Beverage Innovations: Latest Trends & Insights

The beverage industry is witnessing significant transformations, driven by evolving consumer preferences and innovative product offerings. In this blog, we delve into the current landscape and emerging trends reshaping the world of drinks, from functional beverages to non-alcoholic options and beyond.

In recent times, the beverage sector has emerged as a hotbed of innovation, outpacing many other categories in the retail space. More than half of beverage categories are introducing new products faster than the total store, reflecting a dynamic industry keen on meeting consumers’ shifting tastes and needs.

Source: Beverage Custom Group. 52 Weeks End 3.24.2024. Total US-Natural Expanded Channel and Total US- MULO + Convenience (Powered by Circana)

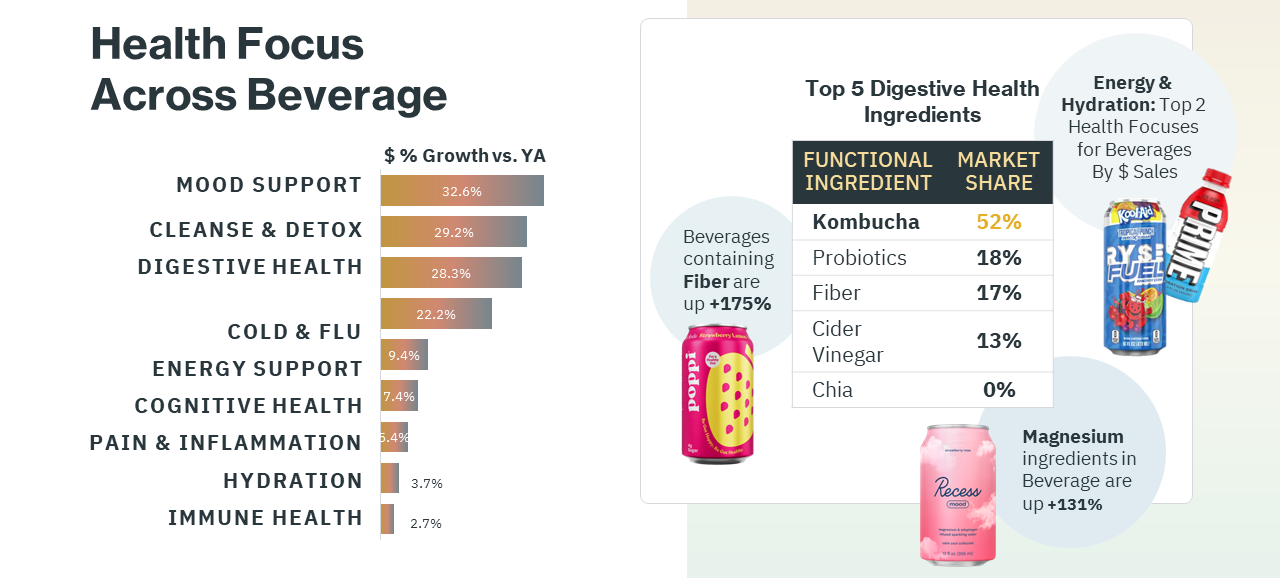

The beverage industry is undergoing a rapid transformation, largely driven by the rising popularity of functional drinks—beverages that offer more than just hydration or enjoyment. These drinks are specifically formulated to enhance health and well-being, aligning with a broader consumer shift towards wellness-focused products. This trend is reflected in the market, where 39% of beverage sales are dedicated to products that promote health benefits, a significant increase compared to the 27% market share for health-related products in all other store categories. Functional drinks cater to a variety of health needs, offering benefits like mood enhancement, detoxification, digestive health, and immune support. Such products are not just a passing fad but rather a reflection of a deeper, more enduring trend towards health-conscious consumption.

Daily Routines Reimagined

Beverages play a crucial role in our daily lives, and this hasn’t gone unnoticed by manufacturers who continuously innovate to fit into consumer routines. From the morning coffee to evening relaxation drinks, the industry sees a shift towards beverages that support different times of the day and different needs.

