The State of Supplements

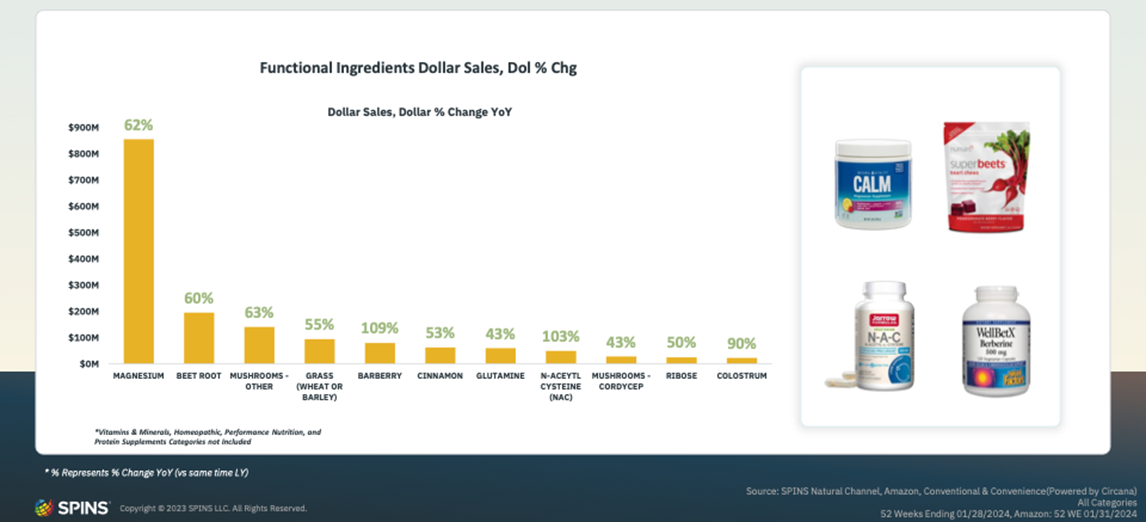

Vitamins and supplements serve many purposes for today’s shoppers. VMS products are in demand from pre-workout before the gym to hydration packets during the workday to protein powders to supplement dietary needs. Key vitamin and supplements categories continue their strong growth, with protein supplements and meal replacements (14%) and performance nutrition (27%) each driving double-digit growth. Functional ingredients continue to broaden their reach by positioning that appeals to a wide spectrum of shopper interests. Some of the fastest-growing functional ingredients address immunity, digestion, energy, and cognitive health.

Shoppers have a range of options when it comes to VMS products on the market. While gummies and capsules saw moderate decreases and tablets remained flat, liquid ready-to-drink (18%) and powder (17%) saw strong growth.

Women’s Health

Women’s health has long been overlooked or presumed to be the same as men’s health—but now it is finally receiving overdue attention. Brands are delivering VMS products with women’s health in mind. The growth in women’s supplements is coming from products targeting digestive health, urinary tract health, reproductive health, and bone health.

More products mean more shoppers are taking notice of women’s health options in a range of categories. Some items that are helping categories grow are inositol for Polycystic ovary syndrome (PCOS), all-in-one support for perimenopause, colostrum for beauty from within, gut and feminine health for microbiome, and green supplements in superfoods.

Active Nutrition

Active nutrition continues to find a new audience as it moves beyond athletes and into a variety of health-focused shoppers. For example, sports nutrition categories (including performance nutrition, protein, and meal replacements, as well as energy and sports drinks) reported double-digit growth.

Performance nutrition has experienced 27% year-over-year growth, driven primarily by two subcategories. First, hydration and electrolyte products grew 52%, which signals the increased popularity of everyday hydration in products like powders and on-the-go packets. Creatine was not far behind with 46% growth, a sign that it’s no longer a supplement solely for high-performance athletes.

