Introduction

After exploring the current market landscape and consumer definitions of sustainability, it’s essential to understand how to approach viewing sustainability in a category analysis. This approach allows us to uncover actionable insights by tracking sustainability attributes—both certifications and claims—across categories, positioning groups, and product innovation. By decoding these signals, we can see how sustainability influences category growth, shopper engagement, and long-term brand performance.

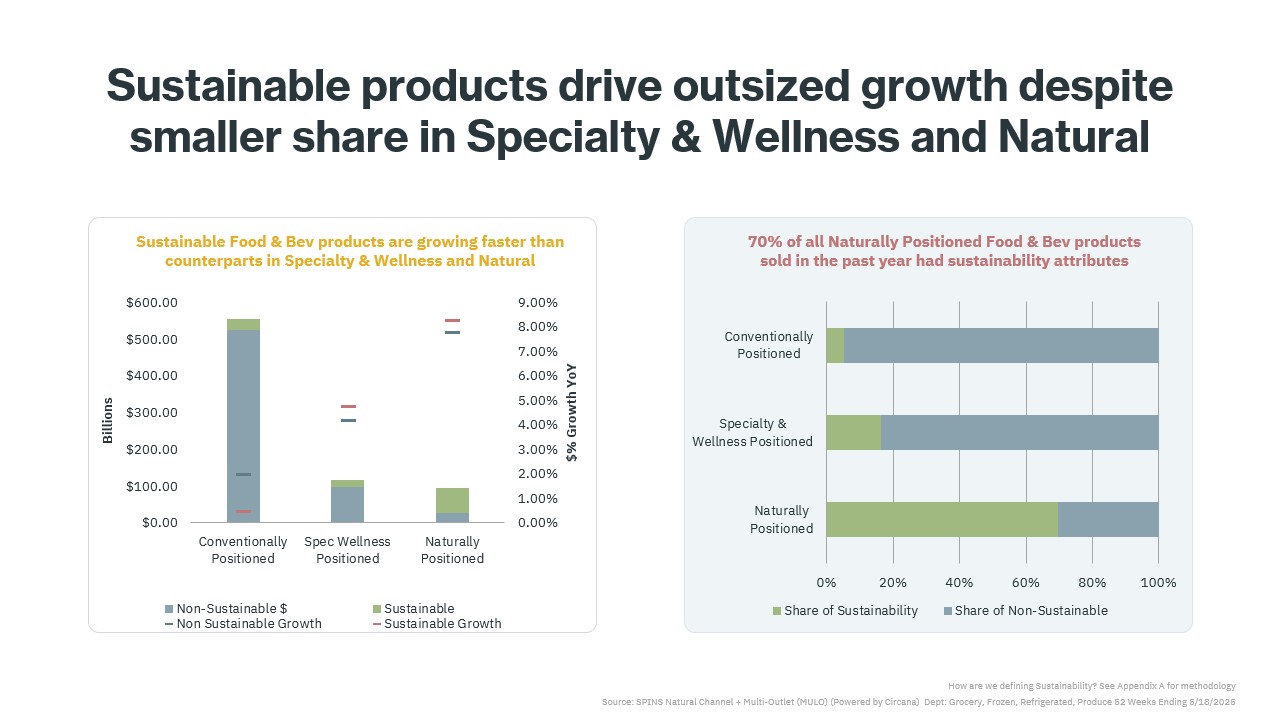

Across food and beverage, products with sustainable attributes are outperforming their non-sustainable counterparts in both Specialty & Wellness and Natural positioning groups. While their share of total dollars remains smaller, their growth rate is outsized, especially within the natural channel.

In fact, sustainable products account for 70% of Naturally positioned total units sold year over year, underscoring that sustainably signaled products are fueling much of the growth in these markets. Although sustainable share is lower in conventional categories, their alignment with health- and wellness-focused shoppers positions them for continued expansion.

Why Naturally Positioned Products Matter

So, why all this talk about Naturally positioned products? This is because Naturally positioned products often serve as early adopters of sustainability trends, leading in attributes such as organic certification, regenerative sourcing, or eco-friendly packaging. With 70% of natural product sales carrying sustainability-related attributes, performance in this set offers predictive insights into where broader category trends may be headed. For this reason, SPINS uses naturally positioned products as a proxy for tracking sustainability momentum.