Source: Refrigerated, Grocery and Frozen Department with any SPINS Functional Ingredients. 52 Weeks End 2.25.202. Total US-Natural Expanded Channel and Total US- MULO (Powered by Circana)

This includes a rise in mood-supporting drinks, non-alcoholic alternatives, and products focused on gut health and energy—all reimagined to integrate seamlessly into daily life.

The Rise of Non-Alcoholic and Functional Beverages

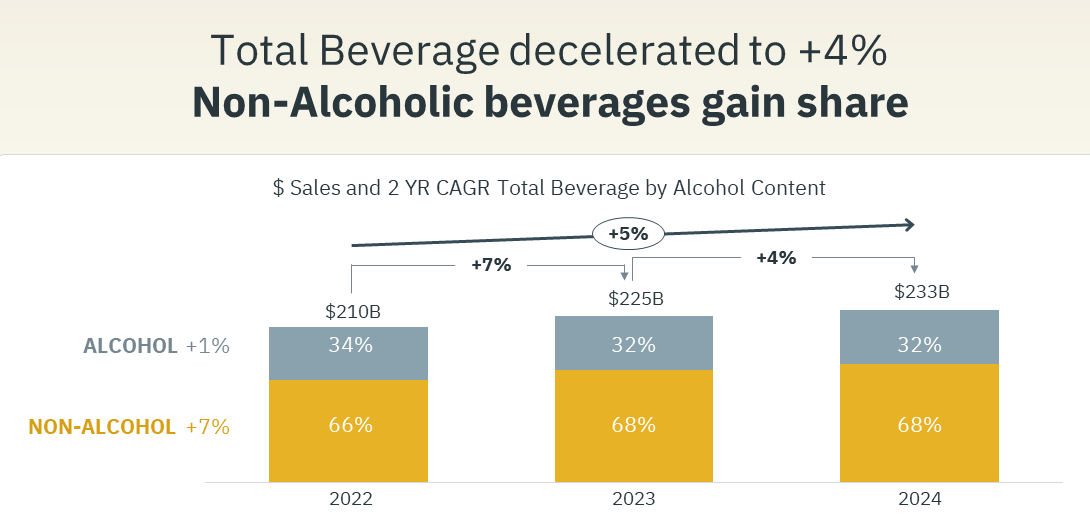

Amidst a growing public interest in healthier lifestyles, non-alcoholic beverages are gaining ground, capturing market share from their alcoholic counterparts. This segment has seen a 2.2 percentage point increase in market share over the past two years, driven by consumer demand, especially among younger demographics.

Source: Alcohol, Refrigerated and Grocery Departments. 52 Weeks End 03.24.2024. Total US-Natural Expanded Channel and Total US- MULO + Convenience (Powered by Circana)

The interest is particularly strong in ready-to-drink (RTD) non-alcoholic cocktails and premium craft non-alcoholic beverages, reflecting a desire for sophisticated, yet healthier drink options.