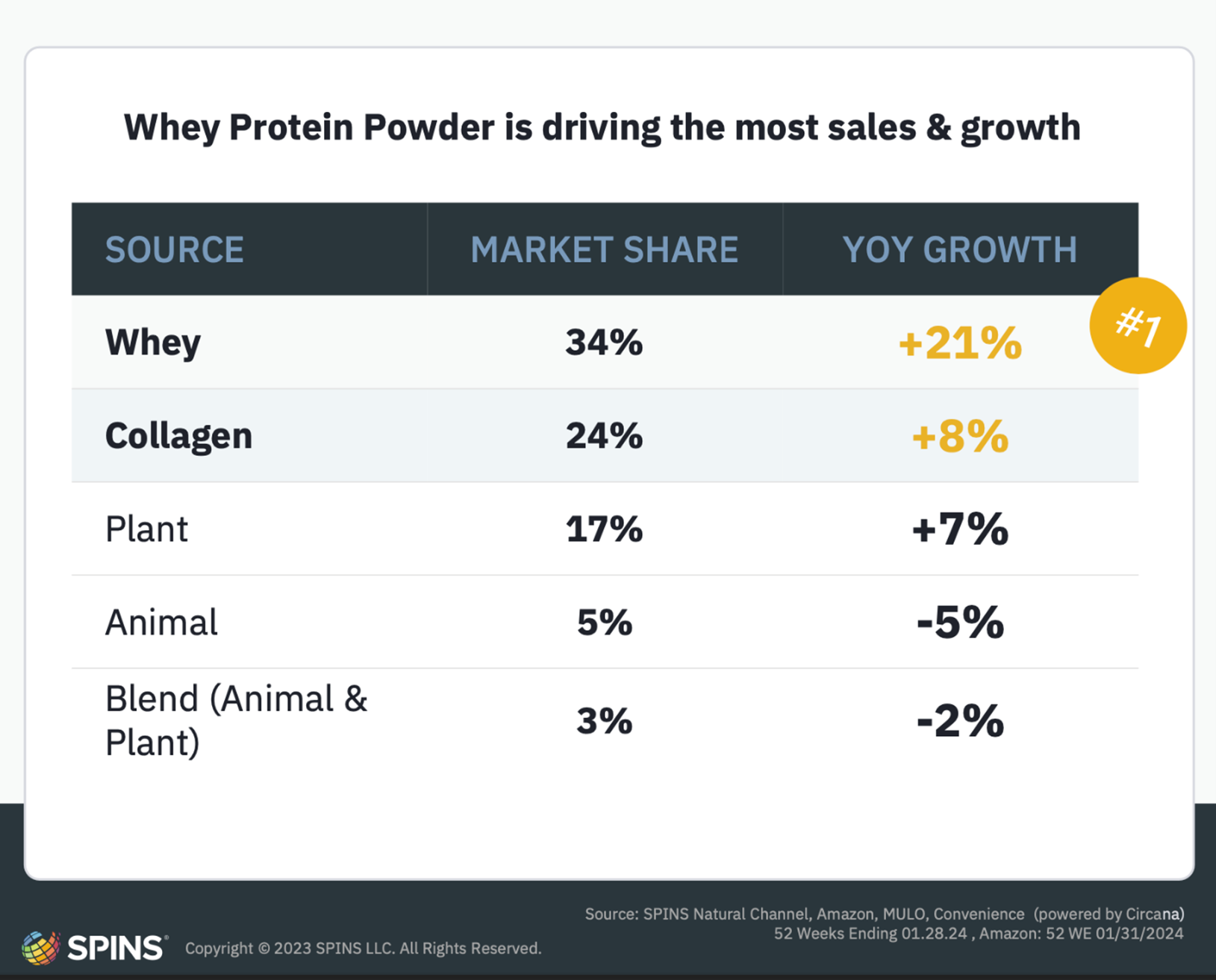

Protein is undergoing a similar transformation as more shoppers count their macros and adopt high-protein diets. There are also more options than ever for protein-focused shoppers. Whey, which is perhaps what most people used to think of when they sought out protein powders, retains the largest market share and has the largest year-over-year growth (21%). Collagen saw 8% growth, with plant protein close behind at 7%.

Sign-up for our monthly "What's Supp?" newsletter to receive the latest happenings across the category in your inbox.

Sign-upLooking Ahead

Shopper behavior is never stagnant, and some current shifts in spending point to possible emerging trends. As we continue to watch attribute, subcategory, and category performances, we can begin to understand whether we’re watching passing trends or if a new normal is emerging for many shoppers. Here are some of the possible trends we’re keeping an eye on:

More Alcohol-free Options

Many shoppers are opting to skip alcoholic beverages for a variety of reasons. Until recently, the alternatives were minimal—often waters and juices rather than similarly tasting options. Now, alcohol euphorics with functional ingredients are on the rice. Among the functional ingredients in beverages that are showing strong growth:

- THC (hemp-derived—Delta 8) is up 2445%

- Bacopa is up 456%

- Magnesium is up 144%

- Super mushrooms are up 58%

- Ashwagandha is up 45%

Lion’s Mane

The lion’s mane mushroom has found a growing audience thanks to its purported benefits in boosting memory, focus, nerve health, and mood support. For products containing lion’s mane, shelf-stable coffee beans and grounds saw 56.4% dollar growth and refrigerated juice and juice drinks experienced 22.8% dollar growth. Wellness bars, shots, and other functional beverages containing lion’s mane are also experiencing an uptick in sales, suggesting this is one ingredient shoppers are excited to get more of.