Strong Sales and Velocity at Premium Price Points

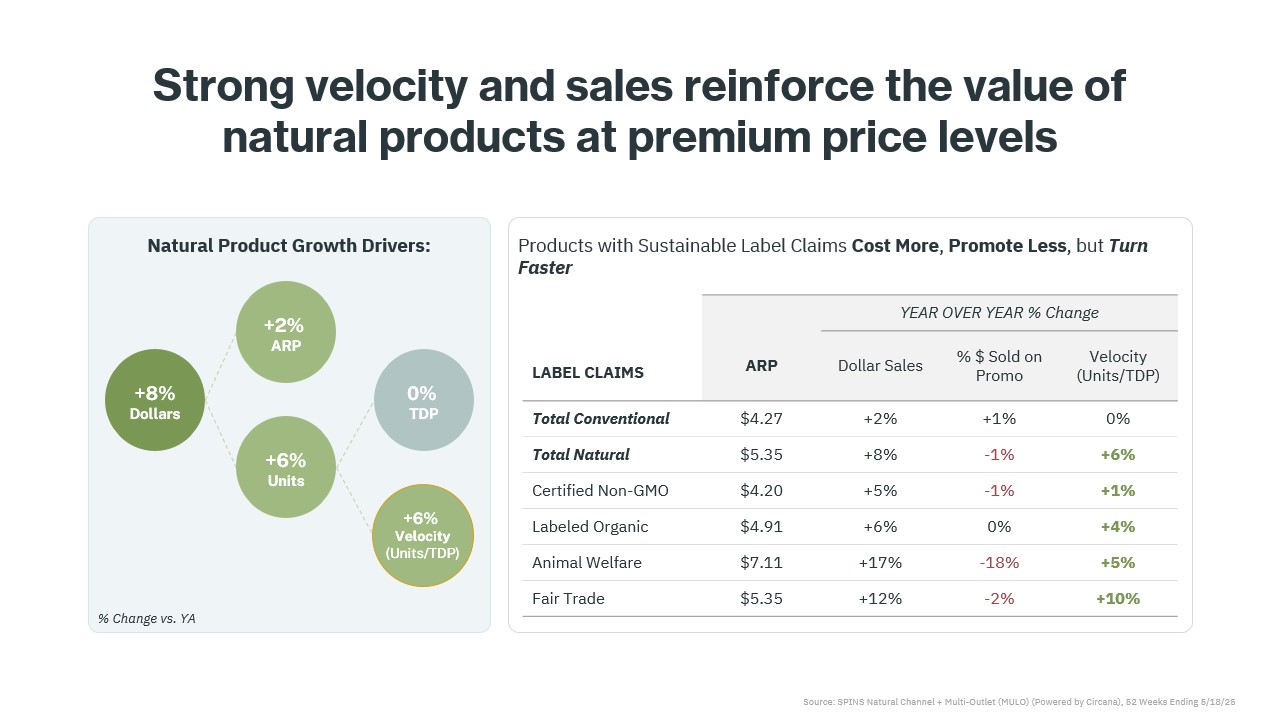

Natural and sustainable products do come with a price premium—averaging about 25% more than conventional products—but that hasn’t slowed their momentum.

In fact, they are not only growing in dollar sales but also turning faster on the shelf. Even with fewer promotions, sustainable products demonstrate strong velocity, reflecting consumer enthusiasm and willingness to invest in values-aligned choices.

