A 5-Minute Assessment for CPG Brands

What’s Your Consumer IQ?

This assessment will help you benchmark your brand's Consumer IQ and identify opportunities to elevate your approach. It's divided into two critical areas:

1. Consumer Centricity

How well you know your consumer

2. Business Impact

How effectively you create results with consumer insights

Section 1: Consumer Centricity

How well do you know your consumers?

Consumer centricity is the cornerstone of successful CPG brands today. Consumer centricity means that the consumer is at the center of all decisions related to delivering products, services, and experiences to create consumer satisfaction, loyalty, and advocacy.

For each question, rate your knowledge level as follows:

Not at allWe don’t really have this information |

A little bitWe have some idea |

Very wellWe have good data on this |

ComprehensivelyWe have a leading understanding |

|

|---|---|---|---|---|

| How strongly your brand understands | Can’t measure or lack precision | Accurately measure and track this metric | Precisely measure and trend over time | Trend over multiple product groups and time periods |

| How comprehensively your brand understands | A portion of my portfolio | My entire portfolio | My full competitive landscape | Adjacent and complementary categories |

| How frequently you assess | Never or seldom | Ad-hoc or 1x a year | Monthly | Weekly |

Not at all

We don't really have this information

Can't measure or lack precision

A little bit

We have some ideas

Accurately measure and track this metric

Very well

We have good data on this

Precisely measure and trend over time

Comprehensively

We have a leading understanding

Trend over multiple product groups and time periods

Not at all

We don't really have this information

A portion of my portfolio

A little bit

We have some ideas

My entire portfolio

Very well

We have good data on this

My full competitive landscape

Comprehensively

We have a leading understanding

Adjacent and complementary categories

Not at all

We don't really have this information

Never or seldom

A little bit

We have some ideas

Ad-hoc or 1x a year

Very well

We have good data on this

Monthly

Comprehensively

We have a leading understanding

Weekly

[Brand Name] results are ready for [Name]

What's Your Consumer IQ?

[Brand Name] results are ready for [Name]

What's Your Consumer IQ?

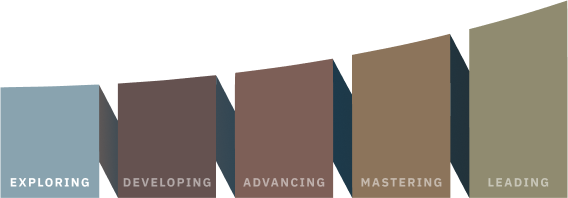

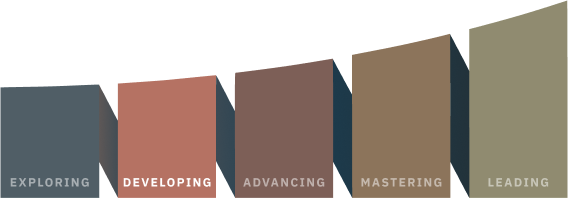

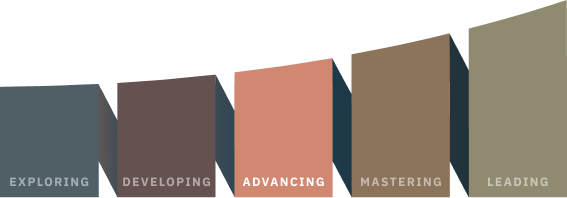

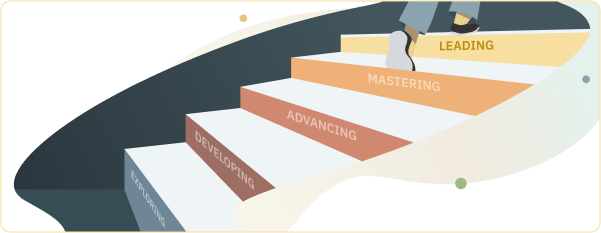

Your Score

Maturity Level

Total

Your Score

Journey to

Best Practice

Leading Buyer Conversations

- Focus primarily on distribution and promotional activity

- Leverage reviews, quotes and metrics from D2C, google searches and brand.com web traffic to derive buyer size and interest