Premiumization and Economic Shifts

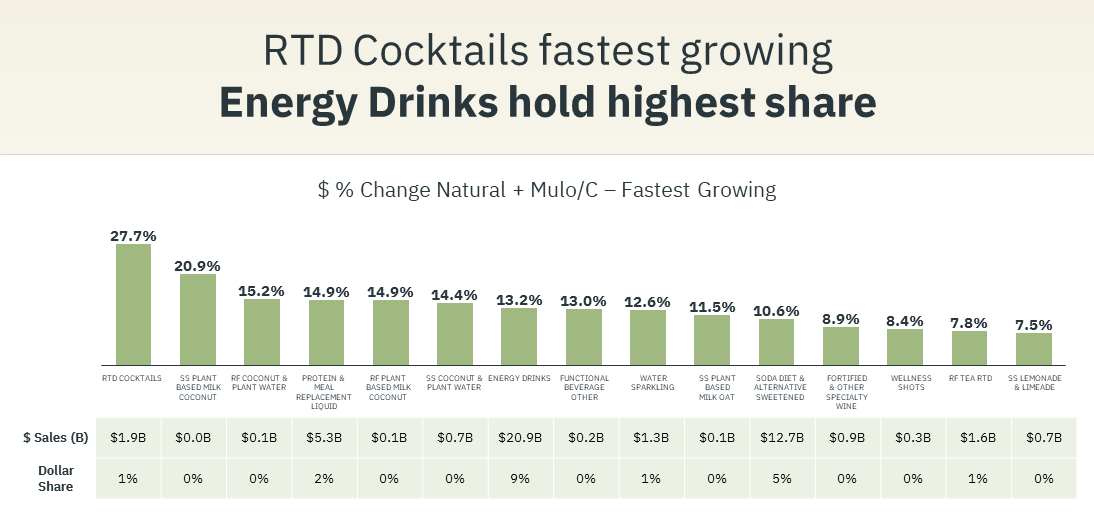

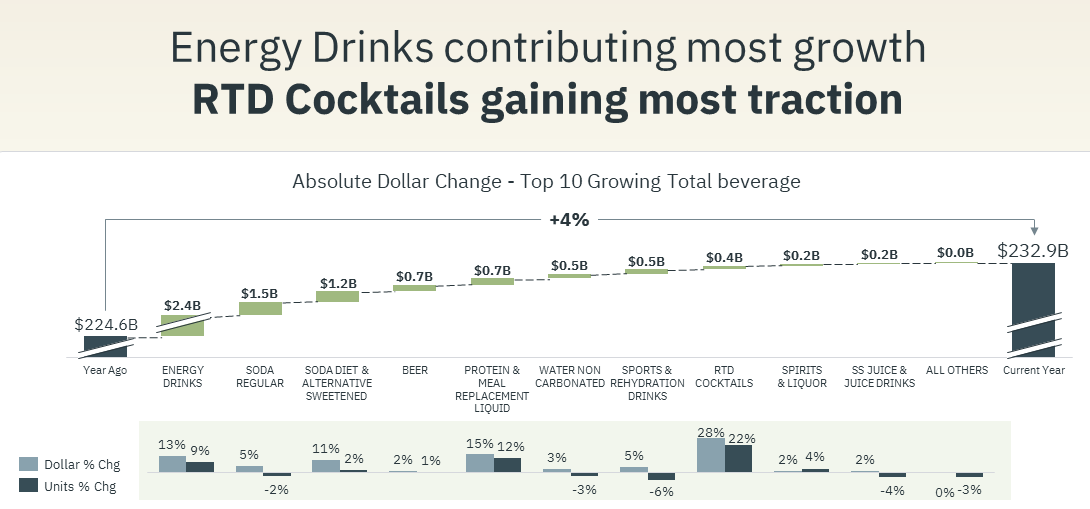

Despite overall price sensitivity in consumer goods, there is a noticeable trend towards premium beverages. Categories like energy drinks and RTD cocktails are growing in sales, which some might find surprising since we’ve heard all the reports about how consumers are tightening those purse strings.

Source: Alcohol, Refrigerated and Grocery Departments. 52 Weeks End 03.24.2024. Total US-Natural Expanded Channel and Total US- MULO + Convenience (Powered by Circana)

However, compared to going out for a meal, having a ready-to-drink cocktail while staying at home is the more economical option.

Energy drinks, on the other hand, continue to dominate in terms of market share growth, evolving well beyond their original market to include options that support an active lifestyle and varied energy needs throughout the day.

Source: Alcohol, Refrigerated and Grocery Departments. 52 Weeks End 03.24.2024. Total US-Natural Expanded Channel and Total US- MULO + Convenience (Powered by Circana)

This category has successfully repositioned itself within the broader beverage market by focusing on performance and lifestyle alignment, appealing to a wide range of consumers seeking tailored energy solutions. That ability to evolve is perhaps why this category has been able to see double digit growth multiple years in a row.