Certifications and Label Claims Build Trust and Drive Growth

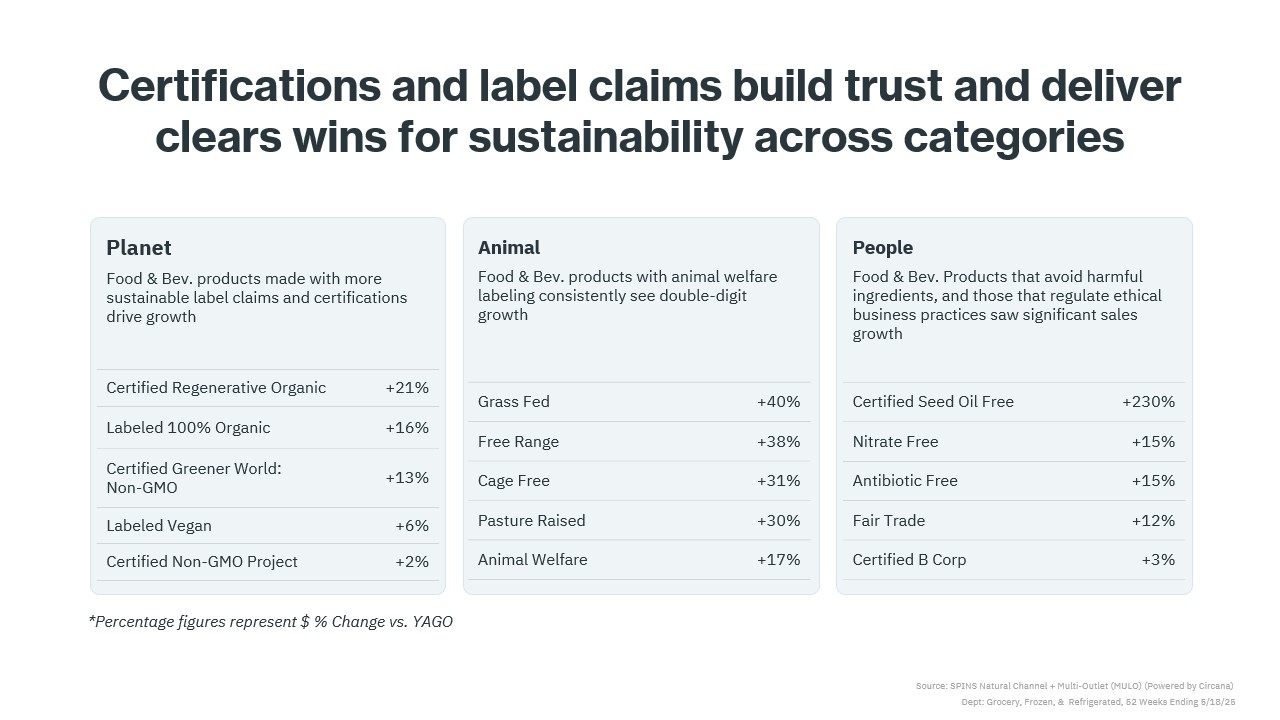

Certifications and label claims remain key to translating sustainability into consumer trust and measurable sales.

Whether the focus is environmental stewardship, animal welfare, nutrition, or social impact, these designations signal credibility and drive growth across multiple departments. For brands, certifications are more than marketing; they’re proof points that influence purchase decisions.

