SPINS acquires Datasembly to create a more expansive and transparent view of the marketplace.

SPINS acquires Datasembly to create a more expansive and transparent view of the marketplace.

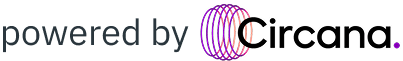

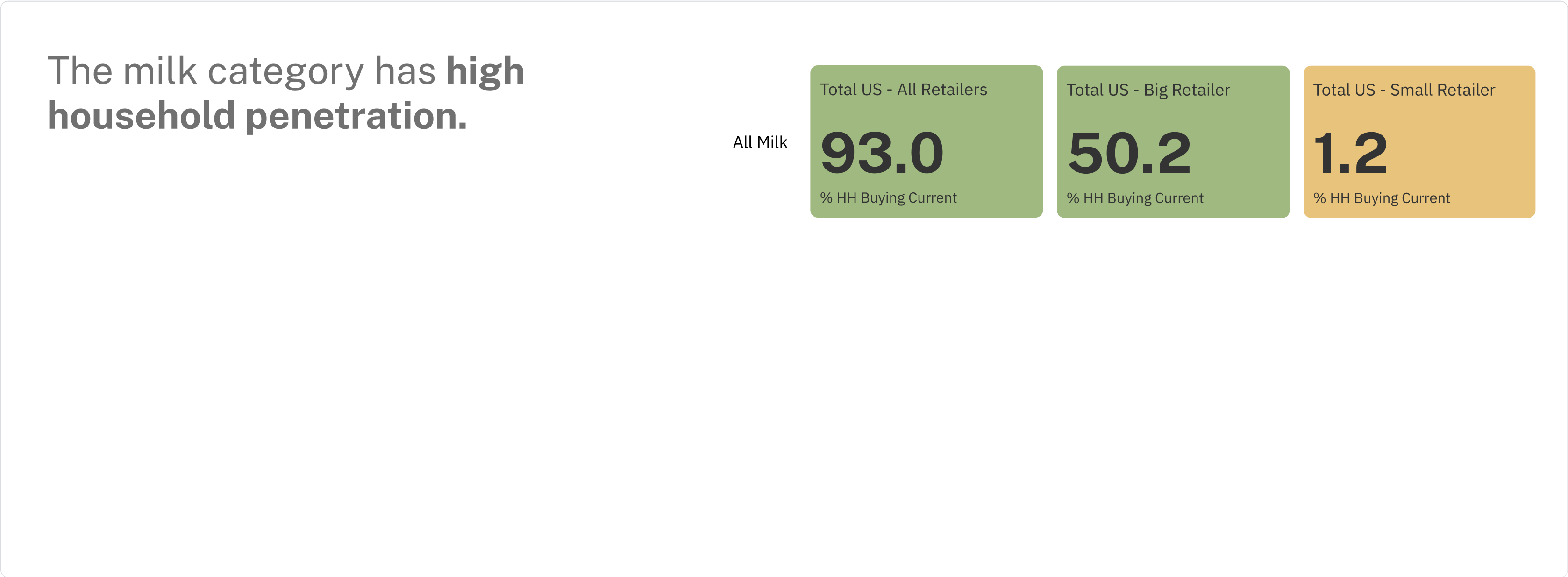

The industry’s most trusted consumer data—the National Consumer Panel (NCP). Why NCP?

