Introduction

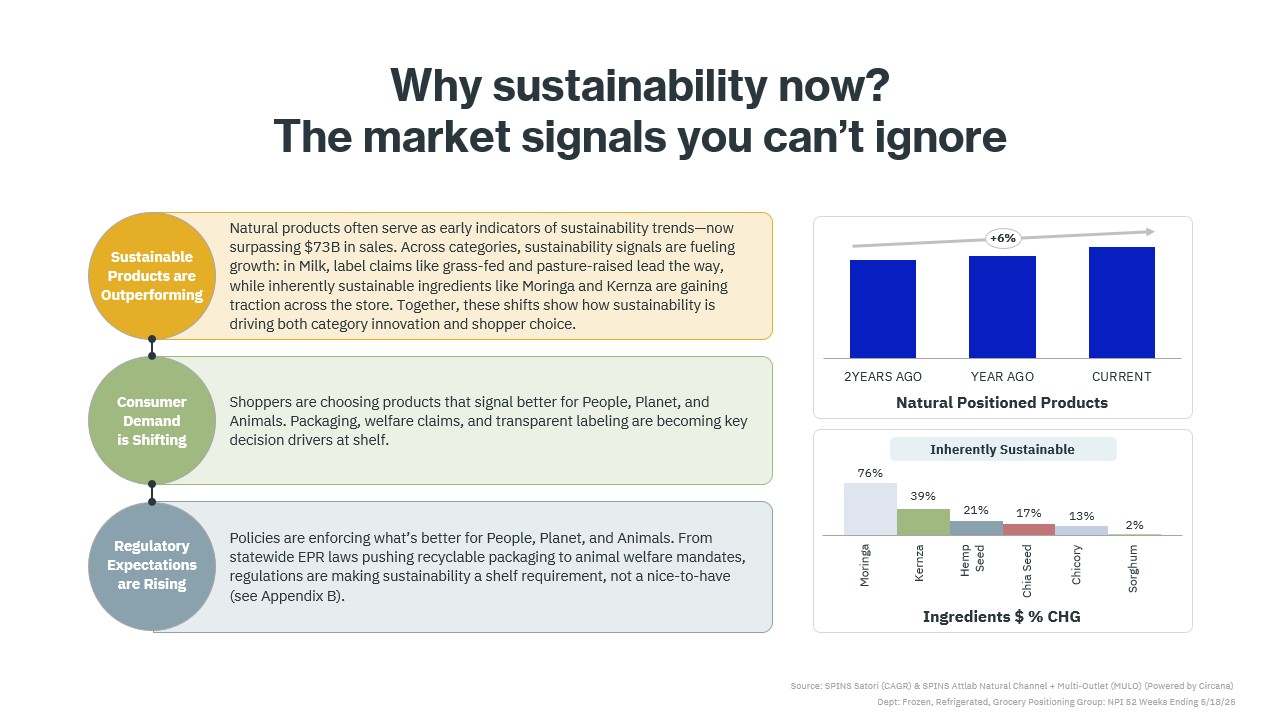

Sustainability has moved far beyond a niche concern and is now a core driver of category growth in today’s CPG market. Shoppers increasingly interpret sustainability through diverse signals, from ingredient sourcing and packaging innovations to certifications and animal welfare practices. External forces such as new regulations and retailer mandates are accelerating the demand for transparency, functionality, and credibility from brands.

Natural products—often the first to lead on sustainability—have surpassed $73 billion in sales, setting the tone for broader market adoption. Shoppers are not just reacting to trends; they are expecting sustainable options to be the norm.

For brands and retailers, this means meeting consumers where they are and delivering sustainability in ways that align with both their values and their budgets. The shift toward sustainability is no longer optional; it’s becoming a market requirement.