Category Impacts: Sustainability as a Growth Engine

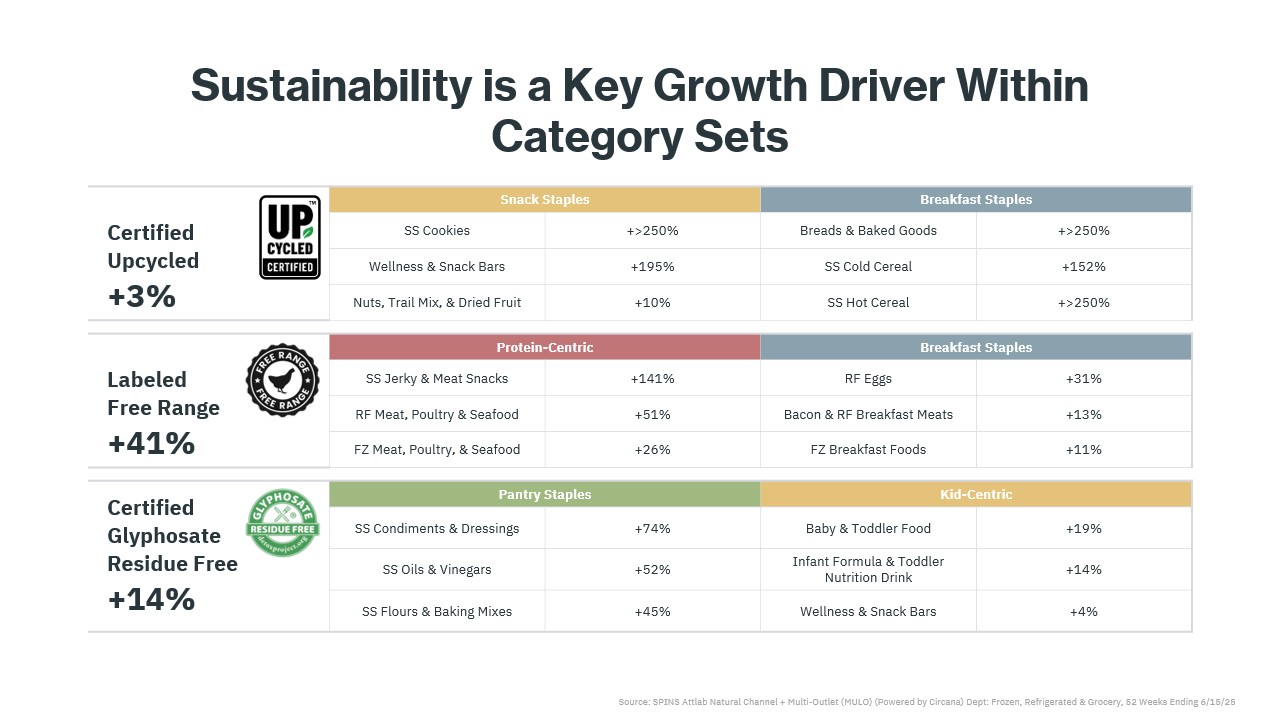

Sustainability-driven certifications are delivering powerful results within specific category sets. In breakfast staples, “Upcycled Certified” and “Free Range” labels are fueling momentum.

In kid-centric categories, “Upcycled Certified” and “Glyphosate Residue Free” claims are resonating with parents who want nutritious, convenient, and responsibly sourced meals. These category-specific alignments reflect a broader shift toward family-friendly sustainability.

Dairy Categories Embrace Sustainability

Dairy is a standout example of how sustainability can drive performance across both major and niche segments. Growth is evident not only in milk and yogurt but also in creams, creamers, frozen novelties, and butter.

Certifications like Certified Regenerative Organic, Non-GMO, Greener World, Organic, and grass-fed are delivering double-digit dollar growth, outperforming the overall category. For example, Creams & Creamers that are labeled organic are seeing a 20% increase in year-over-year sales while the overall Creams & Creamers category is only seeing a 5% growth in year-over-year sales. Brands like Clover Sonoma, Ice Cream for Bears, and 4th & Heart are leading the way with innovative, values-led offerings.