A New Approach to Weight Loss

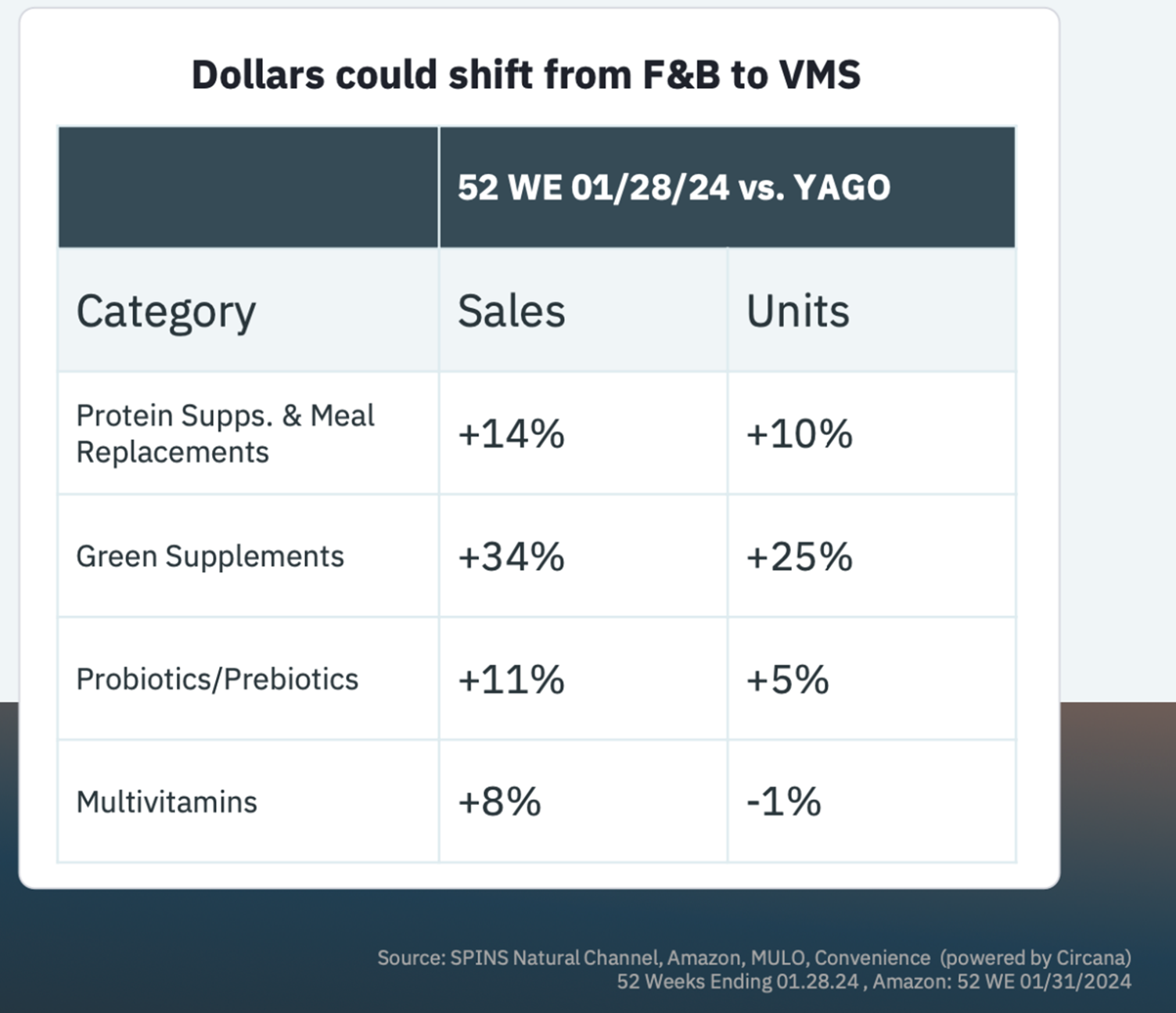

The conversations around weight loss are more diversified and nuanced than ever before, and new drugs are also rapidly changing the landscape. The future of weight loss is prime for disruption, and one emerging trend is a shift toward more VMS products. For shoppers who are on weight loss drugs or have made other dietary changes, they might be consuming less food and therefore lacking nutrients they now need to get via supplements. That’s one reason why green supplements, protein supplements, meal replacements, and probiotics/prebiotics are on the rise.

Take a closer look at these insights: Watch the State of Supplements presentation from Expo West 2024

Watch Now