Optimizing Marketing

- Have limited data about your consumer targets

- Have no or limited view into ROI

Crafting Winning Innovations

- Innovate primarily with internal ideas

Developing Insights

- Primarily rely on sales data (POS) and basic customer feedback

- Using readily available sources eComm/D2C, reviews, search trends, brand.com analytics

- Adhoc or informal insights process

Beating Competition

- Assessing basic competitive performance based on dollars, units and price

Journey to

Best Practice

Leading Buyer Conversations

- Share core consumer insights, like household penetration and shopper conversion

- Demonstrate how you attract a buyer aligned to the retailer’s target buyer

- Using data to inform which retail accounts to target

- Present alignment w/ category trends or gaps

Optimizing Marketing

- Have begun to identify consumer segments with a basic understanding of what drives their purchasing decisions

- Run ‘one-size fits all’ campaigns

- Assess marketing effectiveness at a high level

Crafting Winning Innovations

- Incorporate consumer feedback into product development but may struggle to identify unmet needs

Developing Insights

- Supplement sales data with some consumer insights data on your category or brand, but struggle to integrate these different data sources effectively or consistently

Beating Competition

- Assess competitors at a category level

- Build commercial GTM plans based on category size/growth, competitors and price/promo landscape

- Know where you are beating competition with consumer purchase KPIs like buy rate, loyalty and total basket ring

Journey to

Best Practice

Leading Buyer Conversations

- Showcase the incremental impact, at a channel level, a brand has on category buyers

- Develop retailer-specific strategies based on consumer behavior analysis, including buyer conversion and leakage patterns

Optimizing Marketing

- Maintain detailed shopper profiles that incorporate demographics, purchase behavior patterns, and retailer preferences.

- Can identify high-value consumer segments

- Pinpoint where buyers tradeoff and develop strategies to defend/attack

Crafting Winning Innovations

- Validate concepts based on consumer needs

- Use consumer data to inform targeting and positioning

- Evaluate trial and repeat purchases of new launches

Developing Insights

- Regularly assess consumer and sales performance insights across insights, sales and marketing

- Consistent weekly or monthly insights routine using POS, eComm and Consumer Panel sources

- Brand health trending – understands the level of buyer churn and loyalty

- Understands which competitors most overlap with their consumer base

Beating Competition

- Assess competitors at a microcategory level, using attributes to subsegment and cross traditional category boundaries

- Use Product Switching analyses to understand which competitors you trade off with and how consumers move between your brand and competitors

Journey to

Best Practice

Leading Buyer Conversations

- Showcase the incremental impact, at a retailer level, a brand has on category buyers

- Develop retailer-specific strategies based on consumer behavior analysis, including leakage patterns and retailer loyalty metrics

- Securing better shelf results - more facings, move to mainline Set, win secondary placement/display

Optimizing Marketing

- Integrating consumer segmentations like SPINS NaturaLink into marketing strategy and execution

- Aware of how competitors are targeting and reacting with strategies to mitigate impact on their brand

Crafting Winning Innovations

- Spotting consumer preference, label and ingredient trends in other categories

- Effectively and regularly building new product concepts using consumer panel, consumer survey and/or POS data

Developing Insights

- Driving brand strategy from insights

- Consistent weekly or monthly insights routine using POS, eComm and Consumer Panel sources

- Expert(s) creating reporting and action plans by key account

Beating Competition

- Developing attack/defend strategies based on competitive tradeoff from Product Switching analyses

- Able to identify incrementality across competitors

Journey to

Best Practice

Leading Buyer Conversations

- Sought after as a thought leader for the category

- Impacting shelving assortment decisions with fact-based consumer insights

- Develop consumer insights to inform their own strategies and merchandising decisions

Optimizing Marketing

- Developed sophisticated micro-segments based on purchase behavior, lifestyle indicators, and brand interactions

- Create retailer-specific marketing

- Refine messaging based on switching behavior

- Triangulating advanced Marketing Mix analyses, conversion metrics with on-the-ground views from POS and consumer panel

Crafting Winning Innovations

- Maintain a continuous consumer insights engine that identifies emerging needs and preferences, allowing you to develop innovations that create new category growth