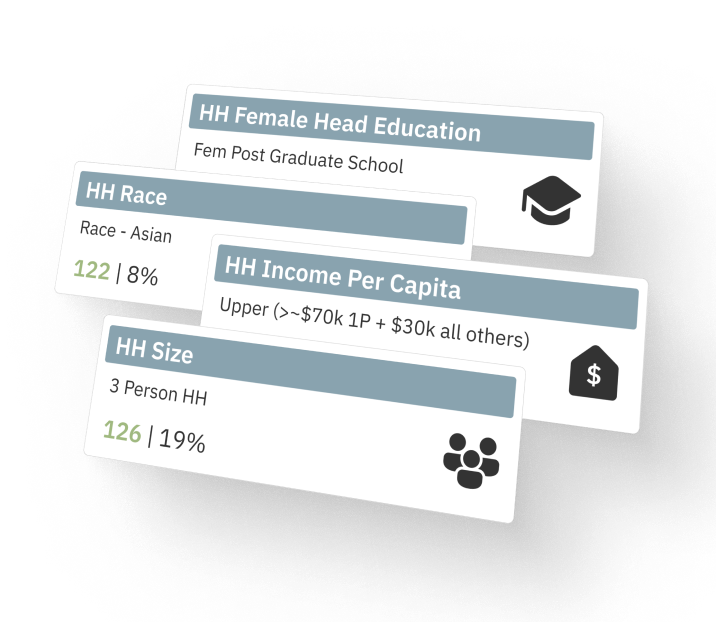

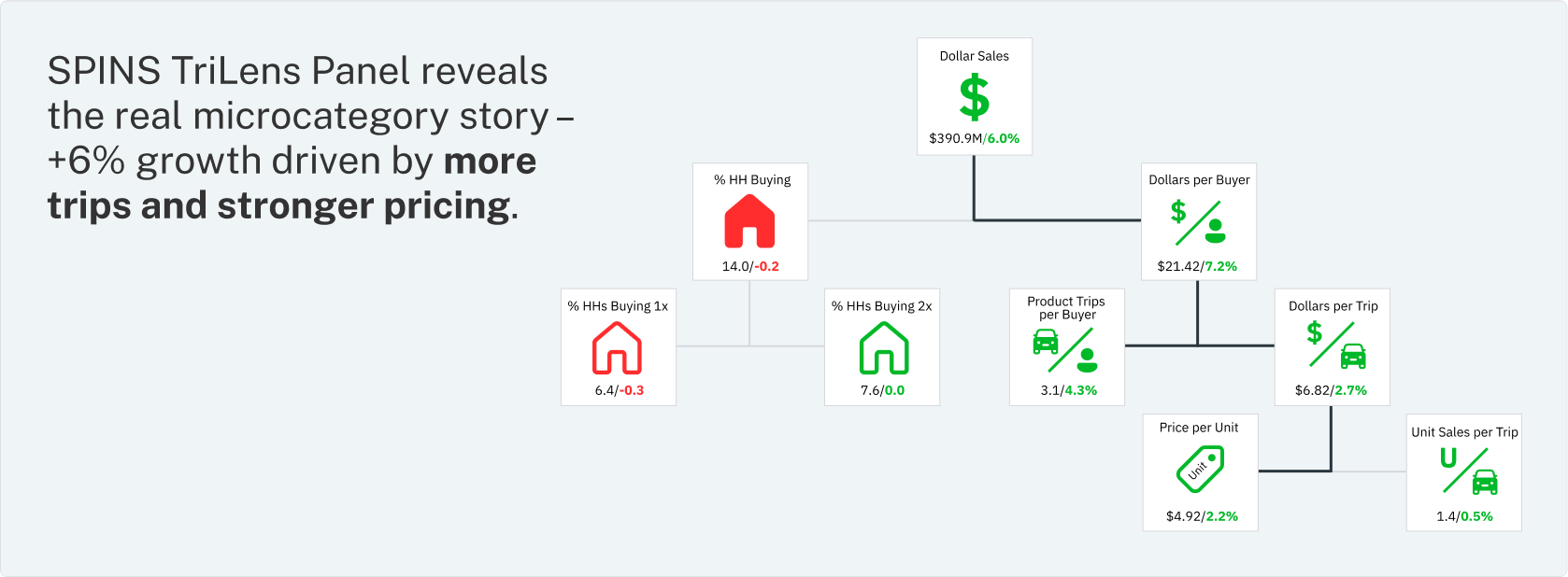

