See your true competitive set in your consumer insights

While others force you to compare against broad categories, SPINS TriLens Panel uses the same hierarchy as your POS data plus 200+ attributes to reveal insights from your actual microcategory and consumer trends.

Why brands are choosing SPINS over Numerator

Data Source Quality

SPINS TriLens Panel

Numerator

National Consumer Panel (industry standard)

Receipt panel (quality varies by category)

Hiearchy

SPINS TriLens Panel

Numerator

Identical to POS hierarchy

Numerator’s own hierarchy –different from retailers

POS Data Alignment

SPINS TriLens Panel

Numerator

Aligned

Not aligned to POS data. May tell a different story

Item-Level Granularity

SPINS TriLens Panel

Numerator

Consistent item-level with attribute filtering

Item-level rare. Usually limited to whole brand analysis

Preference & Product Attributes

SPINS TriLens Panel

Numerator

200+ on- and off-label attributes to dial into the microcategory

Limited attributes

Panelist Bias

SPINS TriLens Panel

Numerator

Minimal. Industry standard recruitment practices and balanced to US Census

Likely. Panelists recruitment methods create bias

Pricing Accessibility

SPINS TriLens Panel

Numerator

Packages for growing brands

Typically $100K+

Vendors

SPINS TriLens Panel

Numerator

One vendor for both consumer and POS insights

Separate vendor = reconciliation required

Critical Feature

Data Source Quality

Hiearchy

POS Data Alignment

Item-Level Granularity

Preference & Product Attributes

Panelist Bias

Pricing Accessibility

Vendors

SPINS TriLens Panel

- National Consumer Panel (industry standard)

- Identical to POS hierarchy

- Aligned

- Consistent item-level with attribute filtering

- 200+ on- and off-label attributes to dial into the microcategory

- Minimal. Industry standard recruitment practices and balanced to US Census

- Packages for growing brands

- One vendor for both consumer and POS insights

Numerator

- Receipt panel (quality varies by category)

- Numerator’s own hierarchy –different from retailers

- Not aligned to POS data. May tell a different story

- Item-level rare. Usually limited to whole brand analysis

- Limited attributes

- Likely. Panelists recruitment methods create bias

- Typically $100K+

- Separate vendor = reconciliation required

Numerator's insights doesn't match your business reality

Misaligned Data Sources

Your POS data shows one story, your consumer panel shows another. Different hierarchies and classifications make it impossible to create a unified story.

Limited Attribute Filtering

Other providers claim "hundreds of attributes" but coverage is spotty. For fast-growing and uniquely positioned brands, this means you can't filter to products that actually compete with yours.

Wrong Competitive Comparisons

Comparing your unique product against the generic category can lead to inaccurate insights and weak buyer proof for what you bring to shelf. Are you making decisions based on your real competitive set?

Missing Consumer Trend Signals

Broad category views hide the micro-trends in label claims, ingredients, positioning and more. You're missing the early signals that could guide your product innovation.

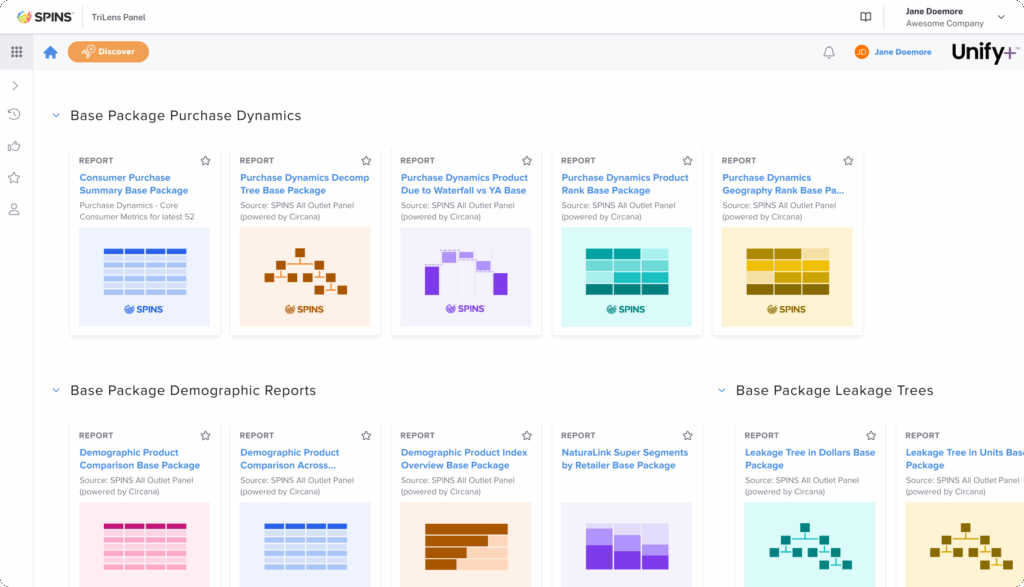

Consumer insights that match your POS reality

SPINS TriLens Panel uses the exact same hierarchy as your SPINS natural, regional and conventional POS data. Plus advanced attribute filtering unlocks a clear view of buyer behavior within your true competitive microcategory.

See Your True Competitive Set

Filter by the attributes that actually define your market (e.g., organic + gluten-free + plant-based + keto-friendly). Focus your buyer conversations on how you beat your real competitors.

Spot Micro-Trends Early

Attribute-based analysis reveals emerging consumer trends within natural and specialty segments before they hit mainstream radar.

One Unified Data View

Same hierarchy between POS and consumer panel means your insights finally align. No more reconciling different category definitions or brand classifications.

Industry-Standard Methodology + Expert Support

Built on the National Consumer Panel with dedicated support from experts who understand natural and specialty brand challenges.

- I love the reports – great to show me what's happening specifically in packaged vs. convenience, and the dynamics of what's going on across brands. We can see across sizes and see how people are trading up into larger sizes and out of smaller sizes."

VP of Sales

Established packaged foods brand

- It is the most accurate and directly applicable to Food and MULO consumption due to the NBD (the data is adjusted to match the retailer checkout data). Circana and Nielsen also share the panel, so it has substantial data integrity. This gives me the confidence to use the data when projecting revenue."

Head of Sales

Fast-growing beverage brand