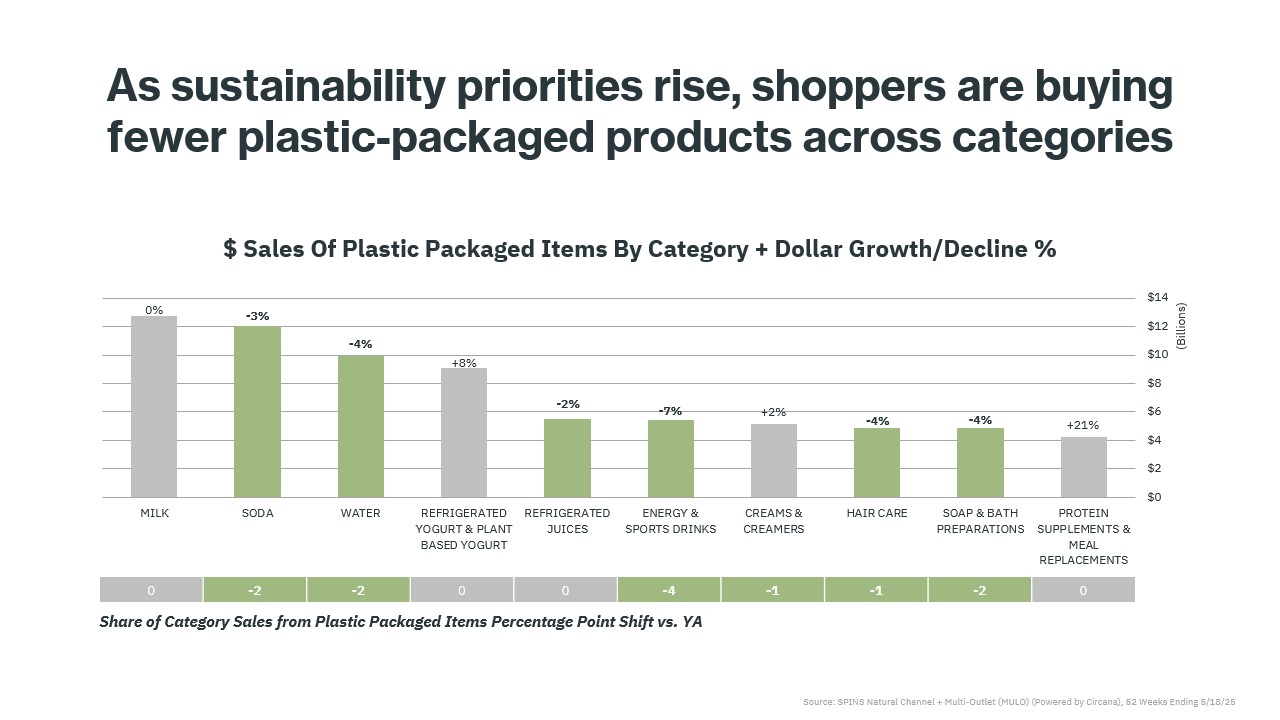

Shoppers Turn Away from Plastic Packaging

Consumers aren’t just talking about plastic as a sustainability concern. They are acting on it. And we’re seeing clear shifts in their purchasing behavior with reduced demand for plastic packaging on the shelf.

Across the top ten plastic-heavy categories, six have seen year-over-year unit declines in plastic-packaged products. Beverages and body care lead this shift, as shoppers seek alternatives with lower environmental impact.

Better-for-the-Planet Packaging Alternatives Gain Momentum

In milk, glass packaging—though a small share—leads in velocity growth, followed by aseptic cartons. In soda and water, cans are driving the highest unit growth while plastic bottles are seeing the largest unit declines.

In hair care, shampoo bars—an emerging zero-waste alternative—are up 31% year over year, while plastic-packaged options are down.