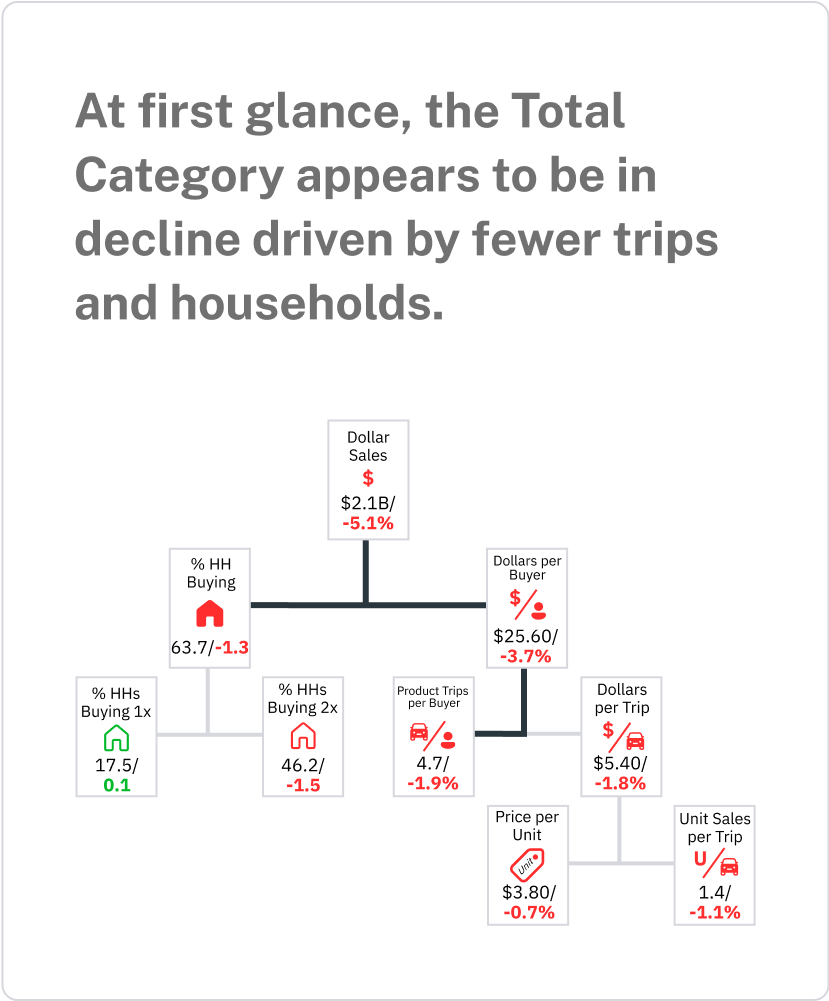

