The Sports Nutrition Category Evolves Beyond Athletic Performance

Today, you can find items like protein powder and electrolyte packets in the average consumer’s shopping cart. Not too long ago, however, sports nutrition items were strictly the domain of athletes looking to optimize their performance and gym rats wanting to bulk up.

An evolved view of health and wellness helped move the sports nutrition trends towards the mainstream. Athletes are still faithful consumers of sports nutrition, but they’re no longer the only shoppers who care about the intersection of a daily lifestyle, health habits, and dietary choices.

A New Approach to Health and Wellness

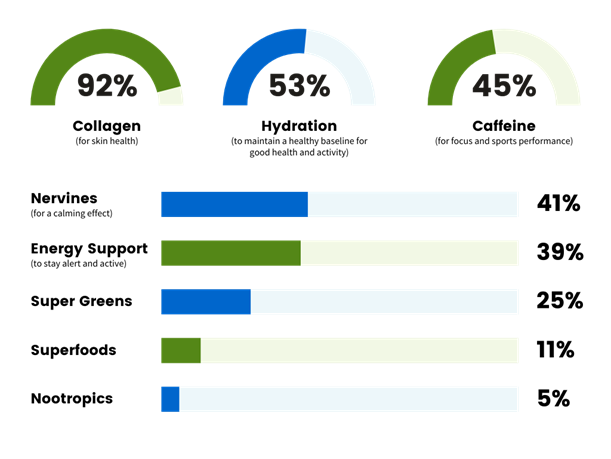

Study after study cites the benefits of sleep on your physical and mental health. An active lifestyle is connected to a healthier and longer life. Preventative health measures have become integral parts of the wellness conversation and the culture is now more hospitable to sports nutrition products for any type of buyer. We see that when we look at SPINS product attributes over the last 2 years to understand which performance nutrition supplements have grown:

Top product attributes to watch for include collagen, hydration, caffeine and nervines as shopper familiarity with their promoted benefits is increasing the demand.

Each of these attributes offers more than one potential health benefit, appealing to shoppers of all activity levels and signaling an opportunity to reach new audiences.

Workout Supplements Evolve and Reach a New Baseline in Sports Nutrition

The 2020 sales surge of all things health and wellness wasn’t a big mystery, but what would come next was. Would customers continue to choose workout supplements once we began to return to normal activities? Now, more than 18 months after the initial pantry-loading phase began and many months since the vaccine began its rollout, we have an answer: Yes!

Both pre- and post-workout supplements and protein powder experienced a significant bump between March and May 2020. With minimal fluctuation, both categories grew at similar rates from 2020 to 2021—and their baseline remains higher than it was pre-pandemic.

Growth in workout supplements and powders wasn’t a one-sided phenomenon driven only by consumer behavior. Brands have been expanding their pre-workout offerings into the energy drink space. Now shoppers don’t need to decide between their powders and their caffeinated beverages. They can find aminos in those caffeinated cans, along with specific ingredients promoting focus and mental clarity. You can expect more sports nutrition manufacturers to follow this model as they combine performance with functionality in other beverages, like kombucha and sparkling water.

Everyone Is Looking for Protein

Worrying about protein isn’t that unusual for most shoppers today, but not too long ago it seemed to belong only to athletes trying to put on muscle. (Think of the clichéd image of body builders eating raw eggs and pounds of skinless chicken breasts.) Today, pretty much everyone is thinking about protein intake, even if they’re not all counting every gram. You can find chips, canned coffee, and plant-based burgers all promoting their high protein count. Not to mention protein powders and shakes, which are still popular in the vitamins and supplements aisle. There are now options for shoppers of every walk of life.

