Today’s Budget-Conscious Shoppers Are Focused on Wellness and Good Prices

Price always matters to shoppers, but it takes on a new level of importance during a recession and a pandemic. Since the start of lockdown, shoppers have been balancing more at-home meals with a desire to stay healthy and also watch their budgets. Yet, the pandemic shifted promotional plans for brands and retailers thanks to higher demand, inability to hold in-store promotions, and concerns about the supply chain. As a result, average retail prices grew, promotions decreased, and shoppers still needed to stock up for more at-home meals.

Shoppers kept their eyes on the price, but they also didn’t stray from their preferred dietary habits. According to data from SPINS Natural Enhanced Channel and SPINS Conventional Channel (powered by IRI), prices in edible departments (alcohol, frozen, grocery, produce, and refrigerated) have been on a steady climb since the beginning of the pandemic (between March and mid-June). Although conventional prices in the same departments have also risen, natural has outpaced them in every category. Shoppers are sticking with their favorite natural foods, even as they take into account economic uncertainty. Looking at retail during this 16-week period, we’ve found 3 ways shoppers are reacting to the combination of a recession and pandemic.

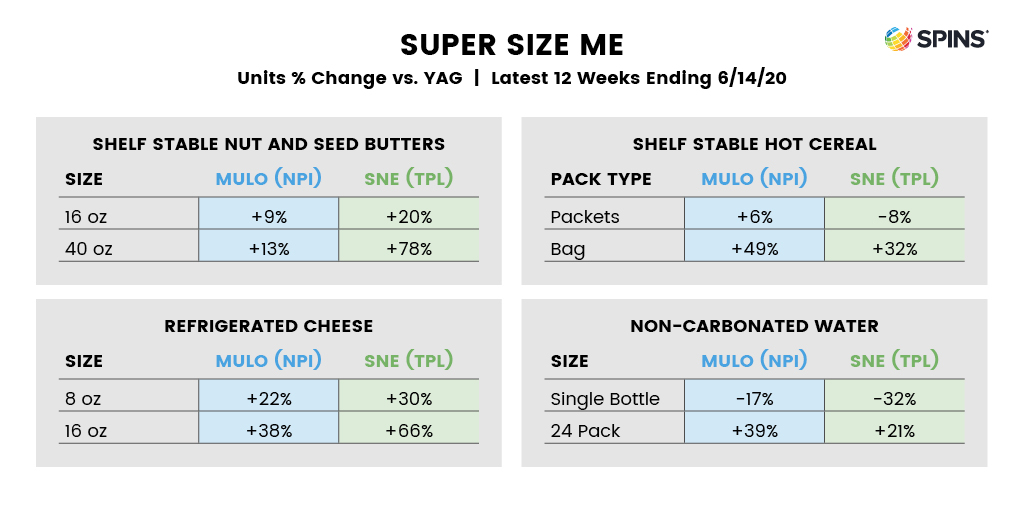

Bigger is Better

In March, no one knew how long lockdown would last, and health experts encouraged everyone to minimize trips to the store. As the economic situation grew less certain, shoppers had several reasons to choose larger sized products on their grocery runs, and that’s what they’ve continued to do. Larger sizes of natural products are outpacing smaller portions on several fronts through Mid-June:

- 40 oz. packages of shelf stable nut and seed butters grew 78% vs 20% for 16 oz

- Bags of shelf stable hot cereal grew 32% while packets decreased 8%

- 16 oz. packages of refrigerated cheese rose 66% but 8 oz packages grew 30%

- 24-packs of non-carbonated water grew 21% while single bottles fell 32%

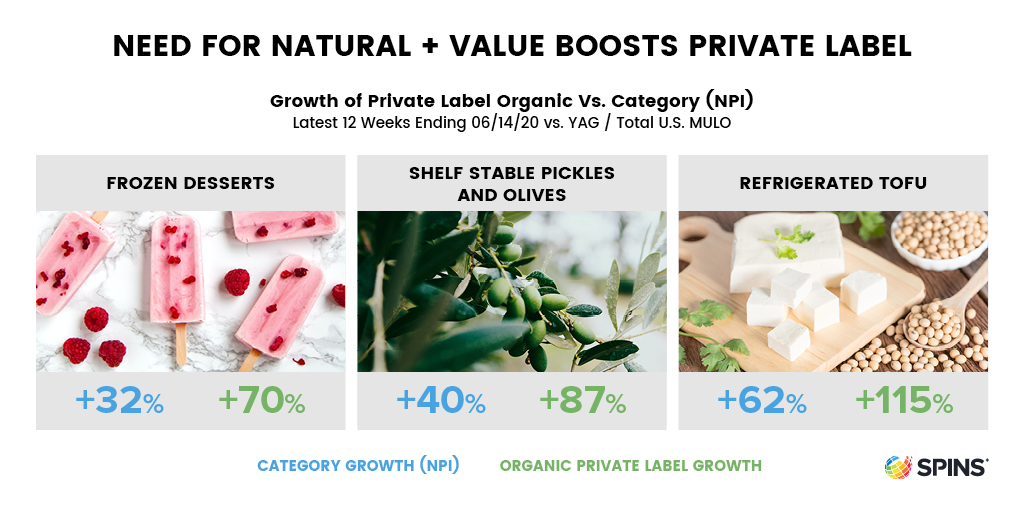

Organic Private Label is Popular

While private label offerings were once less varied and perhaps not exactly comparable to their name-brand counterparts, today’s private label products have the assortment and quality that shoppers are looking for. Private label sales have been growing throughout the pandemic, which is not that surprising considering their rise during and after the last recession.

Comparing growth rates of a category and its correlating organic private label, the trend is clear. Based on data from IRI MultiOutlet POS Data enhanced by SPINS Product Attribution, organic private label wins every time. Even in categories that are showing strong growth from March through June, organic private label is moving at a significantly stronger pace:

- Refrigerated tofu is growing an impressive 62%, but organic private label is up 115%

- Shelf stable pickles and olives have risen 40%; organic private label has grown by 87%

- Frozen desserts have seen a strong 32% growth, but organic private label is up 70%

As private label continues to offer more options and maintain its quality, expect shoppers to explore them—especially if their price points remain lower.

Wellness and Value Are Both in Demand

The trend toward nutritious but budget-friendly options isn’t confined only to private label; it’s a mindset shoppers are bringing to every purchase they’re making. That’s created an opportunity for value brands that offer natural and organic items at a competitive price point.

For example, shelf stable baking mixes and ingredients are growing at a strong 80%, according to IRI MultiOutlet POS Data enhanced by SPINS Product Attribution. However, some value brands are growing even more quickly, with one brand up 148% and another up 264%–and both with a product lineup that is majority Certified Organic. Similarly, shelf stable sweeteners are up 33%, but a fast-growing value brand sweetener—which is organic, non-GMO, and sustainably sourced—is more than triple that rate at 109%. Today’s shoppers are willing to try new items that make sense for their financial and health needs, and value brands are earning their dollars right now.

As different areas of the country ease restrictions and others re-enter lockdown, shoppers will remain focused on finding the best product for the right price.