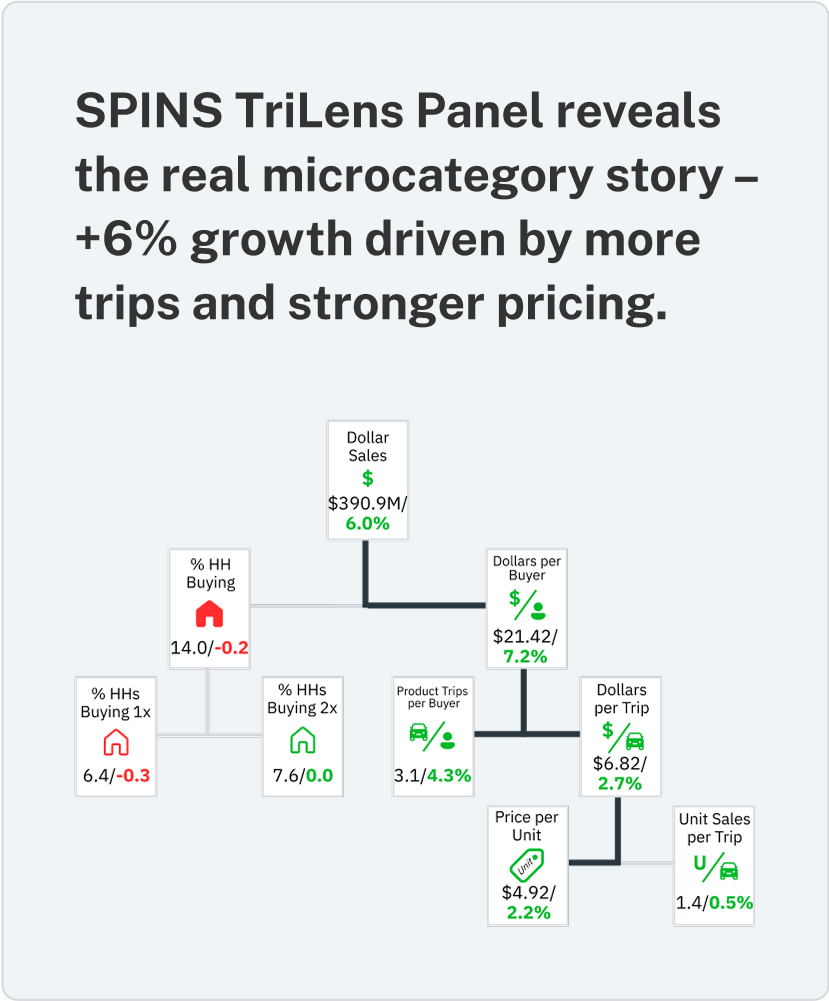

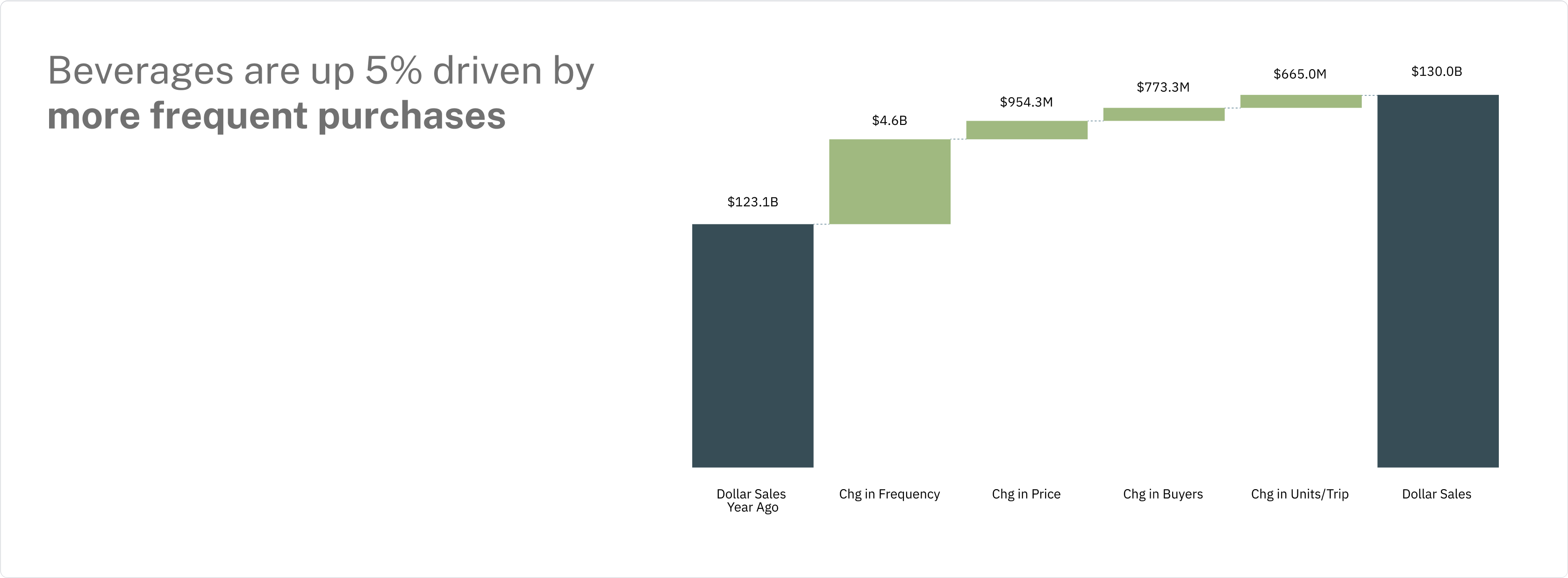