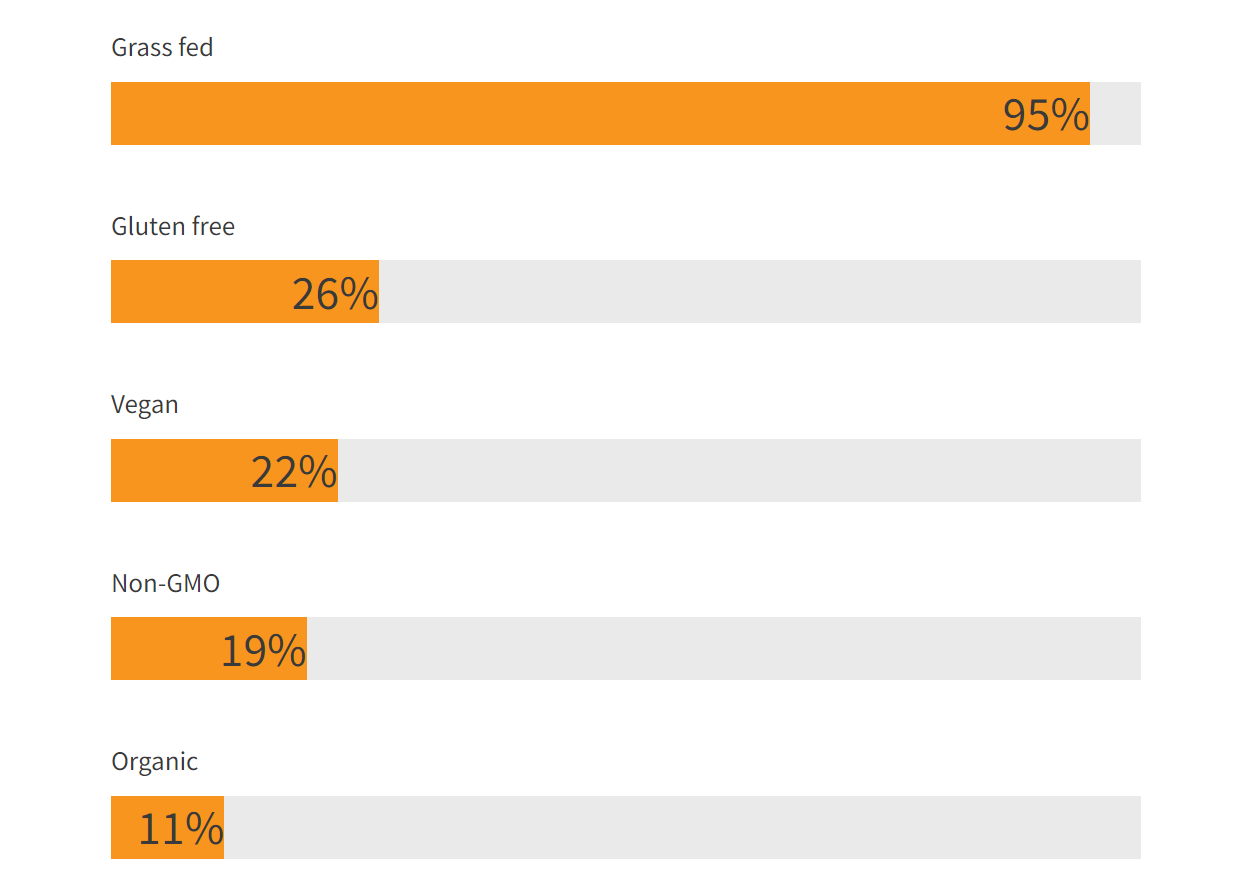

Brands have taken notice and responded to this diversified audience by positioning protein as a natural, healthy part of a balanced diet. Protein supplements and meal replacements are up 18% vs 2 years ago, and in that same time period we’ve seen protein products with certain label claims experience strong growth:

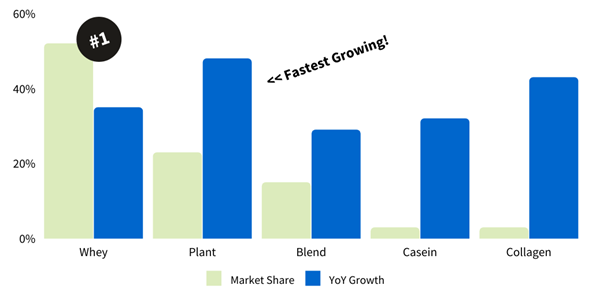

Protein powders have seen steady year-over-year sales volume and dollar growth for the last 3 years, according to SPINS Natural Enhanced and Conventional Multi-outlet (powered by IRI). While whey has the largest market share of protein powder sales at 52%, according to ClearCut Analytics, plant-based has the fastest year-over-year growth at 48%. Protein supplements and meal replacements have become a big tent that has room for a large variety of players, and it is on track to continue growing.

Wellness Bars Find a New Place in a Post-Pandemic World

Convenience is arguably the main reason consumers choose wellness bars. They’re perfect on-the-go snacks or meal replacements during a busy workday or when commuting. Therefore, it’s not surprising that wellness bars suffered a sales setback when the world went into lockdown in early 2020.

From September 2019 to September 2020, year-over-year dollar growth decreased 5.6% for wellness bars (exclusive gels). From September 2020 to September 2021, it grew 1.4%, signaling a slow bounce back as some parts of daily life returned to normal. Whether it will return to 2019 levels remains to be seen, but 2022 will give us a better of idea of what daily life will look like for many workers and how it will dictate their need for wellness bars.

How You Can Stay Ahead in Sports Nutrition

The pandemic caused shoppers to reevaluate their habits: some have been permanently altered and others are temporarily paused until a new routine is established. Here’s how you can stay ahead of the performance nutrition trend and connect with your shoppers:

Meet the demand for convenience and nutrition:

The success of ready-to-drink single-serving performance drinks proves that shoppers are looking to save time while still getting a nutrition boost. Retailers should stock products that meet these demands. Brands should develop new products (or promote existing ones) that address the demand for both convenience and performance nutrition.

Optimize your omnichannel experience:

Shoppers are visiting brick-and-mortar stores and looking online. Retailers should make in-store product discovery easy and work with your digital presence. Brands can ensure they’re working with retailers who are merchandising their products effectively and incorporating them into their online experience.

Stay innovative:

Supplements and functional foods will continue to merge across all aisles. Retailers and brands alike need to build strategies that acknowledge this new reality and don’t try to draw a line between performance, wellness, and everyday items.