Consumer Mentality Shifts: The Top 4 Trends That Are Accelerating Change Across F&B

From Lifespan to Healthspan: The Rise of Functional Beverages

Consumers are increasingly drawn to beverages that offer health benefits alongside hydration. This shift towards nutrient-dense, functional drinks is driven by a desire for products that enhance overall health and wellness, such as beverages that manage glucose levels, improve gut health, and provide sustained energy. Shifting consumer perceptions are making beverages a key part of maintaining longevity and quality of life.

Global Flavors and Formats: Expanding Palates

Globalization is influencing tastes, leading to the rise of international flavors and formats in the beverage industry. Drinks like boba tea, initially popular in restaurants/cafes, are now hitting the retail shelves as ready-to-drink options. This movement highlights consumers’ readiness to explore diverse culinary cultures through beverages and offers brands opportunities to innovate and captivate new audiences with exotic flavors.

Sustainability: A Core Consumer Concern

Sustainability remains crucial, with consumers demanding eco-friendly practices from their favorite beverage brands. This includes sustainable packaging, ethical sourcing, and the use of upcycled and organic ingredients. Moreover, consumers increasingly link sustainability to personal health, seeing environmentally conscious choices as beneficial for both the planet and themselves.

Indulgent Yet Intentional: The New Wave of Indulgence

Indulgence in beverages is evolving to become more mindful and intentional. Nostalgic flavors are being revamped with healthy twists that shift them from “junk” to “health” foods, such as sodas with probiotics. This balance between indulgence and health is appealing to those who had previously shunned certain categories due to health concerns.

The Rise of Functional Beverages

What’s the Next Kombucha?

Taking a deeper look at some of the top trending health focuses across the beverage category, we see that Mood Support, Cleanse & Detox, and Digestive Health are among the top. Digestive health continues to be a central focus for health-conscious consumers. Fermented beverages like kombucha have led the way, demonstrating the market’s receptivity to products that offer gut health benefits. The success of kombucha has paved the way for other fermented drinks, although not all have seen the same level of success.

Source: Refrigerated, Grocery and Frozen Department with any SPINS Functional Ingredients. 52 Weeks End 03.24.2024. Total US-Natural Expanded Channel and Total US- MULO (Powered by Circana)

People are becoming more aware of the implications of gut health and microbiome. Many people have asked, ‘What’s the next Kombucha?’ and perhaps the market might finally have its answer.

Established beverage categories, such as sodas, are now also incorporating fermented elements, reflecting a merging of traditional and health-focused products. Though some may see it as a cannibalization of soda sales, there’s a flip side to this. Many consumers who saw sodas as unhealthy exited the soda category years ago now have a reason to return. Innovative products, such gut healthy sodas that are low in sugar, are incentives to revisit the category when they otherwise wouldn’t have.