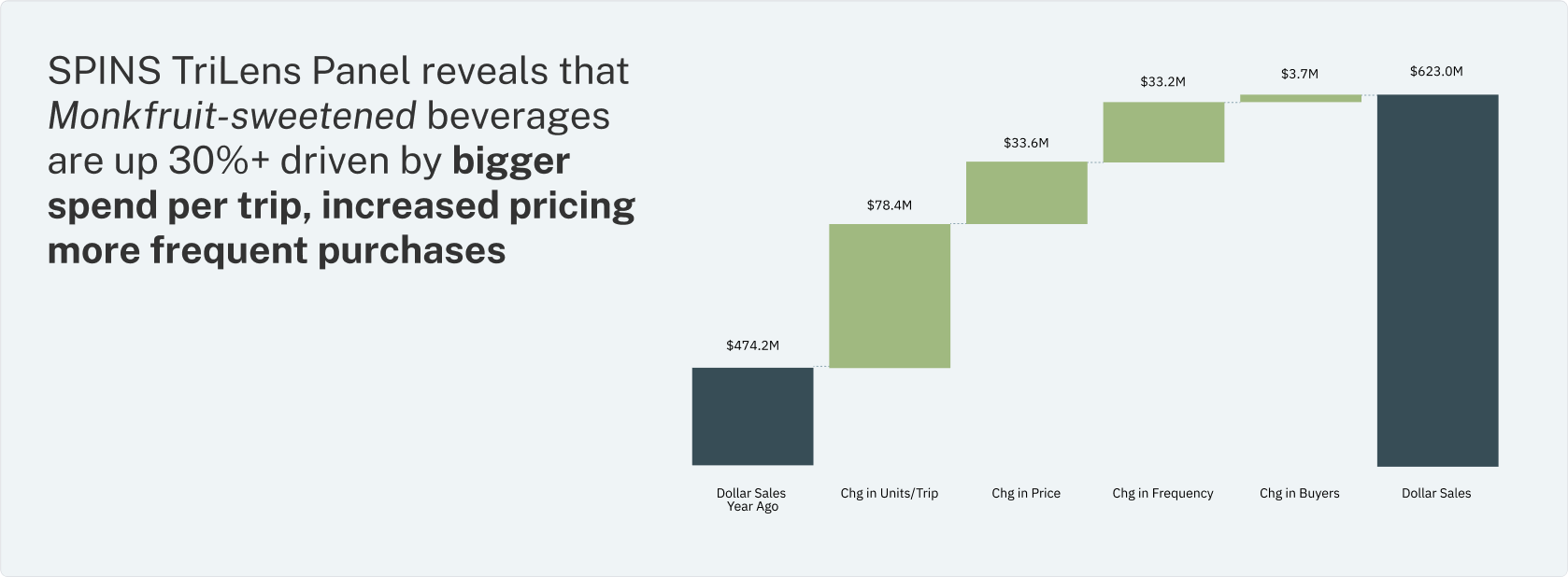

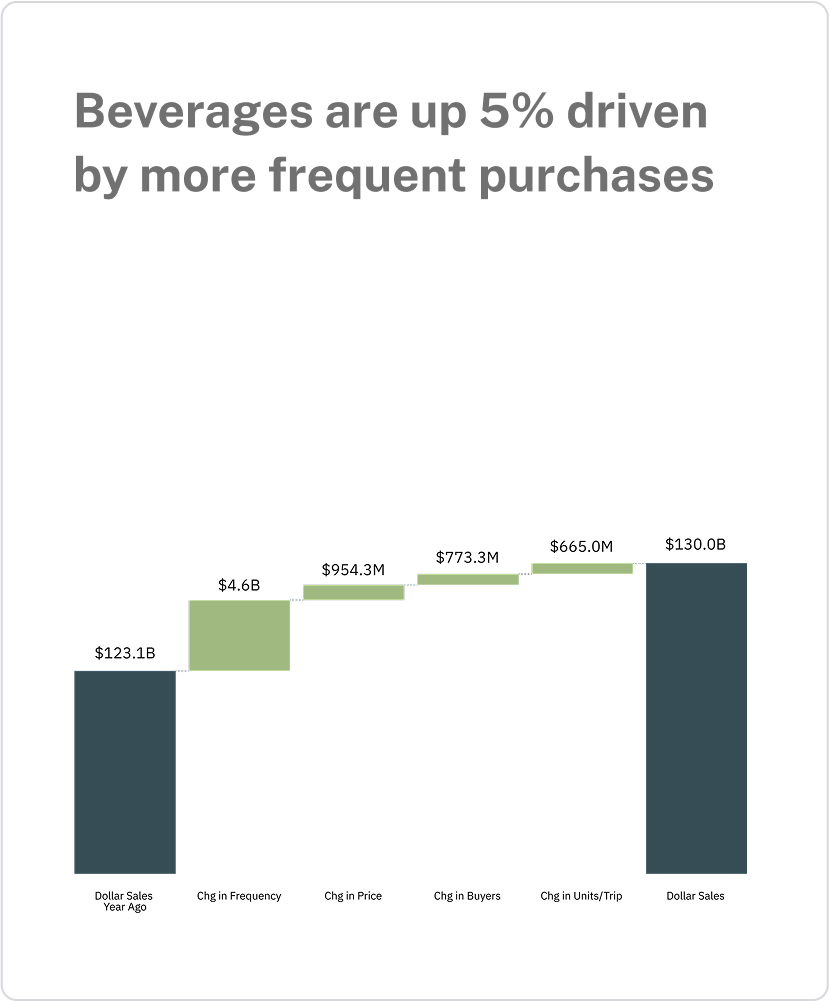

