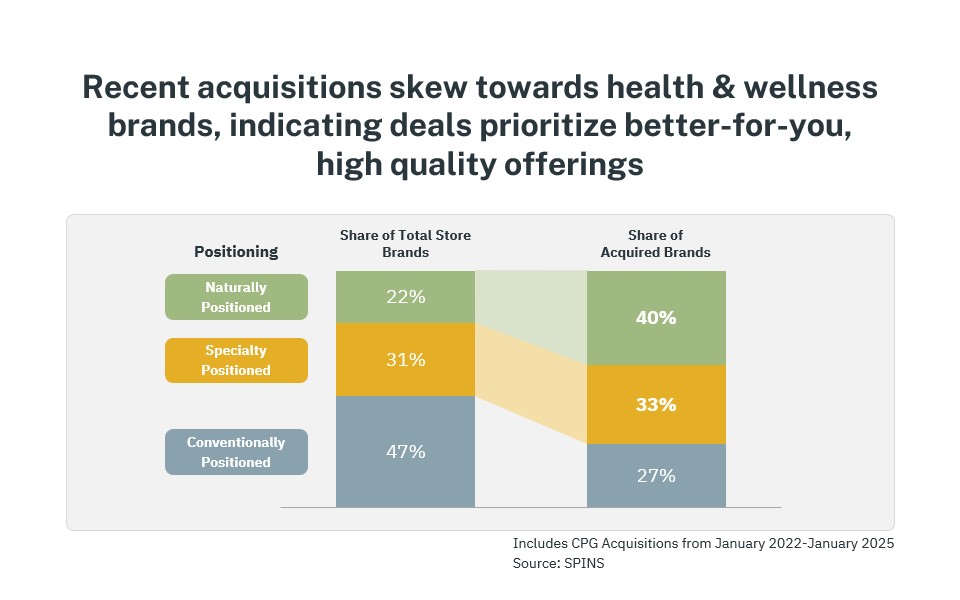

Clean & Purposeful Positioning Drives Investor Interest

Recent acquisition trends consistently favor brands that embrace natural or specialty positioning. These companies lead with clean ingredients, transparent practices, and mission-driven storytelling, all of which set them apart in a crowded market. For emerging brands, such clarity of purpose is more than a marketing asset; it’s a proven accelerator for growth and investor attention.

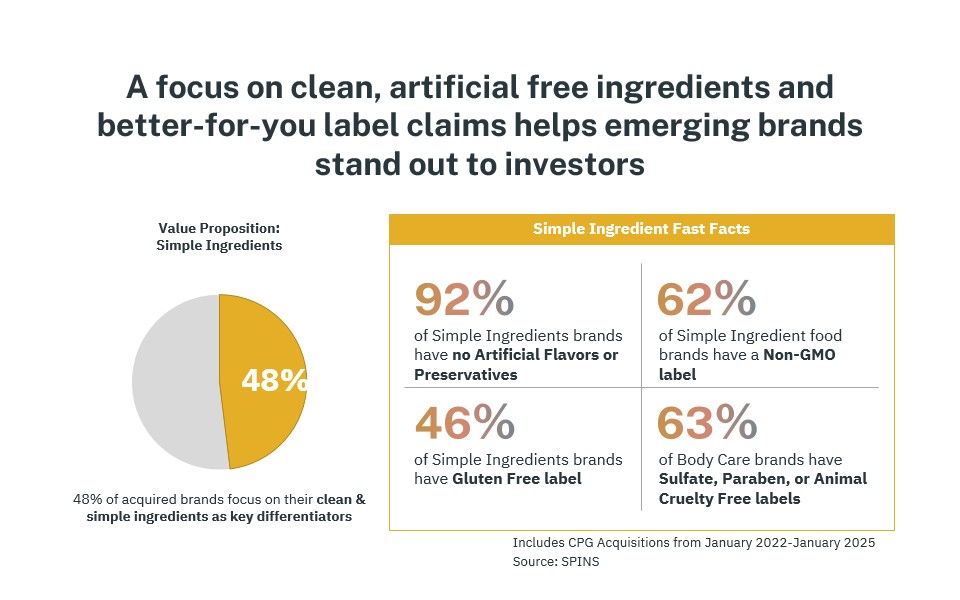

Simple Ingredients, Broad Impact

Clean ingredient brands are leading acquisitions – not just in food and beverage, but also in body care. Nearly all better-for-you brands avoid artificial preservatives and lean into transparent claims like Non-GMO, gluten-free, and cruelty-free. For founders, aligning your ingredient story with transparency and simplicity is more than a marketing play – it’s a valuation booster.

Smart Nutrition, Strong Valuation

Tailored nutritional benefits, such as high protein, low sugar, and reduced calories, are a common feature among recent acquisitions, serving as compelling differentiators that catch both consumer and investor attention. Brands leaning into personalized, better-for-you attributes are not only meeting consumer demand but also signaling long-term growth potential in a rapidly evolving wellness landscape.

Conclusion

Emerging CPG brands aiming for acquisition success aren’t just riding wellness trends – they’re shaping them. Across categories, the most attractive targets demonstrate strategic focus, consumer resonance, and operational readiness. From lean product portfolios and breakout growth to clean ingredients and tailored nutrition, these traits consistently capture investor interest. For founders, aligning with these patterns isn’t just about checking boxes; it’s about building a brand with durable relevance and scalable potential in today’s dynamic retail landscape.