Consumer Intent to Purchase Sustainable Products is Rising, but Barriers Remain

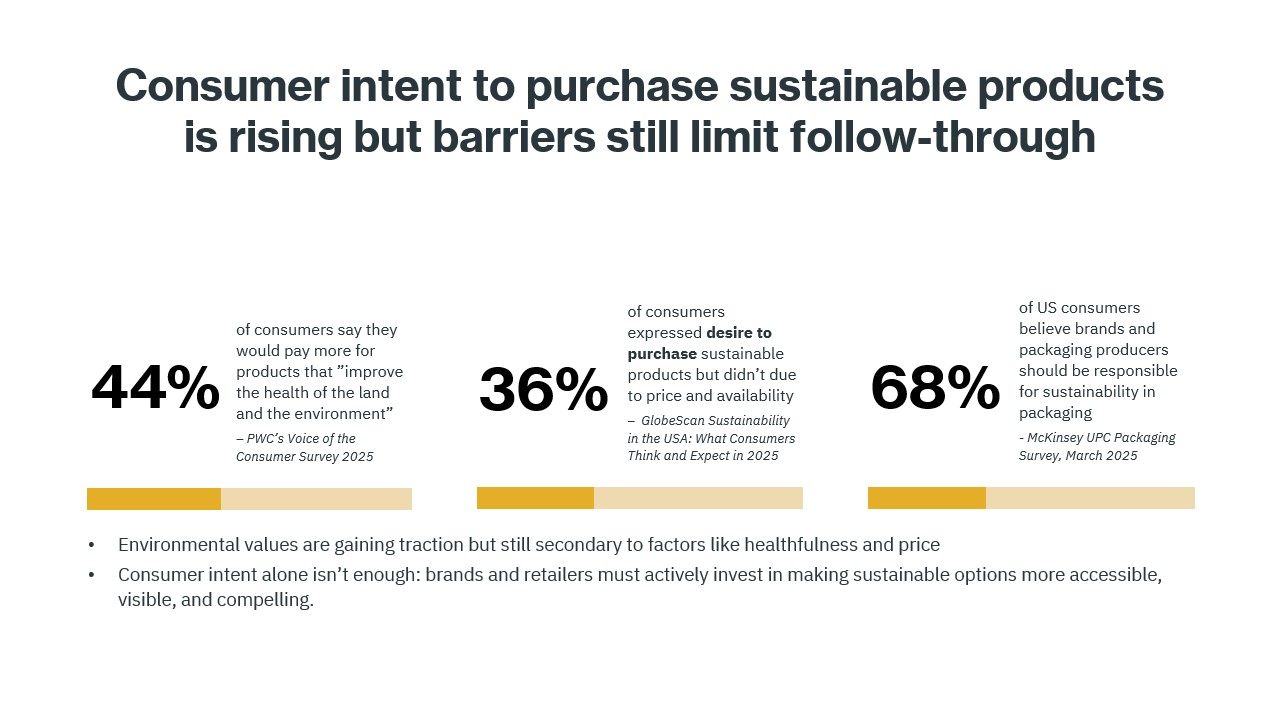

The appetite for sustainable products is strong. Forty-four percent of consumers say they are willing to pay more for products that ‘improve the health of the land and the environment.’ However, intent does not always lead to purchase. Thirty-six percent of shoppers interested in sustainable products report being unable to follow through due to barriers like price and availability.

Access and affordability remain the most common friction points. Without broad distribution and competitive pricing, many shoppers can’t consistently choose sustainable options, no matter how much they want to.

The responsibility for change isn’t falling solely on consumers. Sixty-eight percent of U.S. shoppers believe the burden of providing sustainable packaging rests with brands and packaging producers. This consumer mindset underscores the urgency for CPG companies to lead on sustainability through accessible products and responsible manufacturing.

How Consumers Think About Sustainability Varies

While sustainability is a growing market force, how consumers define it varies widely, creating both complexity and opportunity for brands.

For some, sustainability means prioritizing animal welfare, choosing products labeled free range or cage-free. Others view it primarily through a planet-first lens, favoring certified upcycled or regenerative products. Another way consumers think about sustainability is by placing emphasis on social responsibility, seeking goods produced with fair labor practices and equitable sourcing.

SPINS’ proprietary attribution decodes these diverse “sustainability signals” in the marketplace, revealing which attributes are driving category growth. This granular view helps brands target innovations, refine marketing, and align product claims with what specific consumer segments value most.

Recognizing that sustainability isn’t one-size-fits-all is critical. Brands that understand and respond to these nuanced definitions will be best positioned to capture demand, differentiate in crowded categories, and contribute meaningfully to a more sustainable CPG landscape.