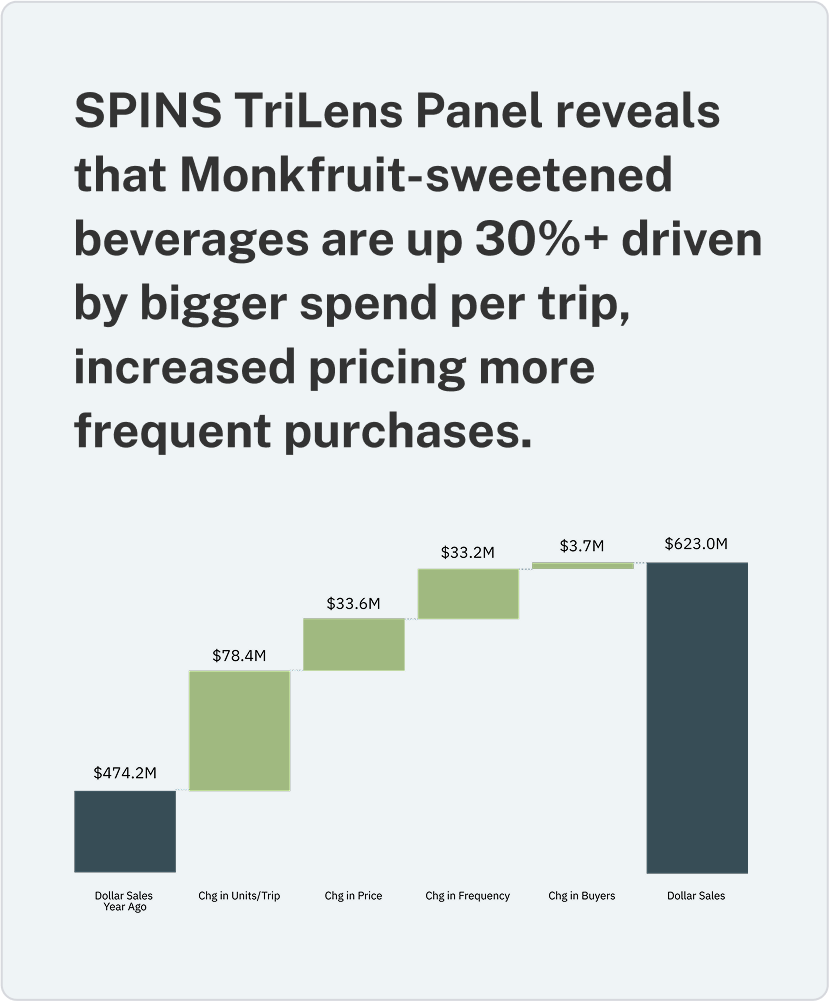

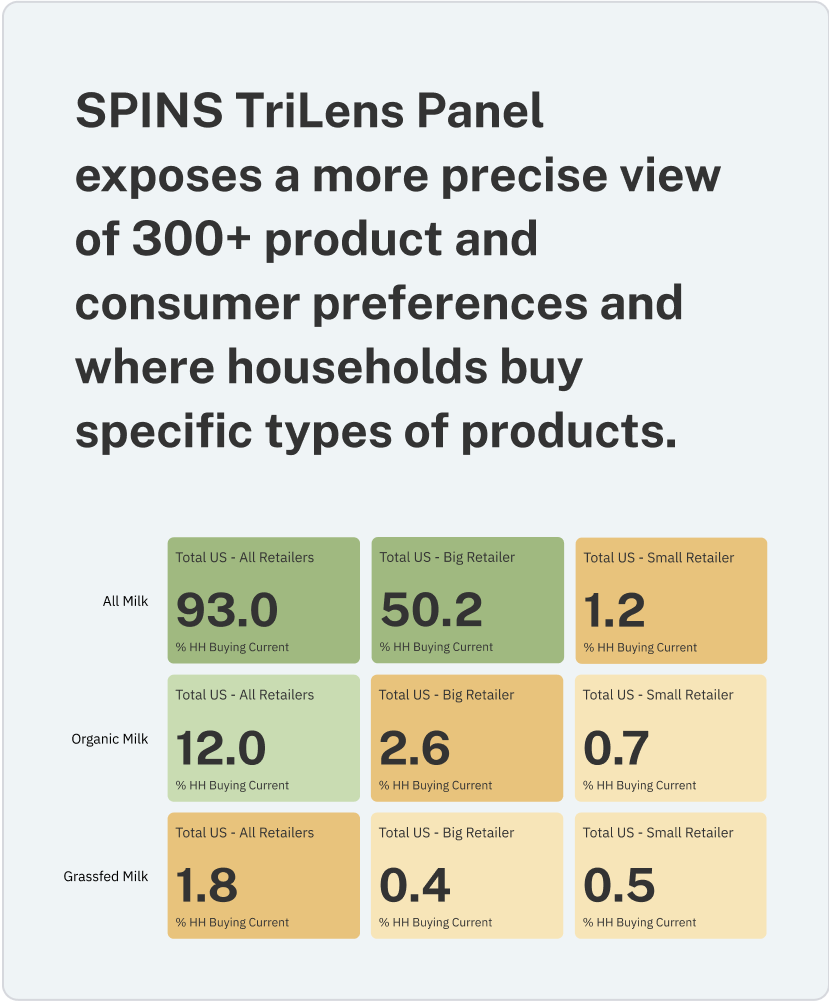

Consistency of SPINS hierarchy. Same view as your POS data.