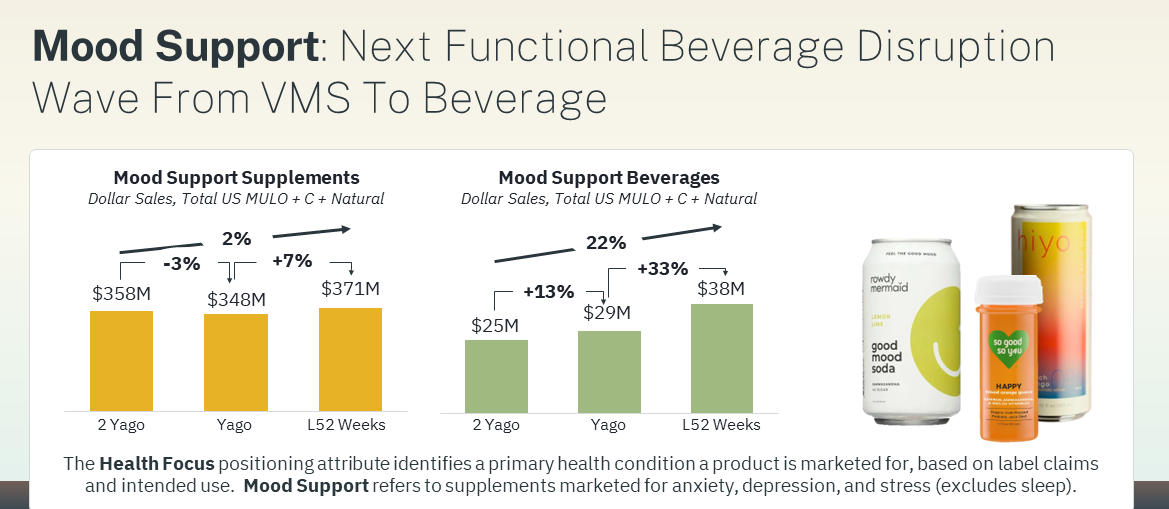

Mood Support Beverages: A Growing Niche

Mood support is a particularly intriguing trend as people look for alternatives to alcoholic nightcaps and other ways to de-stress. Mood support beverages, although a smaller category valued at $38 million, mirrors trends seen in supplements, which have previously experienced significant growth. When looking at the supplements department, we see that the mood support supplements category had a big boom a few years ago, and after a recalibration, it’s growing again at 7%. This could indicate a potential for similar growth in beverages.

Source: SPINS Total US – Natural + Total US – MULO + C (powered by Circana), Health Focus – Mood Support, VMS Department, Beverage Custom Group | Data Ending 03/24/24

Ingredients like magnesium are increasingly being incorporated into beverages, offering a calming effect without the need for alcohol. This shift represents a broader trend where consumers are seeking functional benefits from their beverages that extend beyond basic nutrition and allow for easy incorporation into their daily routines.

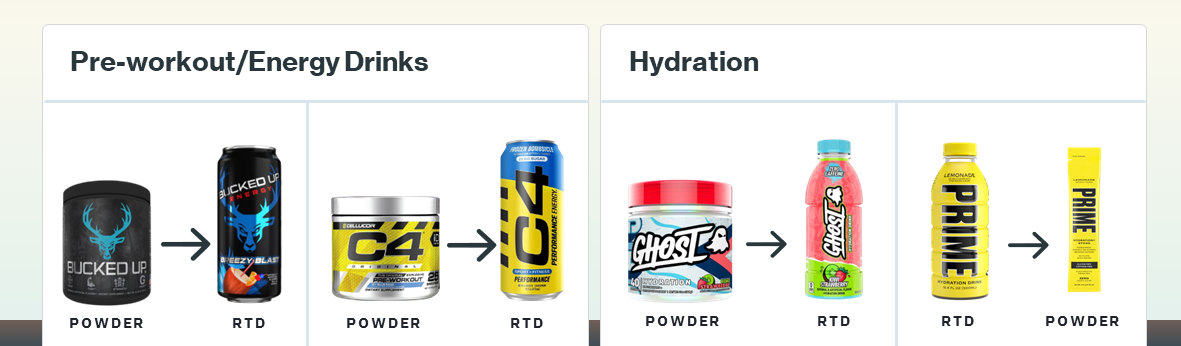

From Supplement to Beverage: Running the Powder to RTD Playbook

Going from supplement to beverage is no new concept. We’ve seen RTD energy drinks come from powdered pre-workout brands. This opened up the category to the performance nutrition space when it was initially simply caffeinated beverages reserved for nightlife/partying or extreme sports.

We’re now seeing hydration brands take a page from the same playbook and go from powder to RTD –and in some cases the reverse. These companies are not just entering new markets, but are also setting trends by transforming how consumers think about and consume healthy beverages. The trust and recognition associated with these brands play a crucial role in their ability to disrupt traditional beverage categories and gain substantial market share.

Moreover, there’s a time and place for both powder and RTD and maybe some brands are starting to realize it doesn’t have to be one or the other.. That’s not to say there haven’t been a few failed attempts at these format expansions, but they work when they find the right niche.