- Keen understanding of category decision-making and the presence of white-space opportunities for innovation

Developing Insights

- Comprehensive Annual Brand Review of performance across key performance indicators—panel data, purchase behavior, loyalty data, and consumer surveys—creating a holistic snapshot view of your brand’s consumer

- Developing advanced analytics to understand consumer decision making and preferences e.g., Consumer Decision Trees

- Robust weekly insights routine using POS, eComm and Consumer Panel sources. Expert(s) creating action plans

Beating Competition

- Conducting competitive deep-dives to identify what worked for best-in-class brands, either within your category or across total store

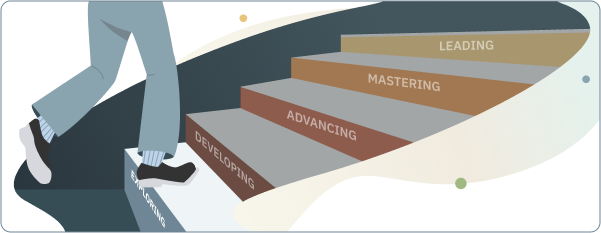

All Maturity Levels

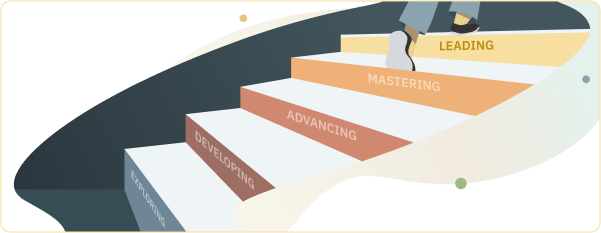

Exploring

Leading Buyer Conversations

- Focus primarily on distribution and promotional activity

- Leverage reviews, quotes and metrics from D2C, google searches and brand.com web traffic to derive buyer size and interest

Optimizing Marketing

- Have limited data about your consumer targets

- Have no or limited view into ROI

Crafting Winning Innovations

- Innovate primarily with internal ideas

Developing Insights

- Primarily rely on sales data (POS) and basic customer feedback

- Using readily available sources eComm/D2C, reviews, search trends, brand.com analytics

- Adhoc or informal insights process

Beating Competition

- Assessing basic competitive performance based on dollars, units and price

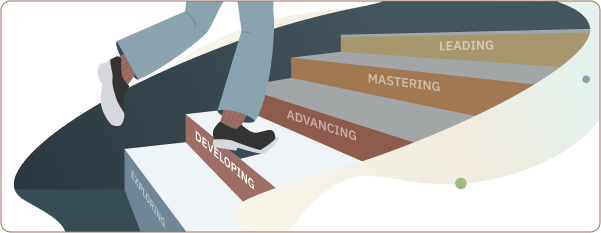

Developing

Leading Buyer Conversations

- Share core consumer insights, like household penetration and shopper conversion

- Demonstrate how you attract a buyer aligned to the retailer’s target buyer

- Using data to inform which retail accounts to target

- Present alignment w/ category trends or gaps

Optimizing Marketing

- Have begun to identify consumer segments with a basic understanding of what drives their purchasing decisions

- Run ‘one-size fits all’ campaigns

- Assess marketing effectiveness at a high level

Crafting Winning Innovations

- Incorporate consumer feedback into product development but may struggle to identify unmet needs

Developing Insights

- Supplement sales data with some consumer insights data on your category or brand, but struggle to integrate these different data sources effectively or consistently

Beating Competition

- Assess competitors at a category level

- Build commercial GTM plans based on category size/growth, competitors and price/promo landscape

- Know where you are beating competition with consumer purchase KPIs like buy rate, loyalty and total basket ring

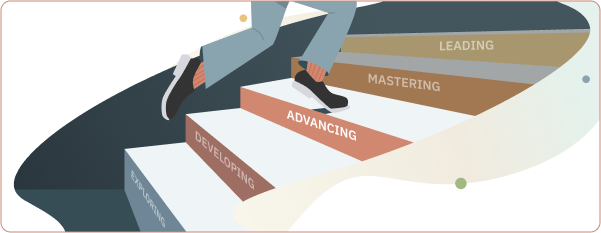

Advancing

Leading Buyer Conversations

- Showcase the incremental impact, at a channel level, a brand has on category buyers

- Develop retailer-specific strategies based on consumer behavior analysis, including buyer conversion and leakage patterns

Optimizing Marketing

- Maintain detailed shopper profiles that incorporate demographics, purchase behavior patterns, and retailer preferences.