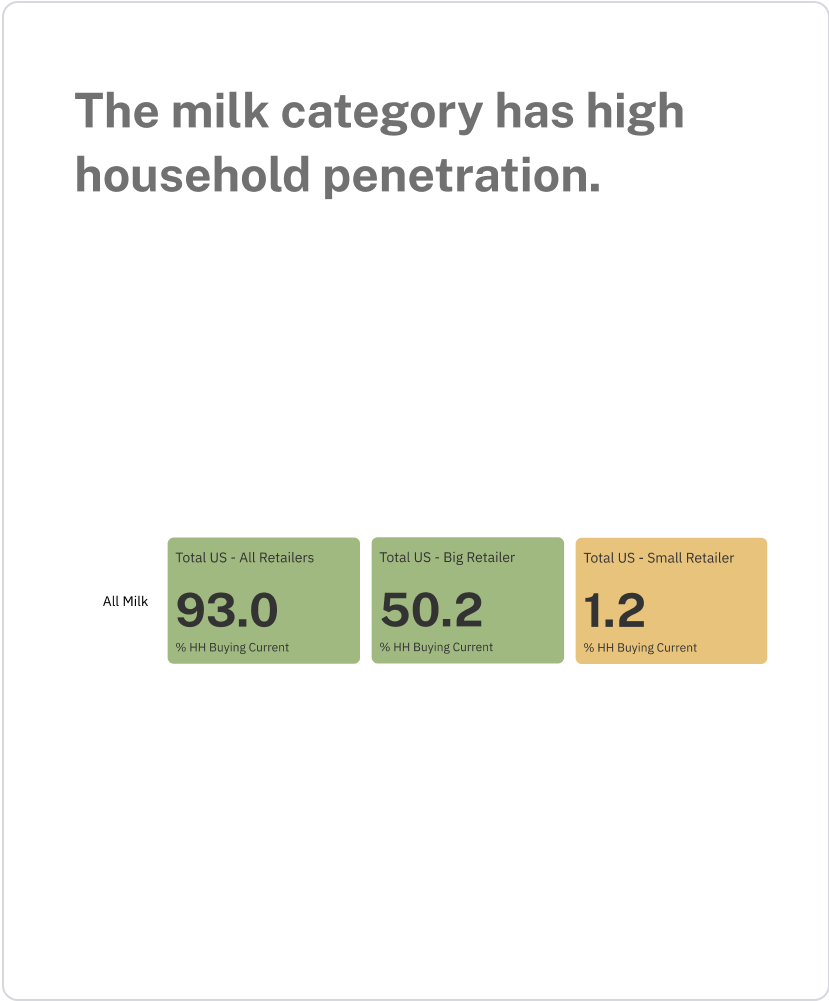

Clarity of SPINS attributes. Understand consumers through their preferences.

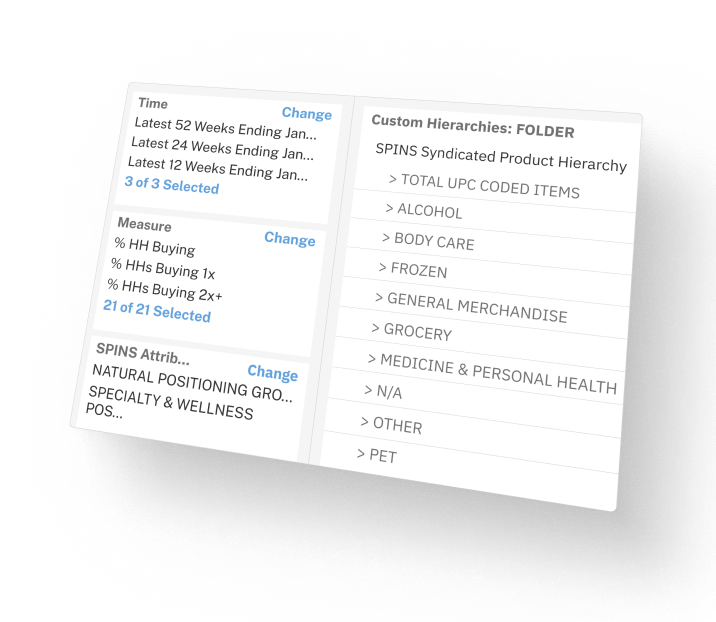

Use SPINS product and consumer preference attributes to dial into the real performance.

Essential category & brand insights for fast-growing brands

Competitive intelligence for velocity-driven brands

Advanced solutions for category leaders