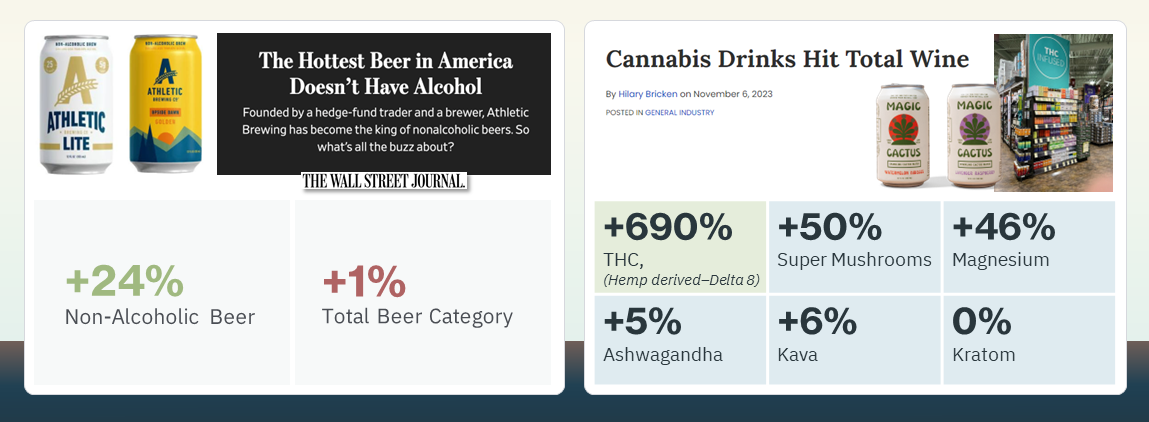

Non-Alcoholic Brews A Success?

One of the most striking trends in the beverage industry is the rising popularity of non-alcoholic beers. Quoting The Wall Street Journal, the hottest beer in America doesn’t have alcohol. This underscores a significant shift in consumer preferences. Major beer brands and new entrants alike are expanding their portfolios to include non-alcoholic options, catering to consumers who seek the social benefits and taste of beer without the alcohol content.

Source: SPINS Natural Channel, SPINS Conventional Channel (powered by Circana) data 52 Weeks Ending 03.24.24 Department: VMS, Grocery, Refrigerated, Frozen

This trend not only meets the needs of those reducing alcohol intake for health reasons but also accommodates the growing acceptance of drinking non-alcoholic beer during traditionally non-social hours, like midday.

Buzz Without the Booze

Beyond non-alcoholic beer, we see consumers who are seeking the buzz that alcohol gives but without the alcohol. There are a variety of functional drinks infused with ingredients like magnesium and adaptogenic herbs that are aimed at providing relaxation without alcohol. Particularly noteworthy is the emergence of THC-infused drinks, which are gaining traction among consumers and have even found placement on shelves in retail outlets like Total Wine. These products cater to the desire for a “buzz without the booze,” appealing to a segment of consumers looking for alternatives to alcoholic beverages.