Categories Ripe for Sustainability Expansion

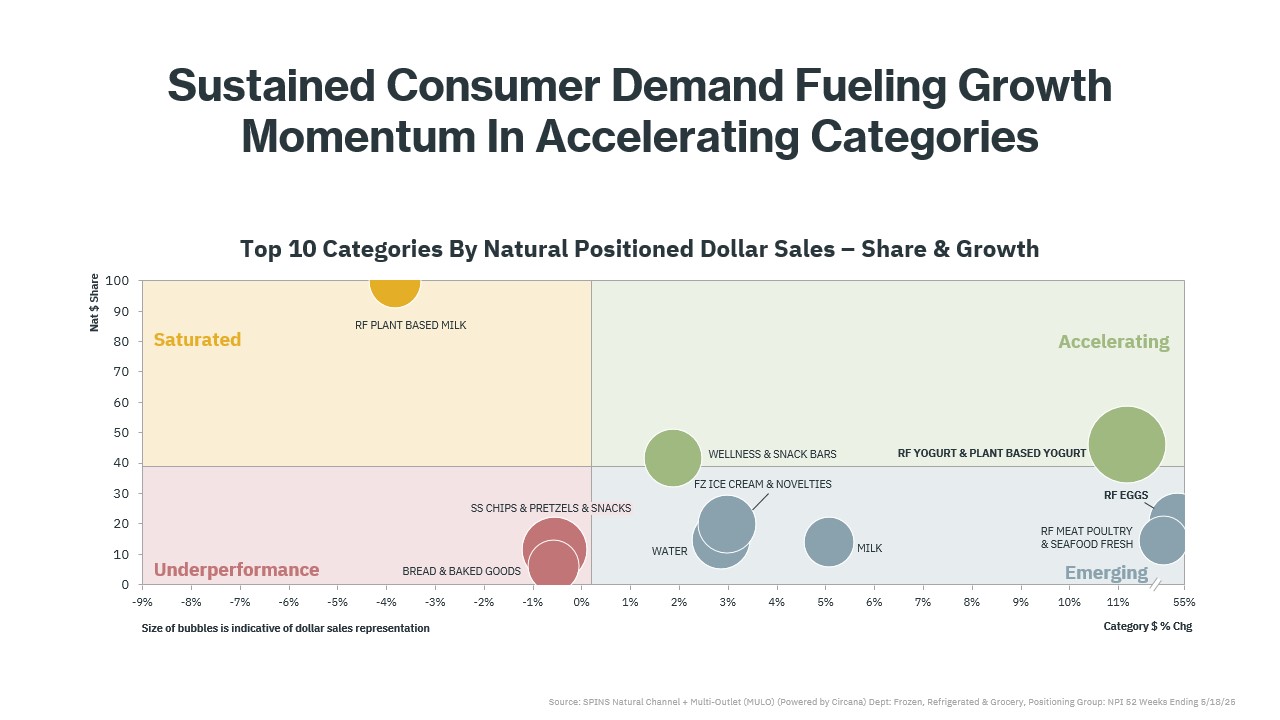

So, where next? When looking at the market as a whole, categories with high natural share and continued growth stand out as the most immediate opportunity for sustainability expansion.

In this chart, the green quadrant highlights categories with both a high share of natural products and continued growth. These represent the most immediate opportunities.

In contrast, the Orange Quadrant shows categories that may be saturated with natural offerings and are now experiencing declines. And Red indicates low share and declining performance, while the Blue quadrant represents emerging categories with low natural share but growing demand. So yogurt and plant-based yogurt are the standout opportunities, showing not only strong natural product growth but also increasing adoption of sustainability certifications.

A Prime Eggzample: Price Stability Meets Sustainability

When talking about sustainable options, perhaps a great category to take into consideration is eggs. Sustainably produced eggs illustrate how ethical farming can also deliver price stability. While conventional eggs have seen a 96% price increase over three years (largely due to avian flu and supply chain disruptions), sustainable eggs have risen by just 54%.

This relative stability, combined with ethical and environmental benefits, makes them an increasingly appealing choice—especially when the price difference is marginal.

Understanding the Sustainable Shopper

Sustainability resonates across diverse consumer segments, but priorities vary. SPINS identifies four key shopper types:

- True Believers – Mostly millennials, focused on natural, healthy options for their families, especially Fairtrade products.

- Enlightened Environmentalists – Primarily baby boomers, prioritizing organic, eco-friendly, and planet-first choices.

- Healthy Realists – Late millennials, seeking organic and natural products with a willingness to pay more for the right attributes.

- Strapped Seekers – Gen Z and younger millennials, price-sensitive but open to paying more for a broad range of sustainability attributes.

The common thread: a focus on health-forward, planet-conscious solutions with strong family well-being ties.

Sustainability as a Loyalty Strategy

Sustainability is no longer a “nice to have”; it’s a loyalty driver. Consumers are increasingly looking for more and more transparency, and brands that clearly demonstrate their values through trusted certifications are earning that trust and fostering long-term loyalty through these certifications.

The graph above shows how Non-GMO really stands out as a leading driver of repeat purchases across the frozen, refrigerated, and grocery departments and then other certifications and label claims like animal welfare, regenerative organic certified and Fairtrade are steadily gaining traction by reinforcing meaningful and values-led commitments.

Newer certifications, such as 1% for the Planet, are also gaining traction, especially when championed by influential brands like Patagonia Provisions and King Arthur. Clear, credible commitments not only build trust, they create lasting customer relationships.