Why Emerging Brands Use SPINS Data

Although all brands want to grow and expand their footprint, emerging brands are in a unique position. Your products are in the market, which means you’ve conquered the daunting pre-launch phase of their business, but you don’t have a wealth of historical data to work with.

SPINS has helped some of the natural industry’s biggest names evolve from emerging brands to today’s trendsetters. You could be that next success story. Newer brands often worry that their lean teams don’t have the capacity to dive into data and keep up with a variety of reports and dashboards, but with SPINS you can leverage data effectively and efficiently.

According to Jennifer Burge, Sales Director at SPINS, “Partnering with SPINS allows you one-on-one support from day one. We support you throughout the initial onboarding process and coach you further to help hone your data fluency and manage your business, supported through SPINS intelligence.”

These 6 uses for SPINS data help emerging brands become experts and make strategic decisions that will lead to long-term success and give you a competitive edge.

1) Understand What Is Happening and Where You Rank In Your Product Channels

2) Use Key Account Data to Strengthen Relationships With Retailers

3) Learn About the Unique Demands of Each Retail Store

4) Establish a Strong Omnichannel Presence

5) Focus on Regional Grocers

6) Access Comprehensive Data With Ease

1) Understand What Is Happening and Where You Rank In Your Product Channels

In order to compete with the other products on the market, you need to know what is out there and how they are performing—especially compared to your brand.

Emerging brands often get caught in the trap of operating with a limited view of the market and focus only on their own sales figures. A comprehensive look at your product channels gives you insights into the variety of options that shoppers are choosing between.

SPINS provides a view across all of its channels: Natural Enhanced, Regional Grocery, and Specialty Pet. Wherever your products belong, you can see how the competition is selling and how you rank. With that information, you can stay on top of the progress or setbacks you’re making in the space and adapt accordingly.

2) Use Key Account Data to Strengthen Relationships With Retailers

Strong relationships with your retailers are crucial to your success. When you work with retailers who provide the support you need and are aligned with your goals, you both see a return on your product sales. The best way to establish those relationships is to understand their business and illustrate how your products connect with customers and fulfill an unmet need on their shelves.

SPINS provides Key Account data for the retailers you’re doing business with and provides insights into their business and category performance. With Key Account data, you see category data, competitive performance, growth drivers, and in-demand attributes for that retailer.

What’s the bottom line?

Key Account data helps you gain a clear view of the retailer’s business.

These insights are critical to helping you craft an effective retail pitch that is critical to successful brands, and Key Account data allows you to tailor your conversations and pitches to their interests, showing how your product is uniquely suited to their business goals and a smart investment that will deliver results.

3) Learn About the Unique Demands of Each Retail Store

In the early days of your business or of a newly launched product, you might be in a small number of retailers—or maybe even just one—but each retailer might carry your products in multiple locations. You can learn a lot about your products and your shoppers by delving into the data from each location. These granular insights can reveal differences between locations so you can begin to understand why your product resonates in some regions but not others.

SPINS Store Level Data lets you explore a retailer’s performance on a store-by-store basis. Top-performing brands use this data to understand a variety of key performance indicators by identifying distribution voids, tracking in-store promotions, and monitoring in-store sales agents. As a result, they are able to enter new markets, launch new products, and improve their retail footprint. You don’t need to be in hundreds of stores to learn valuable lessons from each location; you just need to take what you learn and take action.

EXPERT LENS: STORE LEVEL DATA

4) Establish a Strong Omnichannel Presence

Customers are increasingly moving online, and you want them to find your products when they’re tossing items in their digital shopping cart. Successful brands leverage the power of online shopping to their favor. In fact, eCommerce can play a critical role in emerging brands looking to reach new customers and establish a faithful following.

Destini Buy Online connects customers—existing and potential—to more than 40 top online retailers and grocery delivery solutions. When you use Destini Buy Online, customers can find locations that carry your products, see real-time inventory, and view pricing information. It’s a simple way to broaden your footprint beyond brick-and-mortar storefronts while still maintaining strong relationships with your retailers.