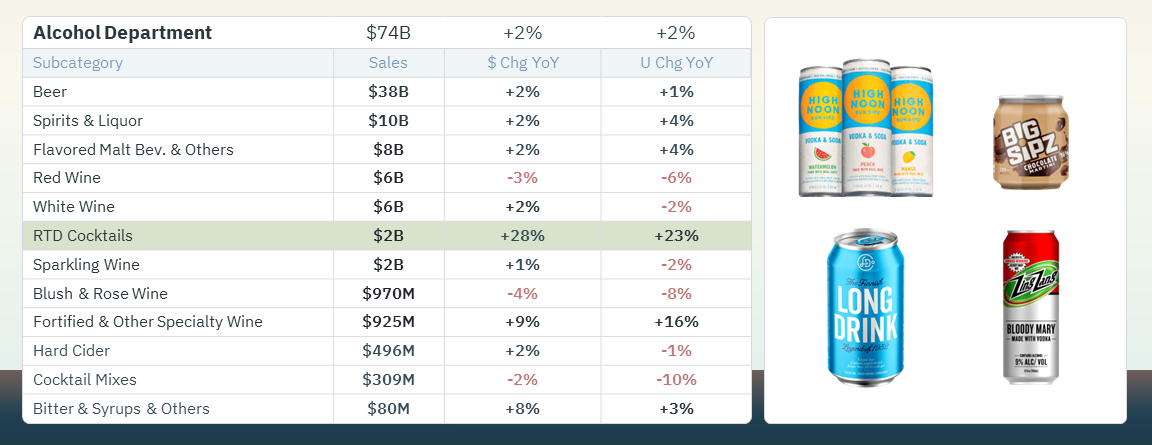

Ready-to-Drink Cocktails: Convenience Meets Craftsmanship

One of the brightest spots in the alcohol category is the ready-to-drink (RTD) cocktail subcategory which is growing at 28% in terms of sales and 23% in units year-over-year.

Source: SPINS Total US Natural Enhanced Channel , Multioutlet & Convenience (powered by Circana), Powered By SPINS Proprietary PI 52 Weeks ending 03.24.2024

When the bars and restaurants shut down back in 2020 for COVID, we saw a lot of innovation in the ready-to-drink alcohol space that was non-beer. This shift has continued to evolve, leading to an expansion in the variety of crafted cocktails available off the shelf. These products cater to consumers seeking premium, convenient options that do not require the skills of a home mixologist, making sophisticated drinking experiences more accessible.

Though this may seem like an unusual premium purchase in times when consumers report that inflation is hurting them, remember that a purchase like this is in a sense cheaper than a night out at a bar. Therefore, by comparison, this is the economic choice and one that still gives them an elevated, premium experience with maximum convenience.

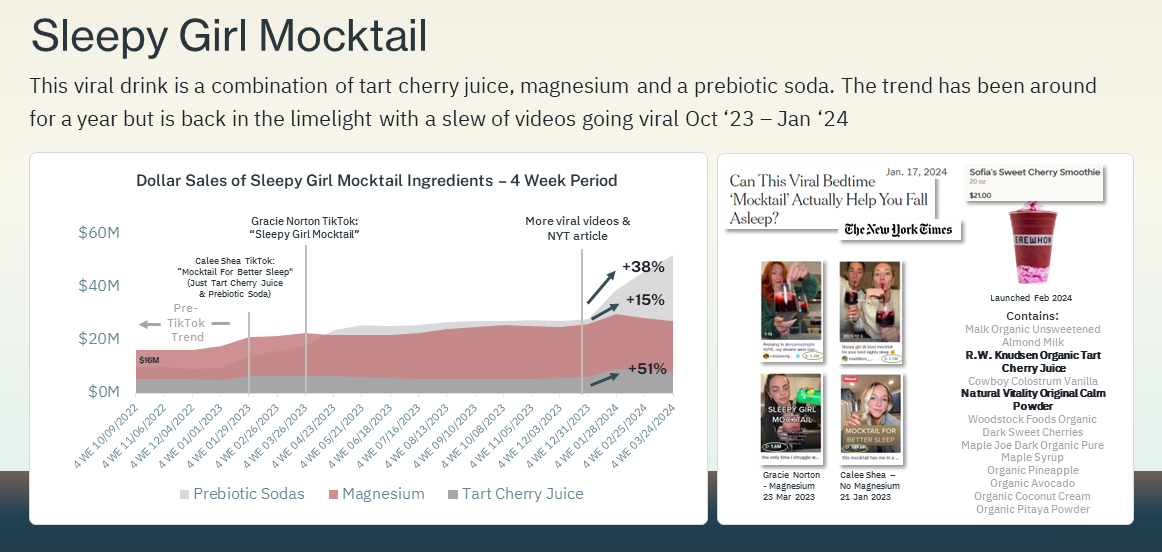

Tik Tok Trending: Sleepy Girl Mocktail

Speaking about at-home mixology, we see that social media continues to play a pivotal role in shaping consumer trends, as evidenced by the viral “Sleepy Girl Mocktail.” This non-alcoholic beverage combines functional ingredients like magnesium and tart cherry juice, known for their health benefits, which is then topped off with a prebiotic soda.