- Can identify high-value consumer segments

- Pinpoint where buyers tradeoff and develop strategies to defend/attack

Crafting Winning Innovations

- Validate concepts based on consumer needs

- Use consumer data to inform targeting and positioning

- Evaluate trial and repeat purchases of new launches

Developing Insights

- Regularly assess consumer and sales performance insights across insights, sales and marketing

- Consistent weekly or monthly insights routine using POS, eComm and Consumer Panel sources

- Brand health trending – understands the level of buyer churn and loyalty

- Understands which competitors most overlap with their consumer base

Beating Competition

- Assess competitors at a microcategory level, using attributes to subsegment and cross traditional category boundaries

- Use Product Switching analyses to understand which competitors you trade off with and how consumers move between your brand and competitors

Mastering

Leading Buyer Conversations

- Showcase the incremental impact, at a retailer level, a brand has on category buyers

- Develop retailer-specific strategies based on consumer behavior analysis, including leakage patterns and retailer loyalty metrics

- Securing better shelf results - more facings, move to mainline Set, win secondary placement/display

Optimizing Marketing

- Integrating consumer segmentations like SPINS NaturaLink into marketing strategy and execution

- Aware of how competitors are targeting and reacting with strategies to mitigate impact on their brand

Crafting Winning Innovations

- Spotting consumer preference, label and ingredient trends in other categories

- Effectively and regularly building new product concepts using consumer panel, consumer survey and/or POS data

Developing Insights

- Driving brand strategy from insights

- Consistent weekly or monthly insights routine using POS, eComm and Consumer Panel sources

- Expert(s) creating reporting and action plans by key account

Beating Competition

- Developing attack/defend strategies based on competitive tradeoff from Product Switching analyses

- Able to identify incrementality across competitors

Leading

Leading Buyer Conversations

- Sought after as a thought leader for the category

- Impacting shelving assortment decisions with fact-based consumer insights

- Develop consumer insights to inform their own strategies and merchandising decisions

Optimizing Marketing

- Developed sophisticated micro-segments based on purchase behavior, lifestyle indicators, and brand interactions

- Create retailer-specific marketing

- Refine messaging based on switching behavior

- Triangulating advanced Marketing Mix analyses, conversion metrics with on-the-ground views from POS and consumer panel

Crafting Winning Innovations

- Maintain a continuous consumer insights engine that identifies emerging needs and preferences, allowing you to develop innovations that create new category growth

- Keen understanding of category decision-making and the presence of white-space opportunities for innovation

Developing Insights

- Comprehensive Annual Brand Review of performance across key performance indicators—panel data, purchase behavior, loyalty data, and consumer surveys—creating a holistic snapshot view of your brand’s consumer

- Developing advanced analytics to understand consumer decision making and preferences e.g., Consumer Decision Trees

- Robust weekly insights routine using POS, eComm and Consumer Panel sources. Expert(s) creating action plans

Beating Competition

- Conducting competitive deep-dives to identify what worked for best-in-class brands, either within your category or across total store

See It in Action:

Blog

How to Turn Consumer Data Into Compelling Retail Stories That Actually Win Shelf Space

Transform basic metrics into powerful buyer conversations with panel insights that prove your brand’s value.

Read More

Blog

Consumer Panel Showdown: Choosing the Right Insights Solution for Your Brand

In today’s competitive CPG landscape, understanding consumer behavior is no longer optional—it’s essential for survival and growth.

Read More

Webinar

Consumer Panel: Beating the Competition with Product Switching Analysis

Tired of losing market share to competitors? Learn how top CPG brands uncover who’s stealing their sales,

Watch NowResult Not Found!

Sorry something went wrong. The result link can't be found.

Consult with an Expert

We've received your request to speak with a SPINS expert!

Our team will follow up to schedule a meeting.