5) Focus on Regional Grocers

Regional grocery stores allow brands to branch out beyond the specialized natural enhanced retailers where they frequently begin and move toward larger, conventional retailers. They are a great bridge for brands because regional grocers tend to have a larger variety of inventory and a customer base that isn’t only looking for natural products.

Yet, they still have a more personal connection than a big box store. Regional grocers tend to be more plugged into their local community, often viewed as trustworthy experts shoppers turn to for recommendations and innovative new products.

SPINS has a that focuses solely on this important sect of retailers. The Regional Grocery Channel already covers a wide breadth of retailers and is growing aggressively every day with an increasing amount of Key Accounts.

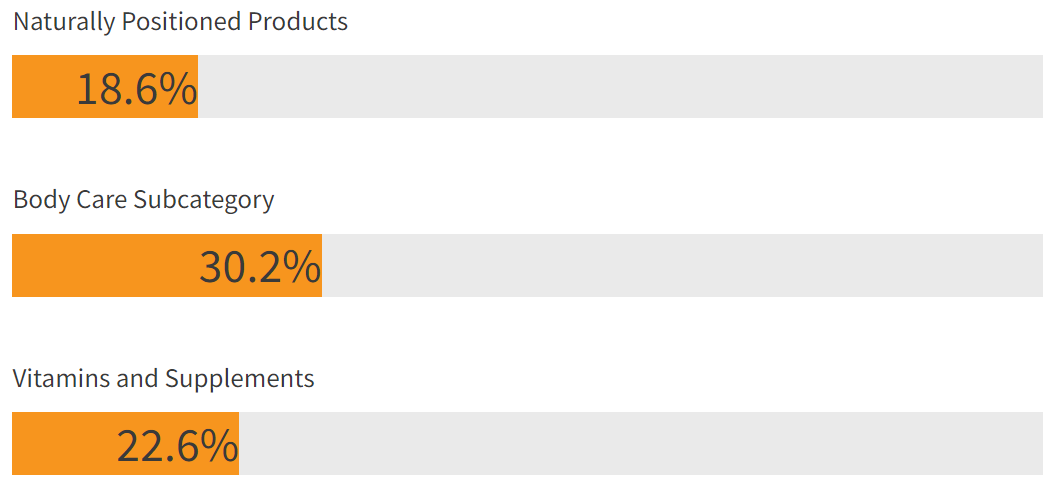

YOY SALES GROWTH IN REGIONAL GROCERY RETAIL

Regional grocery sales are strong, particularly with natural products. Year over year sales for naturally positioned products are up 18.6%, with even stronger growth in some subcategories, including body care (30.2%) and vitamins and supplements (22.6%).

SPINS has exclusive data that these retailers aren’t providing anyone else. Take advantage of the wealth of data you can access from the Regional Grocery Channel and build a strong relationship with these retailers so you can stay on the path to growth.

6) Access Comprehensive Data With Ease

Insights and data about your own brand, your retailers, and your competitors are just as crucial to emerging brands as they are to enterprise brands. However, emerging brands need a solution that can grow as your business grows. Rather than having to clamor for any relevant (and often outdated) data, you deserve convenient access to this information that informs your conversations with retailers: How is your brand performing? How are retailers performing? What is happening with your competitors?

SPINS offers PowerTabs Lite, a solution created for emerging brands who know the power of data but don’t yet have the need for an enterprise-sized team or budget. With PowerTabs Lite, you receive focused data for your brand, your top 2 retailers and 5 key competitors—and it’s organized in easy-to-use Excel-based dashboards that are updated each quarter. Most importantly, you receive customer support that lets you maximize your brand’s potential even if you’re a data newbie.

The best way to grow strategically is to base your decisions on data that are relevant to your business. With these 6 steps to help your emerging brand grow, you are on course to see the long-term success that will result in a bigger, stronger business.