SPINS: Natural, MULO & Convenience (powered by Circana); 52 Weeks Ending 03.24.2024

Though this particular trend has been around for about a year, it went viral again towards the end of 2023 and early 2024. Tracking the sales, we can see how specific videos and bouts of virality both in press and on social media, have the power to push sales of the specific ingredients higher.

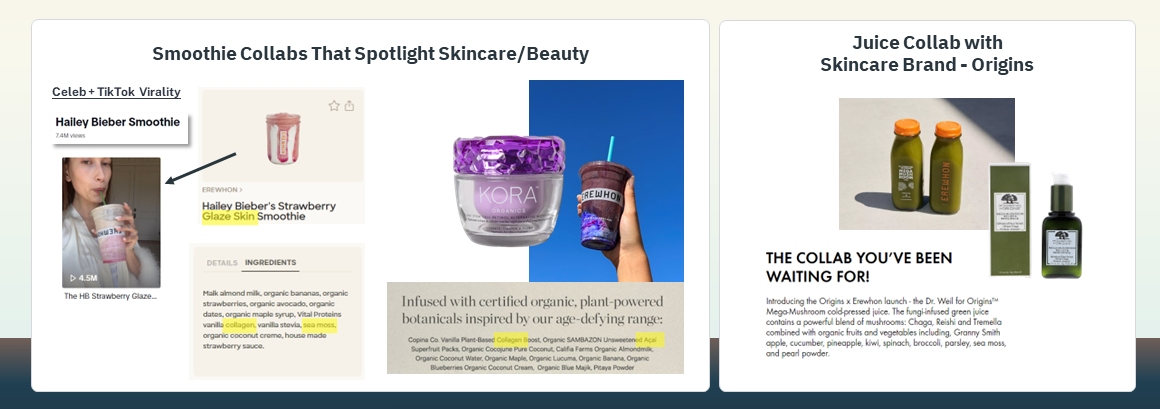

Erewhon’s Viral Smoothies

From viral TikTok concoctions to beyond, perhaps Erewhon’s viral smoothies best highlight how consumers enjoy it when a drink brings both functionality and fun to the forefront. For the uninitiated, Erewhon often creates smoothies in collaboration with celebrities and they tend to go viral and bring in thousands in sales despite the hefty price tag.

These smoothies usually have a functional twist to it, often times beauty/wellness related. From Hailey Bieber’s Strawberry Glaze Skin Smoothie to Miranda Kerr’s smoothie that was launched in conjunction with her new skincare product. With ingredients like collagen, colostrum and more in these smoothies combined with how aesthetically pleasing they look, perhaps the retail chain has unlocked a secret to making smoothies go viral. Videos of these drinks rack up millions of views, especially when the celebrities themselves are the ones posting it.

Beyond the fun of it all, there is a business opportunity in these beverages since branded products are often featured in them. This allows brands to tap into a wide market with that celebrity backing to boot. Additionally, we’ve also seen brands go into direct partnership with Erewhon: Skincare brand Origins collaborated with the retail chain on a “Mega-mushroom Juice,” which was inspired by Origins’ new Mega-Mushroom Skin Concentrate.

Adapting to New Realities

The beverage industry reflects broad consumer trends and economic conditions, swiftly adapting to new demands. With health and wellness as a focal point and a significant shift towards non-alcoholic and premium options, the industry is not just responding to current consumer preferences but is actively shaping them. This is raising the tide for the entire category, signaling a dynamic future for beverages in consumer markets.

As we continue to watch these trends unfold, the beverage industry’s role in everyday life seems set to expand even further, promising exciting developments for the future.